What to expect when you invest in SA equities

One of the basic tenets of investing is that equity is one of the riskier assets you can hold in a portfolio, largely due to the erratic swings in share prices that occur in financial markets – sometimes driven by fundamental factors and sometimes by fleeting sentiment or speculation. Yet the returns you receive are meant to compensate you for the extra risk of holding this equity, generally significantly higher than more conservative bonds or cash instruments over time. Those investors with investment timeframes of five years or longer are generally advised to include a large portion of equity in their portfolios to ensure their savings grows sufficiently over the longer-term.

Recently, however, South African equity returns have been very disappointing, driven lower by a combination of factors both overseas and at home. The FTSE/JSE All Share Index (ALSI) has returned -9.4% so far in 2018 (to 31 October), and 6.0% p.a. over five years. Yet when you look over a 10-year period to 31 October, the ALSI has returned 12.8% p.a., outperforming other asset classes.

Given all the negative headlines around the current SA market slump, one would think that this decline is highly unusual – but this is not at all the case. Past history tells us that downturns are common and therefore, as an equity investor, you should expect them. This way you will not become overly concerned, panic and sell your shares when prices drop, therefore locking in your losses and destroying your hard-earned savings.

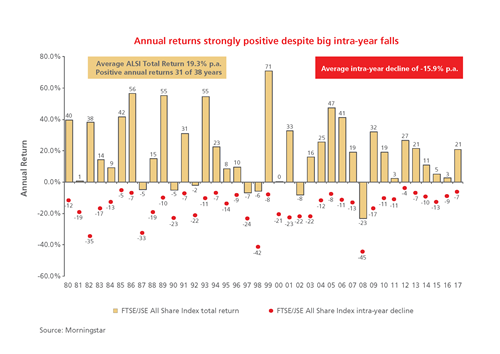

Equity returns strongly positive despite big intra-year falls

The below graphshows all of the FTSE/JSE ALSI’s full calendar-year returns since 1980 (the gold bars), as well as the largest market drops during each year (the red dots). Yes, there have been periods of negative returns during every calendar year since 1980. You may be surprised to see how big these intra-year declines have been when the equity market still managed to produce a substantial positive return for the year. For example, in 1982 the market fell 35% at one point but still managed to deliver a 38% total return for the year. As a less extreme example, in 2004 equities lost as much as 12% but still were able to return 25% for the year as a whole. Over the entire period, investors experienced an average intra-year decline of -15.9%, but the average total return was actually 19.3% per year. The market produced positive annual returns in 31 of the 38 years to the end of 2017, or 82% of the time on a calendar-year basis.

Will 2018 end up being one of the years the FTSE/JSE ALSI posts a negative return? It’s possible. No one is able to predict equity market movements with any accuracy. However, if you do expect short-term losses you will be better equipped to weather the downturn and ultimately reap the rewards of investing in equities over the long-term.

Are you interested in learning more about investing with Prudential? Contact your financial adviser, our client services team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter