The battle for “bling” could be heating up

Article Summary

This article is from the Quarter 1 2020 edition of Consider this. Click here to download the complete edition.

The pending buyout of top US jewellery brand Tiffany & Co. by European powerhouse LVMH has global investors speculating about Richemont’s strategy and a possible battle of the brands ahead, according to Kaitlin Byrne, Portfolio Manager.

Key take-aways

- The combination of Tiffany and LVMH could create even stronger competition for Richemont and other top global jewellery brands, given the two companies’ complementary market presence.

- The merged LVMH-Tiffany group will overtake the more successful Richemont in size, and key will be whether LVMH is able to turn around Tiffany’s slumping revenues.

Towards the end of 2019, the world’s high-end jewellery investors were given a reason to be excited about the coming year with the announcement of the proposed buyout of Tiffany & Co, the US’s number-one jewellery brand, by European luxury group LVMH. What kind of shake-up could materialise in this exclusive market of historic brands, and what innovations could it spur in the competition for the wallets of the rich and famous? Here we take a look at what the transaction could mean for the global jewellery market and for investors in LVMH and Richemont, one of South Africa’s larger listed global corporates and a keen competitor of LVMH and Tiffany.

As equity analysts, we are able to have a glimpse into the world of branded jewellery because three of the globe’s most popular jewellery brands are all currently owned by publicly listed companies – Cartier (owned by Richemont), and Tiffany and Bvlgari (owned by LVMH). Apart from these three large brands and a few other big branded names, the jewellery market globally is highly fragmented. This market includes engagement rings, high-end jewellery and jewellery collections along a wide range of price points, and usually excludes luxury watches. However, here we include them as key parts of the businesses.

Richemont has pulled ahead in recent years

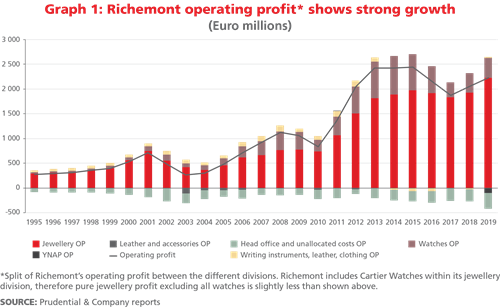

Richemont, which owns Cartier (jewellery and watches) and Van Cleef & Arpels within its jewellery Maison, is a good example of a company which has made a major success of its jewellery brands and managed to continue to grow these year after year – across revenue and operating profits. In fact, they have managed to expand the margins in their jewellery division from 20% to 30%. And because this figure includes Cartier watches at a lower margin than jewellery, the margin they earn from jewellery alone is even higher.

Yet Richemont’s overall success has masked some difficult periods. The group used to be more famously known for its numerous luxury watch brands including Cartier, IWC and Panerai, which, along with the rest of the global watch market, experienced a major expansion until 2013. At this point, the Chinese government clamped down on “gifting” in the public sector, resulting in pressure on watch sales. After years of high growth, the sudden slowdown in sales resulted in an oversupply in the market that is taking years to correct. As investors focused on the declining watch margins within Richemont and the continuous buybacks of stock from wholesalers to reduce the excess watch stocks, global jewellery sales continued to rise. And because jewellery has margins nearly double those of watches, jewellery became by far the largest source of the group’s operating profit.

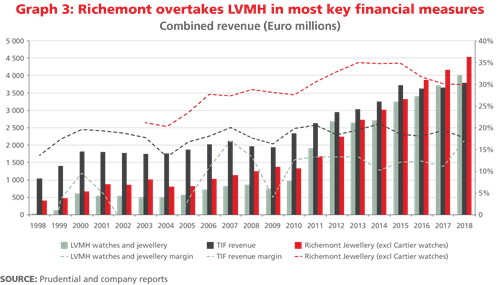

Graph 1 shows this change in the composition of Richemont’s operating profit over nearly 25 years, with its jewellery business now accounting for the majority of the value of the company. At the same time, Graph 3 details the strong revenue growth and high margins Richemont has generated from its jewellery business relative to LVMH in recent years.

Prudential has held an overweight position in Richemont over the last few years as we felt the value of its strong jewellery business and brands was not fully appreciated by the market, as concerns around the declining watch business masked the compounding growth within the jewellery business. Prudential’s portfolios have benefitted from this overweight position, as the share delivered a 20.1% return in 2019.

Has LVMH simply been lucky?

LVMH, which is predominantly known for its leather bags and clothing (Louis Vuitton, Christian Dior) as well as its champagne (Moet & Chandon) and cognac (Hennessy), has been selling watches and jewellery since the mid-1990s, but watches and jewellery make up only 9% of LVMH’s total revenue. Investor interest in LVMH’s jewellery really only gained traction post its acquisition of Bvlgari in 2011, when it demonstrated its ability to double Bulgari’s revenue and expand margins from an estimated 9% to 24%. The key question is whether LVMH really has found the secret to creating a highly profitable jewellery business, or whether it was exceptionally lucky in its timing of the acquisition, which followed on the heels of the Global Financial Crisis (GFC) -- hence Bvlgari’s margins had plummeted and then benefitted from the good growth in the jewellery market post 2011.

The answer is probably somewhere in between the two. We would suggest that the company’s ability to make a success of Tiffany & Co, their largest acquisition to date, will get us closer to the real answer. LVMH announced the planned US$16.9 billion purchase (some R236 billion) in late 2019, and is acquiring Tiffany at margins that are fairly close to their long-term average. Tiffany’s revenue growth has been pedestrian, and stifled by shareholders who have focused on cash flows. This has restricted its ability to invest for long-term growth.

Following the news of the acquisition, there was mixed reaction and speculation by the market as to why LVMH would go after a company such as Tiffany, especially given its high proportion of engagement jewellery (almost one-third of its product mix), which is considered to be a fairly low-growth market segment. Equally, Tiffany does not craft “distinguishable” jewellery pieces, a key selling point which rivals Bvlgari and Cartier have kept core to their brands.

Why would LVMH spend such a huge sum to acquire Tiffany rather than expanding their own jewellery lines organically? First, LVMH has always acquired brands and is essentially a conglomerate of numerous acquisitions. The brands they have purchased in the past, including Tiffany, were in fact founded a few hundred years ago -- this type of history simply cannot be replicated. Just for interest, we have listed the founding dates of some of the world’s best known jewellery brands in Table 1. Maintaining or improving on the brands’ strength is the number-one priority for luxury goods companies. Although having attractive jewellery designs is also important, they can be easily replicated, and new designs can be introduced by competitors. Meanwhile, a strong brand name and what that brand represents keeps consumers from switching out of the brand, creating a high barrier to entry.

Tiffany: An iconic US brand

Tiffany has always had an exceptionally strong brand in the US, being the country’s number-one preferred jewellery brand. The company was established in 1837 by Charles Lewis Tiffany and is known for its diamond rings and iconic Blue Box, which has been used since Tiffany first started selling its diamond rings in 1886. Over the past few years their presence and brand image in China has been growing strongly, elevating it now to the number-two preferred brand in China after Cartier, according to an HSBC survey. This is Tiffany’s largest attraction for LVMH -- its strong brand name and history.

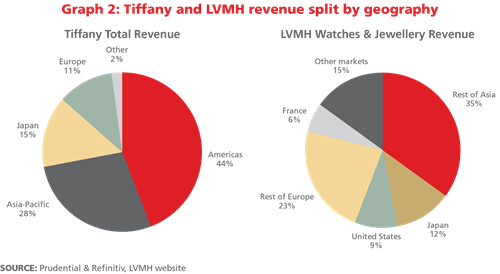

The second attractive attribute that Tiffany has is its broad retail footprint. It has 321 company-operated stores globally, 93 of which are in the United States, its home market, and 90 in Asia Pacific, the fastest-growing region. Over the past five years, its store count in the US has remained largely stable, while its Asia-Pacific numbers have grown by 23%, indicating Tiffany’s strong focus on the higher-growth Asian market. LVMH has an even bigger reach, with 428 watch and jewellery stores globally. Tiffany management believes that being within the LVMH stable will allow them to leverage off LVMH’s expertise in the very important Asian market. In the same way, LVMH can leverage off Tiffany’s experience in the American market. As shown in Graph 2, the United States accounts for only 9% of LVMH’s jewellery sales, compared to Tiffany’s 44% in the Americas region.

Turning around subdued revenue growth

One big challenge for LVMH as a new parent company will be tackling Tiffany’s sluggish revenue growth over the last five years, which has allowed Richemont to overtake it, as shown in Graph 3. In 2017 Tiffany tried to revive growth itself through a transformation strategy that included renewing its product offerings and in-store presentations; strengthening its brand message and committing to higher investment spending. In not resisting the buyout, the company is tacitly admitting that it has not achieved its goals, and is therefore leaving it to LVMH to work its magic.

LVMH’s acquisition of Tiffany, currently a standalone listed company, will result in Tiffany’s financial results being reported within the larger LVMH group, therefore allowing LVMH to increase investment into the brand, but without the same degree of investor scrutiny or publicly available financial information as currently. Within LVMH, jewellery and watch sales currently make up 9% of LVMH’s revenue, but once the transaction is completed, this will almost double in euro terms to 16% of group revenue. Once combined, LVMH’s jewellery division revenue will exceed that of Richemont.

Looking ahead, Richemont will be closely watching developments at the bigger, combined LVMH-Tiffany. The threat posed to Richemont will be significant if LVMH can return Tiffany to growth and, in so doing, take market share from Richemont, after years of market share loss by Tiffany. The increasingly competitive environment may in turn prompt Richemont to boost investment in its own brands. Consumers are likely to be the real winners of any heightened rivalry, given that it could very well spur the creation of many new and wonderous pieces of jewellery to ignite the consumer imagination and add bling to any occasion.

|

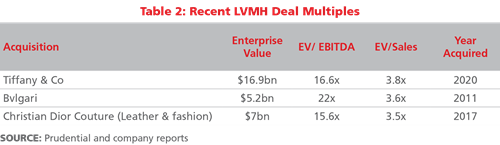

What’s the deal? As detailed in Table 2, LVMH has made an all-cash offer to acquire Tiffany for a total value of $16.9bn and an equity value of $16.2bn, equivalent to US$135 per share, a 50% premium to the share price at which Tiffany was trading prior to the offer. Based on Tiffany’s 2018 results, the multiple paid is a 16.6x EV/EBITDA, and a 3.8x EV/Sales, which is comparable to its previous Bvlgari and Christian Dior acquisitions on an EV/Sales basis, but seemingly cheaper than their Bvlgari acquisition on an EV/EBITDA basis. However, the latter is due to the depressed margins in Bvlgari at the time of that acquisition compared to Tiffany’s more normalised margins now. The deal will take LVMH from a net debt/EBITDA of 0.5x to around 1.6x, which is still a fairly low debt level, posing little financial risk to the company. Over the past few years, Tiffany has generated between US$500-700 million free cash flow (FCF) every year after all capital investments for a 3.5% FCF yield. This indicates that for LVMH to generate a decent return on their investment, they will need to ensure that Tiffany returns to revenue growth and margins can be improved further, to realise at least 5% growth per annum in order to get to an 8.5% return (3.5% free cash flow yield + 5% cash flow growth). Given the number of successful deals that LVMH has done over the years, especially its turnaround of Bvlgari, the market is clearly optimistic that LVMH can work its magic on Tiffany in the same way. The share price of Tiffany has shot up some 46% since the deal was announced, while LVMH’s share price has gained 16%. The transaction is expected to close in mid-2020.

|

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter