Treading carefully in a cheap SA listed property market

This article was first published in the Quarter 3 2020 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Since the March market crash, presented with a plethora of seemingly “bargain basement” share prices, the Prudential investment team has been conducting careful, in-depth analysis to determine which companies have offered the best combination of potential risk and reward for investors, based on their valuations in the very different market conditions prevailing since the onset of the pandemic.

- Caution is required when investing in the sector as the risk is high for some companies with the most exposure to the weak hotel and retail property sub-sectors, and others with weak balance sheets.

- We have identified certain companies we believe will holdup well in the weaker growth environment that have offered excellent value, and have taken advantage of this to increase our exposure to them within our multi asset portfolios like the Prudential Balanced and Inflation Plus Funds: Nepi Rockcastle, Stor-age REIT, RDI REIT and Equites.

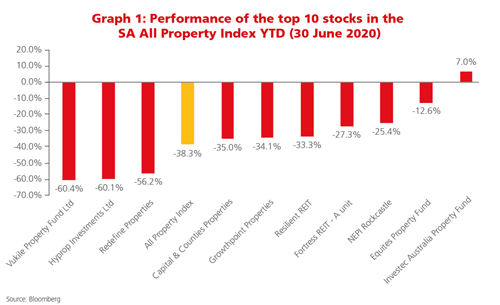

Amid the economic fallout from the Coronavirus pandemic and its global and local lockdowns, the South African real estate sector has been among the worst affected in financial terms. For the year to the end of June the All Property and SA Listed Property Indices have returned -38.3% and -37.6% respectively. This compares to returns of -10.7% for the FTSE/JSE Capped SWIX All Share Index and 0.4% for SA bonds. The share prices most impacted have been those property companies whose operations have been adversely affected by the widespread halt in business operations, and those with higher-than-average leverage (as measured by their loan-to-value ratios). Property owners and managers in the hospitality and retail sectors have been particularly hard hit for obvious reasons. In contrast, the self-storage and logistics sectors, to the extent they have not been exposed to affected industries, have been relative outperformers.

As we can see from Graph 1, the Investec Australia Property Fund has performed relatively well, with its year-to-date return at 7.0%, partially due to a weakening of the rand versus the Australian dollar, but also due to the company having no exposure to retail assets and also low levels of leverage. At the other extreme, Vukile Property Fund, Hyprop Investments and Redefine Properties all have lost over 50% of their value thanks to high levels of debt (relative to their assets) and substantial exposure to the retail sector.

In the months since the March market crash, presented with a plethora of seemingly “bargain basement” share prices, the Prudential investment team has been conducting careful, in-depth analysis to determine which companies have offered the best combination of potential risk and reward for investors, based on their valuations in the very different market conditions prevailing since the onset of the pandemic. Below we examine the prospects for four of the property companies in which we retain overweight exposures within our multi-asset portfolios like the Prudential Balanced and Inflation Plus Funds: Nepi Rockcastle, Stor-age REIT, RDI REIT and Equites.

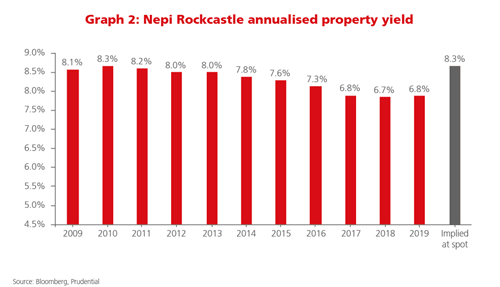

Nepi Rockcastle is the largest single owner of shopping malls in Central and Eastern Europe (CEE). The company has an excellent history of rental and dividend growth, both in absolute terms and relative to property peers. CEE countries appear to have suffered lower infection rates than Western Europe, and as a result the company has indicated that approximately 94% of its gross lettable area would be operational by the end of June, including outdoor restaurants. Tenants were trading very well prior to the lockdown, with the company experiencing high single-digit sales growth among the tenants it is able to measure (unfortunately its grocery anchor tenants do not submit sales data). Though the lockdowns will have impacted the strong operating momentum the company was experiencing, investors are currently paying for an implied 8.3% initial yield on the portfolio, the highest since 2010, as shown in Graph 2. Its moderate loan-to-value ratio of 32% allows the company to absorb valuation movements in the portfolio without placing the company in any distress. At a 12.3% historic dividend yield, the company should handsomely beat inflation over the medium term.

Stor-age REIT (Real Estate Investment Trust) is a specialist self-storage company with operations in both South Africa and the UK. Self-storage has proven to be a resilient class of property globally, as demand for storage space is driven by life events such as moving homes and our propensity to accumulate more material possessions than we can store in our homes. Resilient demand, coupled with the specialised, niche nature of the properties have allowed the company to grow its rentals and expand its number of locations in both South Africa and the UK.

Its “stores” are used to store anything from unused furniture to motorcycles and the inventory of small and medium enterprises. The properties themselves are no more than multilevel storerooms of varying sizes, which makes the cost of maintenance fairly negligible in the long term. This is unlike the conventional subsectors of retail, office and industrial properties which require more regular refurbishments to keep them in line with modern standards. Maintenance costs are not accounted for within property company dividends, and as a result most property companies pay dividends to shareholders well in excess of the amount that is sustainable in order to maintain their operations. This is less true for Stor-age. Although its dividend yield of 8.2% is at a premium to the property sector’s average yield, the low loan-to-value ratio of 30%, the superior quality of earnings and niche asset class give the company a reasonable likelihood of delivering real returns to investors over the medium term.

RDI REIT plc is a diversified UK REIT, listed in both the UK and South Africa. The company owns an eclectic mix of properties, with 29% of its portfolio invested in limited service hotels in the UK, 28% in retail properties in both the UK and Germany, 20% in distribution and industrial assets in the UK, 13% in London serviced offices and 10% in conventional office properties, mostly in London.

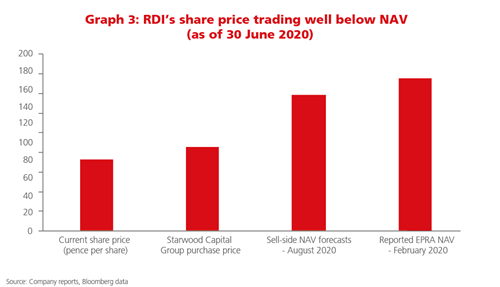

Investors in the UK property sector would be aware of how property valuations can differ very materially from where the stock market may value the assets. This has been especially true for companies that own assets where secular trends, such as online retail, have proven to be disruptive to existing business models. As a result, the net asset values (NAVs) of companies have proven to be a poor measure of intrinsic value in recent years. In the case of RDI REIT, the market is fortunate to have a recent marker of value in the midst of the pandemic, in that Starwood Capital Group, a US real estate private equity firm, bought a 29.5% stake in the company from Redefine Properties at 95 pence per share. Our sense is that Redefine Properties was a motivated seller, so the 95 pence may be an underestimate of fair value.

In terms of RDI’s properties themselves, the hotel and retail assets were more adversely affected than the other sectors as a result of the lockdowns. In the case of the hotels, we are optimistic that the worst is over as the majority of hotels have resumed operation. Though we are unsure whether or not media predictions of reduced business travel will materialise, fortunately the hotels have an alternate use, namely residential, which is higher than their current value-in-use.

The company’s remaining retail exposure is mostly to retail parks as opposed to shopping centres. Retail parks tend to aim their offering at convenience and bulky goods retailers, such as furniture retailers, which are more insulated from online competition — it would be very costly to have a couch or bed delivered only to find that you needed to return it. RDI reports that both footfall and spending are gradually returning to levels experienced before lockdown. And importantly for shareholders, on a conservative valuation of the remainder of the property assets it would appear that shareholders almost receive the retail assets for “free”.

Looking at RDI’s loan-to-value ratio of 41%, this level is manageable given that the company has elected to defer its most recent dividend (therefore boosting its balance sheet assets) and may elect to do similarly in the future. We are encouraged by the company’s recent disposals and would welcome more. The company made approximately 10 pence per share in distributable income on an annual basis before the disruptions of the lockdown. Though some impairment of income is likely in the near term, a slightly lower level of income and the price at which Starwood bought its stake provide investors with a great deal of comfort around the current valuation of the company. As shown in Graph 3, its current share price of 81 pence per share has reasonable upside to the price paid by Starwood and is well below RDI’s NAV.

Equites is a pure-play logistics property owner and developer which owns warehouses in Cape Town, Johannesburg and the UK. The company offers investors an element of safety as a result of its long unexpired lease terms of 10 years. Barring any unforeseen tenant failures, the certainty of income provided by the long leases is attractive given the current downturn in the property market and the associated tenant risks.

The company counts blue-chip global names like Amazon, Puma, Tesco, DHL, Nestlé and Simba (Pepsi Co) among its tenants in South Africa and the UK. Over and above the company’s strength of leases, it is also a developer of assets in South Africa and has recently entered into a joint venture with a UK-based company to undertake several logistics developments in that market. These should result in superior net asset value growth relative to the sector as the company realises profits on them. Though such developments can be risky, Equites’ management is mindful of not taking on projects larger than its balance sheet can handle. As of 30 June the company’s share price was trading at 0.94X its most recently reported NAV and a dividend yield of 9.2%, which is attractive relative to alternative yield assets (like bonds in Prudential’s multi-asset portfolios) given the relative certainty of growth.

Taking select advantage of cheap valuations

Although there are a number of risks present in the SA listed property sector in the near term, in particular the effect of tenant failures and rising vacancies, we have nevertheless taken advantage of a rare opportunity in recent months to increase exposure to companies that are either resilient to adverse structural changes or have offered inexpensive to cheap valuations. We believe exposure to companies like Nepi Rockcastle, Stor-age, RDI and Equites will add value to our multiasset portfolios going forward, helping to deliver the returns our clients seek over time.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter