Multi Asset

Our Balanced Funds leverage off of our expertise in asset allocation, both strategic (long-term) and tactical (short-term). While our Real Return Funds are managed specifically to achieve a return in excess of inflation (CPI), usually over a rolling three-year period.

We’re very serious about safeguarding our clients’ assets.

CORPORATE GOVERNANCE

Active Asset Allocation

We actively manage our multi-asset funds by determining both the long-term Strategic Asset Allocation of our portfolios, and shorter-term tactical adjustments to the allocation, based on mispricing opportunities presented by the market. We firmly believe that active Tactical Asset Allocation can add significant value to investors’ portfolios and we invest significant time and effort in this capability.

Balanced

The objective of our Balanced Funds is to deliver long-term growth to investors accumulating retirement savings. These mandates are compliant with Regulation 28 of the Pension Funds Act. We manage both Domestic Balanced and Balanced (including offshore) mandates. For large clients we can manage Balanced Funds according to bespoke client-specific benchmarks.

Real Return

Our real-return multi-asset mandates are managed with the primary objective of out-performing a specific inflation benchmark over a rolling three-year period. We manage mandates with objectives ranging from CPI+3% to CPI+6%. Please contact us for more information.

Our Multi Asset Team

Our multi-asset offerings draw on the experience and skill set of our entire investment team, where each asset class is managed by a dedicated team. Our Asset Allocation Committee is responsible for deciding the level of exposure to domestic asset classes and the overall offshore allocation in conjunction with investments teams employed by our international majority shareholder, M&G Investments (UK). The day to day management of offshore portfolios into which we invest our client portfolios that allow offshore holdings, is done by a dedicated team employed by M&G Investments in London. Our Asset Allocation Committee is made up of a small number of senior portfolio managers from across different asset class teams, and includes Michael Moyle (Head of Multi-Asset) and David Knee (Chief Investment Officer).

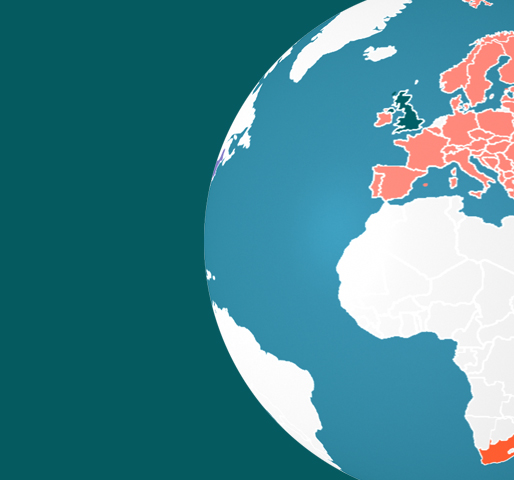

Our global strength - we are part of M&G plc

M&G Investments Southern Africa is part of the UK-listed M&G plc group, one of Europe’s largest active asset managers with over £300bn in AUM, over five million clients and operations in 28 markets worldwide. M&G Investments (UK), the wholly-owned subsidiary of M&G plc, owns 50.12% of M&G Investments Southern Africa. Our investment professionals in South Africa and around the world follow a consistent valuation-based investment philosophy and process, working closely together through the sharing of ideas, information and research. This coordinated approach provides our clients with a combination of local services and international expertise.

Investment Commentary

Read our latest insights and investment commentary on our multi-asset portfolios.

-

Multi Asset

Downloads

-

M&G Balanced

Who Should Invest

This fund is suitable for Institutional investors with an average to high risk tolerance and a long term investment horizon. The product is compliant with Regulation 28 of the Pension Funds Act.

Fund Details -

M&G Domestic Balanced

Who Should Invest

This fund is suitable for Institutional investors with a low to medium risk tolerance and a long term investment horizon. The product is compliant with Regulation 28 of the Pension Funds Act.

Fund Details -

M&G Real Return - Inflation Plus 5%

Who Should Invest

This fund is suitable for Institutional investors that seek steady inflation-beating growth of capital through an actively managed portfolio that complies with Regulation 28 of the Pension Funds Act.

Fund Details -

M&G Real Return - Domestic Inflation Plus 5%

Who Should Invest

This fund is suitable for Institutional investors that seek steady inflation-beating growth of capital through an actively managed domestic only portfolio that complies with Regulation 28 of the Pension Funds Act.

Fund Details -

M&G Real Return - Medical Aid Inflation Plus 5%

Who Should Invest

This fund is suitable for Medical Aid Schemes that seek steady inflation-beating growth of capital through an actively managed portfolio that complies with Regulation 30 of the Medical Schemes Act.

Fund Details

South Africa

South Africa Namibia

Namibia

Multi Asset

Multi Asset