Trust the process

This article was first published in the Quarter 4 2021 edition of Consider this. Click here to download the complete edition.

In writing for this publication over the last two years, I’ve had the opportunity to explore, through reading and observation, the concepts of uncertainty, risk and complexity, among others. The theoretical underpinning was prescient given the events that unfolded over the course of last year as the pandemic gripped the world. I can say I’ve probably got a deeper appreciation of these concepts, but I remain uncomfortable with the lived experience. Thinking about the world probabilistically is not a natural tendency and won’t be for the human species for a long time to come. This observation was clear every time some commentator made a confident deterministic prediction about how the pandemic will/won’t resolve. Our need for certainty drives a strong urge to reduce uncertainty through simplification. This often leads us down the path of ascribing cause to the intuitive and superficially observable.

I have, however, also observed a few tools used quite effectively to navigate the moments when uncertainty dominates. At the heart of many of these was a systematic process-driven approach. I cannot elaborate much on the specifics of why some strategies work the way they do, but in general, continuing to paddle in the right direction even when the fog hides progress has been the right strategy.

Stable but random vs. Dynamic

I recognise the tendency to force complex elements into a simple framework. It is the path of least resistance and feels intuitively more comfortable than thinking about things probabilistically. And for many of the less consequential instances in our lives, approaching complexity in this fashion is of little consequence. However, for events we are continually exposed to and that compound on us, the “shoot from the hip” approach is unlikely to be beneficial unless you’re very lucky.

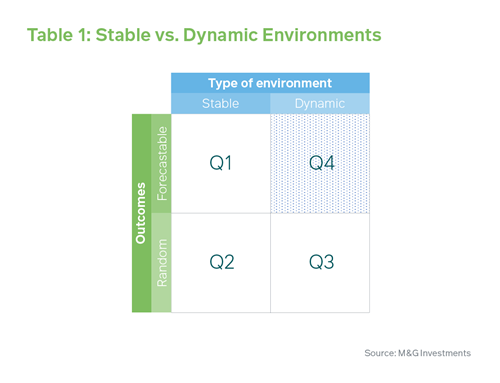

To illustrate the point, in Table 1 we draw a distinction between two types of environments – Stable vs. Dynamic. In each environment, we would like to know whether we’re able to accurately predict or forecast the outcomes of events using all knowable information.

The table therefore yields four quadrants across two axes:

Q1: Stable and Forecastable

Q2: Stable but Random

Q3: Dynamic and Random

Q4: Dynamic but Forecastable

Events that are perfectly predictable are those influenced by variables that are themselves predictable. Perfectly stable environments are artefacts primarily of human invention and tend to be quite confined. An example of a stable environment would be a roulette wheel or a cooking oven (when used to bake). Dynamic environments, by definition, would not be forecastable. Quadrant 4, the shaded area in the table (Dynamic but Forecastable environments), is therefore technically impossible.

This article is, however, not about getting hung up on technicalities, so we will focus on the practical experience of dealing with dynamic environments. Indeed, when going through our daily lives, we don’t have the sense that every moment is completely unpredictable, albeit we live in dynamic environments. We can differentiate those times when things are truly chaotic from the ordinary course when things are more predictable within a range of outcomes.

Getting back to Table 1, we’ve established that Stable and Forecastable environments (Q1) are rare, but baking a cake would be a reasonable enough example: if you follow a recipe and ensure the environment remains stable, outcomes can be reliably predicted. Stable but Random environments (Q2), also primarily engineered by man, would comprise most casino games like roulette or craps. For any single event, the outcome is random. The range of outcomes in these environments is limited, however, so the truly unexpected event would not feature.

Dynamic environments are pretty much where most other activities live. Some are more forecastable than others. For example, taking a standardised test would fall into Quadrant 4. If the candidate understood the course work and was able to complete the test within the allotted time, we can make a reasonable predication on the outcome. By now dear reader, you should suspect that Dynamic and Random (Q3) are the environments that embed much of the complexity we so desperately want to tame. We’ll have a look at a popular game theory example to better understand Quadrant 3.

The prisoner’s dilemma

Readers familiar with game theory may recall the infamous thought experiment known as the prisoner’s dilemma. The thought experiment is as follows:

Two members of a criminal organization are arrested and imprisoned. Each prisoner is in solitary confinement with no means of communicating with the other. The prosecutors lack sufficient evidence to convict the pair on the principal charge, but they have enough to convict both on a lesser charge. Simultaneously, the prosecutors offer each prisoner a bargain. Each prisoner is given the opportunity either to betray the other by testifying that the other committed the crime, or to cooperate with the other by remaining silent. The possible outcomes are:

- If Bonny and Clyde each betray the other, each of them serves two years in prison.

- If Bonny betrays Clyde but Clyde remains silent, Bonny will be set free and Clyde will serve three years in prison.

- If Bonny remains silent but Clyde betrays Bonny, Bonny will serve three years in prison and Clyde will be set free.

- If Bonny and Clyde both remain silent, both of them will serve only one year in prison (on the lesser charge).

The game is often used to highlight the benefit of cooperation, but it also highlights the difficulty of trying to win a game where the outcome is dependent on variables over which you have no control or influence – a dynamic environment. For a single play of the prisoner’s dilemma, the perfect solution does not exist, and each player is at the mercy of the other. In such a case, it is not unusual for most players to hedge their bets by betraying the other. It’s the logical response to a situation over which control is limited.

Repeated play of the prisoner’s dilemma (known as the iterated prisoner’s dilemma), however, presents an opportunity to make strategic choices to maximise outcomes. The repeatability introduces a new dimension that lends itself to a testable process. Although the game remains dominated by random outcomes, a logical process can nudge the game in the direction of predictability.

Since the prisoner’s dilemma is structured to benefit players through cooperation, the correct strategy is one that evolves toward cooperative behaviour. Greedy strategies tend to do poorly over the long run (if the game is played iteratively) as do overly trusting strategies. Although it does not guarantee a successful long-term outcome, a cooperate then tit for tat strategy (eventually culminating in complete cooperation) proves to be the best option for maximising long-term outcomes. However, it is only the continued play that provides the opportunity to implement a strategy and put a process to work.

Taming the complex

Charlie Munger, the erudite long-standing partner of Warren Buffett, is highly regarded for his wit and insight. He has made no secret of his process for erudition – he simply treats the accumulation of knowledge as an iterated game.

Fortunately, in many endeavours of our lives we get to play an iterated version of the game where a process may well be beneficial. These can range from how to optimise your diet to becoming a better conversationalist. Indeed, even the randomness of casino games is overcome by the casino because they are playing an iterated version of the game with a favourable edge. If casinos played a single version of a casino game, no matter how favourable the edge, the randomness would overwhelm any prospect for consistent profitability. That’s why casinos implement a maximum table stake for each game.

Similarly, investment decisions are quintessentially an activity that sits squarely in a dynamic environment, as evidenced by the high degree of variability in investment outcomes. Nevertheless, there is still a significant benefit to be had by following an investment process rooted in phenomena that have stood the test of time. I find this remarkable tool is often underemphasised in investment-related discussion. Most investors will seek investment insight through reading, debate and discussion, hoping to glean some insight and hopefully remember to implement it at the appropriate time. But without a process to hold and make these insights executable, it’s unlikely to find its way into your decisions. A similar theme can be observed for diet, exercise and sleep habits.

Closing thoughts

The last two years have certainly been extraordinary by anyone’s book, and for most of us the world remains a remarkably unpredictable place. If there’s something I have gleaned from the craziness, it is that if you’re serious about making progress in dynamic environments, you should have a process. It is not an easy task, nor is adherence likely to be without interruption, but even a simple roadmap to guide the direction of travel and help steer clear of pitfalls is better than shooting from the hip. Designing, implementing and troubleshooting a worthy process is beyond the scope of this article, but I can report that having a time-tested process is something we hold sacrosanct at M&G Investments.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter