M&G Investments: Marking three years of top Fixed Income returns

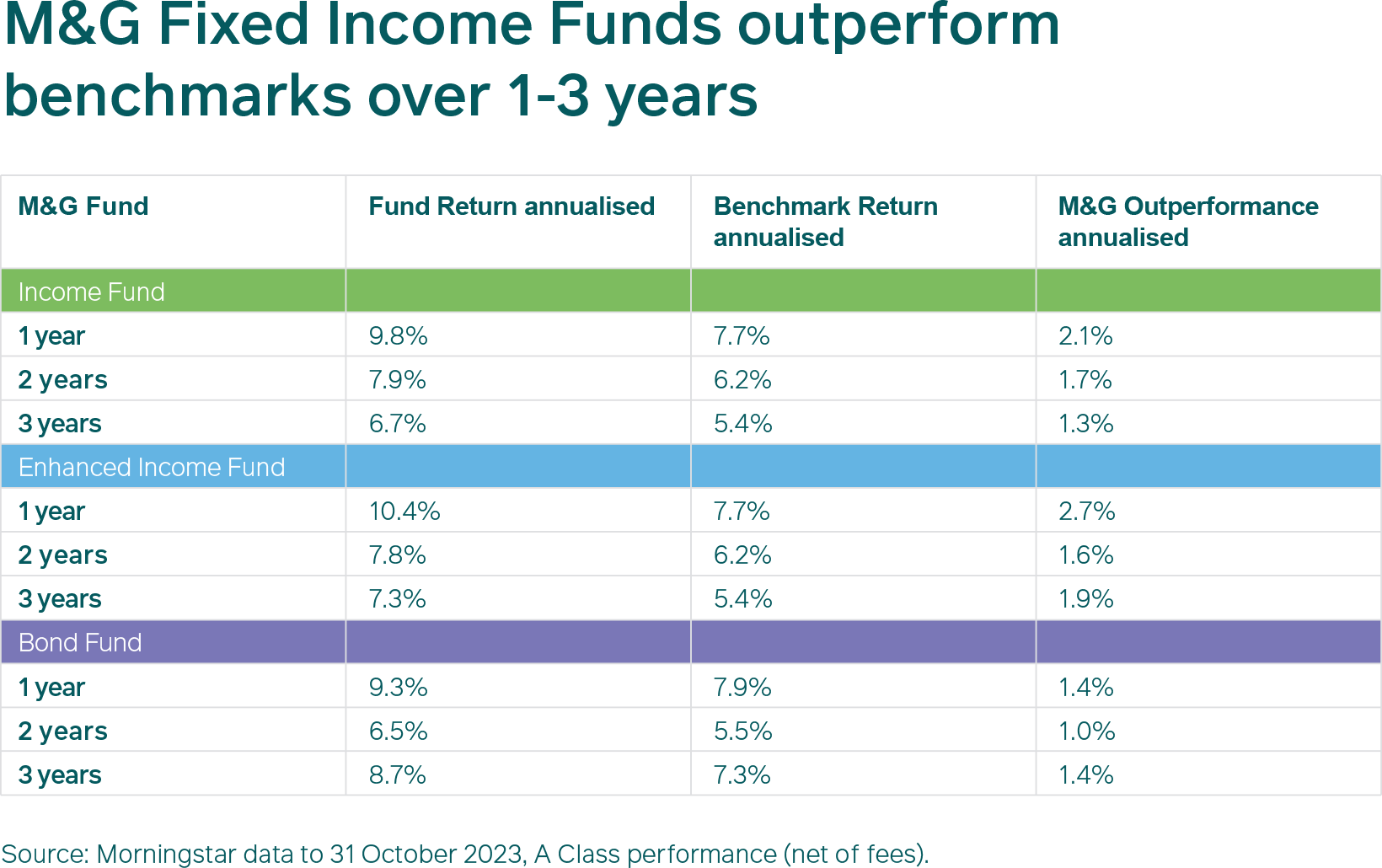

As we approach the end of 2023 and the start of a new year, we’re pleased to report that we’ve been able to deliver consistent top-quartile performance for our fixed income clients over the past three years, despite the difficult market conditions that have prevailed. This steady outperformance (or alpha) has benefited clients through the ups and downs of the SA fixed income market over the period.

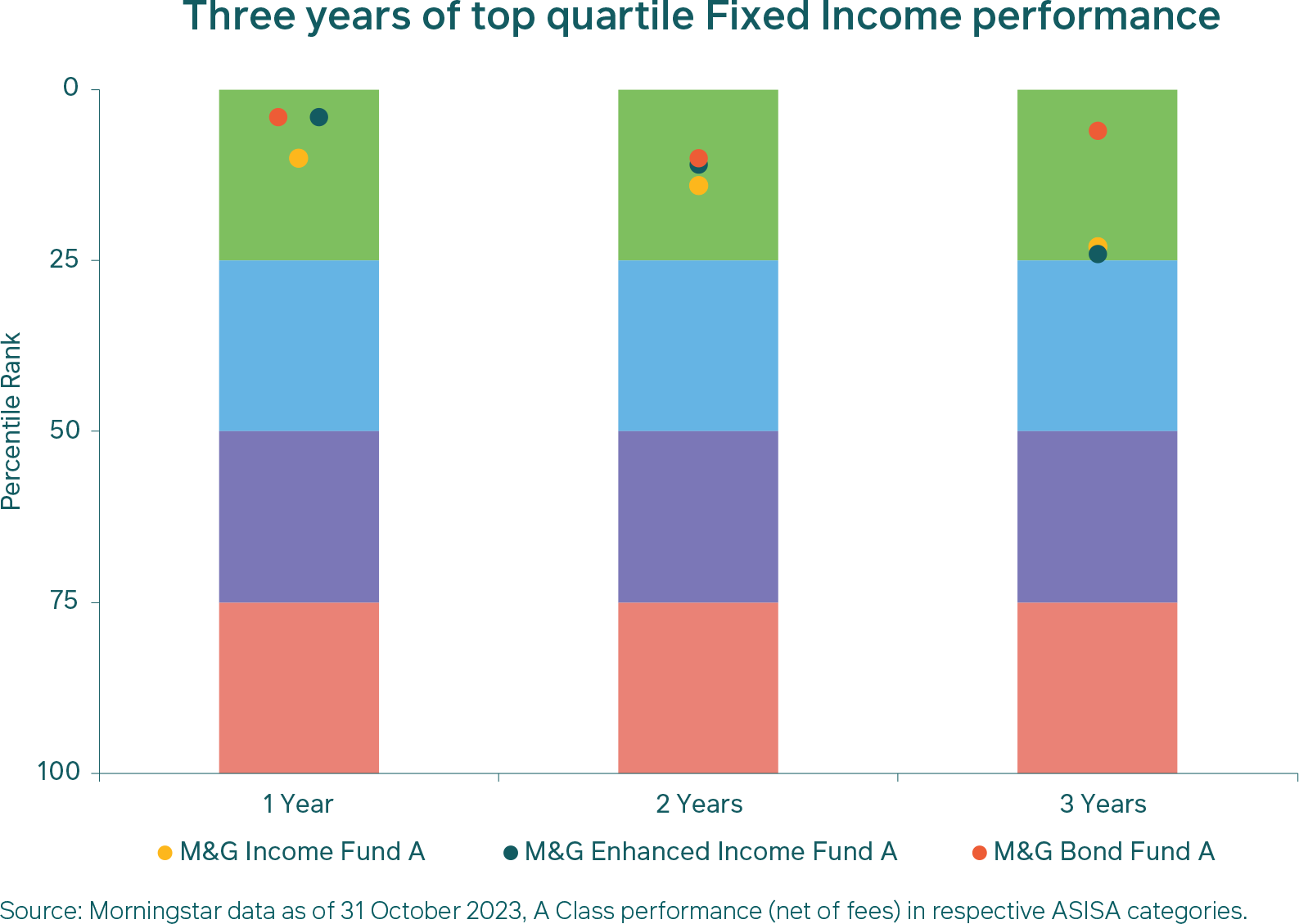

Graph 1 shows the rankings of the M&G Income, Enhanced Income and Bond unit trust funds over one-, two- and three-year periods in their respective ASISA categories, placing them in the top 25% of their peers and illustrating the superior performance which has broadly been reflected across M&G’s fixed income mandates for both retail and institutional clients. Note that the 50th percentile ranking denotes the average fund performance in the category.

Graph 1:

Key drivers of performance

It is important to remember the starting point of this performance three years ago, when we were coming out of the market weakness and low interest rates of the Covid period. South Africa’s fixed income markets experienced a rebound which saw good gains that our funds were well-positioned to benefit from. This positioning was intentional: we maintained our exposures during the Covid downturn and stuck to our consistent, value-based investment process, rather than turning defensive. Consequently, we didn’t miss out on the rebound when it came and fully captured the excellent returns in our funds. This was a key driver of our fund outperformance in the first year of the three-year period.

Subsequently, local fixed income markets have had to grapple with numerous challenges: steeply rising interest rates both locally and globally, fiscal concerns, loadshedding to name a few, all against a backdrop of heightened geopolitical tensions. Bond funds have also had to confront a total lack of fixed rate corporate bonds to invest in both due to a lack of issuance as well as wholly unattractive pricing. We have adapted to these changing conditions by becoming more discerning in our investment choices – ensuring as always that where we do add risk, it is well rewarded. We have also chosen to become more tactical in our investment approach across all these funds, and these changes have been important drivers of outperformance over the past two years.

What do we mean by becoming more tactical? Previously, we maintained a relatively stable long-term fund allocation across different types of fixed income assets based on a longer-term view of their fundamental valuations, and then deviated from that allocation only moderately over the short-term in response to market moves. We have now become more active in adjusting our asset allocation/fund positioning, which has meant deviating more often than previously in our positioning, but still based on our view of fundamental valuations. We are prepared to act quickly when we identify mis-priced instruments along the yield curve, to either buy at cheap levels or take profits and lock in alpha for clients - this more tactical approach has proved to work well in the current conditions.

Last but not least, M&G Investments has also added four new members to the Fixed Income team over the period, two experienced portfolio managers and two credit analysts. We cannot underestimate the important contribution their expertise has made to our fund outcomes as well. The team is pleased to have delivered such strong, consistent returns for clients over the past three years, and is looking forward to going into 2024 with a solid performance base and the right people, philosophy and process in place to continue to produce a similar performance going forward. We recognise that there will always be financial cycles and that top-quartile fund performance is not always achievable, but are confident we have given ourselves an excellent chance to do so in 2024 and beyond.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter