Investment risk when you live in an emerging market

Investors within a South African context have a number of risks that they need to contend with. On the one hand there are the standard concerns over how much their investment values might fluctuate on a daily basis, while on the other hand there are the risks inherent to residing in an emerging market, such as the daily ebb and flow of international money and the chaos it can bring. Fortunately, emerging market risks can be mitigated. Read on to find out why South African markets are subject to particularly volatile swings and how investors can reduce the extent to which these swings negatively impact their investments.

Investor sentiment is a fickle thing

Theory suggests that if the potential returns from two investments are exactly the same, but one has a higher risk profile than the other, the more sensible option is to choose the less risky investment. While this may seem like an oversimplification of a fairly complex investment strategy, it’s important to understand the thinking behind this concept, as it’s one of the key drivers that influences flows into and out of emerging markets.

As international investors are always on the lookout for market signals that may suggest an increase in the risk-profile of a country or better relative returns elsewhere, investor sentiment towards emerging markets like South Africa is generally very fickle. Some of the traditional vulnerabilities associated with emerging markets include political instability, policy uncertainty, high government debt levels and large current account deficits. As these relative metrics begin to move, so do the flows from one market to the next. South Africa is a good example of a country that has been on the receiving end of both the good and the bad sides of emerging market sentiment.

The good: The prospect of better returns

After the Global Financial Crisis in 2008, many developed markets embarked on supportive monetary policies (such as quantitative easing and reduced interest rates) to help their struggling economies recover. From an investor’s perspective, the return prospects from interest-rate-linked investments like bonds in these developed markets became less favourable relative to certain emerging markets, which offered much higher interest rates. This compelled investors to look outside of developed markets for alternative investment destinations. At the time, South Africa had low levels of external debt, a solid investment-grade credit rating, and sound fiscal and monetary policies. Also important was our relatively high prevailing interest rates. Although international investors were keeping a close eye on the country’s political situation, following the ousting of Thabo Mbeki for Jacob Zuma as president, South Africa was still relatively well positioned to weather the blowout from the financial crisis and generate attractive returns for investors at appropriate levels of risk.

The bad: When the relative risk is too high

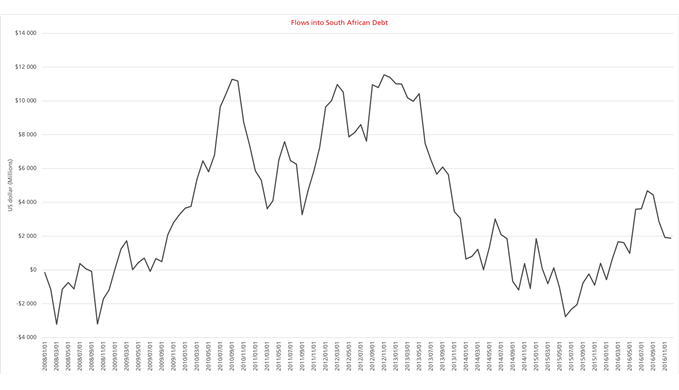

Fast-forward a few years later and the picture looked a lot different. The below graph shows the rolling 12-month flows into South African debt from the beginning of 2008 to the end of 2016 (in US dollars). Volatility aside, the graph shows a strong demand for government debt post the Global Financial Crisis in 2008, which was then followed by a sharp decline as market sentiment towards South Africa began to deteriorate. This decreased demand was largely due to international concerns around the economy, with government and state-owned enterprise debt moving steadily higher, widening trade and current account deficits, slow GDP growth and, more recently, rising corruption. From an international investor’s perspective, the perceived risk-return trade-off of investing in South Africa had deteriorated on an absolute basis, and was also less favourable on a relative basis compared to certain emerging and developed markets.

Source: Bloomberg

In terms of the risks that South African investors face, the flow of foreign capital into the country (or lack thereof) has a significant impact on various areas of the economy. The value of the local currency, for example, is partly driven by foreign demand. If foreign investors perceive the local currency as being risky and the demand for the rand decreases, so too does its value. A weaker rand means that imported goods cost more and the revenue generated by exports drops. In extreme circumstances, inflation pressures rise, the general cost of living increases, and interest rates will need to rise more to stabilise inflation and attract international investors. In emerging markets, with their relatively small economies, foreign flows can be volatile and have a significant impact on the local currency, financial markets, asset values and GDP growth.

And let’s not forget the contagion effect – when something goes wrong in one emerging market and investors sell their holdings in that country, they often decide to sell associated investments in other emerging markets, sometimes simply based on sentiment. South Africa is often caught up in this contagion because the rand is one of the top traded (and easiest to trade) emerging market currencies in the world. Consequently, traders often use the rand as a proxy for all emerging markets. So negative news, or even simply fickle sentiment, surrounding any emerging market can potentially have a significant, and rapid, impact on our own market.

Living in an emerging market, South Africans have had to learn to cope with this volatility.

Reducing the risks associated with emerging markets

For South African investors, one of the best ways to mitigate the risks associated with emerging markets is to invest in offshore funds that hold assets across a range of international markets in various currencies, especially larger developed markets like the US, Europe and Japan. Two prime examples of this type of diversification can be found in the Prudential Global Equity and Prudential Global Balanced Funds. As both funds are actively managed, the portfolio managers are able to increase or decrease the funds’ exposure to different markets based on current valuations and prospective longer-term returns in each asset class and country. In addition, the Prudential Global Funds also invest across regions, sectors, currencies and financial instruments (as in the case of the Global Balanced Fund). From a South African perspective, having this level of exposure is important as it places investors in a position to not only lower their emerging markets risk, but also benefit from the growth opportunities that exist beyond the country’s borders.

If you’re interested in investing offshore and would like to find out more, speak to your financial adviser or contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter