Letter from the CEO - Q2 2021

This article was first published in the Quarter 2 2021 edition of Consider this. Click here to download the complete edition.

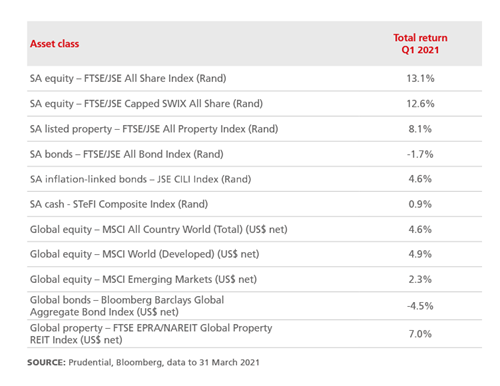

It was another positive quarter for risk assets around the globe, with investor sentiment supported by progress in vaccine rollouts across many large countries, signs of acceleration in economic growth, and promises of more US government spending in the form of a proposed US$2.25 trillion, eight-year infrastructure spending program by the Biden administration. However, gains and sentiment were tempered by growing market concerns over higher US inflation and interest rates which led to bond weakness, mainly in the US.

South African equities outperformed most other emerging and developed markets, recording strong gains for the quarter. We have been commenting for a while now that SA equity market valuations were extremely low compared to history and to other markets. These valuations and a recovery in corporate earnings have driven strong price action over the quarter.

Prospects for global growth continued to improve as central banks kept interest rates broadly unchanged at very low, accommodative levels – central banks currently appear less concerned about inflation than investors – and governments continued to enact fiscal support packages for consumers and businesses.

In South Africa, market sentiment was supported by the government kicking off its vaccination campaign on 17 February, helped by news that local manufacturing of the Johnson & Johnson Covid-19 vaccine had commenced, with 30 million doses earmarked for use in South Africa. However, questions remained over insufficient supply and the slow pace of the rollout.

Also helping the improving sentiment was news that the South African economy grew by an annualised 6.3% q/q in Q4 2020, beating market expectations of a 5% increase, with eight out of 10 industries reporting positive growth in the fourth quarter. The South African Reserve Bank lifted its projected total 2021 GDP growth to 3.8% from 3.5% previously and kept interest rates at near-record lows. Local inflation remained subdued.

Finance Minister Tito Mboweni unveiled a better-than-expected national budget in February, which saw none of the widely speculated personal tax increases, in favour of fiscal consolidation and reined-in expenditure to support the pandemic-battered economy. Mboweni proposed a government wage bill cut to help reduce government debt, and to aid in the funding of the free nationwide vaccine programme. Investors, however, remained cautious over the path of recovery outlined by Mboweni, with Moody’s stating that the lower budget deficits were unlikely to prevent debt from rising. Fitch said the country still faced “severe challenges” to implement fiscal consolidation.

The FTSE/JSE All Share Index delivered an impressive 13.1% return in rand terms for Q1 2021, benefitting from higher commodity prices and the stronger global and local growth outlooks, as well as re-rating. Gains were led by a strong performance from Resources shares at 18.7%, while Industrials delivered 13.0%. More locally-focused sectors were not as impressive but still in the black, with Property posting an 8.1% return and Financials producing 3.8%. Forward earnings yield upgrades have started to come through in the local market, especially for Resources companies, and to a lesser extent for Industrials. Even SA bank forward earnings have experienced upgrades, although to a smaller degree.

The FTSE/JSE All Bond Index (ALBI) was in the red for the quarter with a -1.7% return as foreign investor demand spluttered. The yield curve continued to flatten as bonds in the 1-3 year maturities sold off more than longer-dated bonds, a move that benefitted our Prudential funds on a relative basis, as we are holding longer-dated bonds in portfolios. SA inflation-linked bonds posted another strong performance, delivering 4.6% as investors sought some inflation protection, and cash (as measured by the STeFI Composite) produced 0.9% for the three-month period.

Most Prudential funds outperform

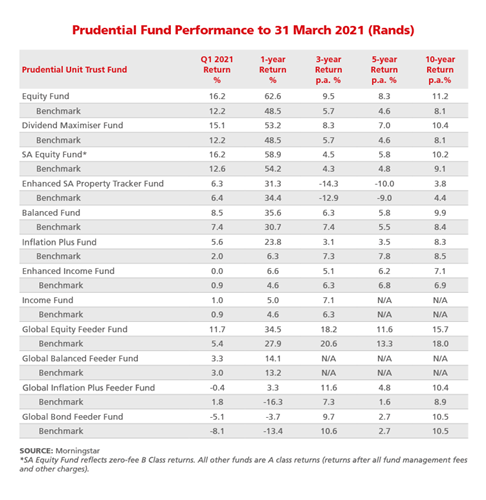

After having experienced poor returns at the height of the Coronavirus crisis, we were very encouraged to see last quarter’s global and local equity market rebounds extend into the new year. Prudential’s client portfolios were well-positioned to benefit from the strong local equity performance (given our overweight exposure to SA equities in our best-view multi-asset portfolios), adding to outperformance for the quarter and lifting 12-month returns substantially. Equally, our stock selection also contributed to outperformance in our equity unit trusts, with contributions from the likes of Anglo American, Implats, Amplats, Sasol and Sappi, to name but a few. The Prudential Equity Fund managed to return an exceptional 62.6% for the 12 months to 31 March, ranking it in the top-quartile in its ASISA category for all annual periods out to 10 years.

Our preference for longer-dated SA nominal bonds also helped to cushion losses in this asset class for the quarter, as the SA yield curve experienced bigger losses in short-dated than longer-dated tenors. At the same time, our client portfolios benefited from our overweight exposure to inflation-linked bonds (ILBs) given these assets’ significant outperformance versus nominal bonds (nearly 5 percentage points) during the period. This helped the Prudential Balanced Fund return 36.0% for the 12 months to 31 March 2021 and the Prudential Inflation Plus fund to return 23.8% for the same period.

The table below shows the annualised returns of our Prudential Unit Trust funds for periods up to 10 years, ending on 31 March 2021. We remain confident that portfolios are positioned appropriately given current asset valuations, and we anticipate much more pleasing outcomes over the next three to five years.

Prudential strengthens ties with M&G plc

During the quarter we were excited to announce our plans to further strengthen our ties with our global parent and founding shareholder, London-based M&G Investments (“M&G”), taking advantage of new opportunities that have arisen from the de-merger of M&G plc from Prudential plc in October 2019. To cement a solid base for closer integration, M&G is planning to increase its ownership in Prudential from the current 49.99% to 50.12%, returning M&G to a position of majority shareholder. We are awaiting regulatory approval for this transaction, which we expect to be completed during the second quarter of this year. We also plan to align with M&G’s global identity in due course. Further details can be found here.

The increasingly globalised and competitive nature of the investment industry has meant that a closer integration with our large, international parent company will be important for our future success as a business and as investors of our clients’ savings. We (and by extension our clients) will have easier access to the latest technological advances in investment management and administration, innovative new investment solutions such as in the areas of unlisted credit and ESG investing, and closer sharing of active investment ideas from around the globe, all of which will enhance our investment offering to clients. Equally, we will be able to further leverage off M&G’s scale and global supplier relationships, and align with their continuously improving global best-practice governance and risk-management standards for asset managers.

Most importantly, we expect this to result in better investment outcomes for our clients. They will benefit to an even greater extent from our closer cooperation with M&G Investments’ large team of investment experts, global best-practice, and expanded access to the latest global investment ideas and technology, among many other advantages.

Looking forward, we are acutely aware that the world, and South Africa, have not escaped the ravages of the Coronavirus – much more needs to be done. Despite this, we remain optimistic that the supportive global policies and positive local economic developments of recent months will continue to improve growth prospects and investor sentiment, in turn extend the turnaround we have experienced during the quarter. Based on current asset class valuations, we believe investors will be well rewarded for taking measured risk in their portfolios, despite the still-precarious environment in South Africa and many other countries.

We hope you enjoy this Q2 2021 edition of Consider this, and as always welcome any feedback you may have.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter