Is gold a disappointment?

This article was first published in the Quarter 3 2022 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Despite falling what may seem to be a disappointing 6% year-to-date in US$ terms, gold has performed better when priced in non-US$ terms and has outperformed many other assets.

- A stronger US$ and rising US and global interest rates pose headwinds for gold, which does not pay interest. Another headwind is the existence of pockets of traditional assets that have offered other investment opportunities. These factors help explain why gold’s performance may not be as disappointing as it appears at face value.

- For M&G Investments, while we recognise the diversifying property of gold bullion in general, its lack of cash flow tends to preclude it from our investment framework. And, while gold equities can be valued on cash flows, we tend to avoid these stocks because their fundamental driver, the price of gold, undermines this.

Normally an environment beset by macroeconomic risk (particularly of the inflationary kind), geopolitical risk (as reflected in the Russian invasion of Ukraine and the associated energy crisis in Europe and globally), and thirdly the potential for financial contagion risk (from various causes, most notably the bubbling Chinese property crisis), would have built the conditions for gold to perform. Against this backdrop, its 6% price decline year to date is disappointing, at face value.

Defending the safe-haven case

In defence of the safe-haven case for gold, various factors stand out. First, the US dollar (US$) itself has been an outperforming asset, even as US Treasuries have experienced their worst year-to-date performance in history amid rising US inflation and interest rates. While a strong dollar is often a reflection of safe-haven demand as cash flees riskier assets like equities, commodities and emerging markets, gold has nevertheless been a relative outperformer itself; as becomes clearer when considering the gold price in non-US$ currencies.

Besides a stronger US$ being a headwind to the US$-denominated gold price, rising US and indeed global interest rates are a material challenge to gold. While gold broadly responds favourably to negative real interest rates (generally viewed as the strongest driver of the gold price), as presently occurring due to elevated inflation, the non-interest paying characteristic of gold hurts its competitive position against cash in the short-term (carry trade opportunity costs).

In summary, gold can be viewed as a default, uncorrelated and unanchored asset, which comes into its own when all alternative “mainstream” asset classes fall by the wayside. In that regard, bonds have performed poorly in an apparent inflection of a multi-decade bull market, equities entered a bear market earlier this year (but have since experienced a robust recovery with the US S&P 500 up around 15% off its Q2 lows), and the property investment case suffers from post-Covid adjustments and the rising interest rate risk.

Among commodities, industrial metals have generally started to price in recession risk, as prices gravitate towards their marginal cost, although energy commodities have benefitted from supply disruption amid realisations of catastrophic underinvestment and under-preparedness for a transition to renewables.

Thus pockets of mainstream investment opportunities still exist, and the relative strength of the US economy and labour market in particular puts paid (at least so far) to the stagflationary conditions that would simultaneously disrupt the case for these assets and pave the way for gold.

A word on crypto

Some market participants have viewed cryptocurrencies as an alternative to gold, variously as a non-fiat currency, potential inflation hedge and uncorrelated asset. The quadrupling of this asset’s market cap to above US$3.0 trillion from 2020 to 2021 is thus likely to have taken some shine from gold. However, its subsequent two-thirds loss, as risk assets have fallen and inflation surged, does serve to distinguish the uniqueness of gold. It is also worth noting that the estimated value of the crypto market at its peak was material relative to gold at approximately US$11.0 trillion.

What about gold miners?

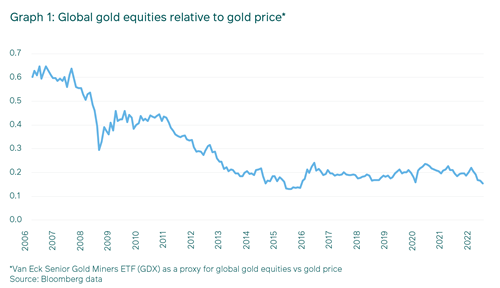

In terms of the case for the miners, gold equities have experienced a long period of low cost escalation and thus responded well to the Covid-induced monetary stimulus. In the larger context, global gold equities materially underperformed the gold price in the decade up to 2016, particularly as costs rose and equity ratings fell. The equation for gold equites to perform is (simplistically):

(gold price - unit costs / FX) x volume / shares in issue x rating.

Subsequent to 2016 global gold equities actually performed in line with the gold bullion price following the excesses of the early 2000’s. Now however, off a relatively elevated price level, when bullion breached an all-time nominal high in 2020 (and again breached US$2,000/oz briefly this year), mining cost inflation is hurting rather than helping the performance of gold equities, via a squeeze in profit margins, at a time when aging assets struggle to deliver productivity gains. A further sign of gold equities being in a late cycle is the escalation of merger and acquisition (M&A) activity, as seen in the current all-share offer by Gold Fields for mid-tier Canadian listed Yamana Gold, as the former looks to rebuild its pipeline of replacement and growth opportunities for the longer term.

Thus, while the gold bullion price is an important factor in driving companies’ share prices, a miner’s operational and local currency also play a material part, as does market rating.

How does gold fit into our framework?

In conclusion, although bullion has a place in a diversified multi-asset portfolio, the case for gold equities in an equity portfolio is much narrower and tactical. One cannot make a specific investment case for gold bullion without understanding all the investment alternatives, which highlights the difficulty in assessing the merits of gold in its own right. The mainstream assets can typically be valued using conventional metrics (cash flow), which fit naturally into our valuation-based investment process.

While we recognise the diversifying property of gold bullion in general, this valuation characteristic (lack of cash flow) tends to preclude it from our investment framework. And, while gold equities can be valued on cash flow (in theory at least), their fundamental driver, being the price of gold bullion, undermines this. Equally, the low returns on capital of building new gold mines further impairs our view of the investability of gold miners, beyond tactical dislocations between share prices and the underlying gold price.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter