Table Talk: Q1 2024

Q: What value does listed infrastructure as an asset class add to a portfolio? Isn’t it the same as global equity?

A: Before I can answer the question, let’s start by unpacking listed infrastructure as an asset class. Global listed infrastructure is a relatively new and untapped asset class in South Africa.

However, amendments to Regulation 28 of the Pension Funds Act could be the catalyst to opening up the opportunity set for infrastructure, and more offshore investing. The most recent amendments brought about key changes:

- The definition of “infrastructure” was published which includes assets with the main objective of developing, constructing, or maintaining physical assets and technology to provide utilities, services, or facilities to the benefit of the economy, business, or the public. It includes private sector developments as well as traditional public sector projects.

- Retirement funds are now allowed to invest in infrastructure, up to a total limit of 45% across all asset classes (excluding any debt issued by or guaranteed by the SA government).

“Listed infrastructure” is therefore buying shares in the listed companies that own or control strategic physical infrastructure assets with high dividend growth potential over the long term. This is in contrast to private equity, where the investment is made in unlisted companies with no tradability or price discovery over time.

In managing the M&G (Lux) Global Listed Infrastructure Fund) we invest in critical infrastructure, long-life concessions, and perpetual royalties. The most important common denominator for these assets is the ability to secure long life cashflow streams. An example of this, and a unique component to our strategy, is the use of “perpetual royalties”, which means paying royalties in perpetuity to the landowners for any economic value derived from that land. These long life cashflow streams can be valuable for investors seeking stable and growing long-term incomes, like pension and provident funds that need to provide steady payments to their retired members over long periods of time.

Components of infrastructure: Economic (core), social, and evolving

At M&G Investments, we have broadened our definition of global listed infrastructure to access the full breath of the asset class and bring it into modern society’s requirements. Typically, listed infrastructure centers around three categories: utility, energy and transportation infrastructure. While these are core to our strategy and what most listed infrastructure funds focus on, our strategy also has dedicated exposure to social infrastructure, which consists of health, education, and civic infrastructure.

The third component is termed evolving infrastructure, which includes the physical infrastructure assets that are geared towards a digitally-enabled society and is designed to ensure that the infrastructure exposure in our strategy properly reflects the increasingly digital world that we live in. In this way, the structural growth from ‘evolving’ infrastructure injects a new dimension to an asset class which has stability at its core.

The three classes of the global listed infrastructure strategy that we employ, as well as examples of the assets and sectors we invest in, are shown in Graph 1.

Graph 1: M&G Infrastructure classes: Bringing the asset class into the modern age

Economic (65%-75% of fund exposure)

The economic component is often called “core”, and most infrastructure strategies invest solely in this component. It incorporates:

- Utilities, such as pipelines and terminals. It’s an important part in ushering in the energy transition and security.

- Energy, such as electricity, water and waste management.

- Transportation, such as railways, airports and ports.

Benefit: Tends to be defensive in nature and offers conservative but stable dividend growth over time.

Social (10-20% of fund exposure)

Social infrastructure covers infrastructure providing health, education and civic functions. The characteristics of this component tend to add defensive qualities and typically have a guaranteed revenue stream (most often coming from governments) for the infrastructure provided, with generous dividend yield that tends to grow with inflation over time, regardless of market movements. This component has performed well in difficult market conditions – during the global health pandemic, it was the best-performing part of the fund. While this component is more prevalent in the private equity space, the fund accesses it through listed strategies.

Benefit: Offers similar defensive characteristics and dividend profile to the ‘economic’ sphere.

Evolving (15-25% of fund exposure)

The “Evolving” component covers areas of infrastructure that are serving the modern world, for example, digital infrastructure encompassing the physical aspects like transmission towers, data centers and optical networks used in facilitating modern day communication. We tend to focus our positioning to infrastructure providers offering high rates of structural growth.

An example of the fund’s exposure to this type of infrastructure asset, is our holding in American Tower, which has transmission towers in both developed and emerging markets, including South Africa. This holding has added phenomenal value to the fund due to their presence in Africa during a period of growing network density, the rollout of 5G, and other drivers for growth, the company managed to compound their dividend growth at a 16% annual rate over the last six or so years.

Benefit: We focus our positioning on infrastructure providers offering high rates of longer-term growth.

This broader definition of infrastructure gives the fund a higher level of return diversification because:

- The underlying return constituents of each of the three categories tend to behave differently across various market environments.

- There is diversification across the categories, sectors, and subsectors.

- It is a global strategy, giving the fund geographical diversification.

Global listed infrastructure versus global equity

While listed infrastructure operates in the global equity market, it has different characteristics and behaves differently to global equity as an asset class in terms of three important factors: return profile, volatility and dividend growth potential.

Compared to global equity, the return profile of infrastructure is more consistent and stable. This is directly related to the high-quality companies carefully selected within the fund for their ability to provide stable, long-term dividends.

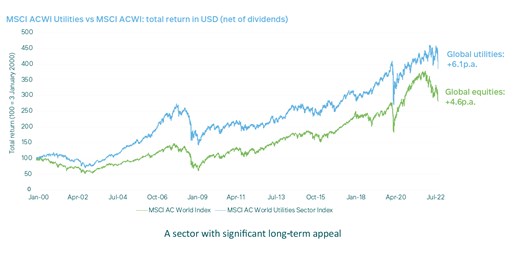

Looking solely at performance (net of dividends), Graph 2 compares the All- Country World Index Utilities Sector Index (a proxy for infrastructure) versus the ACWI (proxy for global equity) returns over a 20-year period. With a 6.5% p.a. return from Utilities and a 5% p.a. return from the ACWI, this 1.5% p.a. outperformance illustrates the reliability, compounding effect and significant long-term appeal of infrastructure investments.

Graph 2: Utilities offer higher returns than global equity over time

Because the strategy does invest in the equity market, investors can experience some market volatility typically associated with equities. But infrastructure moves differently to the equity market over the long-term, and with a beta measure of less than one, is less volatile than the overall equity market. Looking back at 2023, global equity market returns were concentrated in the “magnificent seven” tech stocks in the US. While the market’s attention was centered on these seven stocks, there were some attractive companies still delivering against expectations and for us – this is where we saw the real opportunity.

“With a beta measure of less than one, [infrastructure] is less volatile than the overall equity market”.

As an actively managed fund, our investment edge is the ability to rotate capital around the various sectors, categories and regions to take advantage of market opportunities. This makes the strategy unique and gives the fund an advantage over peer funds over time.

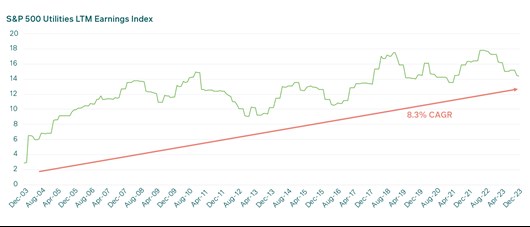

At the same time, Graph 3 shows the compound annual growth rate (CAGR) of the S&P 500 Utilities LTM Earnings Index has averaged 8.3% over a 20-year period. This demonstrates the power of consistent compounded earnings, cashflow and growth that has resulted in two decades of high single-digit returns and presents a compelling investment case for any portfolio.

Graph 3: Two decades of high single-digit compounding

A promising outlook

In conclusion, the expansion of the opportunity set allowed in Regulation 28 has provided local investors with access to a wider range of asset classes and geographical regions than ever before. The philosophy employed in our global listed infrastructure strategy is focused on delivering growing cashflow streams to our clients backed by companies owning strategically advantaged physical assets with long-term growth potential. Our fundamental belief is that investing in companies that are growing their dividends is a successful strategy in the stock market over the long term. We believe that a progressive dividend policy helps a company to improve because it instils capital discipline, which allows the business to grow profitably and support a rising dividend stream.

A rising dividend stream regulates the amount of cash that can be reinvested in the business and therefore ensures that only the most profitable projects are selected. Looking at it another way, the potential for value destruction is more limited when dividends compete with the capital available for growth investment. We believe that dividends should not be an afterthought; they should be an integral part of good company management so that the business grows in a sensible manner.

Furthermore, the resilience of earnings, the defensive nature and attractive valuations on offer from listed infrastructure in relation to the global economy makes it a valuable diversification tool in any portfolio. We believe that global listed infrastructure presents a promising outlook for investors in the years ahead – those seeking convenient access can do so via the uniquely positioned M&G (Lux) Global Listed Infrastructure Fund (USD) and M&G Global Listed Infrastructure Feeder Fund (ZAR).

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter