The easy way to calculate how much money you’ll need to retire

GO TO THE RETIREMENT CALCULATOR NOW

Retirement planning is not the sort of comfortable topic we’re accustomed to discussing at a dinner party – in fact talking money is often frowned upon, even among family members. Hence your plans for retirement – when you want to say goodbye to your desk, where you want to settle and how much money you’ll need to achieve your desired lifestyle – are rarely spoken about in the important years when you actually need to be building up a retirement portfolio.

Yet planning for retirement is almost as important as the actual saving. If you’re taking on the retirement planning responsibility yourself, and don’t want to use a financial adviser for whatever reason, you’re left with a lot of guesswork. Are you using the correct investment solutions, saving enough every month? Prudential recently introduced a range of online investment tools to help you plan and achieve your investment goals from the comfort of your home. The easy-to-use retirement calculator takes you through a series of steps:

- At what age would you like to start saving for retirement?

- At what age would you like to retire?

- How long do you think you will be in retirement?

- What is your salary when you start investing for retirement?

- What percentage of your salary would you like to budget towards your retirement?

- How much have you already saved for your retirement?

- Replacement ratio?

- What amount would you like to withdraw from your investment at the time of retirement?

- What return will you need from your investment above inflation (ie, real return)?

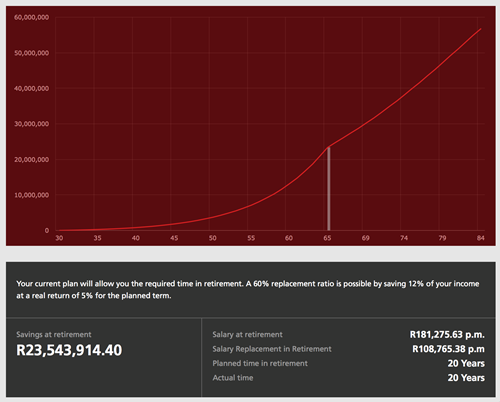

Your savings at retirement, salary at retirement and salary replacement in retirement are then automatically calculated and can be saved straight to PDF.

How do the numbers add up?

Let’s use the fictional example of “Pete”. Pete had student debt to pay off and then decided to save towards a deposit on his first home. This meant that the first time he really considered saving towards retirement was when he was 30.

Pete doesn’t have any exotic plans for his retirement, but he knows the earliest he will retire will be 65, which is the age stipulated by the company he currently works for. He’s a pretty healthy guy, and his grandfather lived to the age of 85, so he figures he’s got about 20 years of retirement to plan for.

He started saving for retirement when his salary reached R25 000 a month (after tax). He plans to save about 12% of his income (typically, you are advised to save 10%-15%, but we are now allowed to save up to 27.5% of pre-tax income towards retirement). He estimates he will need about 60% of his current salary when he retires (this is called a replacement ratio) as his expenses will probably be lower. He opts not to draw cash when he retires, and expects 5% from his investments above inflation. Let’s look at Pete’s numbers…

Now try to calculate your own retirement using the Prudential Retirement Calculator.

You can also try these other Prudential tools:

Ready to invest with Prudential? Complete an online application form now or contact our Client Services Team on 0860 105 775 or at query@prudential.co.za for more information.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter