Market Observations: Q3 2023

After a promising start to the third quarter (Q3) of 2023 in July, it was largely downhill for investors in the following two months as the global interest rate outlook deteriorated, taking with it 2024 growth prospects and investor risk sentiment. As the prospect of “higher for longer” interest rates became increasingly likely, risk aversion took hold and global equity and bond markets sold off broadly. September saw significant sales of developed market government bonds on the back of ongoing hawkish comments from the US Federal Reserve and others, and forecasters revised downward their 2024 GDP growth outlooks, even while revising upward those for 2023.

Disappointing Chinese growth also continued to weigh on market sentiment, as did risks associated with the ongoing Russia-Ukraine war, and the sharp increase in the price of oil, which jumped to over US$97/bbl (Brent crude) in late September and sparked more inflation worries as oil producers extended their production cuts and inventories fell.

The extent of market losses was broadly similar across equities and bonds, and developed and emerging markets, with global property stocks hardest hit by the “higher for longer” outlook. For the three months ended 30 September 2023, the MSCI All Country World Index delivered -3.4%, the MSCI Emerging Markets Index produced -2.9% and global property stocks (the FTSE EPRA/NAREIT Global REIT Index) returned -6.8% (all in US$). At the same time, the Bloomberg Global Aggregate Bond Index offered no diversification for investors, delivering -3.6% (in US$).

South African markets took their cue from their global counterparts in Q3, with local concerns adding to the pessimistic tone. The elevated risks associated with SA assets brought on partly by the “Lady R” incident in May persisted, with perceptions of SA’s pro-Russia stance enhanced by the hosting of the BRICS Summit and growth prospects remaining subdued (highlighted by a temporary increase to Stage 6 loadshedding in September). This kept pressure on all SA assets, including the rand.

Over the quarter the SA equity market was dragged down by Industrial counters, as well as Resources (amid fears of slower global growth and demand, particularly from China). Locally-focused companies fared better. The FTSE/JSE All Share Index (ALSI) returned -3.5% in Q3 while the Capped SWIX delivered -3.8% (both in rands). Industrial counters returned -6.2% and Resources -5.3%, while Financials produced 2.2% and the All Property Index -0.6% (all in rands).

For the quarter, SA nominal bonds (the FTSE/JSE All Bond Index) delivered -0.3% in rands, as capital losses were offset to some extent by the high yields they offer in absolute terms, while inflation-linked bonds (ILBs) produced 0.8% and cash returned 2.1%. Finally, the rand lost 0.3% against the US$ for the quarter, and depreciated 3.2% against the euro and 4.3% versus the UK pound as sentiment toward SA remained depressed.

|

Asset class |

Total return Q3 2023 (Rand and US$) |

|

SA equity – FTSE/JSE All Share Index (Rand) |

-3.5% |

|

SA equity – FTSE/JSE Capped SWIX All Share (Rand) |

-3.8% |

|

SA listed property – FTSE/JSE All Property Index (Rand) |

-0.6% |

|

SA bonds – FTSE/JSE All Bond Index (Rand) |

-0.3% |

|

SA inflation-linked bonds – FTSE/JSE Composite ILB Index (Rand) |

0.8% |

|

SA cash - STeFI Composite Index (Rand) |

2.1% |

|

Global equity – MSCI All Country World (Total, US$ net) |

-3.4% |

|

Global equity – MSCI World (Developed) (US$ net) |

-3.5% |

|

Global equity – MSCI Emerging Markets (US$ net) |

-2.9% |

|

Global bonds – Bloomberg Global Agg Bond Index (US$ net) |

-3.6% |

|

Global property – FTSE EPRA/NAREIT Global REIT Index (US$ net) |

-6.8% |

Source: M&G Investments, Bloomberg, data to 30 September 2023

United States

In the US, after hiking by 25bps at its July policy meeting, the Fed left interest rates unchanged in September, in line with expectations. However, the central bank subsequently surprised the market by hawkishly signalling the possibility of another rate hike before year-end, reinforced by later statements by Fed Governor Jerome Powell and other key voting members, which left little doubt that interest rates would be higher than forecast for longer. Markets have now priced in another 25bp rate hike for November. This perceived shift in the Fed’s views came in the wake of still-strong US economic data, including a robust jobs market and higher August headline inflation at 3.7% y/y versus 3.2% in July, driven predominately by higher energy prices. However, Core CPI, which excludes volatile food and energy prices, fell to 4.3% y/y in August from 4.7% in July. And US GDP growth for Q2 was reported at 2.1%, revised down from the 2.4% initially estimated.

Adding to uncertainty was the Congressional stand-off over the national budget, which went down to the wire and could have seen the government partially shut down, with some services halted and thousands of workers going unpaid. This prompted further weakness in bond markets, with the 10-year US Treasury yield rising to 4.75% at quarter-end compared to 3.8% at the start – a substantial upward move for the market.

For the quarter, US equity returns were in the red: the Dow Jones produced -2.1%, the Nasdaq -3.9%, and the S&P 500 -3.3% (all in US$). The Nasdaq remains the top-performing developed equity market year to date with a return of 27.1%.

UK

In the UK, the Bank of England kept its main interest rate unchanged at 5.25% at its September meeting, ignoring the lower-than-expected August CPI data at 6.7% y/y (versus 7% forecast). UK inflation has been particularly high and resilient compared to other major economies, and the markets are expecting at least one further 25bp rate hike in 2023, especially given the recent rise in global energy prices. Meanwhile, Q2 2023 growth surprised marginally on the upside at 0.2% y/y compared to the 0% consensus, and up from 0.1% in Q1, still managing to avoid a recession. Similar to the US, resilient consumer demand and a tight labour market are keeping growth in positive territory. For Q3 2023, the FTSE 100 returned -1.9% in US$.

Eurozone

In the eurozone, inflation remained relatively high during the quarter, with the latest August CPI at 5.2% falling only slightly from 5.3% in July. Core inflation, which excludes volatile energy and food prices, eased to 5.3% from 5.5%. After lifting interest rates by 25bps in September to a record 4.0%, in the 25 September ECB Hearing before the European Parliament, President Christine Lagarde suggested further hikes may not be necessary, but upside inflation risks remained. In other news, as in the UK, the region continued to avoid a recession as GDP growth accelerated slightly to 0.3% q/q in Q2 2023 after 0.1% in Q1, but the latest ECB projections called for slow growth of 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025. In European equity markets, France’s CAC 40 returned -6.3% and Germany’s DAX delivered -7.5% (in US$) in Q3.

Japan

Japan continued to impress investors with its stronger-than-expected recovery, announcing Q2 2023 GDP growth of 6.0% y/y due to robust export growth (thanks to the weaker yen) and soundly beating forecasts of 3.1%. Reflecting this, Japan saw the strongest earnings growth among large regional markets in the last earnings season. A number of Japanese companies have been improving their operational leverage (with a positive impact on earnings growth), increasing buybacks, and raising dividends.

In line with expectations, the BOJ maintained its ultra-low interest rates during the quarter in support of the recovery, and markets are looking for hints on when it will phase out stimulus. Meanwhile, core inflation remained above the BOJ’s 2% inflation target at 3.1% in August, steady from July, but the BOJ has said they will continue policies designed to keep the country out of deflation. The Nikkei returned a disappointing -6.3% in US$ for Q3, but is still up 10% in 2023 so far.

China

During the three months, China again reported disappointing GDP growth, this time at 6.3% y/y for Q2 2023 versus 7.3% expected. The country’s rebound continued to lose momentum despite new stimulus measures from the PBOC as it lowered reserve requirements for commercial banks in a bid to help them lend more. Five big banks also cut their lending rates in September. However, the PBOC kept its benchmark lending rates unchanged. China’s CPI rose 0.1% y/y in August after a 0.3% y/y decline in July. On a positive note, China's industrial production rose by 4.5% y/y in August, beating the 3.9% forecast and up from 3.7% in July. Pent-up consumer demand continues to underpin the (weaker) expansion, along with consumer services, while the property sector remains weak and youth unemployment high. After notable losses in Q2, local equity markets were still fairly weak in Q3, with Hong Kong’s Hang Seng returning -4.1 % and the MSCI China delivering -1.8%, both in US$.

Emerging markets

Larger emerging equity markets ended the quarter in the red, with the exception of the MSCI Turkey, which engineered a sharp recovery with a 32.8% return, and the MSCI India, which posted 2.9% (both in US$). The MSCI China managed to pare its large losses from the previous quarter, delivering -1.8%, while the MSCI South Africa registered a -4.4% return (in US$). Brazil’s Bovespa returned -4.9% and South Korea’s KOSPI -5.9% (both in US$).

Commodities

The international oil price moved higher over the quarter, with Brent crude starting at around US$76/bbl but jumping to just over US$97/bbl at quarter-end. This came on the back of oil producers like Saudi Arabia solidifying their plans to extend production cuts, as well as a fall in inventories and the failure of major economies to slow as much as expected so far in 2023. Other commodity prices were mixed amid the uncertain outlook. Among precious metals, gold fell 3.7%, while platinum was relatively flat at 0.4% and palladium rose 1.6%. Nickel was the largest loser, down 8.0%, while aluminium gained 10.1%, copper was up 0.2% and zinc rose 11.7%.

South Africa

In South Africa, the SA Reserve Bank kept its repo rate steady at 8.25% at both its July and September policy meetings, as expected by the market, but still cited upside risks to the inflation outlook such as higher global energy prices and the weaker rand. Governor Lesetja Kanyago’s hawkish comments left the door open for another interest rate hike in November. Headline inflation ticked up to 4.8% y/y in August from 4.7% y/y in July, and the SARB revised its CPI forecasts for 2023 to 5.9% (from 6.0%) and for 2024 to 5.1% (from 5.0%).

GDP growth for Q2 2023 surprised positively at 0.6% q/q versus 0.3% expected, helped by growth in manufacturing, finance and a turnaround in agriculture. The central bank also upwardly revised its GDP growth forecast for this year to 0.7% (from 0.4% in July), while the 2024 and 2025 forecasts remain unchanged at 1.0% and 1.1%, respectively. Consumer confidence improved slightly against the backdrop of falling inflation and a potential peak in interest rates, with the FNB/BER Q3 2023 Consumer Confidence Index registering -16 points from -25 points in Q2.

The headwinds to growth remained considerable, however, as loadshedding ramped up to Stage 6 temporarily in September, a reminder of the energy constraints facing the country, while China’s slower growth presents challenges for commodity exports. Lower-than-expected tax collections have also fuelled concerns over the national budget deficit, with negative implications for the local bond market.

How have our views and portfolio positioning changed in Q3 2023?

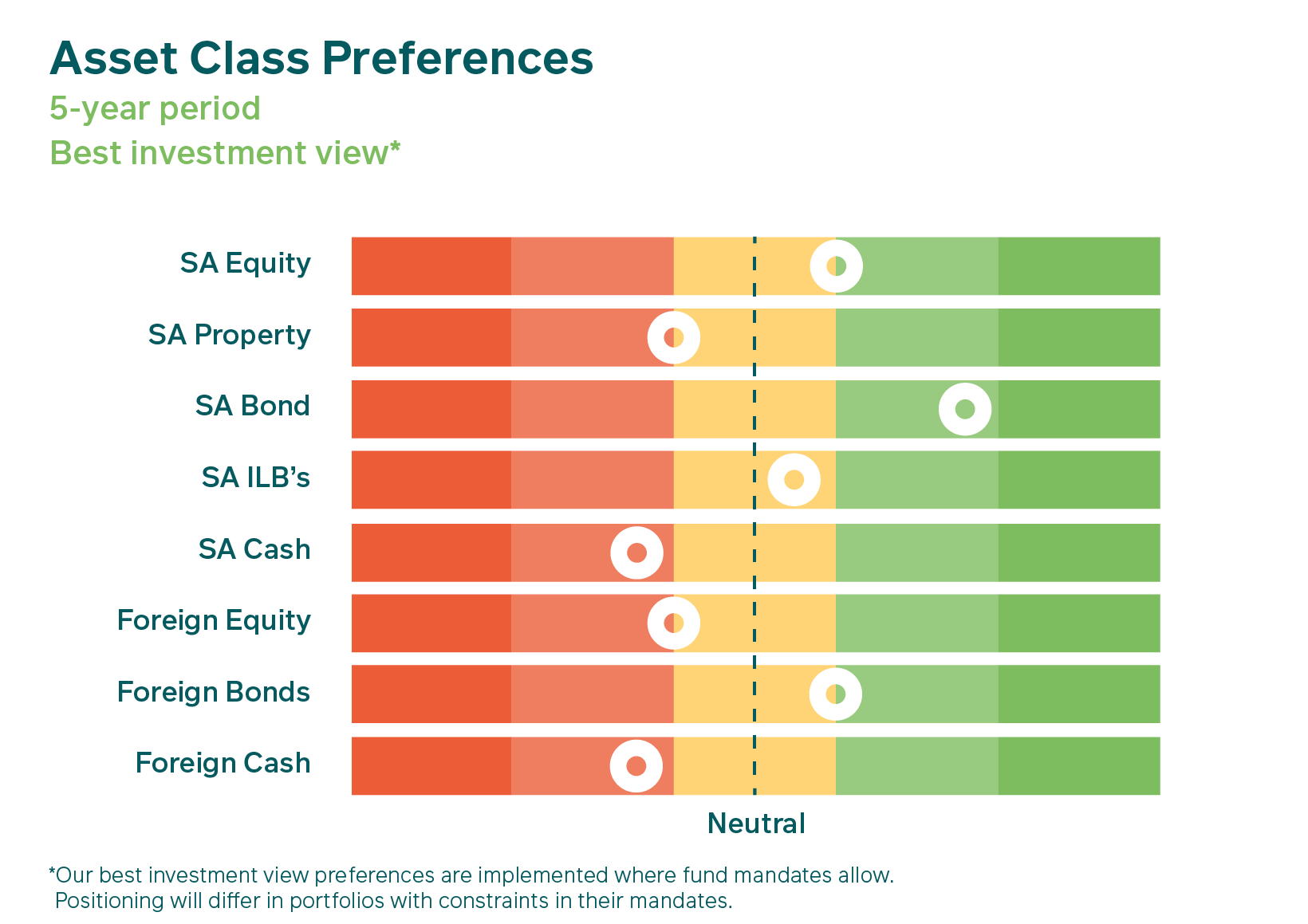

Starting with our view on offshore vs local asset allocation in our house-view portfolios, during the quarter our relative exposure remained largely unchanged, as we continued to prefer more attractively valued SA assets compared to their global counterparts.

Within our global holdings, during Q3 we sold a small amount of global equity. We also bought more global bonds largely out of global cash during the significant September sell-off, adding to our existing tactical overweight in 30-year US Treasuries, and opening new tactical overweights in UK gilt and German bund holdings. As of quarter-end, this has given us a small underweight in global equities in our portfolios, an overweight position in global bonds and duration, and a continuing underweight in global cash due partly to our forex positioning.

In global equities, the MSCI ACWI 12-month forward P/E fell to around 15.9X at quarter-end from 16.4X at the beginning of the quarter as stock prices slumped. We pared our position slightly as the growth outlook appeared to worsen, while we retained our ongoing concerns that earnings expectations, particularly in the US, still do not fully reflect the downside risks to corporate earnings associated with central banks’ steep interest rate hikes and the increased likelihood of rates remaining elevated for longer. While we did see meaningful downward revisions to GDP forecasts for 2024 during the quarter, corporate earnings forecasts have remained remarkably resilient. As such we continue to be selective around our global equity holdings and have moved slightly underweight. In the current environment, as stressed previously, we prefer high-quality companies with pricing power, strong balance sheets and reliable cashflow generation.

Our tilt away from the US reflects that market’s relatively expensive valuations (at a forward P/E of 18.9X at quarter-end), and we are also avoiding Australia and Canada. Equity markets that we prefer for their cheaper valuations include the UK, Japan, China and other emerging markets that are relatively cheap. For example, the 12-month forward P/E of the MSCI Emerging Markets Index stood at around 11.8X at quarter-end.

Within global bonds, real yields became much more attractive over the quarter and in our view offer more-than-fair compensation for the risk involved, which primarily reflects investors’ views of “higher for longer” global interest rates. We moved to an overweight position in global government bonds in Q3 from our previously broadly neutral stance, adding to our holdings of 30-year US Treasuries, 30-year UK gilts and long-dated German bunds. Duration also rose given our preference for long-dated paper. We are also holding moderate levels of local currency sovereign EM bonds where the real yields are high and the currency is trading at fair-to-cheap levels.

The fund was underweight global corporate credit at quarter-end, based on our view of credit spreads as unattractive for the risk involved versus their government counterparts. Despite risk-averse sentiment, US High Yield bonds have managed to record a 1.5% return for investors year to date, outperforming developed market government bonds which are substantially in the red.

The M&G Balanced Fund still favoured SA equities at the end of Q3 2023, with our positioning largely unchanged. SA equity valuations (as measured by the 12-month forward Price/Earnings ratio of the FTSE/JSE Capped SWIX Index) were also little moved over the quarter at 9.5X, experiencing similar declines in both earnings expectations and share prices.

Despite its weakness in Q3, MTN is still up over 100% in the past three years. MTN Nigeria has been impacted by the June devaluation of the Naira, while load-shedding has placed pressure on MTN SA’s profitability. However, volume growth in Nigeria, cost cutting initiatives, price increases and the implementation of additional backup power solutions are expected to help offset lost revenue.

Commenting on some of our tactical changes to the fund in Q3, over the last year we have gradually decreased our overweight to the Banks sector as earnings and dividends have recovered strongly post the COVID lows. We continue to be positioned in favour of the lower-rated banks, Standard Bank, ABSA and Investec, and underweight the more highly rated banks, Firstrand and Capitec. ABSA is worth mentioning as it has shown a steady improvement in operating performance and is generating a return on equity of 17%, up substantially from the high single-digit returns it was generating just a few years ago. Although its share price has performed relatively well versus the other banks, we think that it is still undervalued and it remains one of our top overweights in the banking sector. We have reduced our overweight position to Standard Bank due to its substantial re-rating. However, we continue to have an overweight position to the Banks sector as we think that the banks that we own are trading on undemanding valuations, especially given that earnings and dividend growth are exceptionally strong currently.

During the quarter we added to our overweight position in British American Tobacco (BAT) as we believe that the investment case remains very strong -- the company is trading with an exceptionally attractive dividend yield of 8% and we expect this dividend to continue growing for the next five years, despite the risks which tobacco companies face. We anticipate continued strong cash flows from BAT’s core business in the United States to drive a repayment of debt, as well as continue to fund investment into next-generation lower-risk products. BAT is at the forefront of offering its customers alternative products which reduce harm and we expect this trend to continue. We think that BAT can continue to grow profits while helping its customers switch to much lower risk and less harmful products. BAT provides us with very stable and defensive cash flows at a very attractive valuation, especially amidst continued concerns around the risk of a global recession.

Platinum group metals (PGM) companies continued to be impacted by the fall in PGM prices – for example, the price of palladium has fallen 42.5% in the past 12 months. Rhodium, at its peak over a year ago, was contributing more than 50% of a typical platinum producer’s revenue and contributed massively to their profitability. This sector’s fortunes have changed rapidly over the last five years. In 2019, margins started to improve after many years where margins were not even high enough to compensate the mines for ongoing maintenance capex. In 2021 and 2022, margins in the sector were at near-record highs and cash generation was very strong. We were cognisant of the high margins that companies were earning and moved our clients’ portfolios to an underweight position in 2022. We also strategically shifted our preference for companies within the sector to the higher- quality platinum companies which are likely to see production growth as a result of their investment in capacity. In the first quarter of 2023, we sold out of Sibanye Stillwater in order to further increase the quality of our holdings in the platinum sector, which now only comprise Northam and Impala Platinum. In the past quarter, in order to remain underweight the platinum sector and given the relatively good performance of Northam, we reduced this position slightly, although it remains our favoured exposure within the sector.

During the quarter we remained tilted away from SA listed property as property sector risks remained high relative to other sectors. We still prefer exposure to non-property shares that we believe offer better value propositions for less risk. Conditions in the local property sector remain uncertain given expectations for ”higher for longer” interest rates (many property companies are reliant on finance to expand their portfolios) and relatively weak growth prospects, among other fundamental factors.

Despite their further weakness in September, we did not increase our exposure to SA nominal bonds, maintaining our significant preference for these assets in our house-view portfolios. From a yield of 11.4% at the start of the quarter, the 10-year SA government bond reached a high of around 12.28% on 28 September before recouping some of the losses on the last day of the quarter. This is not far from the 12.4% high reached during the height of Covid. While we acknowledge the heightened risks to the local economy, we continue to believe SA nominal bond valuations are attractive relative to other fixed income assets and to their own longer-term history, and will more than compensate investors for their associated risks over time. The fund has no meaningful exposure to SA inflation-linked bonds (ILBs).

Lastly, the fund remained tilted away from SA cash, given that other SA asset classes offer higher real yields on both an absolute and relative basis.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter