Market Observations: Q3 2022

Global financial markets were painted in a sea of red in the third quarter (Q3) of 2022, falling more sharply in September as any remaining optimism over economic growth for the year and into 2023 was largely crushed by global central banks, led by the US Federal Reserve. Their stiff fight against persistent global inflation resulted in surprisingly aggressive interest rate hikes, with markets having to revise their forecasts for interest rates much steeper on several occasions during the period. While acknowledging the “painful” consequences felt by consumers and businesses, central bankers have been more concerned about higher inflation levels becoming embedded into the broader economy through the second-round effects of inflation expectations and wage demands.

These developments translated into greater pessimism over corporate earnings growth and weighed on bond prices, with risk-off sentiment sending most markets into negative territory -- particularly emerging market equities. Conditions were exacerbated by the ongoing Russia-Ukraine war, the energy crisis in Europe, and China’s continuing economic slowdown resulting from tight Covid-related restrictions and a weak property market. With a more limited geographical impact, but still of note, was the September meltdown in UK bonds and the pound on the back of new PM Liz Truss’s surprise introduction of plans for a much higher government budget deficit on the back of proposed unfunded tax cuts (broadly favouring the rich), among other measures. For the quarter ended 30 September 2022, the MSCI All Country World Index returned -6.8%, the MSCI Emerging Markets Index produced -11.6%, and the Bloomberg Global Aggregate Bond Index delivered -6.9% (all in US$). As an interest-rate-sensitive asset class, global property stocks were hurt almost as badly as emerging markets, with the FTSE EPRA/ NAREIT Global REIT Index returning -11.1% (US$ net).

South African markets were not spared in the sell-off; growth prospects deteriorated amid rising prices, higher borrowing costs and the high frequency of electricity outages, all of which weighed on economic activity. All sectors of the equity market delivered negative returns for the quarter: the FTSE/JSE All Share Index (ALSI) returned -1.9% and the Capped SWIX -2.4%. Locally oriented sectors were weakest, with -4.2% from Financials and -4.1% from Listed Property (All Property Index), while globally oriented sectors delivered marginally better returns with -1.3% from Industrials and -2.1% from Resources. For the 12 months to 30 September, the ALSI has returned 3.5%, outperforming the -5.2% recorded by global equities (the MSCI All Country World Index), in rand terms.

SA bonds continued to put in a marginally positive performance: The FTSE/JSE All Bond Index (ALBI) delivered 0.6% for the quarter, cushioned largely by its high yields on both an absolute and relative level. For the 12 months to 30 September, local bonds (ALBI) outperformed global bonds with a return of 1.5% versus -5.0%, in rand terms. Inflation-linked bonds (ILBs) produced -1.0% and cash returned 1.4% for Q3. Finally, the rand depreciated significantly against the rampant US$, which reached multi-decade highs versus other global currencies like sterling and the euro. The rand lost 9.7% versus the greenback, 2.8% against the euro and 0.9% against the pound sterling over the quarter.

In the US, the US Fed hiked its Federal Funds rate by a combined 150bps in Q3, a very aggressive policy tightening move by historic standards, even as annual inflation eased to 8.3% in August from 8.5% in July. Meanwhile, US economic growth shrank by 0.6% y/y in Q2 2022 on the heels of a 1.6% contraction in Q1, as consumer incomes and corporate profits were hit by higher debt costs and rising prices for food and energy, despite a fall in the latter in September. The Fed’s latest survey showed the median of US GDP growth forecasts was revised lower to just 0.2% for 2022 (vs 1.7% previously) and 1.2% in 2023 (vs 1.7%). And Fed Funds Futures contracts now imply US interest rates reaching approximately 4.5% in mid-2023, well above the 2.9% forecast in May.

For the third quarter in a row, US Treasury bonds sold off sharply as a consequence of the deteriorating inflation and interest rate outlooks, resulting in an unusually volatile market: the Bloomberg Aggregate US Treasuries Index returned -7.6% in US$, for a total return of -21.3% for 2022 so far. For a safe-haven asset favoured by conservative investors, this is a painful result. Meanwhile, US equity returns were also negative for the quarter: in US$, the Nasdaq delivered – 3.9%, the Dow Jones produced -6.2% and the S&P 500 returned -4.9%, the latter now having recorded a -23.9% return for the year to date.

In the UK, new PM Liz Truss sparked protests from both financial markets and the public after unveiling a budget plan heavily reliant on deficit spending and tax cuts (especially for the well-off) to boost growth. Both government bonds and the pound promptly experienced a sharp sell-off. The new PM also proposed an Energy Price Guarantee to limit energy cost increases for the coming winter, which is expected to help lower inflationary pressure on consumers. The Bank of England raised its key interest rate by a total of 100bps to 2.25% for the quarter, pushing borrowing costs to the highest level since 2008. This came against consumer inflation of 9.9% y/y in August, down from 10.1% in July. For Q3 2022, UK equities were also in the red: the FTSE 100 returned -10.6% in US$.

Meanwhile, the European Central Bank (ECB) raised interest rates by an unprecedented 75bps in September as annual inflation in the Euro Area jumped to 10% (from 9.1% in August), the first time on record that inflation reached double-digits. The Euro Area’s Q2 2022 GDP growth came in at 4.1% (q/q annualised), slowing from 5.4% in Q1. Dominating the news were stories of an expected energy crisis in the region in the coming months, amid gas and oil shortages on the back of sanctions against Russia and the imposition of Russian oil price caps. Meanwhile, inflation was expected to remain high, consumer spending to come under pressure and growth to slow sharply in 2023. The ECB’s September forecasts showed GDP growth at 3.1% for 2022 (revised up from 2.8% following positive surprises in the first half of the year), and then slowing to only 0.9% in 2023 (cut from 2.1% previously). In France, the CAC 40 returned -8.6%, while Germany’s DAX delivered -11.2% for the quarter in US$.

In Japan, the Bank of Japan (BOJ) maintained its ultra-easy monetary policy during the quarter, leaving its policy rate unchanged at -0.1%. The market continues to forecast no interest rate hikes through 2023. Japan’s economy expanded 0.9% q/q in Q2, the third straight quarter of positive growth and above market consensus of a 0.7% rise, helped by the lifting of all Covid-19 curbs. Following other global equity markets lower, the Nikkei returned -6.9% in US$ for the quarter.

In China, the focus was squarely on supporting economic growth for the quarter. GDP growth for Q2 2022 disappointed at only 0.4% y/y compared to the 1.0% expected. Activity was weighed down heavily by the government’s harsh crackdowns against Covid-19 as the country suffered its worst outbreak of the virus since the peak of the pandemic in early 2020. Large cities such as Shanghai, Chengdu and Wuhan fell under strict containment measures, severely denting consumer demand and business activity. Ongoing property market weakness also undercut consumer and business sentiment.

As a result, the central bank left its benchmark lending rates unchanged in September, after having implemented some credit easing measures earlier in the quarter, while the government also contributed fiscal support. This ongoing monetary policy divergence between China and the US increased the risk of further yuan depreciation and capital outflows, with the yuan falling to a 13-year low against the surging US$ in September.

In its September outlook, the World Bank forecast China’s GDP growth at only 2.8% in 2022, far below the government’s 5.5% growth target for the year. This is the first year in decades that the country is lagging the rest of the Asian region (seen at 5.3% growth in 2022), largely as a result of its much slower recovery from the pandemic. For the quarter, Hong Kong’s Hang Seng produced -20.2%, while the MSCI China returned -22.4%, both in US$.

Most large emerging equity markets were in the red for the quarter, with the exceptions of Turkey, India and Brazil, which were driven by their own idiosyncratic factors, returning 16.3%, 6.8%, and 8.0%, respectively, in US$ terms. The MSCI China was the worst performer with a -22.4% return, as explained above, while South Korea’s KOSPI was down 16.0% and the MSCI South Africa delivered -12.0% (all in US$).

The oil price fell during the quarter on the back of expected lower demand as growth slows: Brent crude oil lost 23.4% in US$, ending the month at around US$90 per barrel. Supply cuts could be on the horizon, however, as OPEC+ members consider reducing production to prop up the price. Over the past 12 months the oil price is now only 12.0% higher. Looking at other commodity prices, palladium was the only gainer for the quarter (+10.2%) largely due to supply constraints, whereas slower growth and the stronger US$ weighed broadly on demand. Among precious metals, gold fell 8.5% and platinum lost 5.7%. Industrial metals prices lost between 1%-9% in Q3.

South Africa

It proved to be another difficult quarter for South Africa. The South African Reserve Bank (SARB) followed the US with a total of 150bps of interest rate hikes during Q3, both to curb local price pressures and to ensure the interest rate differential between SA and the US did not become too wide, thereby protecting against rand weakness. More hikes are expected in the coming months, in line with the rest of the world. The Q3 rate increases came amid a contracting economy: Q2 GDP growth came in at -0.7% (q/q annualised), marginally below market forecasts of a 0.8% fall, as the lasting impact of the devastating floods in KwaZulu-Natal and intense power outages during the period negatively impacted economic growth on top of the global slowdown. As a consequence, the SARB pencilled in growth for Q3 and Q4 at 0.4% and 0.3%, respectively, and trimmed its GDP growth forecast for 2022 to 1.9% from 2.0% previously. Looking further ahead, the central bank sees the economy expanding by only 1.4% in 2023 and 1.7% in 2024.

In more positive news, SA’s annual inflation eased to 7.6% in August from an over 13- year high of 7.8% in July, marginally above market expectations of a 7.5% rise. The Purchasing Managers’ Index expanded to 52.1 points in August from 47.6 in July, following a steep fall in fuel prices at the start of August, which helped moderate cost pressures. And finally, retail trade climbed by 8.6% y/y in July following a 2.3% fall in the previous month, marking the steepest rise in retail activity since June 2021.

How have our views and portfolio positioning changed in Q3 2022?

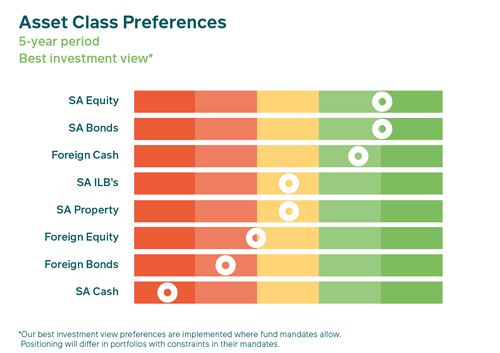

Starting with our view on offshore asset allocation, we maintained our portfolio positioning favouring local assets over global assets. In addition to their more attractive valuations, the weaker rand/US$ exchange rate also supports this view.

Within our global holdings, we continued to prefer global cash over global bonds, and are neutral global cash versus global equities. As valuations cheapened later in the quarter we trimmed our global cash position slightly in order to buy more global equities and developed market bonds. The MSCI ACWI’s valuation fell from a 12-month forward P/E of 13.9X to 13.2X during the quarter, while 10-year US Treasury yields rose from 3.0% to 3.8%, and 10-year Euro government bond yields also rose 0.8 percentage points.

As a result, we increased our allocations in both our global equity and global bond positioning out of global cash. However, our cash holdings are still partly cushioning our funds against the current market downturn, and leave some liquidity to take advantage of even better market opportunities that could arise. We are still mindful of the risks that exist globally in terms of slower economic growth, rising interest rates and persistent high inflation, which continue to represent downside risk for corporate earnings and bond prices.

Within global bonds, we still have a preference for bond markets where the real yields are high and the currency is trading at fair-to-cheap levels. We also continue to hold almost no exposure to investment-grade corporate credit, despite improving valuations over the quarter as spreads widened. We continue to believe that corporate yield spreads are not sufficiently high for the risk involved.

Our House-View portfolios like the M&G Balanced Fund still favoured SA equities at the end of Q3. During the quarter, our overall weight in this asset class changed little. SA equity valuations (as measured by the 12-month forward Price/Earnings ratio of the FTSE/JSE Capped SWIX Index) de-rated over the quarter, falling from around 8.5X at the beginning of the quarter to around 7.8X at quarter-end. While share prices fell approximately 2.4% across the Index, corporate earnings expectations rose by around 4.1%, causing the de-rating. Although risks to earnings has risen, the weaker rand/stronger US$ have given a lift to JSE-listed companies with rand-based costs and US$-based earnings.

Within SA equities, there were few shares contributing positively to absolute returns for our House-View portfolios during the quarter, given the broad nature of the Q3 sell-off. Leading contributors included Absa and Glencore, with smaller positive value added from Exxaro, Textainer, MultiChoice and Woolworths. Among the largest detractors for the period were Sasol (on the back of the drop in the global oil price), Naspers/Prosus, MTN and Investec. Collectively, it was the Basic Materials sector that detracted the most from absolute returns, largely due to the decline in commodity prices over the period.

We maintained our neutral positioning in SA listed property in Q3 2022, preferring to hold other shares that we consider offer better value propositions for less risk. Conditions in the local property sector remain uncertain given the rising local interest rate cycle (many property companies are reliant on finance to expand their portfolios) and relatively weak growth prospects, among other fundamental factors.

On a relative basis, our portfolios benefitted from our ongoing preference for SA nominal bonds in the third quarter thanks to their outperformance of SA equities, although they did underperform SA cash. The 10-year SA government bond yield rose modestly from 11.0% to 11.4% at quarter-end, with the SA yield curve flattening slightly in the longer end (between 10- and 20-years) in what was a volatile market. We still believe SA nominal bond valuations remain attractive relative to both other income assets and their own longer-term history, and will more than compensate investors for their associated risks.

Although we are not holding inflation-linked bonds (ILBs) to a meaningful degree in our House-View portfolios, we do hold them in our real return portfolios like the M&G Inflation Plus Fund, where we retained our neutral view. ILB real yields remain relatively attractive compared to their own history and our long-run fair value assumption, but compared to nominal bonds, their valuations are less attractive and they have lower return potential.

Lastly, despite the SARB’s interest rate hikes during the quarter, our House-View portfolios remained tilted away from SA cash as our least-preferred asset class, given the extremely low base rate off which the SARB has hiked. In our view, other SA assets remain more attractive on an absolute and relative basis.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter