Excellent stock-picking adds to 2021 fund outperformance

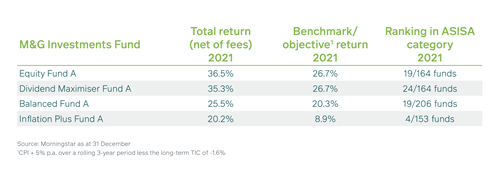

It was a good year to be invested in South African equities, as the local market closed December with strong gains, helping boost investor returns from equity and multi-asset unit trusts to excellent levels for 2021 as a whole. M&G Investments’ Equity Fund, Dividend Maximiser Fund, Balanced Fund and Inflation Plus Fund (as well as other M&G multi-asset funds) all benefitted from this strong market performance, but successful stock picking from the Equity Investment team also added above-market returns (alpha) for our clients. Consequently, all four of these funds were ranked in the top 25% of unit trusts in their ASISA fund categories for the year, comfortably outperforming their benchmarks.

At the centre of our portfolio construction process, we buy stocks that we believe are undervalued on a risk-adjusted basis, and add these to many of our portfolios at different weights – weights we judge appropriate to the level of risk for each portfolio. For the M&G Balanced and Inflation Plus Funds, among our overweight equity choices for the year that added the largest above-market performance included shares like MTN, Investec, PPC, Sasol, Textainer and Naspers. Additional value came from our overweight exposure to Anglo American, Exxaro, Remgro and Truworths, among other smaller positions.

Meanwhile, in our M&G Equity Fund, top overweights that added significantly to alpha for clients for the year included MTN, Investec, Textainer, Sun International, Mpact, Sasol and PPC. For the M&G Dividend Maximiser Fund, which aims to source more returns from higher-dividend-yielding shares, excellent alpha stemmed from overweights in MTN, Tsogo Sun, Investec, Motus, Combined Motor Holdings, Anglo American and enX Group.

While these companies recorded stellar returns over the past 12 months (to greater or lesser degrees), it is also important to recognise their diversity: we purposefully spread our equity exposure across different sectors, company sizes, sources of earnings, etc… in order to help reduce portfolio risk in what were very uncertain market conditions, trying to take advantage of different sources of returns. Each of the above stocks had their own reasons for delivering above-market returns in 2021 – the common factor among them being cheap valuations -- and we are pleased to have recognised these opportunities and to have added value for our clients over the last 12 months.

For more information on investing with M&G Investments, please contact our Client Services Team on 0860 105 775 or email us at info@mandg.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter