Nigeria: Will a new broom sweep clean?

Nigeria’s new president, Bola Ahmed Tinubu, came into office on 29 May this year. He faced (and is still facing) an enormous task. Nigeria has for years, if not decades, been hampered by opaque and inconsistent economic policies, and experienced weakened macro stability as a result of rate distortions, a decline in oil revenue and a lack of fiscal discipline. To summarise, there is a lot wrong with Nigeria and nothing that can be fixed with a quick band-aid. The government has not only lost credibility internationally, but also the trust of its own citizens.

I visited Nigeria in April this year, where the mood was one of cautious optimism that a new broom will sweep clean. I was more skeptical, given the country’s track record, and it was therefore a pleasant surprise when President Tinubu did indeed address some of the most pressing issues in his first few days and weeks of being in office.

The reforms

One of the most pressing issues in Nigeria has been the multiple FX (foreign exchange) windows that were a result of government intervention in the FX market and a restriction on US dollar outflows to defend the country’s FX reserves. Tinubu has reopened the FX market and thus taken the first step in allowing for a flexible, market-responsive exchange rate. The removal of the long-standing Central Bank of Nigeria (CBN) governor and other personnel changes also hint at a more orthodox monetary policy going forward.

The second critical reform that has been passed is the removal of fuel subsidies, which were first introduced in Nigeria in the 1970s as a response to the oil price shock of 1973. Despite numerous previous attempts, the government has never managed to successfully remove the fuel subsidies, in large part due to strong popular opposition to reform. It is therefore very encouraging that President Tinubu has addressed this in his first few weeks in office.

The cost of the fuel subsidy to the fiscus was enormous, estimated by the World Bank to have been 2.5% of the country’s GDP for 2022. The subsidy was problematic, especially during a high oil price environment, as government paid the international market price for oil and then provided it to consumers at a lower subsidised price, funding the difference. The volumes of fuel sold through this subsidised scheme increased significantly as the arbitrage in petrol prices led to cross-border smuggling. While it is unclear whether some of this spending will be redirected to social benefits, and how exactly the new fuel price mechanism will work going forward, it is a step in the right direction.

This does not solve all of Nigeria’s problems

These reforms and the President’s demonstrated willingness to make the hard choices are extremely encouraging so far, and could help to restore the government’s credibility and foster medium-term growth and development. However, short-term challenges remain. Nigeria’s chronically high inflation has increased since 2019, especially for food items, eroding the purchasing power of poor and vulnerable Nigerians and leading to rising poverty levels.

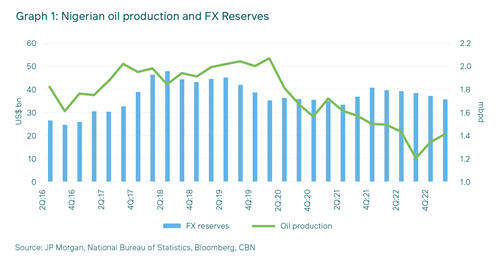

Another persistent problem has been the decline in Nigeria’s oil production, as shown in Graph 1. The oil sector, which historically has been the main contributor to fiscal revenues and accounts for an estimated 90% of the country’s exports (and therefore FX reserves), has underperformed since 2020. Nigeria’s oil production fell from 1.8 million barrels per day (bpd) in 2020 to an estimated 1.4 million bpd in 2022. The 22% drop has been attributed to various factors – a lack of investment, joint venture operator debt problems (such as cash-call arrears) and theft – and came at a critical time as Nigeria failed to benefit from the high oil price environment.

A commitment to deeper reforms is therefore key to improving conditions going forward, many of which come with significant challenges. Among these include: ramping up oil production; increasing the government’s revenue base through asset sales, doubling VAT (as recommended by the IMF) and improving tax revenue collections; increased fiscal discipline; and strengthening parliamentary oversight of federal government spending.

Why does this matter?

A lack of macroeconomic stability in Nigeria has hampered private investment and prevented growth. Growth in Nigeria averaged 1.4% per year between 2015 and 2022, slower than its population growth, with a resulting decline in GDP per capita, as Graph 2 illustrates. As population growth has continued outpacing poverty reduction, the much-discussed “demographic dividend” of Africa’s largest economy has failed to pay off.

Although they have vastly different economies, if one contrasts this with another frontier market like Indonesia, it becomes clear why growth matters. In the 1980s, Indonesia had the same GDP per capita as Nigeria. Today, Nigeria’s income per capita is just 36% of Indonesia’s, as clearly shown in the graph. This has meant lower living standards for Nigerians.

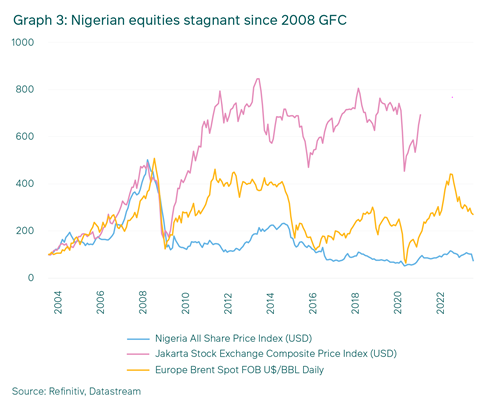

For the local equity market, meanwhile, it has resulted in a lack of both growth and price appreciation. Graph 3 demonstrates Nigerian equities’ stagnation in US dollar terms since the 2008 Global Financial Crisis (GFC), compared to Indonesia. The Nigerian market has also failed to capitalise on periods of significant oil price strength.

Why keep investing in a market like Nigeria?

Given all the above challenges, why do we keep investing in a country like Nigeria? The answer is simple: there are some high-quality companies in this market that are excellent operators. They have for years operated successfully in this extremely tough environment, and we believe they are undervalued by the market on a three-to-five-year view.

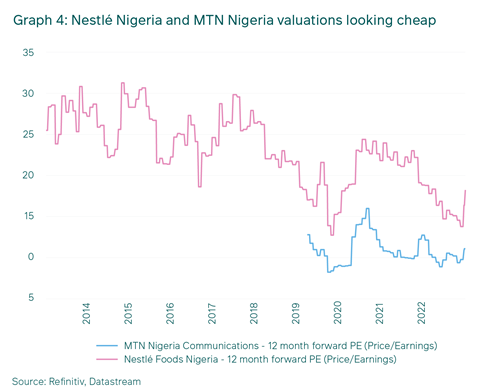

In the M&G Africa Equity Fund, for example, we hold high-quality Nigerian names like MTN Nigeria and Nestlé Nigeria, which have offered attractive valuations, as highlighted in Graph 4. MTN has an improving operating margin and was trading at single-digit P/E ratios despite delivering double-digit revenue growth in US dollar terms. Nestlé Nigeria, meanwhile, operates with low financial leverage, and will benefit from any sustainable recovery in consumer spending in the medium term, thus giving it high operational gearing to an improvement in the environment. Yet it has recently traded at the lowest valuation level in its history. We believe these companies are attractive value opportunities that offer cheap exposure to any potential upturn in the Nigerian market.

Conclusion

Time will tell whether the reforms will be lasting and whether President Tinubu manages to restore the credibility of the Nigerian government. We do not pretend to know the future. Nonetheless, we believe that the recent reforms are encouraging and that there are still good opportunities to be found in the Nigerian equity market. Successful investors in this market will be those who have the patience to look through near-term volatility to the long-term, yet-to-be-realised, potential.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter