Letter from the CEO - Q3 2021

This article was first published in the Quarter 3 2021 edition of Consider this. Click here to download the complete edition.

During the second quarter (Q2) of 2021, more progress in Covid-19 vaccine rollouts worldwide, as well as positive corporate earnings reports and economic news, continued to lift returns, particularly in developed market equities, even as concerns emerged over high valuations and breakouts of more infectious Coronavirus variants in some countries. Bonds – both government and corporate credit – also recorded solid performances, retracing some of their Q1 losses and buoyed by reassurances from central banks that easy monetary policies would not be halted any time soon. Cheaper, previously out-of-favour equities like Listed Property and Financials were among the strongest performers, while more expensive sectors like Resources took a breather.

In the US, the approval of even more US government spending – this time on infrastructure - helped support the global growth outlook, as did improving conditions in the UK and Europe. However, emerging market equities lagged those of developed markets. South African equities broadly underperformed their emerging market peers due largely to the local market’s higher Resources exposure, after outperforming in Q1. In contrast, South African nominal government bonds posted strong returns compared to those of many other countries over the three months.

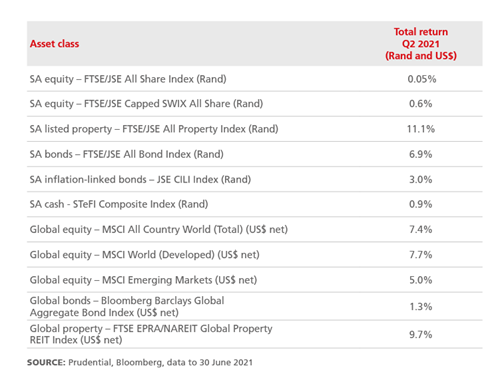

As shown in the table, in US$ terms, global equities (the MSCI All Country World Index) returned 7.4% for the quarter, with emerging market returns of 5.0% lagging developed markets’ 7.7%. For SA investors, the rand’s 3.3% appreciation against the US dollar would have dented global investment returns. Global bonds delivered 1.3% for the quarter, regaining some of the losses recorded in Q1 as inflation fears receded somewhat. And finally, global property posted another quarter of good gains with a 9.7% return. As in previous quarters, central banks kept interest rates broadly unchanged at very low, accommodative levels – less concerned about inflation than investors – and some governments continued to enact fresh fiscal support packages for consumers and businesses.

For South African investors, some positive developments for the quarter included Q1 2021 economic growth surprising to the upside at 4.6% q/q annualised, notably higher than the 2.5% market forecast. Covid-19 vaccine supplies also continued to make their way into the country and the government’s vaccination programme made headway. However, this was hindered in June as the third wave of Covid-19 infections forced President Cyril Ramaphosa to reintroduce Level 4 lockdown measures. Post quarter-end, the social unrest and rioting that broke out in Durban, and spread to Gauteng, has set back the vaccination programme in these provinces, in addition to causing terrible damage to property and livelihoods.

Meanwhile, the South African Reserve Bank kept its benchmark interest rate unchanged at a record low of 3.5% at its 20 May MPC meeting, warning that slow progress on vaccinations, limited energy supply and policy uncertainty continue to pose downside risks to the economic outlook. This was despite the jump in consumer inflation to 4.4% y/y in April and 5.2% in May, attributed largely to coming off a low base. The central bank raised its growth forecasts for 2021 from 3.8% to 4.2%, but lowered its projections for 2022 and 2023 to 2.3% and 2.4% respectively. It is also projecting two 25bps interest rate hikes in 2021.

The FTSE/JSE All Share Index was basically flat for the second quarter, returning 0.05%, while the FTSE/JSE Capped SWIX All Share Index, which we use as the equity benchmark for most of our client mandates, returned 0.6%. The standout sector was Listed Property (the All Property Index) with an 11.1% total return. Financials delivered 7.5% and Industrials eked out 0.8%, but the Resources Index returned -5.0%. This performance reflected the value still seen in “SA Inc” counters, which have lagged during the recovery, and the growing view that Resources shares may be reaching the end of their bull run.

SA bonds posted a strong 6.9% return (as measured by the FTSE/JSE All Bond Index), remaining sought-after sources of yield for global investors compared to many other sovereign bonds. The yield curve between 10-year and 20-year bonds also flattened by 34bps, with the spread now down at 120bps from its peak of 216bps during the Coronavirus crisis in May 2020 and highlighting lower investor risk perceptions. Meanwhile, SA inflation-linked bonds produced 3.0% (Composite ILB Index) on the back of somewhat softer demand for inflation protection, and cash (STeFI Composite) delivered 0.9%.

Finally, the rand appreciated against the major global currencies over the quarter, rising strongly from its oversold position in April and May before retracing some gains in June. It gained 3.3% against the US dollar, 3.1% versus the pound sterling and 2.4% against the euro over the three months. However, post quarter-end, following from the social unrest, the rand weakened and gave back most of these recent gains.

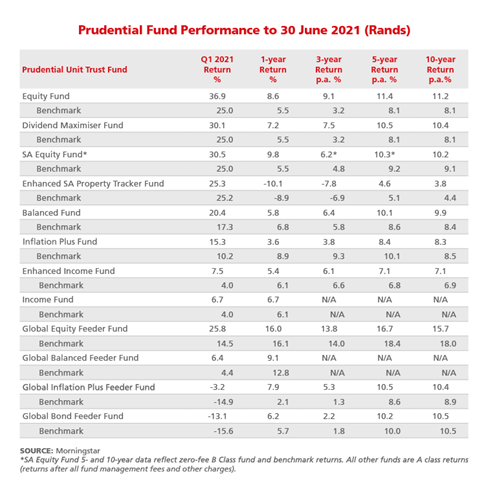

Most Prudential funds outperform

The quarter proved to be another strong one for Prudential’s client and fund performance, with most of our funds recording top-quartile returns in their ASISA categories (according to Morningstar). The Prudential Equity Fund, in particular, continues to demonstrate consistently competitive first-quartile returns over every rolling (and annual) period out to 20 years (measured to 30 June 2021). It is followed closely by the Prudential Dividend Maximiser Fund, which has also ranked in the top quartile over this long term (apart from three- and four-year annual returns). This represents excellent results from our equity team, throughout these truly unprecedented conditions.

Clients would also have enjoyed pleasing relative performance from our range of global funds, with the Prudential Global Equity, Prudential Global Balanced and Prudential Global Inflation Plus Feeder Funds all posting top-quartile returns for both the quarter and the year to 30 June 2021.

Our investment team’s asset class positioning and stock selection both added relative value to client portfolios over the three- and 12-month periods. Our preference for SA nominal bonds, and for longer-dated bonds within this asset class, continued to add to our clients’ returns over the quarter. Our overweight exposure to local equities also remained a significant contributor.

For investors who ignored valuations and switched out of SA equities into offshore assets amid the worst of the Coronavirus market crisis in 2020, subsequent market performance has shown that this decision has come at a cost. Over the 12 months to end-May, the combination of subsequent rand appreciation and local (equity) assets’ outperformance of global assets has resulted in these investors foregoing some substantial returns. See Pieter Hugo’s article for more details on this.

The table below shows the annualised returns of our Prudential Unit Trust funds for periods up to 10 years.

Protecting your personal information

This quarter has been a busy one with the finalisation of our personal data protection project, which was brought about by the implementation of the Protection of Personal Information Act (POPIA) on 1 July 2021. POPIA is the primary law that governs the protection of personal information for both people and juristic persons (e.g. companies), and all South African companies must comply with POPIA. We have accordingly reviewed how we communicate with our clients while also ensuring that we have the best possible operational and technical processes in place to safeguard your data and to meet the other POPIA obligations.

Some of our Q2 priorities related to POPIA included staff training, implementing a new Privacy Policy, and amending our agreements with clients and service providers where necessary to ensure all are fully compliant with the POPIA requirements. Among the changes, for example, you may have noticed that from 18 June we started to password protect all our email correspondence that contains information relating to your Prudential investments, which includes your investment statements and tax certificates.

Where possible we have tried not to affect the client experience onerously. Our article in this edition of Consider this provides more clarity on these changes and how they may affect you as a client.

Looking ahead

Although the emergence of the third wave of Covid-19 infections has been discouraging over the shorter term, I would like to emphasise that our focus remains on a longer-term three-to- five-year view, and that this has not changed materially during the quarter. Corporate earnings prospects, apart from local Listed Property, continued to improve during the quarter even as share prices moved sideways, creating better value in the equity market and more attractive investment opportunities. Many SA companies have emerged stronger from the Coronavirus crisis than when it first began, with better cash flows and stronger balance sheets, and investors are able to take advantage of this. More broadly, progress also continues to be made on the vaccinations rollout and anti-corruption measures. So it remains for clients to look through the short-term disappointments, and stay patient and exposed to risk assets as appropriate. For our part, we believe the bigger-picture trend remains positive and are confident that our portfolios are positioned appropriately to continue to perform strongly, given current asset valuations, with clients set to reap the benefits over the next three to five years.

The social unrest, looting and rioting that erupted in Durban and Gauteng around the time of writing is a truly low point in our country’s post-apartheid history. We are monitoring these events closely. Having consulted with management of those companies affected, we have not altered our views on any of our current investment positions. However, at this time our thoughts are with the people, communities and businesses that are directly affected.

We hope you enjoy this latest edition of Consider this, and as always welcome any feedback you may have.

Sincerely,

Bernard

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter