Namibian Breweries, Heineken and Distell: A big deal for African beverages

Global brewer Heineken’s acquisition of South African drinks group Distell, completed on 26 April 2023, was a big deal for the African beverages market. It was an important step towards Heineken strengthening its presence in the region, while for Distell it provides a much larger regional platform for the distribution of its products.

What may have been less headline-grabbing, but equally as important a part of the transaction, was the acquisition of a controlling stake in Namibian Breweries Ltd (NBL or Nambrew) by Heineken N.V. (Heineken) from the Ohlthaver & List Group of Companies. This in turn had additional pre-conditions relating to the acquisition of Distell’s Namibian subsidiaries and the sale of NBL’s stake in its associate, Heineken South Africa, back to Heineken.

Given the importance of NBL to the Namibian economy – as a sizeable exporter and a major employer in the local labour market with nearly 1,000 direct employees and 10,000 indirect employment opportunities – the focus of this article is on NBL, its historical relationship with Heineken, as well as how this acquisition has impacted NBL shareholders and the future of this well-known Namibian brewer.

About Namibian Breweries

Namibian Breweries, previously South West Breweries Limited, was established in 1920 and listed on the NSX in 1996. Today, it is a leader in the Namibian beer market with well-known brands such as Windhoek and Tafel Lager and a significant market share in the premium beer segment. In the last full financial year (FY22), the beer category contributed 94% of Namibian Breweries’ revenue. NBL also exports its products to 13 countries outside Namibia and South Africa.

Its 3 million hectolitre (HL) Windhoek brewery is one of only a few large-scale commercial breweries in Africa that brews according to the German Reinheitsgebot of 1516, which prescribes that the only ingredients that may be used in the brewing process are malted barley, hops, and water. NBL’s commitment to this “Purity Law” guarantees that its beer is brewed only from natural ingredients.

Nambrew’s history with Heineken

NBL’s history with Heineken dates back to 2003, when a strategic partnership, DHN Drinks Proprietary Limited (DHN Drinks), was formed between NBL, Heineken and global spirits giant Diageo. This partnership aimed to market, sell and distribute a combined beer, spirits, and cider portfolio in South Africa. Beer was sourced from NBL’s Windhoek facility and from the Sedibeng Brewery in Johannesburg. At that time, DHN also owned 50% of Brandhouse Beverages, a distribution and cost-sharing joint venture with Diageo.

In 2015, Diageo exited the partnership, taking full ownership of the spirits portfolio and Brandhouse with it. This left NBL and Heineken to consolidate their efforts to capture further beer market share in South Africa. NBL took a 25% stake in Sedibeng and DHN drinks, later rebranded to Heineken South Africa, with Heineken owning the remaining 75%.

The Sedibeng Brewery was built in 2009 with a capacity of 4.5 million HL of beer, which was expanded in 2020 and now produces around 8.0 million HL. As part of the joint venture, NBL migrated some of its production volume to Sedibeng to optimise utilisation of this new facility.

This increase in production capacity, together with the announcement of further investments in a new R15.5 billion brewery and malting plant in South Africa over the next five years, is confirmation of the successful growth and confidence that the Dutch brewer has in the South African market, especially the premium category. Indeed, Heineken South Africa’s growth rate from 2016 to 2019 stood at 27% and was underpinned by growth in the Heineken brand. The premium beer category in South Africa is forecast to grow at 4.9% p.a. in real terms, while the mainstream beer category is only expected to grow at 1.2% in this mature market. Of this category, Heineken South Africa has more than 50% market share, while brand Heineken has a 10% overall beer category market share and 43% in the premium category.

NBL sells its stake in Heineken South Africa back to Heineken

This brings me to the first of the recent pre-scheme transactions for NBL: The sale of NBL’s 25% stake in Heineken South Africa to Heineken.

While there are some clear benefits to NBL, it is giving up its participation share of brand Heineken and other Heineken brands’ growth in South Africa. These include the Amstel brands, Jack Black, Soweto Gold, Camelthorn and Stellenbrau. Growth now accrues fully to its new parent company, Heineken. Other income that would fall away is the “know -how” fees received from Heineken on the brewing of Windhoek Lager at Sedibeng.

On the upside, the production of some of its own brands will shift back to NBL’s Windhoek facility, increasing utilisation, but without giving up the steady royalty revenue stream received from Heineken for the distribution of its brands into SA. There is now potential to achieve a higher growth rate than the historic 8% compounded royalty growth rate given the new and expanded distribution network.

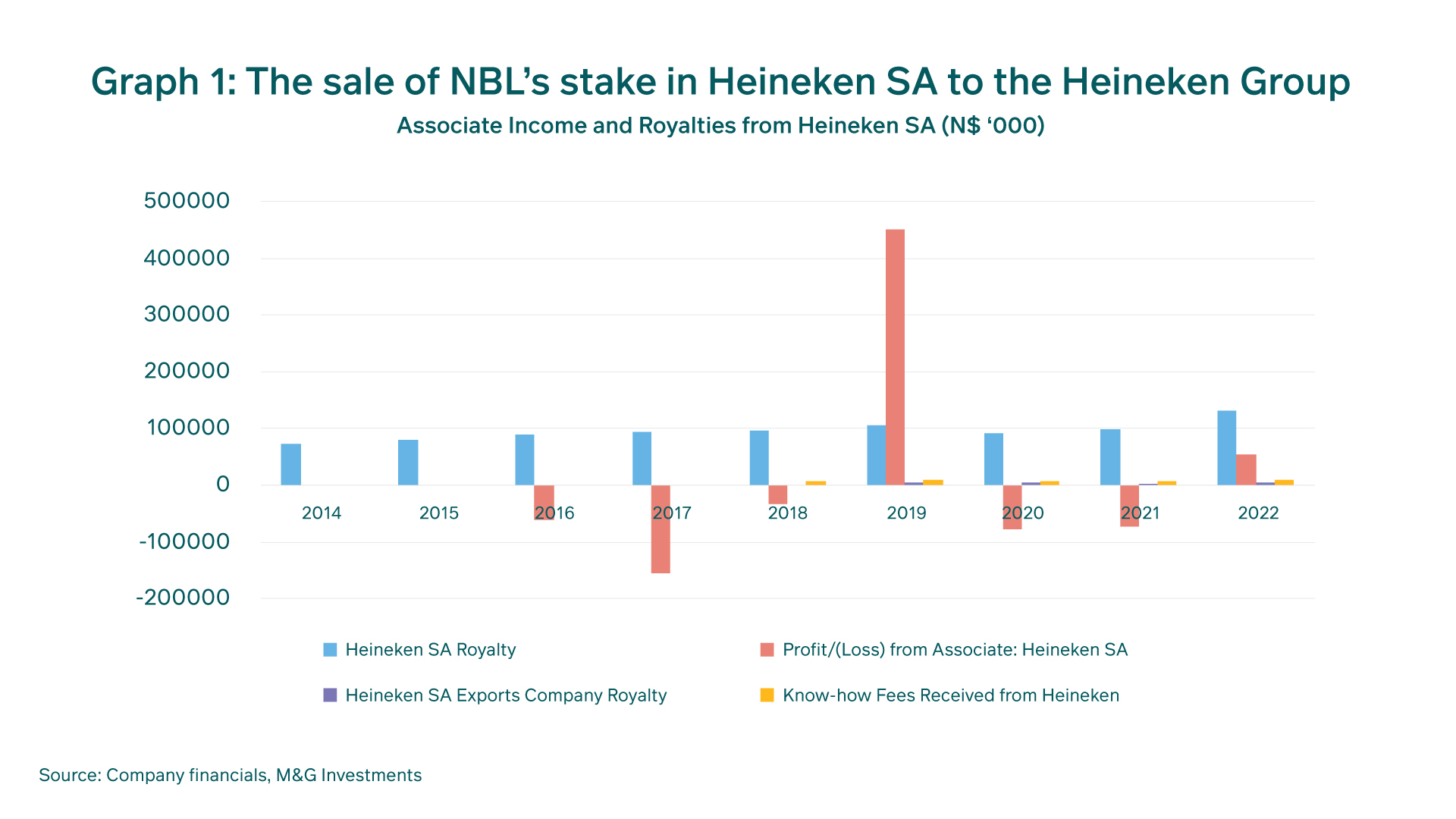

Looking at Graph 1, it seems that NBL sold out of an associate that up until 2021 was loss-making (excluding 2019 where the recognition of a deferred tax asset led to profit being recognized). What this chart fails to capture, but only hints at in the 2022 profit figure, is the significant growth of Brand Heineken in South Africa.

Its 25% stake in the associate was sold to Heineken for N$ 5.442 billion at an historic multiple of 18.9x EBITDA based on its 2019 pre-Covid full year results. This seems like adequate compensation, but actual rapid growth could bring this multiple down quite quickly.

NBL acquires Distell’s Namibian business

The second pre-scheme transaction was the acquisition of Distell Namibia by NBL. As a condition to the bigger Distell acquisition, NBL had to acquire Distell’s Namibia business, focusing on wine and spirits brands. The transaction consolidates two highly complementary businesses, creating a single player in Namibia across the different alcoholic beverage categories and enabling cost and revenue synergies.

Most of Distell’s business in Namibia has always been supplied via imports from South Africa, so one of the advantages of the acquisition is increased utilisation of NBL’s Namibian manufacturing capabilities in cider and wine (with brands like Savanna, Hunters and Tassenberg, for example), which in turn reduces the logistical costs associated with importing or exporting finished goods.

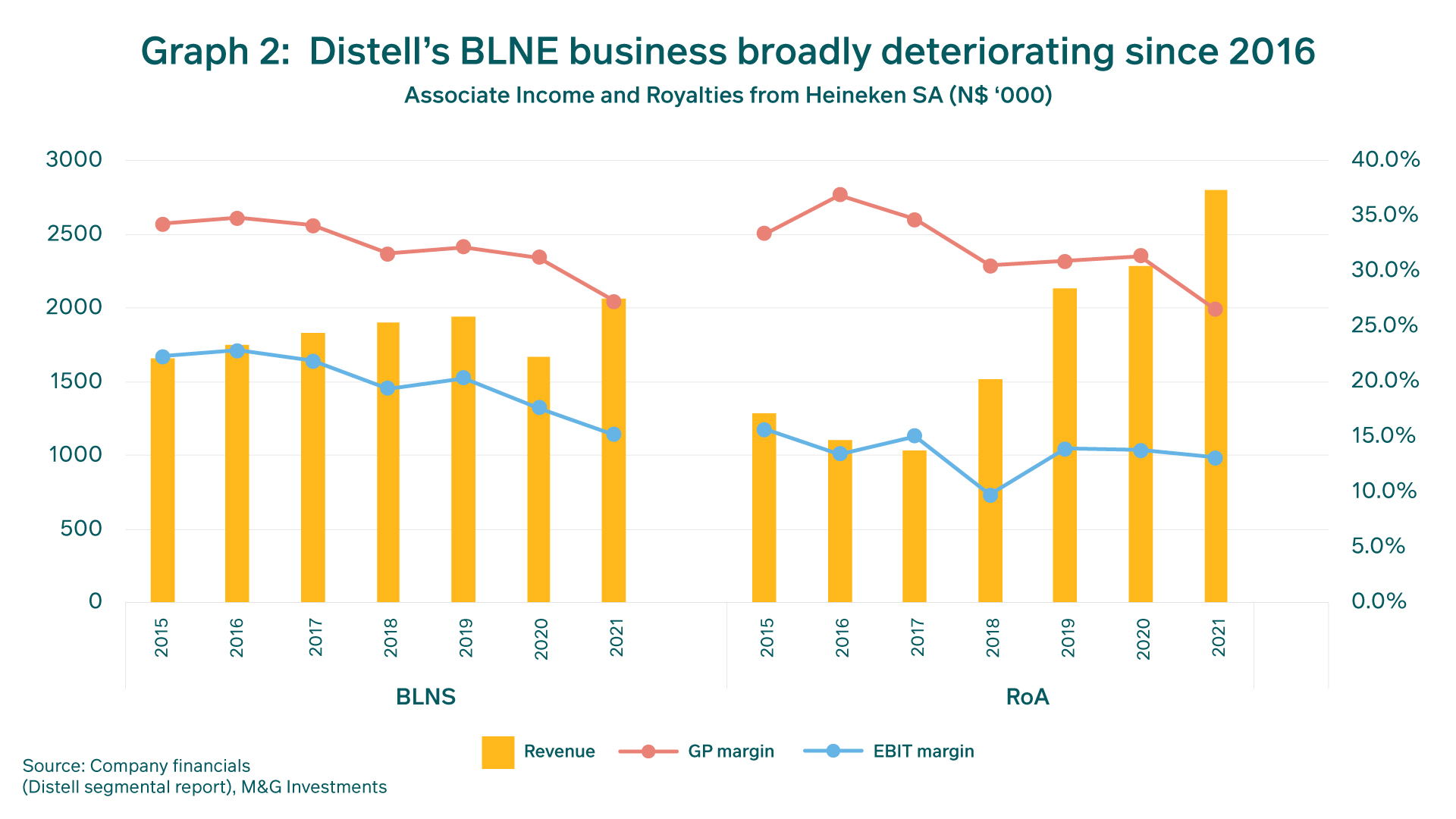

This import substitution would be extremely beneficial if Distell’s business in Namibia was performing well and growing, but if one looks at Distell’s BLNE (Botswana, Lesotho, Namibia, Eswatini) division’s historical performance up to the date of the acquisition announcement, this region has shown margin pressure and weak growth, making it one of the weakest regions in the Distell stable, as Graph 2 demonstrates. Namibia is estimated to make up 55-60% of this region. Based on this recent history, in the absence of a macro turnaround, it appears that new Nambian production may find weak demand in neighbouring Southern African markets outside of Namibia and South Africa.

There would thus need to be significant synergies, cost reduction and value unlock for this to be an attractive asset to NBL given that Distell Namibia was acquired for N$1.64 billion, a 23x trailing P/E multiple on its pre-Covid 2019 results. This is not an excessive multiple for a company experiencing growth, but considering the fact that the world’s leading brewers are trading below 20x earnings at the time of writing, it does appear that some of these synergies and growth have already been priced into a business that has grown only 2% annually from 2019.

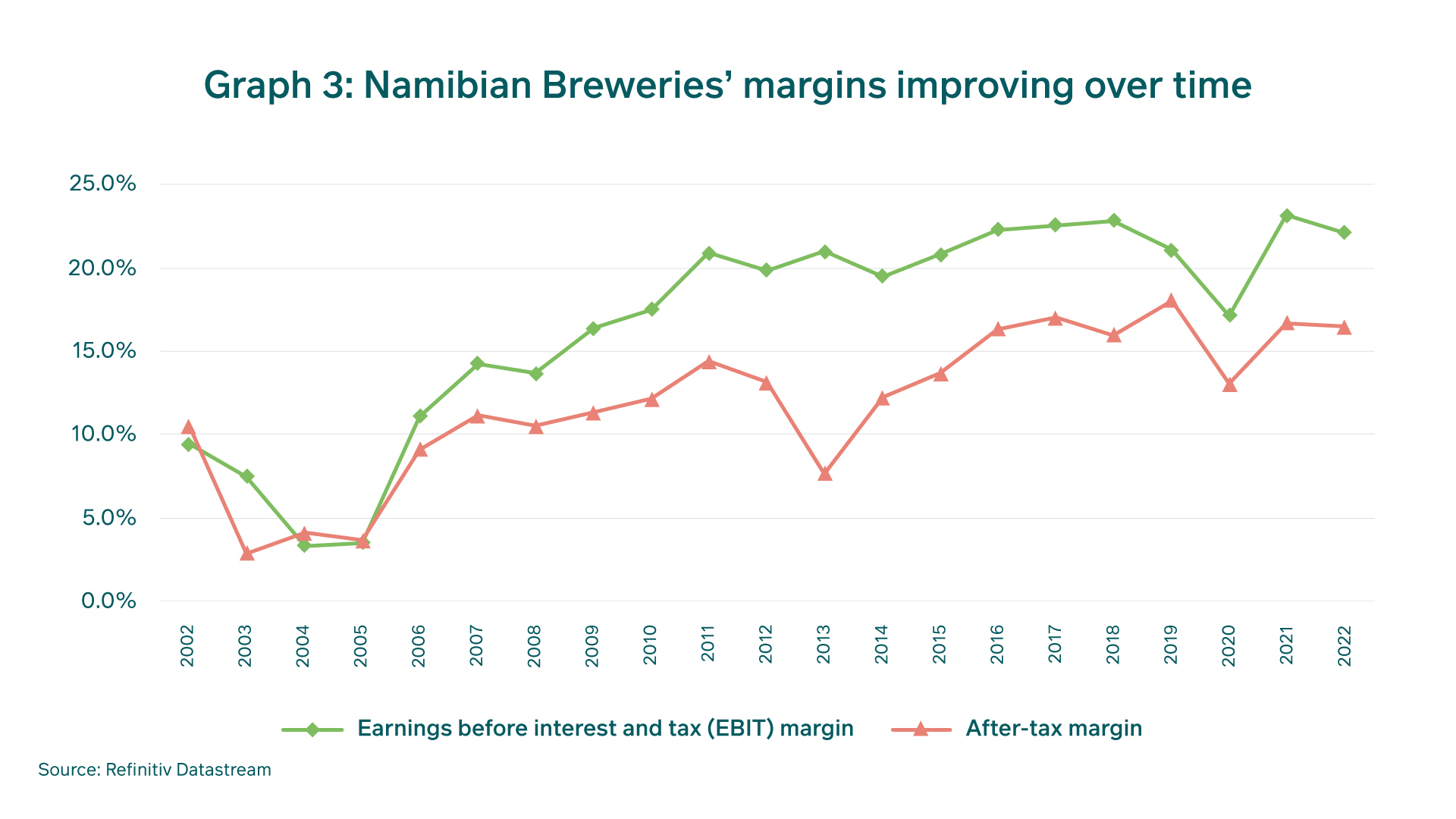

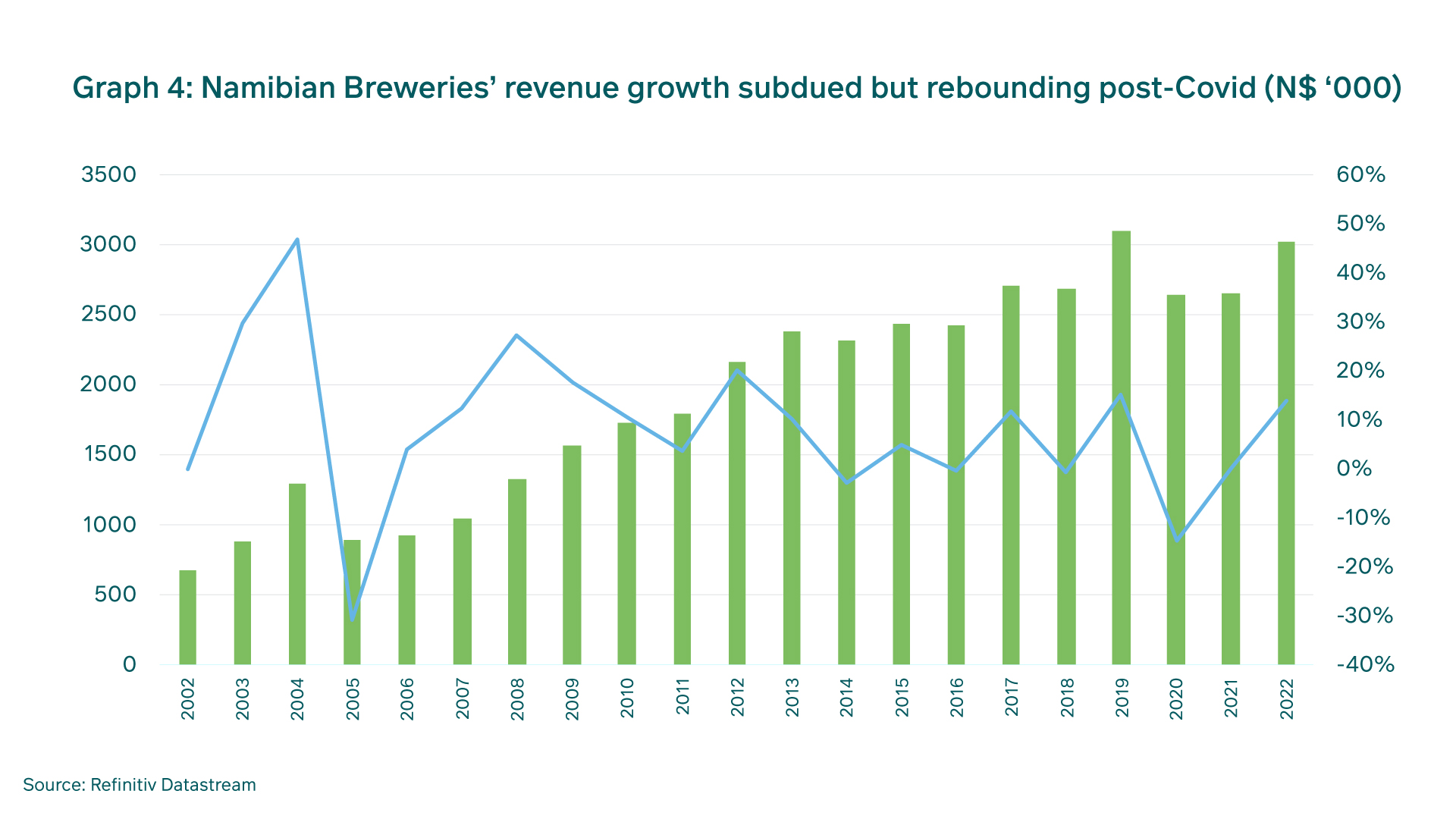

When comparing Distell’s performance as shown in Graphs 3 and 4 to that of NBL, it is clear that NBL is a better-quality business. While revenue has been muted, margins have been resilient over time.

Heineken acquires NBL’s holding company with 59% stake

Heineken acquires NBL’s holding company with 59% stake

The final part of the transaction was the acquisition of Namibian Breweries Investment Holdings Limited (NIH) by Heineken. NIH owned 59.37% of NBL, which is now owned by Heineken. NBL declared a dividend of N$26.35 per share, being the proceeds from the disposal of its Heineken SA stake, and NIH used the dividends to repurchase its own shares from O&L, with the remainder being bought outright by Heineken.

At the end of all of these transactions, the key questions are: What are shareholders left with and who are the main beneficiaries?

A big benefit for NBL shareholders

NBL shareholders received an extremely attractive special dividend of N$23.65 per share at a time when the share was trading at N$32, which was 74% of the market cap at the time, as well as share price appreciation from the re-rating before the transaction and O&L’s buybacks. The returns were exceptional and represented a remarkably attractive gain in the short-term.

As such, M&G Investments’ Namibian clients invested in the M&G Namibian Balanced and Inflation Plus Funds will have benefited from the transaction, given these funds’ holdings in the company.

In the long run, investors are left with shares in a predominantly Namibian-exposed entity, with the potential of growth in existing royalty income as NBL’s brands become larger and more relevant in the rest of the region. NBL has given up participation in the growth of Heineken’s brands outside Namibia, but they stand to gain from any growth in Distell’s brands manufactured in the country.

While the company now forms part of the larger Heineken group, many the synergies and growth have been extracted and will accrue to Heineken and its unlisted South African subsidiary, which in the absence of a local market turnaround, leaves NBL slightly worse off net-net in terms of growth potential. Going back to valuation, however, post the transaction NBL is still only trading at a 13X annualised earnings multiple. In our view, this is still attractive enough to wait and see how the future unfolds, given the superior economics of the business. As well-known investor Howard Marks states: “There are no facts about the future, just opinions.”

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter