Consumer headwinds bode ill for retailers

Key take-aways

-

Post-Covid, consumers’ pent-up demand boosted retail earnings as they resumed more “normal” spending patterns.

-

Rising inflation and interest rates will now leave consumers with lower budgets for discretionary spending, putting pressure on retailers’ earnings going forward.

-

M&G Investments is underweight the SA retail sector, but holds The Foschini Group because of its attractive valuation and our belief that it is best-positioned to weather these headwinds.

This article was first published in the Quarter 1 2022 edition of Consider this. Click here to download the complete edition.

Consumer spending patterns changed materially in early 2020 as concerns of the impact of Covid-19’s arrival in South Africa and the possibility of lockdowns became a reality. Food and drug retailers saw substantial volume increases as consumers panic-bought groceries and personal care products, while apparel, liquor and entertainment retailers (restaurants, bars, cinemas, travel, etc.) had to adapt to not being allowed to trade.

These sudden changes created several interesting investment opportunities for investors willing to look through the extreme short-term negativity (by taking the view that the draconian bans on trading would be lifted at some point) and buy stocks whose prices were trading well below their intrinsic values. Within the retail sector, apparel stocks sold off heavily as the market questioned how long they would earn no revenue, while the food retailers outperformed as the market priced in the volume boost from the panic buying. We took advantage of the dislocation of the apparel retailers’ share prices relative to their intrinsic values and established a position in The Foschini Group (TFG) as our preferred exposure in our M&G equity funds.

Over the past two years, retailers’ share prices have performed far better than initially expected, as earnings for most retailers rebounded relatively strongly and have exceeded pre-pandemic levels of 2019. The earnings recovery was driven by a combination of strong revenue growth and judicious cost management.

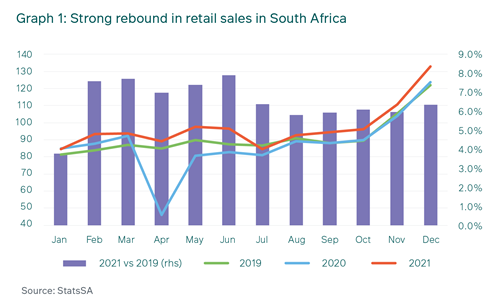

While consumer incomes were impacted by jobs losses and reduced working hours, there were other offsetting factors that resulted in disposable incomes remaining relatively robust, including: the inability to trade in restricted categories (liquor, entertainment, etc.); substantially reduced travel costs (due to work-from-home requirements and restricted holiday travel); additional government grants; and the 300-basis point (bp) reduction in interest rates (positive for mortgage and vehicle lease costs). South Africans are not known for being particularly good savers, and hence consumer spending in the categories the listed retailers operate in, namely food, apparel and drug retail, recovered quickly, as illustrated in Graph 1.

Retailers also experienced a swift improvement in margins, both at the gross profit and operating profit levels. Strong demand and reduced stock levels due to disrupted global supply chains enabled retailers to promote less and make more full-price sales, boosting gross profit margins. At the same time, from an operating expense perspective they used the opportunity to become far more efficient by exiting poorly performing space, negotiating significantly lower rentals, rationalizing product ranges and reducing head count where possible. The 300-basis point interest rate cut substantially reduced net finance costs. The combination of these factors resulted in earnings recovering far quicker than consensus estimates.

Acceleration of the omni-channel transition

The one structural trend which Covid-19 accelerated in the sector was the growth of online shopping, delivering three to five years of growth in only one year. While online sales provide phenomenal convenience for consumers, it is a costly service to offer and is margin-dilutive since companies incur additional operating costs to pick, pack and deliver, for the same revenue. It is thus a drag on shareholder returns.

Online penetration in South Africa remains low currently, at 4% of apparel and 2% of food sales, but will continue to grow rapidly as customers increasingly demand the choice to shop in any channel, at any time they choose. To stay relevant, retailers must transition to an omni-channel offer (physical stores plus online), but doing so profitably remains an unresolved challenge, with most retailers uncertain of what scale is needed to break even.

TFG has an advantage over SA peers as it can leverage the knowledge and experience of its non-SA divisions that operate in markets which are far further down the omni-channel transition – for example, online sales account for 38% of total apparel sales in Australia and 35% in the UK, according to Euromonitor.

The return to a post-Covid normal

We are now two years on from the start of Covid-19 and life has started to return to pre-Covid “normal” as lockdown restrictions have been eased. There will be some structural changes to spending patterns: for example, in-home food consumption will be higher, as a greater proportion of people work from home than pre-Covid.

Yet, most spending patterns are returning to pre-Covid norms and consumers are having to re-allocate their spending from categories that benefitted from Covid (in-home consumption and homeware/DIY) to the categories which suffered. The key categories seeing a return of spending are transport costs (the second-biggest expense after debt repayments for the average South African’s budget), out-of-home consumption (restaurants, bars, entertainment) and apparel (shifting away from loungewear to fashionwear).

Our thesis that spending patterns would normalise once the restrictions were lifted and that the apparel retailers would deliver earnings significantly above those implied by their share prices in mid-2020 has played out. This leads to the question: how do we expect the retail sector to perform going forward?

Back to SA’s low-growth reality

At M&G Investments we acknowledge that we have limited ability to forecast macro changes better than the market, but we are cognisant of the environment companies are trading in. The tailwinds of Covid are largely behind us now and headwinds are starting to build, making us increasingly concerned about the level of consumer spending going forward and the impact this will have on retailers’ earnings relative to consensus expectations.

The headwinds which concern us the most are:

- Unemployment continues to escalate, placing a greater burden on those with incomes and on the government to provide grants to those without incomes. The businesses we engage with are also not looking to rehire the employees let go during Covid, partly due to the restrictive labour laws of South Africa, and partly because they’ve adapted to doing more with less staff.

- Without employment growth aggregate gross earnings are unlikely to grow in real terms, as salary increases are generally pegged to inflation in the private sector and government has budgeted increases of 1.8% for the next three years. Government’s ability to increase grants will also be constrained when commodity prices normalise and the super taxes currently being paid by the mining companies reduce.

- Inflation is expected to rise, with upside risks to consensus expectations given the impact the Russia/Ukraine war is having on global food and fuel prices. Prices of staple food products will need to increase significantly, as wheat is up over 40% and maize has risen over 25% since the start of 2022. And the petrol price is already 32% higher vs March 2021, with further increases highly likely. The inflation the consumer feels in their everyday spending will be considerably higher than reported core inflation, to which their salary growth is pegged.

- The interest rate hiking cycle has started. The SA Reserve Bank has already raised the repo rate by 75 basis points, and the market consensus is expecting another 100 basis points in each of 2022 and 2023, which would almost fully reverse the 300 basis points of cuts during 2020. As mortgage payments are the largest component of consumers’ monthly expenditure, these rate hikes will have a material impact on disposable incomes.

There are three ways a retailer can grow its sales: market growth, expansion (organically or acquisitively) and market share growth (i.e. out-competing).

For the reasons stated above, SA is a low-growth market. Therefore, to grow their sales at a reasonable rate, retailers must either expand organically through rolling out new stores (like TFG in SA and Australia) or acquisitively (such as Mr. Price buying Power Fashions and Yuppie Chef in 2021). An acquisitive strategy can deliver growth quickly, but has high risk of not delivering the forecast returns on the capital deployed (a lot of capital has been destroyed by SA businesses following this strategy). The third growth avenue, taking market share by out-competing peers, is extremely challenging to do consistently in the highly competitive retail sector.

Best placed to weather the storm

While we remain underweight the consumer sector in our M&G equity funds given the combination of a low-growth environment with increasing headwinds skewing risk to the downside, we continue to see value in TFG, as it has multiple self-help levers. If these self-help levers continue to be executed successfully, then we expect their earnings to materially beat consensus forecasts.

TFG has the greatest number of self-help levers of the listed SA retailers, among which are:

- The SA business still has a decent growth runway, as it can roll out stores across the 21 niche brands they own, and these brands are growing market share in aggregate.

- TFG was extremely opportunistic in their acquisition of Jet in September 2020, where they paid R385 million for 425 stores. Jet is a strong brand, but the business had been starved of capital under Edcon’s ownership. With TFG injecting the required level of working capital and plugging Jet into the TFG procurement and manufacturing systems, Jet’s operational performance is improving rapidly. If Jet meets our revenue and earnings forecasts for FY22, TFG would have acquired the business for an extremely cheap price-earnings ratio of under 1.0X.

- Their local manufacturing division produces approximately 25% of the apparel they sell, of which over 70% is made on a quick-response basis. This enables TFG to hold 30% less inventory and ensures they have stock of high-demand products, resulting in more full-price sales and hence a higher gross profit margin. The recently announced acquisition of Tapestry Brands (owner of Coricraft, Dial-a-Bed and Volpes) will significantly enhance their local manufacturing of homeware products and improve the working capital utilization of their homeware division.

- TFG has made the most progress in transitioning the SA business to an omni-channel retailer and has recently hired the two founders of Superbalist to drive the development of their omni-channel offering.

- RAG, the Australian division which operates five niche brands, has recorded a compound annual growth rate (CAGR) in sales of 15% over the last seven years and still has substantial store growth potential in Australia and New Zealand. It has also established an online presence in the USA for its Johnny Bigg brand, which provides fashionable apparel and footwear to the niche oversized-menswear market (sizes XL – 10XL).

- TFG UK is the division most exposed to formal/social wear, so was most negatively impacted by Covid lockdowns. Since restrictions were lifted in late 2021, they have experienced significant pent-up demand, which combined with the cost rationalisation implemented has seen profit margins return to high-single digits, above pre-Covid levels.

The combination of the above factors is expected to give TFG the highest three-year earnings CAGR of all the retailers to 2023, and should result in the company’s P/E re-rating from the current low level of 11x.

While SA consumers are likely to come under increasing pressure over the rest of 2022, we are confident that TFG has sufficient self-help levers – and is using them – to outperform the other retailers and hence add value to our clients’ portfolios.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter