In the eye of the storm: SA hotels, casinos and restaurants

This article was first published in the Quarter 3 2020 edition of Consider this. Click here to download the complete edition.

Key take-aways

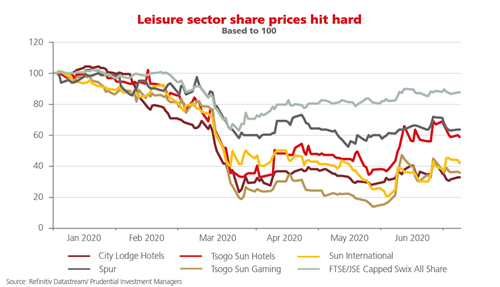

- In the Coronavirus pandemic, the share prices of hotels, casinos and restaurants have been among the worst punished, with some hotel counters losing around 70% of their value at their worst levels in March. Based on our analysis, the sell-off has been overdone based on the fundamentals and future prospects for the leisure sector.

- Among other remedial actions, hotels have been aggressively cutting costs and managing room portfolios, restaurants have been negotiating hard with landlords, and casinos appear to be managing their debt levels responsibly with funders.

- Prudential doesn’t believe all these companies will be permanently damaged by the pandemic, although their survival may well depend on external factors such as the ability and willingness of debt and equity funders to continue to support companies, and how long the economy takes to re-open fully and pick up again.

Since the outbreak of the Coronavirus pandemic and economic shutdown in South Africa in March 2020, three sectors in particular have found themselves in the eye of the storm: hotels, casinos and restaurants. The share prices of the companies in these sectors have certainly felt the pain, underperforming the FTSE/JSE Capped SWIX Index significantly. All three were already facing risks of their own, but a complete shutdown for months was certainly not on the cards for any one of these sectors at the beginning of 2020.

The accompanying graph shows how companies like City Lodge, Tsogo Sun Gaming, Sun International and Spur have seen their share prices fall much further than the overall market (as measured by the FTSE/JSE Capped SWIX Index) during the downturn and have struggled to recover to the same extent as the rest of the market. Tsogo Sun and City Lodge have been particularly hard-hit, losing around 70% of their value at their worst levels from the start of the year. Spur was somewhat more resilient, with a decline of around 30%. This dire performance is understandable if we consider some of the drivers behind it, but has the sell-off been overdone based on the fundamentals and future prospects for the leisure sector?

Hotels: Aggressively cutting costs and managing room portfolios

The listed hotel space in South Africa has three companies with pure hotel exposure - City Lodge, Tsogo Hotels and Hospitality Property Fund - although most of the value in Tsogo Hotels is attributable to its 59% holding in Hospitality Property Fund. Before the shutdown in March, all the hotel companies had been struggling with depressed occupancy levels, and as a result, an inability to increase their room rates by more than inflation. Sandton hotels had been hit with oversupply from new rooms added in the last few years, combined with a weak local macroeconomic environment. The Western Cape saw major declines in occupancy levels as a result of the severe drought in 2018, which took its toll not only on international tourism, but interprovincial travel as well. 2020 was meant to be the year where Western Cape hotels finally recovered from one of their toughest trading years and started to return to more normal occupancy levels, while also hopefully regaining the ability to price their rooms above inflation. City Lodge compounded its struggles in South Africa by completing a multi-year expansion into the rest of Africa where they have invested over R1bn. They are more likely to see losses than profits from this expansion in the next few years.

Upon the announcement of the complete Level 5 lockdown in mid-March, all the hotel companies prepared to close their entire portfolios and embarked on drastic cost-cutting measures to save cash. Focus was put on employee costs, lease expenses and cleaning and laundry, as well as debt service costs which can be a large part of non-operational costs.

While City Lodge didn’t have a high amount of debt on their balance sheet at the outbreak of the pandemic, it was certainly higher than previous years due to the African expansion and the losses from the African hotels, which had started to impact their results. To manage this, they have been able to get debt covenant waivers from their lenders for their debt repayments due in June and December 2020, as well as securing additional liquidity. However, they have experienced additional troubles stemming from a R750m loan guarantee to their BEE partners. As City Lodge shares were held as security for this loan, trouble lay ahead as the share price of City Lodge tumbled. As the share price fell, so the guarantee to lenders kicked in. As a result, City Lodge have now announced a R1.2bn rights issue to cover the bulk of their outstanding debt, as well as the BEE loan guarantee.

Meanwhile, Tsogo Hotels have successfully agreed on delaying debt repayments coming due in September 2020, with lenders recognising that it was difficult for the group to make payments when their hotels were not trading. More recently, now that provincial travel is allowed for business purposes, Tsogo Hotels are re-opening key hotels in each of the main cities, but will more than likely be watching their cash burn rate very closely, with hotels that are focused on international travellers remaining shut.

In March, City Lodge shut down all 62 of their hotels, then initially opened seven in order to provide accommodation for essential workers for some businesses, some for tourists not able to return home, and some for quarantine purposes. They are currently sitting with 21 hotels open, undoubtedly at reduced occupancy levels, and should continue to slowly open more as the economy starts to re-open.

In general, the hotel groups have done a very good job reducing cash costs as much as possible while their properties have been closed, and planning the reopening of their portfolios in the most cost-efficient way. Funders have also been very supportive so far, which is also the advantage of having a portfolio of hard assets (i.e. fixed property) which can be used as security for borrowings.

Restaurants: Negotiating hard with landlords

The restaurant industry also came under significant pressure when the lockdown came into effect. In mid-March the restriction on the number of people allowed into a restaurant had already created severe pressure for restaurant earnings. Although one would think that some business is better than no business, this is far from the case. As Spur later announced to the market, the full lockdown almost came as a relief to the company because operating with the same cost base but fewer customers is more damaging than operating with no customers at all, but with the ability to significantly lower costs.

Spur operates a franchise model, meaning they receive a set franchise fee based on revenue from the franchisee who owns the restaurant. Spur have over 600 restaurants which include the popular brands Spur, Panarottis, Hussar Grill, John Dorys and Rocomamas. The group is in a positive net-cash position and therefore doesn’t face the same level of financial pressure as hotels and casinos, but they do face the risk that earnings would be permanently lowered should several of their franchisees go bankrupt. Therefore, it is in the group’s best interest to ensure that franchisee health is maintained, which is where the real financial pressure is felt. They have been able to be very firm in rental negotiations with landlords, since having such a large store footprint in the group gives them an element of bargaining power. They have also given their franchisees relief in the form of their monthly franchise fees and marketing contributions.

Spur are starting to slowly re-open restaurants that are able to operate profitably under a delivery-only method, such as those where the rental negotiations have been favourable, despite earning a lower margin compared to sit-down restaurants. The one advantage that should come from this crisis is that the restaurants that are able to survive should be the financially stronger restaurant that are more rational with pricing. This should allow the remaining restaurants to regain some pricing power in what should be a less-competitive industry going forward, as we have seen the likes of Dominos and a number of smaller restaurants close their doors.

Casinos: Managing higher-than-usual debt levels

The casino industry is known for its multitude of risks, all of which are well known to industry operators, such as the potential for the government to impose gaming tax increases, VAT increases that can’t be passed on, and a smoking ban within the casinos. However, no one ever anticipated a risk like a pandemic that would see casinos, whose doors are barely ever closed, facing months of no revenue with a large fixed cost base.

Sun International and Tsogo Gaming (split from Tsogo Hotels in 2019) are South Africa’s large, listed casino companies, with Peermont being the third (unlisted) casino company. This shut down came at a bad time for both Sun International and Tsogo Gaming in terms of how much debt they carried on their balance sheets. Tsogo Gaming had purposefully taken on more than their share of debt when they split from Tsogo Hotels, given that the casino business is more cash-generative than hotels with their heavy capital spending; therefore they should have been able to repay the debt over a reasonable time period. Sun International still had a high amount of debt on their balance sheet following their construction of Menlyn Casino in 2017 and 2018, where revenues turned out to be significantly weaker than expected, resulting in a rights issue in 2018. Both Tsogo Gaming and Sun International had completed their large capital spending projects, and had planned to focus the next few years on strong cash generation to pay down the debt associated with these expansions.

However, the advent of the pandemic meant this was no longer possible. Both casino groups had to close all their casinos, as well as their limited pay-out machines (which are placed in bars and restaurants), and found themselves in a tight space in terms of debt levels. Both Tsogo Gaming and Sun International submitted plans to funders on how they would manage the crisis and cash levels, and most have been supportive thus far, waiving covenants in the near term. Sun International have announced another rights issue to raise R1.2bn more in capital, which will help them weather this period of very low cash flows, and most likely keep debt funders more comfortable.

Casinos are, by nature, very cash-generative businesses if they do not overspend on capital projects; however, they are geared to the economy to a degree. The recent announcement that casinos would be allowed to open up again at 50% occupancy is very positive, despite the reduced occupancy levels. The companies plan to manage costs carefully to ensure they are cash-positive, even at a lower occupancy level.

Any permanent damage dependent on external factors

At Prudential we are cautiously optimistic about the medium-term future of these industries. We don’t believe all these companies will be permanently damaged by the impact of the Coronavirus pandemic, but we acknowledge that they are most certainly high-risk businesses given the level of high operating leverage as well as the high financial leverage prevalent in some of them. Their survival may well depend on several external factors, such as: government’s decisions around the timing of the full reopening of these sectors; the ability and willingness of debt and equity funders to continue to support companies during this period of high financial stress; and how long the economy takes to pick up again. To date none of the companies have encountered problems in either having their debt terms eased or raising extra capital through rights issues; investors and creditors have still deemed it attractive to support them.

Even now, three months after the worst of the market crash, we still see significant value in some of these companies like Sun International on a three- to five-year basis, even taking into account further capital or debt raisings. We are very cognisant of the high level of risk involved in investing in these companies as well, and are therefore cautious about the overall size of the exposure to these three sectors, as well as to any one of these companies individually, in our client portfolios.

To find out more about our equity funds, visit the Our funds section of our website. Alternatively, if you’re ready to start investing now, you can do so online in under 10 minutes by completing our online application form.

For more information, please feel free to contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter