TABLE TALK: Investor worries over rising US Treasury yields

This article was first published in the Quarter 2 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

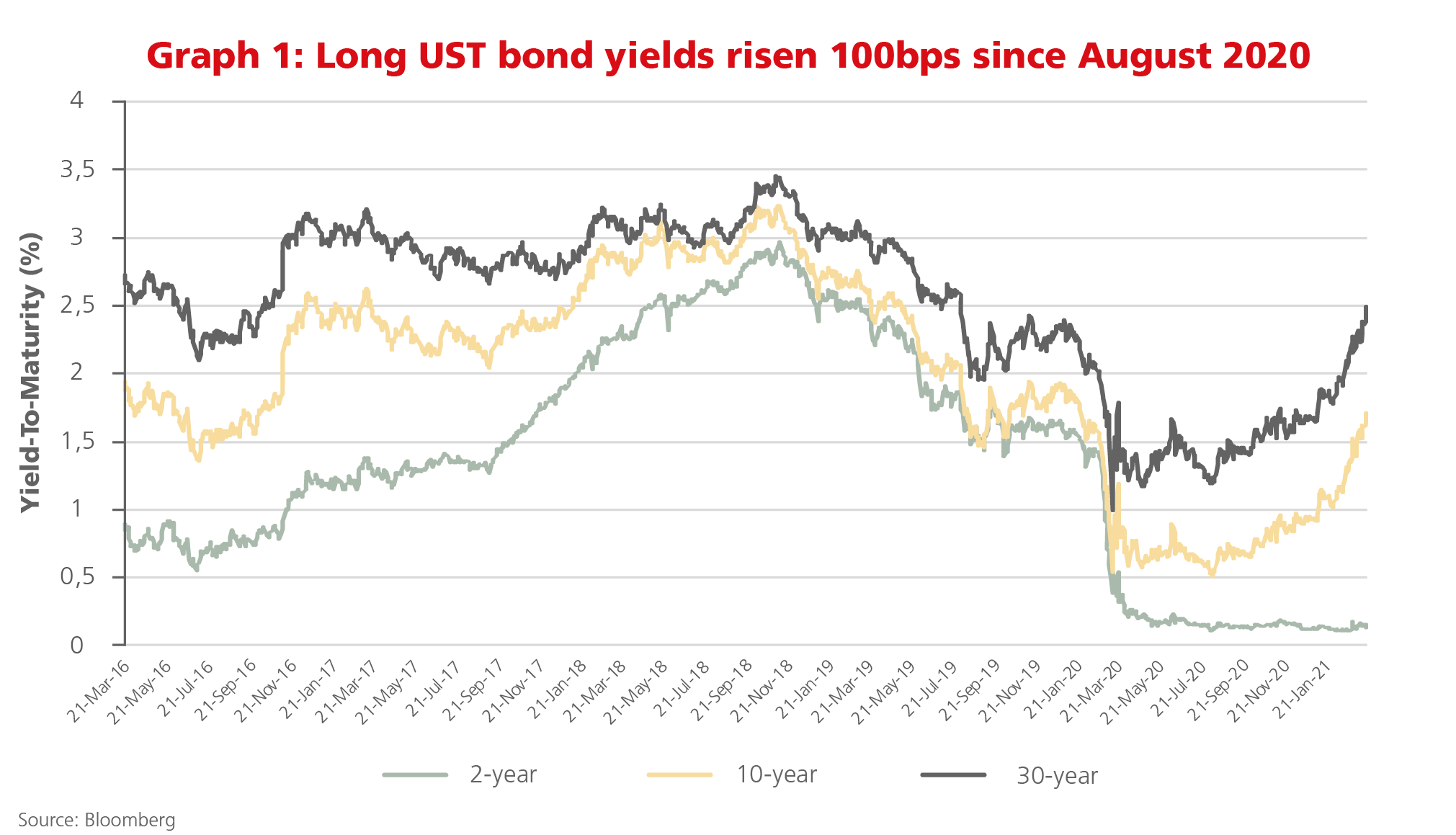

- Investors have been selling longer-dated US Treasury bonds amid worries over a possible acceleration in inflation due to the government’s large spending programmes and recovery in economic growth. Yields have risen significantly (over 100bps) in the past seven months.

- Investors are concerned the higher yields from safe-haven assets like US Treasuries will cause others to switch out of higher-yielding emerging market assets into USTs, sparking a sell-off. This has happened previously as US interest rates rose.

- However, Prudential doesn’t believe UST yields have risen enough to cause a sell-off in emerging markets. In the past, it was shorter-dated USTs (out to three years) and not the longer-dated tenors, that saw rising yields which triggered the emerging market sell-off. This has not been the case in recent months.

QUESTION:

I have been hearing that we are likely to get a sell-off in emerging market investments soon, because US bond yields have risen so far so quickly. What is your view on this?

ANSWER:

It’s true that some investors are worried that the recent increase in long-dated US Treasury (UST) bond yields could soon have a negative impact on the demand for emerging market assets, including SA equities and bonds and cause a broader sell-off in emerging markets (EM). The yields on 10- and 30-year UST’s have jumped more than 100bps (1.0%) over the past seven months, as Graph 1 shows, with the benchmark 10-year bond at over 1.6% in late March versus a low of around 0.5% in mid-August 2020. However, at Prudential we believe it will take a larger increase in UST yields from current levels to cause a shift in investor risk appetite and an EM sell-off.

While the move in UST’s has been very quick and quite substantial in a historical context, we are somewhat more sanguine about it than we would be under “normal” circumstances due to the exceptionally low yields/high prices at which USTs (and other sovereign developed market bonds) had been trading prior to August, given the prevailing easy monetary policy globally. Therefore it’s not surprising that a relatively expensive asset has experienced a correction.

The previous time rising UST yields led to problems for emerging markets (and other risk assets) was 2016-2018, when it was the rise in short-dated US yields that arguably caused maximum damage, as this tightened global monetary/financial conditions and had a profound dampening effect on risk appetite and thus risk assets. The higher yields offered by such safe-haven assets tempted many investors to switch out of riskier assets.

Yet one aspect of this recent move that has been very different to the previous episode has been that two-year UST’s have hardly moved: yields have remained virtually flat, as Graph 1 clearly shows. They have been anchored by the US Federal Reserve (Fed)’s steady, exceptionally low interest rate policy and its bond purchasing (quantitative easing) programme. The central bank has been steadfast in reiterating its continued support for low interest rates until US economic growth and employment recover. As such, it has been the 10-year and 30-year bonds where the re-pricing has taken place, steepening the yield curve notably. With the shorter end of the yield curve unaffected, we have not seen an impact on investor preferences and risk appetite: the “risk-on” sentiment has stayed intact.

At the same time, the equity market has been quite comfortable with pricing-in higher growth. This is supported by upward revisions to global GDP forecasts and equity earnings as confidence in country and regional vaccine rollouts improves. According to the March 2021 interim OECD Economic Outlook report, global GDP growth is now projected to be 5.6% this year, an increase of more than 1 percentage point from its December report. It therefore makes sense that assets which typically do well in rising growth environments, like EM equities, are doing well right now.

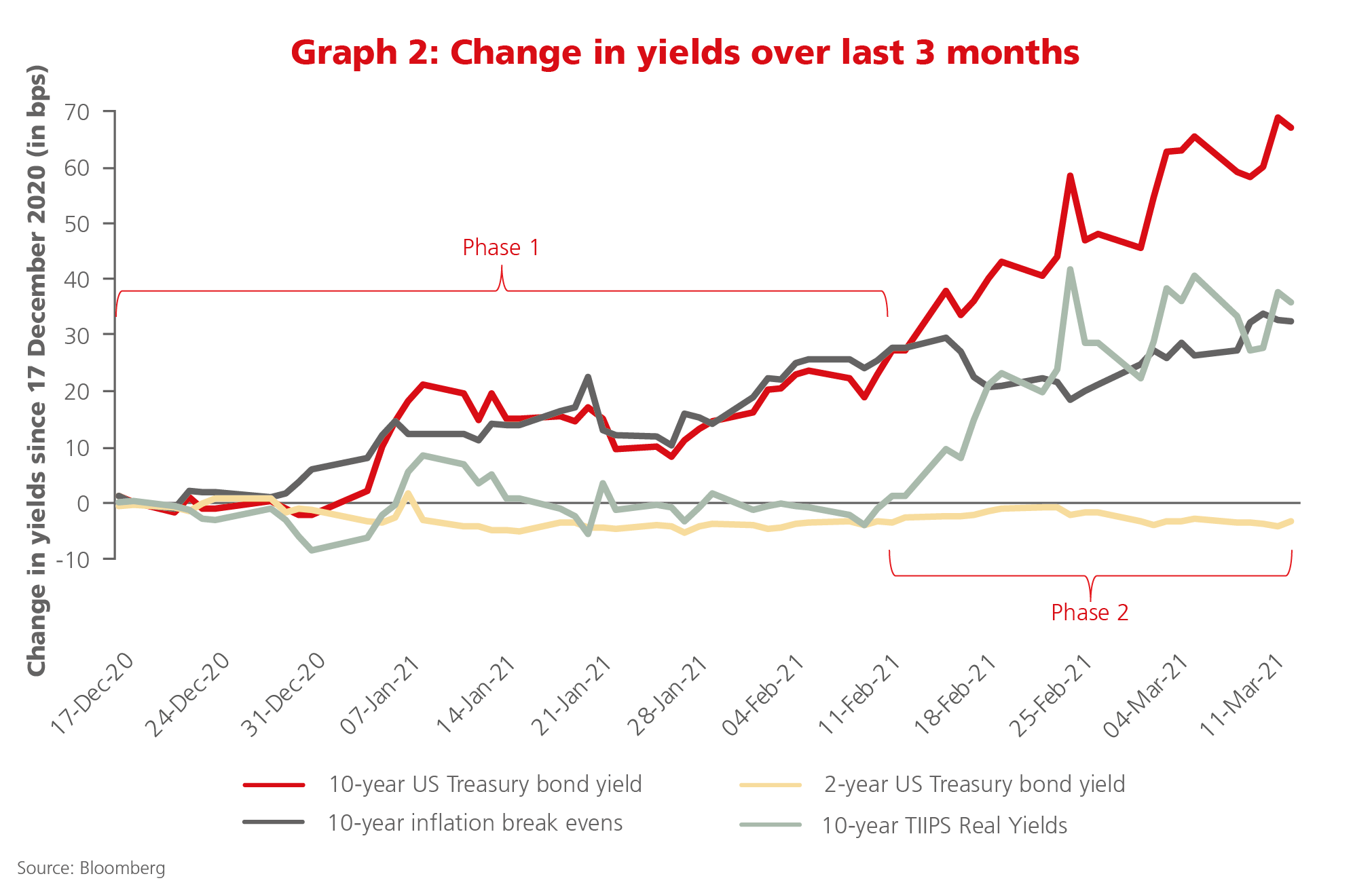

It’s not clear to us exactly what factors are behind the rising long bond yields in the US, apart from speculation around accelerating inflation and some technical US Treasury microstructure issues. However, the Fed has indicated that it is not concerned by the increase and has thus committed to maintaining current policy. In fact, if we look closely at the change in US bond yields over the last three months displayed in Graph 2, there are two distinct phases:

- Phase 1: December 2020 to mid-February 2021: the increase in 10-year US bond yields is associated with an increase in inflation expectations, but

- Phase 2: Mid-February 2021 to today: the subsequent rise has been driven more by higher real yields than inflation expectations.

M&G Investments, our global shareholder, believes that there is a tipping point above which higher 10-year and 30-year UST yields could become problematic for global risk appetite, but that current levels are still far from this point. If we saw another quick 100bp sell-off in 10-year USTs, for example, this could become worrying for EM assets. For now, however, we don’t believe investors need to be concerned about the jump in UST yields. As long as the market is comfortable that real bond yields will remain steady and the Fed continues to buy up the extra bond issuance required to finance the government’s higher spending from the US$1.9 trillion Coronavirus rescue programme, investor risk sentiment should remain supportive of emerging market assets.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter