What type of investor are you?

In much the same way that there are many ways to classify different types of personalities, there are also various types of investors. Of course, the aim of categorising investors isn’t to put anyone in a specific box, but rather to explore the collective characteristics of each investor type, and to shed some light on the strengths and potential weaknesses associated with each. This is the first in our series of five articles aimed at giving individuals a better understanding of how they might best approach the world of investing, plus some tools for managing some potential weaknesses – all to ultimately help limit the chances of costly mistakes down the road.

Risk: The common denominator

While there are many ways to tackle the concept of investor profiling, for the purpose of this series we will focus predominantly on risk (or volatility), which is the extent to which the value of an investment can go up or down over time.

Unless you put your money under the proverbial “mattress”, the reality is that there will always be a certain degree of risk when it comes to investing. The level of risk associated with investments is largely dependent on the type of assets held within your portfolio (such as equities or cash).

All asset classes have different risk/return profiles. Equities, for example, are regarded as the riskiest of all the major asset classes as their values are the most volatile over shorter periods. Fixed-income assets (such as bonds and cash), meanwhile, are regarded as less risky, as their values tend to experience lower volatility over time. So why not put all your investments in cash? This is because riskier asset classes typically reward investors with better long-term returns.

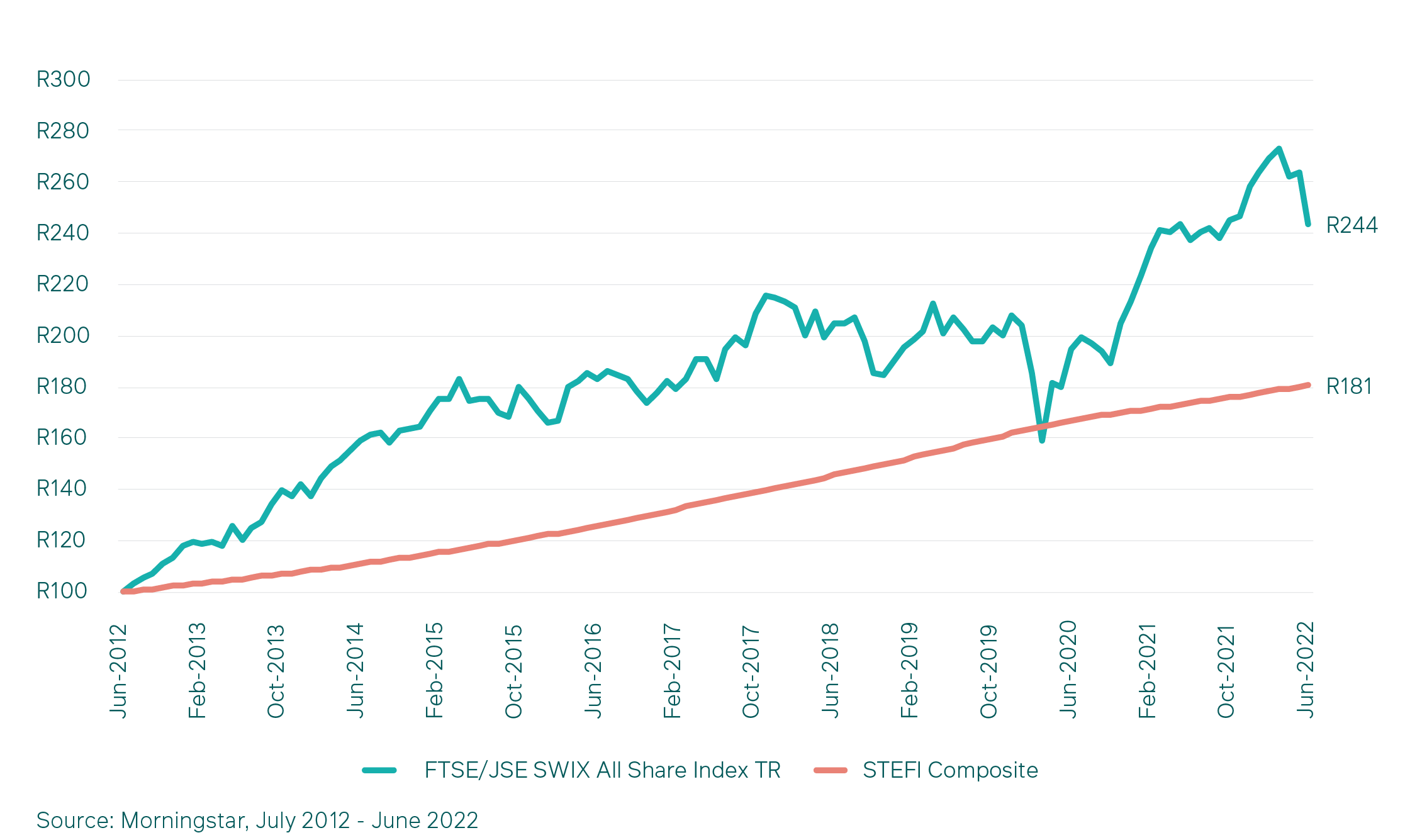

As shown in the graph below, if you had invested R100 in equities ten years ago, the current value of your investment would be R244, which is significantly higher compared to the cash return of R181 over the same period. From this, it’s clear that equities, although more volatile compared to cash, offer investors far greater prospective returns over the long term.

Choosing asset classes

Deciding which asset classes to invest in should largely depend on fundamental factors, such as your investment objective and your investment time horizon. In practice, however, some investors base this decision on their attitude towards risk and not necessarily on their fundamental investment goals.

This could play out in a variety of different ways. For example, you might be relatively young but extremely conservative and risk-averse, and consequently, allocate very little of your investment portfolio to equities. While on the other extreme, you could be well into your retirement years with very little cash reserves to fall back on, but because you love taking chances, you end up overexposing your investment portfolio to equities.

In theory, both these asset allocation decisions may not be the most appropriate, because sentiment is guiding your choices. Generally speaking, the younger you are, the more time you have to invest, which means you have a longer investment time horizon that will lower the risk of equities for you. Meanwhile, on the other end of the spectrum, older investors typically have shorter investment time horizons. This means that they should try to balance out their exposure to equities, bonds and cash, so that they have the right portfolio composition to deliver long-term growth, while also limiting the downside to some extent.

So you can see why basing your asset allocation solely on your attitude towards risk can be problematic. This is one of the reasons why financial advisers will often ask first-time clients to fill out a questionnaire that takes into account their entire financial position, in addition to their willingness and ability to take risk. This helps with structuring a richer, more nuanced financial plan that is tailor-made to the client’s specific investment needs.

Over the next few weeks, we will be looking at four broad types of investors based on their approach to investment risk. To start off, below is a brief outline of the different types we’ve identified. Then we’ll flesh out these descriptions in more detail in new instalments.

Type 1: The Avoider

Avoiders are likely to have not started investing yet. One of the reasons for this might be that they feel overwhelmed by the amount of choice available, and they don’t want to make a mistake and potentially end up losing money. Important to note, however, is that delaying investing can be one of the costliest mistakes they’ll ever make.

Type 2: The Risk Taker

Risk Takers approach investing in the same way that they approach many things in life. Often bold and adventurous, Risk Takers tend to be focused on short-term market movements and hate to miss out on opportunities. But there are long-term drawbacks to this approach that they’ll need to be aware of, which could end up eroding their investment returns.

Type 3: The Balancer

As the name suggests, the Balancer likes to take a balanced approach to investing, covering all the bases in case they miss out. But the trick is to get the balance right, based on their financial position and investment goals. If they have too much or too little of a particular asset class they could miss out on their investment goals.

Type 4: The Protector

The Protector is focused on the future with the primary objective of capital preservation. They know that it can sometimes take an exponential amount of time to make up for losses so they are therefore very risk-averse. The Protector’s investment portfolio is typically conservative, but they need to be careful not to miss out on growth opportunities.

Based on the brief description above, you might already see yourself in one of these investor profiles, or you might not. In either case, it may be a good idea for you to follow our series: having a good understanding of your investor profile can help you identify what biases to look out for when it comes to your own investment decision, and hopefully, help limit the probability of making costly investment mistakes further down the line.

For more information on investing with M&G Investments, please feel free to contact our Client Services Team on 0860 105 775 or email us at info@mandg.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter