Market Observations: Q2 2020

As the world continued to battle the Coronavirus in the second quarter of 2020, countries started to reopen gradually and financial markets rebounded; however, by the end of the quarter the pandemic was still a long way from being conquered, nor did markets fully regain their losses. It continued to take a heavy toll on human lives even as lockdowns were lifted, and caution prevailed as estimates started to emerge regarding the extent and severity of its impact on economic growth. The IMF projected a 4.9% contraction in global growth for 2020, depending on how quickly countries and industries were able to open safely. Yet financial markets bounced back from oversold levels, with most global assets posting strong gains for the three-month period.

Having fared worse than most countries in Q1 2020 due to its already-precarious government finances and the recessionary economic environment, South African financial markets rebounded more strongly in Q2 than most of their emerging market peers. However, this belied the exceptionally weak economy, with an ever-worsening growth outlook.

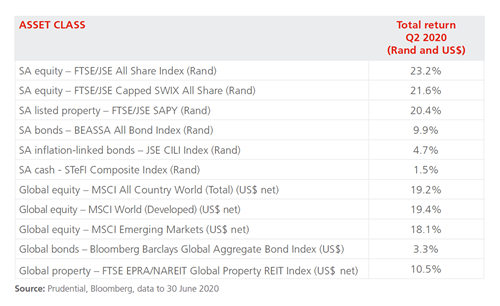

As shown in the table, in US$ terms, global equities (the MSCI All Country World Index, ACWI) returned 19.2% for the quarter, while developed markets delivered 19.4% and emerging markets produced 18.1%. For SA investors, the rand’s 2.7% appreciation against the US dollar trimmed offshore investment returns somewhat. Global bonds delivered 3.3% for the quarter and global property returned 10.5% (both in US$). This was helped by further widespread emergency monetary easing and market support from the major central banks, and large fiscal support packages from governments.

In the US, Q1 2020 GDP contracted by 5.0% q/q and inflation fell to 0.1% y/y in May, its third straight month of decline. However, Q3 and Q4 data are expected to reflect strong positive growth off a low base as all states started to reopen in June.

After its emergency 100bp interest rate cut in mid-March, at its June policy meeting the US Federal Reserve left the benchmark interest rate unchanged at near 0%, saying it expected rates to remain around zero through 2022. It also said it would continue to buy back bonds to support the economy. The growth outlook deteriorated further as the Fed lowered its GDP forecast to a 6.5% contraction for 2020, but it expects 5.0% growth in 2021. In the equity market, the S&P 500 gained 20.5% in US$ for the quarter, while the Nasdaq shot up 30.3%, making it one of the only equity markets to fully regain its Q1 losses.

In the UK and European Union, governments also started to reopen their economies, with the UK lagging Europe. Like the US, the Bank of England and European Central Bank (ECB) maintained record-low interest rates and supportive bond buying programmes. For the first time, the ECB launched a backstop facility to provide euro-denominated repo lines to countries outside the euro area. For Q1 2020, the UK reported a -2.2% q/q contraction in its GDP, the largest in 40 years, while the EU’s economy was even weaker with a 3.3% q/q contraction over the quarter. In the equity markets, the FTSE 100 returned 8.8% in US$ for the quarter, while Germany’s DAX produced 26.8% and the French CAC 40 delivered 16.2% in US$.

In Japan, the economy was already weak going into 2020 with a much worse-than-expected contraction in GDP growth of -7.2% y/y in Q4 2019, due largely to the impact of the new local consumption tax and the US-China trade war. For Q1 2020 the economy slumped by 2.2% y/y, putting the country in recession. The latest consumer spending, exports and output data are pointing to the worst growth performance for the country since World War II in Q2 2020. The Nikkei 225 returned 18.1% for the quarter.

China, meanwhile, reported a 6.8% y/y contraction in GDP for Q1 2020, even though the economy had started to reopen as early as March. This was the country’s first decline in growth since 1992. Industrial production fell 8.4% over the quarter, while retail sales were down 19%. However, analysts were increasingly optimistic that China would escape a technical recession, forecasting 1.5% y/y GDP growth in Q2 and a 1.8% y/y expansion for 2020 as a whole thanks to stimulus measures from the government and PBOC. At the same time, China’s move to impose new restrictions on Hong Kong’s democratic freedoms through new legislation around treason, sedition and other forms of anti-government protest was met with widespread condemnation, both local and international, dampening investor sentiment. Despite this, the legislation was passed. Consequently, Hong Kong’s Hang Seng Index returned a subdued 4.8% for the three months and the MSCI China returned 15.4% in US$.

Among other large emerging equity markets, in US$ terms the MSCI South Africa was the top performer with a 27.5% return, followed by Brazil’s Bovespa with 23%. The MSCI China recorded the weakest return at 15.4%.

The price of Brent crude oil ended the quarter at around US$42 per barrel, up from US$34 at the end of March as markets anticipated more demand as the global economy opened up. OPEC and Russia ended their price war, negotiating further reductions in supply. As for other commodities, palladium was the only major commodity that lost ground over the quarter, down 16.4%, while gold gained 9.8% and copper shot up 25.9%.

South Africa rebounds with rest of the world

It was a mixed picture in South Africa for Q2 2020: although local equities rebounded more than those in many other countries, the economic picture worsened despite the gradual re-opening of the economy from June. Data showed SA GDP shrank by 2.0% q/q in Q1 2020 (better than the -3.8% q/q expected), but the Treasury forecast a sharp -7.2% contraction for 2020 as a whole. The already-recessionary conditions were exacerbated by the lockdown, drastically curbing consumer and business spending, investment and industrial production. Although the government implemented fiscal tax relief and spending programmes to help cushion the economy, these were necessarily relatively modest due to budget constraints.

At its policy meeting on 21 May, the SARB cut the repo rate by a further 50bps to 3.75%, an historic low. This brought the total reduction to 275bps for 2020 so far. This was reinforced by the latest inflation data, as April CPI came in at 3.0% y/y, its lowest level since 2005. The SARB also lowered its GDP growth forecast to -7.0% for the year, versus -6.1% in April, while expecting 3.8% growth in 2021 and 2.9% growth in 2022. In addition to this, the central bank bought back large amounts of government bonds for the first time to support the market during the quarter.

Meanwhile, Finance Minister Tito Mboweni’s Supplementary Budget unveiled in mid-June highlighted at least part of the extent of damage done by the pandemic. The government budget deficit is now expected at 15.7% of GDP in the current 2020-21 financial year, more than double the previous forecast of 6.8%. The budget did aim to stabilise the government’s growing debt burden, but at 87% of GDP by 2023/24, this is still a worryingly high level. Still, financial market reaction to the details contained in the Supplementary Budget was subdued as most of the bad news had already been priced into bond yields.

The BEASSA All Bond Index rebounded from its -8.7% loss in Q1, returning 9.9% in Q2 2020 as some investors snapped up what they thought to be attractively high yields, while SA inflation-linked bonds returned 4.7%. Cash (as measured by the STeFI Composite) produced 1.5% for the three-month period.

The local equity market experienced a very strong quarter after the indiscriminate selling in March that saw the FTSE/JSE All Share Index (ALSI) return -21.4% for Q1 2020. Companies with global earnings held up better than local “SA Inc” shares, as the ALSI delivered a 23.2% return for Q2. This was led by Resources stocks with a 41.2% return, followed by Listed Property (SAPY Index) with 20.4%. Industrial stocks produced 16.6% and Financials returned 12.9%.

Finally, along with other emerging market currencies, the rand posted small gains in Q2 against all three major currencies after its drastic sell-off in Q1, appreciating 2.7% against the US dollar, 3.0% against the pound sterling and 0.4% versus the euro.

How have our views and portfolio positioning changed?

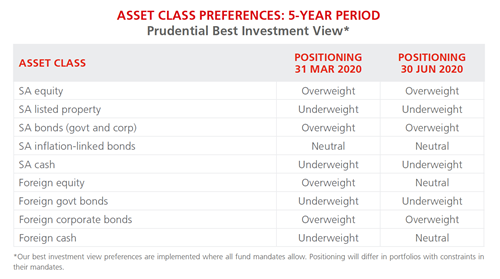

Starting with our view on offshore asset portfolios, during the quarter we reduced global equities from an overweight to a neutral position, in favour of buying more SA nominal bonds and SA equities due to their relatively more attractive valuations. Developed market equity valuations fell less than those in SA in March, and following this we took the opportunity to reduce some of our global equity positions to buy more cheaply valued but high-quality SA equities and SA nominal bonds.

Within our global equity positioning, our portfolios have been underweight the more expensive US market in favour of selected European and emerging market equities. We have been aiming to position the portfolios with higher weightings of very high-returning global assets while maintaining a mix of assets that have diversified return profiles.

We remain underweight developed market government bonds, although less so now than at the beginning of the quarter, as we established a position in 30-year US Treasury bonds as a risk diversifier for the portfolio. We remain overweight US and European investment-grade corporate bonds and selected emerging-market government bonds, which offer attractive real yields. Our portfolios have already benefitted from a rebound in many of these assets during the quarter, after having sold off indiscriminately in March.

Our best investment view portfolios continue to be overweight in SA equities. After falling to an exceptionally low price-book value ratio of around 1.0X during March, SA equity valuations rose over the quarter to trade at around 1.3X by the end of April and 1.4X by the end of June, a still-attractive level compared to the market’s long-term average of around 2.2X. During the quarter, we used part of the proceeds of our offshore equity sales to take advantage of some rare opportunities that arose to acquire normally expensive, high-quality shares at very attractive valuations. We were mindful of the importance of maintaining a prudent approach, to ensure that the companies we chose were able to endure a prolonged shutdown.

For example, we added Bidcorp exposure in our best investment view portfolios where appropriate. Bidcorp is a high-quality business, as demonstrated by its history of delivering steady compound growth in profits over time, as well as having a strong balance sheet. We also increased our holdings in Remgro and MTN after their shares reached substantial discounts. Remgro had the additional attraction of the unbundling of its stake in RMH during the quarter, while for MTN we saw nearly 40% upside potential in its share price, even after incorporating further discounts for future currency depreciation and other potential negative developments. A final example is Growthpoint, where we had calculated that its SA portfolio of properties (including the V&A Waterfront) was trading at a 61% discount to its net asset value at its low point. At the same time, its implied distribution yield was over 50%, and although this subsequently halved to around 27% over the quarter as the Growthpoint share price recovered, this was still very attractive for investors, even considering a very negative scenario for the company going forward.

Meanwhile, our portfolios’ top holdings continue to include global giants like Naspers, British American Tobacco (BAT) and Anglo American, all of whose share prices held up well during the March sell-off -- and should continue to do so. Naspers’ online gaming and other services benefited from the global lockdowns, especially in China, while BAT has solid, defensive-quality earnings and Anglo American’s operations are highly diversified across commodities and geographies. These equity holdings, among others, give our best investment view portfolios the potential to deliver above-market returns going forward.

Our higher-risk holdings continue to include Sasol (now with a quite small overweight exposure), as well as some of the gaming stocks, where closure of casinos and limited payout slot machines brought a temporary but painful full stop to their earnings. During the quarter Sasol was one of the top-performing shares on the JSE as it rebounded following the partial recovery in the oil price and announced significant cost-cutting and other measures to improve its balance sheet. This contributed to portfolio performance during the quarter.

As for gaming companies, these businesses have done a good job cutting costs and renegotiating debt repayments during the quarter, and from July will be able to open their doors again, albeit at reduced capacity. We do not believe the pandemic will cause permanent damage to this highly cash-generative sector, although it will take some time for the businesses to regain their pre-pandemic profit levels.

We were already substantially underweight SA listed property in our best investment view portfolios in Q1 2020 as the sector continued to sell off sharply, and we remained underweight in Q2. This positioning reflects the significant macroeconomic uncertainty exacerbated by the pandemic in South Africa, and surrounding the outlook for distributions, as well as the relatively high debt levels in the sector. The risks around property company earnings remain high given the deterioration in the economic outlook, although share prices did rebound over the quarter.

During the quarter we moved further overweight in SA nominal bonds in our best investment view portfolios, buying mostly long-dated bonds with maturities of 20+ years out of the proceeds of our offshore equity sales. We are overweight in these longer maturities, which have higher prospective returns than their shorter-dated counterparts and have lagged the gains seen in the latter in recent months. The yields of 20+year bonds rose to exceptionally attractive levels of over 13% in March, subsequently recovering to trade at over 11% in April and through the rest of the second quarter. This is still cheap compared to their pre-Coronavirus yield of 10%. We believe these yields will more than compensate investors for the risk associated with the government debt burden, especially in light of the plans included in the Supplementary Budget (assuming the government is able to adhere to this). If inflation averages 4.5% y/y (the mid-point of the SARB’s targeted inflation range) going forward, bonds offer investors a prospective real return that is well over their historic average of 2.5% p.a.- somewhere around 6.5% p.a., depending on when they were purchased during the quarter.

Our best investment view portfolios remained neutral in inflation-linked bonds as of the end of the second quarter of 2020. At the end of March ILBs were offering a very attractive future return for investors of over 6.0%, which is guaranteed if they are held to maturity. During the second quarter ILBs recovered some ground, with 10-year real yields falling to around 4.5%. With real cash yields currently around 0%, the gap between ILB and cash real yields has never been wider. We are comfortable with this neutral positioning because we believe better value exists in SA equity and SA longer-term nominal bonds, given their extraordinary pricing: both have the potential to offer more attractive returns over the medium-term and are much more liquid.

Lastly, cash is the one SA asset class where prospective returns are now much lower than before the Coronavirus market crash, due to the large interest rate cuts from the SARB. Our best investment view portfolios remain underweight SA cash, since prospective real returns from this asset class are now negative -- no longer even beating inflation.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter