Letter from the CEO - Q2 2020

This article is from the Quarter 2 2020 edition of Consider this. Click here to download the complete edition.

The Q2 2020 edition of Consider this is being released in the most extraordinary of times. At the time of writing, the end of April 2020, South Africa remains in a state of disaster with a hard “lockdown” and extensive physical distancing to slow the spread of the COVID-19 disease. We are not alone in these efforts: across the world other countries have taken similar steps. A positive development is that some countries are now beginning to lift some restrictions, as they pass their points of peak infection. Indeed, New Zealand have just announced that they believe they have “eliminated” the virus after weeks of severe lockdowns. New daily infections in that country are now down to single digits.

In South Africa we will shortly begin the gradual re-opening of our economy as we move to Level 4 of our crisis response, and hopefully lower levels will follow in short order – our economy desperately needs that.

Portfolio and market performance

Over the past few weeks we have written extensively about or recorded some of our thoughts on the crisis, its impact on the global and local economy, and particularly the effect it has had on the price of various financial instruments that we hold or can purchase on behalf of our client portfolios. Please visit our insights page where you can view or read these at your leisure. In this edition of the magazine we have included several article addressing our portfolio positioning and how investors can help themselves during the market sell-off.

Rather than repeating the observations by my colleagues, I’d like to make a few general observations about financial markets and recent conditions.

1. Investment markets are forward- looking. The price you pay for an asset today should reflect the present value, at a suitable discount rate, of the long-term stream of cash flow you expect to receive from your investment. For example, buying shares in a company entitles you to the future profits that business will earn, which are either reinvested in the business or distributed to shareholders as dividends. In “normal” times, markets broadly get this right and asset prices tend to follow the intrinsic value of the underlying businesses. However, in crisis events, market participants frequently shorten their time horizons, opting to sell their shares immediately in anticipation of a coming collapse in company profits. In doing so, the market inevitably suggests (through the resulting crash in share prices from panicked selling) that any short-term profit reduction will become a permanent feature and by implication that profits will never recover.

Over the past few months we have seen this happen in nearly every single share price on the JSE. We would suggest this has been a drastic reaction, and the market has been oversold. Certainly, some companies will be permanently damaged by the COVID-19 crisis and economic shutdown. But the majority will survive, and those are the companies we are seeking to buy or buy more of, at bargain prices.

2. Following on from the prior point: share prices will begin rising well before economic growth recovers and profits return. I am not suggesting the JSE All Share Index low of 37,963 points on 19 March 2020 will be the “bottom” during this COVID crisis. We simply have no way of knowing that with certainty. It is certainly plausible that share prices could take a further tumble. However, our level of conviction about future returns does increase along with our time horizon. Put differently, the odds increase in our favour as our investment holding period increases, and economic fundamentals impact companies’ share price performance more than short-term emotions of often-irrational investors.

3. Starting valuations matter. A lot. South African assets, including many SA equities and bonds, were already attractively priced before the crisis. Throughout 2019 the valuations of these assets were reflecting investor concerns about sluggish economic growth, a concern we shared but felt we were adequately compensated for by the prices being offered. (None reflected any news about a novel Coronavirus that would begin infecting people in the Wuhan province of China, and then the world, a few months later). Across those Prudential portfolios aiming to deliver moderate to high levels of long-term real returns, we therefore held overweight positions in SA equity, certain global equity markets and South African and emerging market debt. The outbreak of the COVID-19 crisis of course pushed these asset prices down significantly. In our assessment, this has shifted the prospective returns from certain quality assets even further in our favour, notwithstanding the short-term negative performance that our investors (clients and staff alike) will observe from their most recent investor statements.

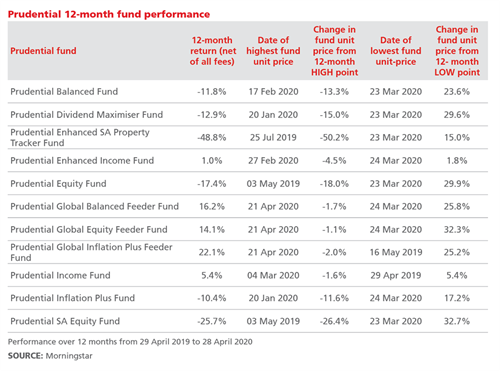

4. Looking back over the 2020 year-to-date performance of investment portfolios, the worst thing an investor could have done was to de-risk her or his portfolio in the midst of the market correction. While portfolios are still significantly down from their highs, they have already delivered a very significant rebound from mid-March lows, as can be seen from the performances of a sample of Prudential’s most popular funds in the accompanying table. This reflects the portfolios’ net-of-fee performance for the 12 months to 28 April 2020. It further shows the returns for the period from each portfolio’s highest unit-price level during the last year, as well as the performance from each portfolio’s’ lowest unit-price level, i.e. the performance that has already been recovered from the March low points.

As can be seen, these portfolios have all delivered substantial negative returns from their 12-month highest unit-price levels (and indeed over the full 12-month period to 28 April 2020). However, in every case, the portfolios have delivered significant positive performance from their respective lowest unit-price levels. While the funds have not yet recovered all their recent losses, as is clear from the negative 12-month performance shown in the table, investors that sold out of these funds during the market collapse, and especially those moving funds to cash, would not have benefited from the subsequent performance recovery.

The current short-term rebound in returns may well not be permanent. As stated earlier, we have no ability to predict very short-term returns, and it is possible that further pullbacks may occur over coming weeks and months. There are undoubtedly significant challenges ahead. However, investors trying to time these volatile markets are likely going to miss short bouts of recoveries, and in doing so might crystalise a loss on paper, into a permanent loss of capital. A much better strategy is to simply remain invested during this period of extreme volatility, and stick with a long-term, patient investment strategy.

Giving in times of need, and meeting our obligations

Turning to more community-focused matters, I am pleased to report that in these times of extraordinary need, Prudential has made a donation to the Solidarity Fund to help those unable to provide for their families during the lockdown, and particularly to finance the acquisition of Personal Protective Equipment for our healthcare workers. Many staff have also donated portions of their salaries, recognising the privilege we have to be able to work and earn a living in the current conditions.

Prudential continues to meet all our financial obligations, in full and on time, through this lockdown period. This includes paying all office rentals, taxes, insurance premiums (including for staff insurance and medical aid benefits) and suppliers. In doing so we will reduce the crisis-related pressure on those firms and people that rely on our payments and allow others to avail themselves of the various COVID-related relief schemes that are available.

Business continuity

Finally, as you know from our previous communications, Prudential has been operating smoothly during lockdown, continuing to ensure the active management and security of our clients’ assets. Prudential staff are all operating at full productivity. Every one of our employees can work from home using remote technology, and a large proportion are doing so with only a small core team of essential workers working from our head-office and our separate disaster recovery office.

Our clients’ investment portfolios remain front-of-mind, and robust investment team debates take place daily.

In uncertain times like these we wish to engage with our clients even more than normal, so please reach out to us if you have any questions or require any assistance with respect to your investment portfolios.

Please remain safe and healthy and know that “this too shall pass”.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter