SA’s corporate credit market bounces back

This article was first published in the Quarter 1 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- From a virtual standstill in April, the local credit market has rebounded surprisingly well, with good levels of supply and investor demand.

- Despite credit rating downgrades and a contracting economy, most companies have found flexible funding sources and been able to renegotiate borrowing terms if necessary.

- Today’s higher borrowing costs reflect the higher risk involved, and Prudential thinks investors are being adequately rewarded for those risks but otherwise the scars from the Coronavirus market crash are few.

It was a rough ride for participants in the local credit market in 2020, through which companies can borrow to finance their operations, and investors like Prudential can (usually) benefit from lending to them. With the onset of the Coronavirus crisis and uncertainty surrounding economic growth, the market ground to a virtual standstill in the second quarter of the year, and prices were not being adjusted accurately. This we discussed in our article “Fairly valuing corporate bonds for our clients” (Consider this, Quarter 3 2020). Along with the pandemic came a string of bad news around the prospects for both global and local economic growth, and more sovereign credit rating downgrades for South Africa. Risk levels appeared extremely high.

Yet the good news is that the year has ended surprisingly well for the corporate credit market - despite all the disruption, issuance has resumed and is even encouragingly active. We have seen companies of different credit risks being able to raise debt again and investors willing to invest. But is this too good to be true? Are the risks being accurately reflected in pricing for company debt, or are investors not being adequately compensated for holding it? Are there attractive deals to be had? Below we examine key aspects of the market to give investors insights into the risks – and rewards – now presenting themselves.

Debt issues revive with enthusiasm

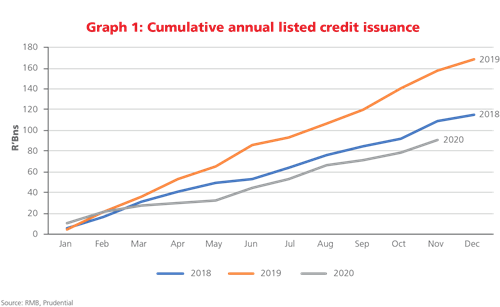

As we have seen in the past, such as during the Global Financial Crisis, liquidity and deal flow in the local credit market tend to dry up during episodes of financial stress. This was certainly the case in the months following the onset of the Coronavirus pandemic in South Africa. Graph 1 shows how cumulative new credit issuance came to a virtual standstill for the period March to May. What is also evident from Graph 1 is the gradual recovery in issuance levels through the end of November, where the rate of new issuance (as seen by the slope of the grey line), is almost on par with that of 2018. Investors are again comfortable to lend to companies, and corporate borrowers to take on more debt. Still, it appears as though total issuance for 2020, at around R100 billion or so, will be far lower than the roughly R170 billion seen in 2019.

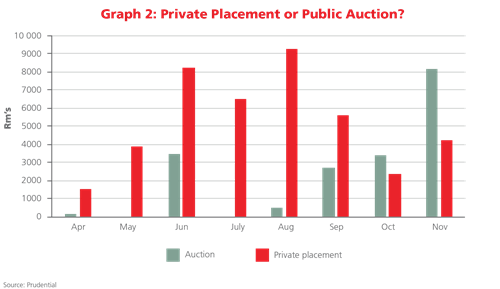

Another sign of the impact of the pandemic was seen in the absence of public auctions of new debt. Instead, companies preferred to conduct private placements of debt on a bilateral basis or, where there was a bit more demand, with more than one investor (see Graph 2). These deals, concluded behind closed doors, were preferred by issuers as they allow for price discovery away from the eyes of the market. If a company did not like the pricing being offered, it could walk away without the stigma of having held a failed (public) auction, where not all of the debt it wants to issue is taken up, or the price is driven up substantially. More recently, as the South African economy has opened up and confidence has returned to the market, more public auctions have been taking place (as shown in Graph 2), deepening investor participation in price discovery.

Corporate financing options

So how have companies sought to deal with the financial stresses brought about by the pandemic, and the lack of activity in the debt capital market? One of the initial actions many corporates took was to access their undrawn bank debt facilities, with already-approved terms, that they can ordinarily draw down over time. Not only did this provide instant liquidity for balance sheets, it also addressed the risk that under severe financial distress the banks may decide to not stand by these undrawn facilities. A further action taken by many corporates was to put additional committed bank facilities in place. These provided an extra source of emergency liquidity. Although these facilities come at a price in the form of commitment fees, this is a price corporates are willing to pay if it helps them weather the crisis, even if the facilities are not always utilised.

Given the lack of activity in the credit market, and companies’ concerns around the elevated cost of funding in the market at the time, unutilised bank facilities were in many cases used to repay maturing listed debt in the corporate bond market. This saw maturing listed debt not being rolled over, but rather replaced by unlisted bank debt. Corporates would prefer to do this than raise new debt at higher credit spreads (or higher default risk premiums), effectively setting a new, much wider, marker for where their debt should price. The strategy was to rather sit out the period of market stress and re-enter the market once conditions were more conducive and credit pricing moved lower, closer to past levels. Where companies have opted to access the debt market, there has been a preference to issue for a shorter term. Doing so ensures that an issuer does not lock in higher funding costs for too long. Shorter-term debt may also be attractive to investors who have concerns about the longer-term outlook for an issuer, although it can be argued that with Covid-19 the risks are, in any event, heavily weighted to the near term.

Renegotiating terms

Unsurprisingly, the impact of Covid-19 and the lockdowns on business activity has weakened most companies’ financial health. As a result, several corporates across different industries were faced with the prospect of potentially breaching, or at least getting close to breaching, borrowing covenants. This led to a number of them approaching their lenders to temporarily waive covenant-testing or relax covenant levels. In the listed bond market the most notable example of this was property group Redefine, which asked debt holders to relax their loan-to-value, or LTV, ratio covenant from 50% to 55%. Interestingly, they did not offer any additional compensation, such as paying an increased interest rate, for this indulgence. Prudential’s view in this case was that by increasing the LTV covenant level, investors were being asked to accept a higher risk than what had been the case when the debt was initially sold to investors, and as a result a higher level of compensation for taking on this risk was warranted. Despite Prudential voting against this change to the debt terms, the resolution passed overwhelmingly. This was no doubt helped by the fact that the majority of noteholders who could vote had the benefit of security over fixed property assets, and were thus less sensitive to a deterioration in Redefine’s credit risk, as evidenced by the higher LTV.

Banks come to the party

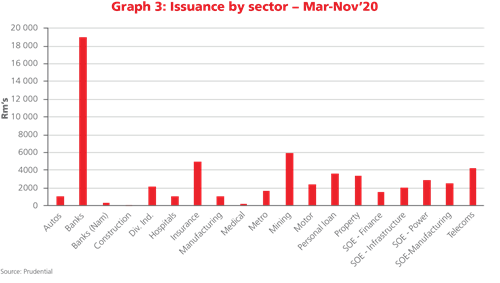

During the Covid-19 period, the types of company debt issuance, in terms of sector exposures, have been broadly in line with historic trends. By far the largest amount of issuance has come from the banking sector, as highlighted in Graph 3. One might have expected that in the Covid-19 environment the investor appetite for bank risk would have been limited to lower-risk senior debt, but we have actually seen a number of banks also being able to raise subordinated debt (both tier II and the even riskier additional tier 1 bonds). However, credit spreads did move wider for this riskier subordinated debt as investors did demand higher risk premiums.

Why were investors happy to take on higher-risk bank debt? Despite the severe impact of the lockdowns on the South African economy, local banks entered this crisis in a stronger position than at the onset of the Global Financial Crisis. Capital levels are higher and new liquidity requirements have also strengthened balance sheets. In addition, government interventions aimed at taking risk alongside the banks, to assist distressed borrowers, have helped to prevent any local financial crisis that could have arisen as a result of the withdrawal of credit. For example, in June Standard Bank issued Tier II subordinated debt via an auction at a spread of 3.75% compared to 2.15% before the crisis. At Prudential we decided to take advantage of this additional compensation and managed to add some of this attractively priced paper to our client portfolios. Read more about the local banking sector’s resilience in Stefan Swanepoel’s article “COVID-19 and SA banks: Recovering from the lows” in this edition of Consider this.

Attractive corporate pricing

Outside of bank issuance, Northam Platinum is one corporate that has been a particularly active issuer this year. Since April Northam has placed R5.9bn of debt in the market, all via private placements. The debt has been used to replace preference shares (guaranteed by Northam) issued by Zambezi Platinum, Northam’s BEE shareholder. Platinum group metal (PGM) producers have benefitted significantly from the tailwind of strong PGM basket price growth over the last 24 months – the PGM basket price having risen nearly 200% (see our article “PGMs shine in lacklustre SA equity market” in the last edition of Consider This). This has substantially changed the economics of mining PGMs, and although mining commodities will always be high-risk, cyclical businesses, the near-term outlook is encouraging for them. Given the positive outlook, we participated in Northam’s private placement debt bookbuild in November, adding the paper to several of our client funds which we are confident will add value.

Another company we supported recently was Super Group. Despite being impacted by Covid-19 in its European Supply Chain business and vehicle dealerships (both in South Africa and the UK), its net-debt was only marginally higher at June 2020, helped by working capital inflows. The decline in its operating cash flows had also not been severe, and there was a fair amount of headroom relative to its debt covenant levels. We also took comfort from the adequate cash available to cover the group’s next 12 months of maturing debt.

Having said that, at Prudential we were still sensitive to the risks of second-wave lockdowns in Europe affecting the Supply Chain business and the UK Dealerships business. Likewise, the SA Dealerships will face headwinds from the weak South African economy and the risk of our own second wave. When Super Group approached the market in November to raise debt, the pricing represented a premium of 0.85% over comparable senior bank debt costs. Contrast this to a year earlier when Super Group raised three-year debt at 0.30% above three-year bank borrowing costs. In our view, we were being offered adequate additional compensation for the risks. We participated in the auction and received an allocation of this Super Group debt.

Banks getting cheaper risk pricing

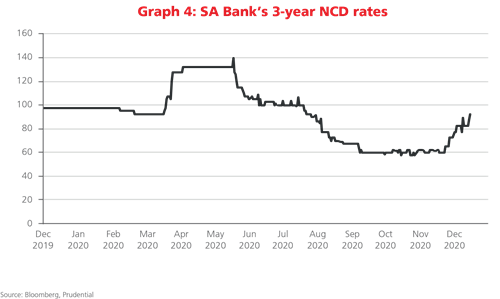

Besides the increase in bond auction activity in the latter part of the year, another bullish signal was observed in the pricing of senior bank credit risk, as seen in the tightening yield spreads of bank negotiable certificates of deposit (NCDs), demonstrated in Graph 4. After an initial widening in March and early April, it was interesting to note the spreads trending tighter from late May to the end of September. Given the challenging environment and impact of Covid-19 in elevating the risk of credit losses in bank lending books, this reduced credit risk pricing for banks appeared counterintuitive. However, the primary driver of this spread tightening has been the banks’ reduced requirement for debt funding. On one side banks have understandably been cautious about extending lending amid the uncertain conditions brought on by Covid-19. On the other, government interventions to assist in the extension of credit to borrowers affected by the pandemic, as well as actions by the South African Reserve Bank (SARB) aimed at easing liquidity in the financial system, have meant that banks have been flush with cash. As a result, banks have not required much funding, and the fall in spreads on their NCD’s across the second half of the year reflected this. This fall in bank spreads does challenge the prospective returns available to investors in money market and income funds who have been accustomed to significantly higher compensation from these bank instruments over the last five years. This tightening dynamic did reverse to some extent in December, with NCD rates rising to near their pre-Covid levels.

Overall, we are encouraged by the improvement in activity levels in the credit market and we would expect further improvement in issuance levels after the usual lull in activity in January 2021. The levels of compensation for default risk (the credit spread) did move wider during 2020 (except for banks as explained above), but given the impacts of Covid-19 and the uncertain outlook for most issuers, these adjustments have been fair in most circumstances. For the most part, there has been an absence of obvious bargains for investors to snap up.

Currently, the implications for investors are that a measure of caution needs to be applied in assessing credit market opportunities. The evolution of the Covid-19 pandemic is still highly uncertain. Further waves of infections, and responses to contain these, still need to play out. And as for the vaccines, developments offshore are encouraging, but their arrival and roll out in South Africa will still take some time. Even then, once the dust has settled there are bound to be longer-lasting changes to the functioning of our economy which will impact many businesses. As always, we will continue to look for opportunities that provide a margin of safety to guard against the downside risks.

For more information or to invest with Prudential, please contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter