The Egypt opportunity uncovered

This article was first published in the Quarter 2 2022 edition of Consider this. Click here to download the complete edition.

Key take-aways

- During Covid-19 and in its aftermath, valuations of Egyptian stocks have become cheap as risk aversion has caused share prices to fall even as company earnings have remained relatively stable.

- Although Egyptian inflation is rising, we believe there are high-quality companies with the experience and earnings resiliency to navigate this environment well.

- Our portfolio of Egyptian equities comprises companies with the ability to price up their goods and services in periods of high inflation; companies with a US dollar earnings base; and companies with good cash-flow generation ability and strong balance sheets.

The M&G Investments Africa team recently spent some time on the ground in Egypt, meeting with management teams and visiting the facilities of various companies listed on The Egyptian Exchange to gain a deeper understanding of the investment opportunities available for clients of the M&G Africa Equity Fund. Here we share with you why we believe Egypt could offer investors with a relatively high risk appetite the chance to add some high-quality companies to their portfolios at attractive valuations.

Our rigorous process of in-depth fundamental analysis involves engaging directly with senior company management, relevant industry participants, and in the case of our investments in Africa, country visits that allow us to get a first-hand sense of what is happening on the ground. On this week-long trip, we spoke to management teams across a broad range of industries and visited several operating facilities. This supports our investment philosophy of making decisions based on known facts.

Our visit happened to coincide with the announcement of a devaluation of the local currency and an interest rate hike, and we were able to engage management teams and local analysts on the impacts of these events and the inflationary pressures we have been seeing both globally and in the local market.

A decoupling of the market vs fundamentals

Before the trip and in months subsequent to the onset of the Coronavirus pandemic it had become clear that the Egyptian stock market had dislocated from the fundamentals - stock prices, representing the market’s view of the value of companies, and earnings, representing the underlying fundamental driver of a company’s value, were diverging.

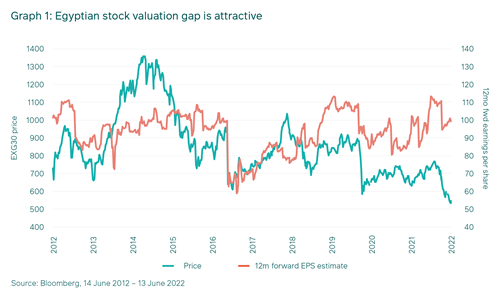

Equity outflows were significant during the initial stages of the pandemic. High yields offered on local bonds, to attract foreign investment, were providing very attractive returns relative to equity. During this period of outflows, the earnings base of stocks listed on The Egyptian Exchange was not significantly impacted; in fact, earnings proved to be relatively stable. Yet market prices fell substantially. Graph 1 shows the price and 12-month forward US dollar earnings estimates over the past 10 years for the primary Egyptian index – the EXG30 representing the top 30 companies – where we can see that the traded value of the market had decoupled from the earnings of the market in early 2020. Since those initial pandemic months, that valuation gap has continued to widen such that the market is currently trading on a 6.0X price/earnings (P/E) multiple, versus its 10-year average of around 9.0X. In our view this represents a very attractive valuation.

The risk of inflation

Global supply chain issues and a spike in global commodity prices driven by the Russia-Ukraine conflict are currently driving inflationary pressures in the Egyptian economy and globally. This inflationary pressure creates uncertainty around economic growth and the near-term earnings potential of the companies we invest in. If we look at the earnings performance of the EGX30 in previous high-inflation periods, it is evident that the earnings base of companies listed on the exchange is quite resilient. In September 2016, the Egyptian pound (EGP) depreciated from EGP9 per US dollar to EGP18, which resulted in inflation peaking at around 30% in July 2017, and then subsequently moderating to the high-teens in 2018. Despite this massive shock, the earnings base of the EGX30 recovered steadily in USD terms. Consumption has helped to underpin corporate earnings, proving to be relatively inelastic in previous instances of high inflation. At the time of our visit in March 2022, the Egyptian pound was devalued by 15%, and we are presently seeing inflation at around 13%. Many management teams we engaged with reassured us of their ability to navigate this environment.

Our preference for quality

Within the investible universe open to the M&G African Equity Fund, we have a preference for the higher-quality names: companies with the ability to price up their goods and services in periods of high inflation; companies with a US dollar earnings base; and companies with good cash-flow generation ability and strong balance sheets -- i.e. companies that can withstand the challenging environment better. Return on equity is one measure of quality we pay attention to, and on balance the stocks we invest in generate a return on equity higher than the market average. We believe that our portfolio is therefore able to show better resilience than the broader market.

One such quality stock is Eastern Company, Egypt’s monopoly cigarette manufacturer. Eastern Company produces their own cigarette brands (with a 75% market share) and roll cigarettes for international players under toll manufacturing agreements (25% market share). The government has recently issued a second licence for cigarette manufacturing in Egypt; Eastern Company will own a 25% stake in the new manufacturer.

In our opinion, Eastern Company displays the quality characteristic of being able to price up their products in the event of cost inflation -- in the last 12-month period the company has increased prices twice without negatively impacting volumes sold. The company also has control of the value segment of the market and will likely retain this control. In the current high-inflation environment, their control of the value segment bodes well for their ability to grow volumes, since in the event the consumer wallet comes under pressure, Eastern Company will be able to gain market share from its international competitors as customers trade down. This has been demonstrated in their performance metrics in recent results announcements.

The company has a strong, unlevered balance sheet, and generates a high return on equity and strong cash flows through time. In addition to favourable quality metrics, Eastern Company is also very attractively valued, trading at around a 5x PE multiple, and delivering a 15% dividend yield.

Market reforms

We are positive about the level of structural reform that is taking place in Egypt. The Egyptian government is taking bold steps to help the economy withstand the current pressures. The government is working on incentivizing local production in the industrial sector. They are also working to increase the private sector shareholding in state- and military-owned assets, as the army’s control of significant assets has historically created a negative perception of the business environment. Going forward, increased private sector involvement in the economy should drive improved investor sentiment, as will the engagement with the IMF on a reform program.

Risk versus return

It seems that market participants underestimate the ability of African companies to weather tough economic periods. A focus on both the short-term impacts of economic events and short-term trading mindsets leads to a mispricing of assets, and in that mispricing lies an opportunity for funds like ours. We construct our portfolios on a risk-conscious basis and are aware of the risks present in African markets. The level of risk is elevated versus developed markets, and concerns around political instability, currency, inflation, liquidity and market volatility are front-of-mind for us. We recognise and acknowledge the higher risk, but at the same time we are optimistic about the potential return associated with taking on such risk.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter