Short volatility

If there were a trifecta of features desirable to investors, it would likely include steady, linear, and above-average returns. These attributes, on the surface, seem innocuous and even aspirational. However, when prioritized at the expense of underlying realities, they can lead to disastrous outcomes. Consider Bernie Madoff, who promised unsuspecting investors a steady, non-volatile return profile, only to defraud them of billions of dollars. Or the Nobel Prize-winning fund managers from Long Term Capital Management (LTCM) who pursued low volatility options strategies that ended in a spectacular blow-up, requiring a bailout from the Federal Reserve. And perhaps more relatable, the 2008 crisis precipitated by a cascade of financial derivatives that unravelled because they were built on the assumption that real estate market volatility was manageable, and prices only go up. The pursuit of better-than-average long-term performance is not in question; indeed it is a pursuit we hold core to our existence at M&G. Rather, it is the desire to achieve outperformance without volatility, or worse, the suppression of volatility to create the illusion of steady returns, that can lead investors down a perilous path.

“…It is the desire to achieve outperformance without volatility, or worse, the suppression of volatility to create the illusion of steady returns, that can lead investors down a perilous path.”

Pennies in front of a steam roller

The term "short volatility" characterizes strategies reliant on a tame, non-volatile return stream to meet investment objectives. It gained prominence as volatility targeting became sought after, especially with the rise of exchange-traded products.

But what does it mean to be short volatility?

Being short volatility essentially entails making a bet that the level of volatility (or the rate at which prices fluctuate) will remain subdued over time. This strategy can yield gains in stable market conditions, but it leaves investors vulnerable to substantial losses when volatility spikes. Hence the metaphor ‘picking up pennies in front of a steamroller’.

In contrast, strategies that seek to profit from increases in volatility, such as “tail-risk hedging” or “crisis hunting” have become more popular in recent times. A useful way to think about tail-risk hedging is like vehicle insurance. A form of tail-risk hedging would be taking out insurance on your vehicle – in the unlikely (but costly) event that you are involved in a motor accident, the insurance would pay for the cost of repair. Crisis hunting, meanwhile, would be equivalent to taking our insurance on all your neighbours’ vehicles. In the event of a damaging hailstorm, you would be paid out on multiple vehicles (none of which are owned by you) and thus benefit from a crisis. These are examples of long volatility trades, as you are a beneficiary in the event of an abnormal bout of volatility. The insurance provider would be short volatility, benefitting from the premium while things are calm, but suffering a large loss when an unusual weather event comes to pass[1].

[1] While this example is illustrative, insurance providers will not allow someone other than the owner to take out an insurance policy on the vehicle.

In pursuit of certainty

Being short volatility is not unusual, though – much of our lives are premised on the notion that life marches to the drumbeat of predictability. When you board an aircraft, go for a routine medical, or even when you get your hair cut – you’re betting that things will turn out more or less as they have in the past. Now sometimes this is not the case, but for the most part, “normal” generally means within expectation.

This point is made abundantly clear in the classic book Against the Gods by Peter L. Berstein. The book details how throughout history, humans have sought to tame uncertainty and volatility in their environment. From the early days of agricultural societies, where crop diversification mitigated the risks of famine, to the development of modern financial instruments that hedge against market fluctuations, civilizations have made significant strides in managing risk (reducing the likelihood of the unexpected). These advancements have enabled individuals and societies to undertake ventures that were previously deemed too risky, leading to greater prosperity and progress. Indeed, the triumph of civilization lies not only in mastering the physical world but also in understanding and managing the uncertainties inherent in human endeavours.

Nevertheless, things can still go wrong; planes do crash, and you may be diagnosed with an unexpected illness. The fact that these events are surprising is testament to how far we have come in controlling for the unexpected in our environments. This “surprise control” cannot be as readily transferred to the domains of financial markets and investing, though. These are much too complex for us to expect the normal to prevail uninterrupted.

Contagion

A plane crash is a devastating event, not just because of the potential loss of human life but also because it is so rare (the chance of being a casualty in a plane crash is 1 in 11 million). Unless planned, plane crashes are isolated. When we consider the possibility of a plane crashing, we almost never consider the scenario of all planes operated by a single carrier or all planes within a 1,000 km radius of a particular airport crashing at the same time. No, we think about the risk of a plane crash as a single discreet event. But this is not the case in financial markets or the economy – when we think about a bank failing, it is not uncommon to consider the possibility of other banks failing as a consequence or indeed, since 2008, the possibility of a financial crisis that may well spread across the globe. A bank failing is not like a plane crashing, it is more like the death of patient zero in a life-threatening pandemic. The shock zone can cascade orders of magnitude beyond the initial impact.

Why are plane crashes discreet while bank failures are contagious?

The question obviously does not lend itself to a simple answer, but in general the degree of interconnectedness in the domains of global finance and the economy at large leads to significant correlations across asset classes and markets, especially when conditions are abnormal. There are numerous reasons why the global economy is increasingly interconnected – globalisation, government policy, and technology, among others. While we will not get into a discussion on the merits of an interconnected global economy in this article, I believe financial markets will continue to exhibit these traits for the foreseeable future. The implications can often crop up in mysterious and unexpected ways.

You know it when it gets you

“I know it when I see it” – colloquial expression derived from Arthur Conan Doyle’s works

Unlike other subjective events which don’t have clearly defined parameters, risk is one of those concepts that doesn’t always make itself known through observation. Indeed, it is still challenging to define risk, and we are barely able to settle on a consensus for how it should be measured. I think we all understand the broad meaning that risk is the possibility of something happening that you did not want to happen, like a loss. But sometimes you will only realise the risk was present after you have suffered the loss.

"Sometimes you will only realise the risk was present after you have suffered the loss.”

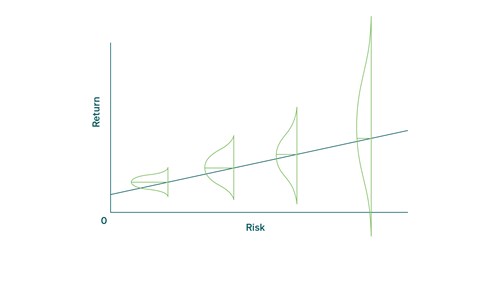

In depicting the risk inherent in a position or asset, a probability distribution has become the industry standard for framing that risk. Graph 1 reproduces the famous chart from one of Howard Marks’ memos titled Fewer Losers, or More Winners? [1]. Marks’ view is that the linear relationship between risk and return, as taught in traditional finance, is incomplete. While the relationship between risk and return ought to follow a positive relationship (i.e. more risk assumed should offer greater potential return), the relationship is not necessarily linear – nor is it certain. He provides a more complete picture by overlaying probability distributions along the risk/return continuum, as shown in Graph 1. A low risk/return asset has a narrower distribution of outcomes vis-à-vis a riskier asset which has a wider range of outcomes. This helps us understand the relationship between risk and return a little better.

Graph 1: Risk vs Return: Probability distribution

Source: Fewer Losers, or More Winners? September 2023 memo (oaktreecapital.com)

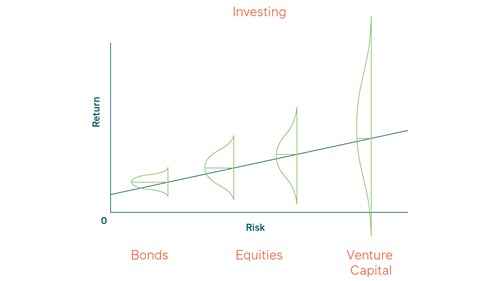

We often think about the return distribution of an asset or asset class based on its underlying characteristics. For instance, bonds are less risky than equities and would offer a narrower range of outcomes, as shown in Graph 2 (also from the Howard Marks memo).

Graph 2: Asset class risk vs return probability distribution

Source: Fewer Losers, or More Winners? September 2023 memo (oaktreecapital.com)

This more complete depiction of risk and return got me thinking about the possibility of the same asset or asset class shifting along this spectrum under different circumstances. For example, gold was an asset that demonstrated low volatility for the first half of the past decade, but then saw a step change in volatility during the Covid-induced market crash. It has remained elevated since. The same morphic behaviour can be seen for many assets along both ends of the volatility (or risk) spectrum, including some of the largest and most liquid markets in the world, e.g. US Treasuries, Global Tech, the CBOE Volatility Index (VIX), Meme Stocks, Crypto currency etc.

It strikes me that accepting a degree of volatility is a rite of investor passage in the pursuit of better-than-average returns, more so today than in the past. Managing expectations is probably the more effective endeavour, rather than attempting to suppress or bet against volatility.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter