Opportunities in SA Equity through careful stock selection

Looking at South African equities, investors can be hard-pressed to find compelling reasons to invest with all the negative new headlines constantly on display. Yes, South Africa has its challenges, but we see value in the local equity market and hold the view that the negativity is largely already priced into markets. Further to this, it’s important to remember that many of the companies listed on the JSE All Share Index not only have global sources of revenue to diversify SA-specific risk, but that these companies are also trading at attractive valuations currently. On a 12-month forward price-earnings (PE) basis, the SA market is at one of its cheapest levels in a very long time -- the possibility of any positive news from this point onward has not been priced into the market. This is the time when the greatest opportunity exists to invest in SA equities. With so many attractive stock options to choose from, where does one begin?

Picking stocks

From a stock selection perspective, one can look at building a ‘safe’ portfolio by considering different factors that make a company more resilient in tough times, such as balance sheet strength, which often allows companies to make the best decisions for the long term when peers are under stress and significantly reduces the risk of the company’s equity value being wiped out by debt holders. ; as well as the levels of its pricing power in that sector, which allows companies to maintain margins in higher inflationary periods

It’s important to note that the overriding key factor remains valuations. There could be, for example, an exceptional company with stable, high margins and a strong balance sheet; but if you’re paying an expensive price for it, there is still a greater probability of losing money than of making attractive shareholder returns.

We’ve looked at some companies and sectors that have demonstrated these attributes over the past few years, where market conditions have been difficult.

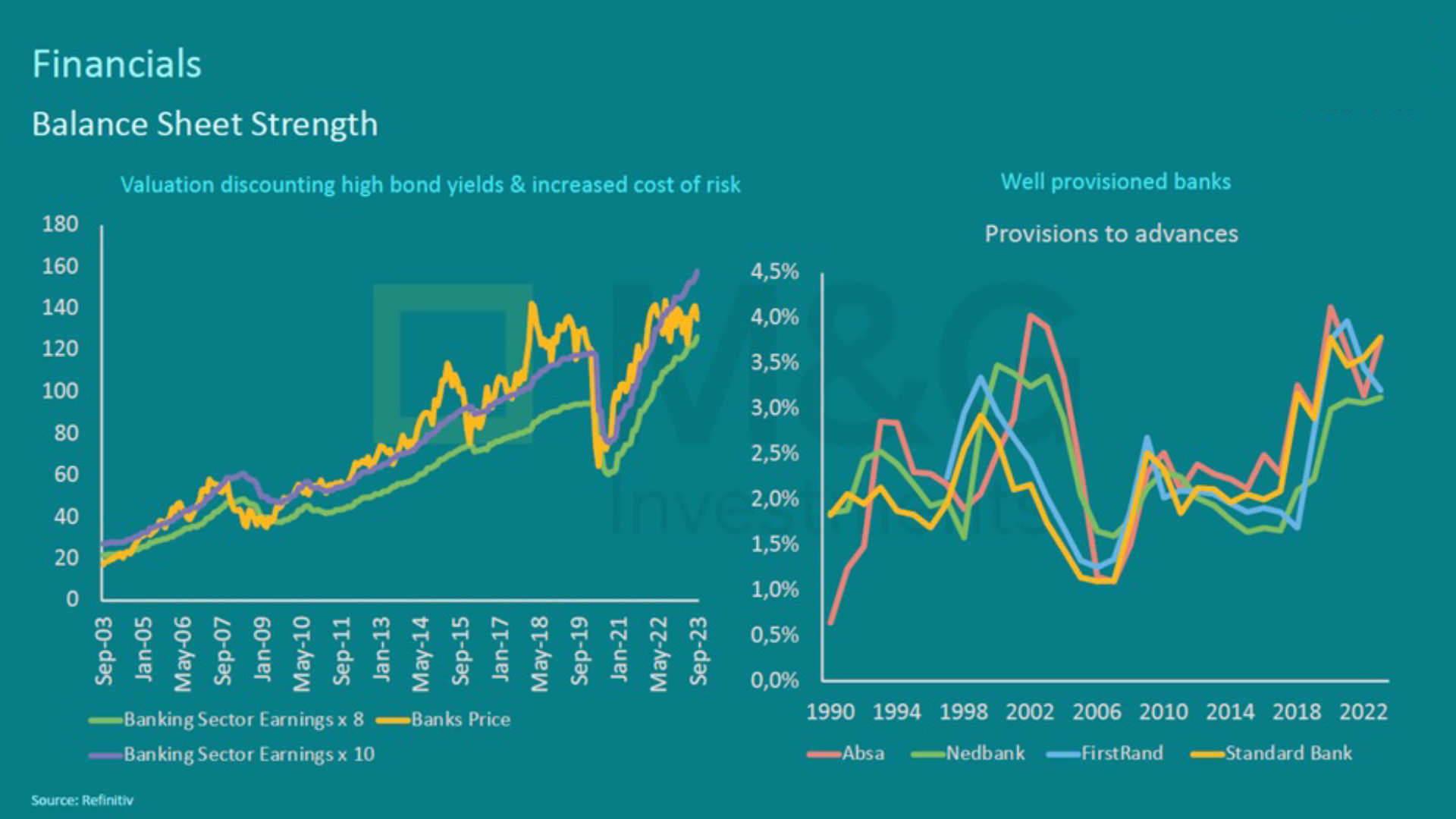

The SA banking sector is one such example. With the rapid and high interest rate increases totalling 450 basis points since 2021, it makes sense to proceed with caution here, since borrowers are now under pressure. But a caveat to that is that leading up to the period of rate hikes, most South African banks were exceptionally conservative when lending, keeping loan growth low. Banks have also managed their balance sheets cautiously by, for example, taking high provisions during COVID-19. Further strengthening their position was the implementation of IFRS 9 (International Financial Reporting Standard) in 2019, which further ensured that banks shored up their balance sheets. Currently, there is the risk of increased impairments coming through on bank balance sheets, but we believe that their capital is exceptionally well-managed, and the market is aware that the consumer is under pressure.

Graph 1: SA’s banking sector has strong balance sheets, adequate provisions

Looking at Graph 1, we see that despite SA banks’ earnings continuing to grow because of the “higher-for-longer” interest rate environment, the market has already priced in the fact that impairments are likely to rise. This presents a compelling opportunity for investors due to the balance sheet strength in the banking sector, which is trading at very compelling valuations.

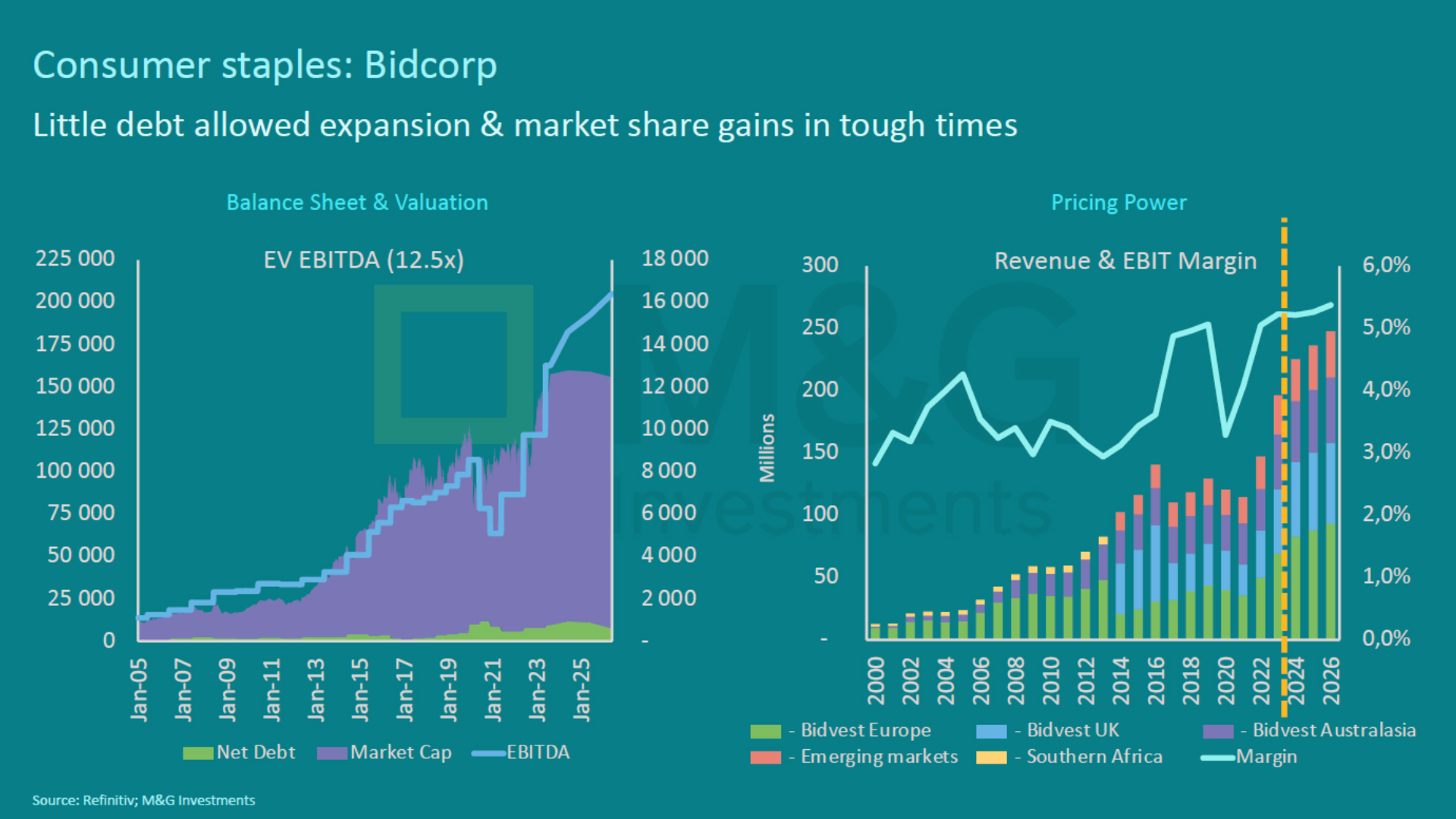

An interesting example of the importance of a strong balance sheet is Bidcorp, a food services company that delivers food items to hotels, restaurants, prisons and hospitals. As a global business, its revenue is derived from many different parts of the world and is not solely dependent on revenue generated in South Africa.

Graph 2: Bidcorp: Low debt allowed expansion and market share gains in tough times

The left part of Graph 2 shows that Bidcorp entered COVID with low levels of debt on its balance sheet, which bode well for the company. When COVID hit, the food services industry came under huge pressure with restaurants and hotels closing. There are quite a few smaller players in this industry who, in order to survive, ended up closing a considerable amount of capacity because they didn’t have the balance sheet strength (access to debt or cash) to sustain it. Because of how Bidcorp was positioned, the group was able to expand capacity during this tough time and still had enough access to cash to fund the large working capital outflows that were required when markets started reopening Bidcorp was able to gain market share. In theory, Bidcorp shouldn’t have pricing power because it is a company that delivers food items, that for the most part are not specialized and there are many small players in the market which shows that the barriers to entry are not very high. This is a business model that thrives off economies of scale. But because of the capacity gap that opened during COVID, it was able to raise its prices to the extent of food inflation. As a result, its revenue far exceeded expectations and it has been able to expand its margin, as the right part of Graph 2 illustrates.

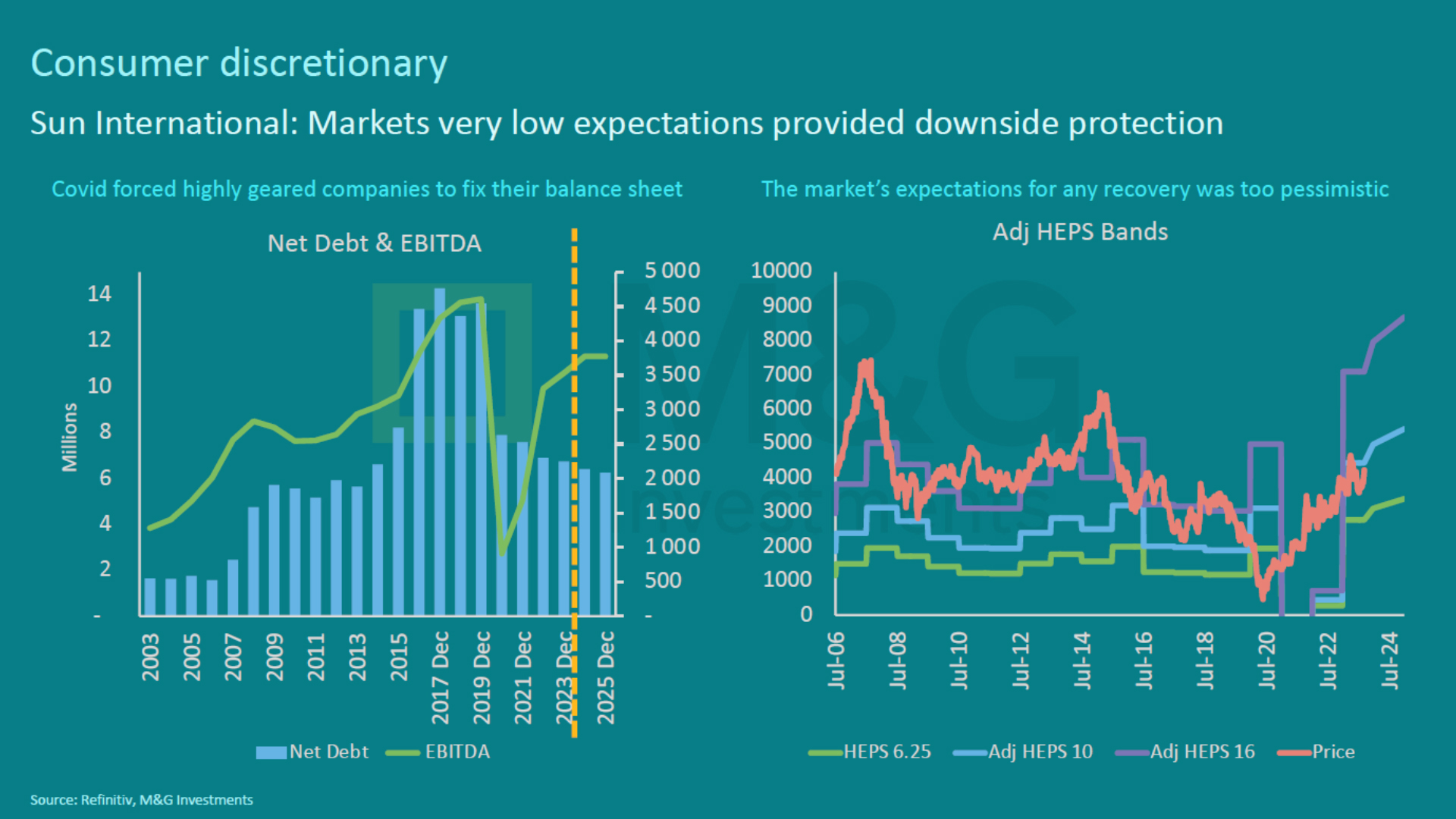

Meanwhile, Sun International is a company in the hotel, gaming and entertainment group and is an example of a company that did not have a strong balance sheet and has no pricing power yet provided a very interesting investing opportunity because of the overriding attribute of a cheap valuation

Graph 3: Sun International: Market’s very low expectations provided downside protection

Sun International’s balance sheet had been highly geared going into COVID, due to large acquisitions and funding new developments. At the same time, market expectations for a recovery were quite pessimistic, reflected by the company’s valuations dropping to levels so low that the market did not anticipate that the company would survive. But because of the way its balance sheet was structured, with many different businesses, it was able to sell some businesses and hard assets, as well as cut back on capital spending, in order to settle its debts. In fact, Sun International reduced its debt far more than expected, and its earnings (EBITDA) eventually recovered. This is highlighted in the left part of Graph 2, while the right part illustrates how the share price reacted positively as earnings normalized and the balance sheet concerns disappeared This serves as yet another reminder that valuations are a key component to providing safety to your portfolio returns.

Safety in portfolios

When constructing portfolios, we carefully consider the risks and evaluate opportunities based on valuations and robust research and analysis. In our view, continued headwinds in South Africa and the accompanying pessimism have created an opportunity for investors to acquire strong companies at very attractive valuations. These considerations of safety in portfolio construction and stock selection have delivered alpha and driven long-term performance in our M&G Equity and M&G Dividend Maximiser Funds.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter