Fortress - Not such a shareholder bastion

This article was first published in the Quarter 3 2022 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Fortress has recorded a sharp drop in its property-related income due to 1) the Covid-related downturn; and 2) downward adjustments to its income from implementing more transparent accounting methods. This has prevented it from reaching its shareholder distribution requirements, threatening its REIT status.

- Shareholders and management have disagreed over maintaining its dual-unit share structure and over its legal framework. These challenges have left Fortress A and B shares trading at substantial discounts. We find that its A shares offer compelling value over the medium term given that its income is already improving and we are optimistic that the impasse will be resolved favourably.

Coming out of the Covid-19 crisis, listed property group Fortress REIT has been mired in controversy, largely as a consequence of its poor past accounting practices. It has suffered a string of challenges that could potentially lead to the loss of its status as a Real Estate Investment Trust (REIT). While we think it may yet find a workable solution, there are a number of issues that need to be resolved between the Board, shareholders and the legal system before the company will fully regain investor trust. Here we unpack the issues facing Fortress and its shareholders and explain why we’re relatively optimistic about the outcome for the company as holders of Fortress A shares.

About Fortress

Fortress REIT listed in 2009 as a property loan stock with a dual unit “A” and “B” shareholding structure. These dual unit structures were not uncommon at the time, permitting companies to raise capital from sections of the market with different risk appetites. The A shareholders invested the majority of the capital on listing, R9 per share, and the B holders R1 per share. In return, the A holders received the majority of the company’s income, with growth capped at the lower of 5% or inflation, and the B’s enjoyed the remainder. In the ensuing period (which turned out to be a boom period for SA listed property), the company was able to pay regular dividends to both its A and B shareholders.

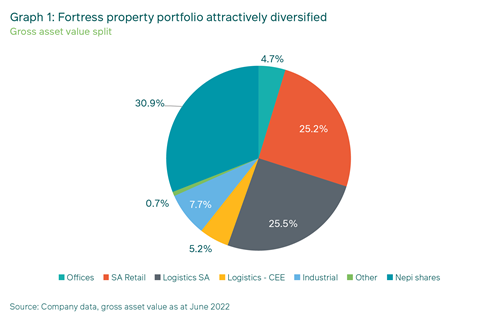

As illustrated in Graph 1, the company’s R40.4 billion property portfolio has an attractive mix of assets, with the largest portion invested in NEPI Rockcastle. The retail portfolio is grocery-anchored, while the logistics portfolio is mostly new and fit for purpose. The company retains little residual exposure to the beleaguered office sector.

Click chart to enlarge

Opaque accounting practices

Unfortunately, during the boom period the company -- perhaps due to shareholder pressure or management’s incentives for “growth” -- had picked up some bad habits. Chief among these was the recognition of profits that were not backed by cashflows. The examples were numerous, and included: cross-currency interest rate swap1 income; the non-recognition of interest expenses, which were instead capitalised against land and developments; and also interest recognised on funds advanced to BEE vehicles that were not always settled in cash.

The depths of the Covid pandemic in 2020 turned out to be something of a Damascene moment for Fortress as it closed out its cross-currency swaps positions sadly at a large loss compared to when we had first warned the company of the existential risks posed by these instruments) and attempted to improve the quality of its earnings by fully expensing the interest costs incurred on land and developments. This clean-up came as the property sector was hit by lost income from the Covid lockdowns, reducing Fortress’s dividends from NEPI Rockcastle as well as income from its own operations.

The net result of the company’s adjustments to their accounting policies has seen its distributable income collapse by over 50%, from R3.6 billion for the entire company in 2018 to just R1.7 billion in 2022, despite the company’s net property income being flat in that period. An analysis of the decline in income, shown in Table 2, reveals how poor the quality of earnings was prior to 2020. The NEPI dividend, now recognised on a cash as opposed to an accrual basis, should recover in time.

Click table to enlarge

Shortfall in income creates controversy

With its income levels leaving nothing for its B shareholders and even falling below the entitlement of its A shareholders, more recently the company made an attempt to collapse the dual unit structure. However, this move failed to meet the necessary shareholder support threshold to pass successfully. Behind this failure several factors were at play.

When the company listed in 2009, its Debenture Trust Deed was the governing document of the company. The current scenario, where the income falls below the A share entitlement, was contemplated by the Debenture Trust Deed. The deed awarded all of the income to the A shareholders in the event that the income fell below the entitlement.

Complicating matters was that Fortress converted to a REIT in 2015 after REIT regulations were promulgated in 2013. During the conversion process, a circular which was released to all shareholders promised that “no material rights of the shareholders would be affected as a result of the conversion”. At the same time, the clause which awarded all the income to the A holders should the income fall below the entitlement was not carried over to the Memorandum of Incorporation (MOI), which means the MOI is silent on the matter.

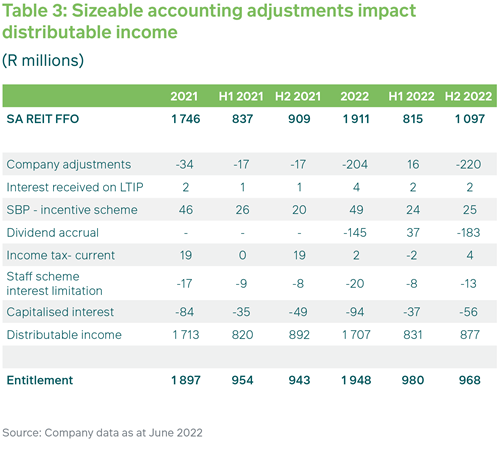

The Fortress Board has taken the view that it cannot pay a dividend until such time as the company achieves the minimum income required to meet the A entitlement as defined in the MOI. As such, it currently faces the prospect of losing its REIT status due to not having paid at least 75% of its earnings to shareholders. This is despite having in fact generated sufficient income in the second half of the most recent financial period to pay dividends to both the A and B shareholders, were it not for the adjustments made to the SA REIT Funds from Operations (FFO) measure. Table 3 shows the sizable R183 million net deduction taken in H2 2022 for the NEPI Rockcastle dividend accrual which pushed the company below its R1.95 billion entitlement requirement.

Click table to enlarge

All is not lost

Given the strong recovery in the NEPI dividend, there is a reasonable prospect of Fortress paying a dividend to both classes of shareholders in the medium term. In deciding how best to participate in the potential upside in the company, M&G clients are overweight the A shares, and have an underweight to the B shares based on our assessment of the group’s medium-term income-generating potential when compared to the share prices. Ignoring taxes, the A share trades on an 18.3% forward yield based on its entitlement, or a 5.5X PE multiple. This represents compelling value, and we are optimistic that a solution to the current impasse can be found among both A and B shareholders.

1The cross-currency interest rate swap operates as follows: the company enters into an agreement with a bank to swap a notional sum in rand for one in euros, such that the company receives Jibar from the bank and pays Euribor plus a credit spread in return. The difference between Jibar and Euribor creates income, which is in turn paid to shareholders. However, this stream of cash flows is not a “free lunch”, as the company would need to provide funding for any adverse movements in the euro/rand exchange rate.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter