Diversifying income assets with detailed risk analysis

Key take-aways

- At M&G Investments, we don’t rely solely on ratings agencies for a borrower’s credit quality, we conduct extensive in-house analysis and assign our own ratings.

- We employ many different measures of creditworthiness to determine a fair rate at which to lend, one that balances risk and reward for our clients.

- The Equites debt issue was very competitive, and we obtained an allocation for our client portfolios that favourably enhanced diversification and prospective returns for the risk involved.

This article was first published in the Quarter 1 2022 edition of Consider this. Click here to download the complete edition.

As risk-aware investment managers, one of M&G Investments’ primary aims when building client portfolios is to include a broad range of income-earning assets to help diversify risk, guided by our in-depth credit analysis process. A recent opportunity to do this came in the form of a credit issue by Equites Property Fund, the JSE-listed Real Estate Investment Trust (REIT), which came to market in November 2021 looking to raise between R750m and R1bn across one-year and three-year bonds. Here we were successful in adding what we assessed to be a high-quality issuer to the M&G High Interest Fund (and other client portfolios), further diversifying the fund’s sources of income while earning an attractive yield.

A look at M&G’s credit analysis for Equites

Equites was listed on the JSE in June 2014 with a R1bn portfolio of properties located in the Western Cape, but has subsequently grown to own a portfolio of high-quality logistics properties located in South Africa and the UK valued at some R22bn.

Our assessment of the business risks identified several significant positives for the Equites investment case. First, Equites is benefitting from very strong demand for logistics space, on the back of the rapid growth in E-commerce and consequent business moves to multiple sales channels (omni-channel) and demand for faster fulfilment. Interestingly, unlike the experience of many other landlords, the Covid-19 pandemic has been a tailwind for this specialised sub-sector of the property industry due to supply chain disruptions and the resulting drive for supply chain resilience and optimisation, and a move away from “Just-In-Time” processes. These dynamics are leading to increases in inventory levels, with concomitant commercial need for larger storage space.

Equites also benefits from a significantly long lease expiry profile of more than 14 years, compared to its peers’ average lease expiry profiles of around three to four years. This reduces risk for its creditors given the longer-term revenue visibility this entails. Its vacancies are also low in contrast to those of its peers, further evidencing the keen demand for space in their portfolio.

The final significant positive is that the group has been shifting its geographic exposure out of South Africa into the lower-risk UK over the last five years. Management has plans to increase this UK exposure, which will reduce the overall portfolio risk further.

The investment case is not without weaknesses, however. Adding to risk is Equites’ greater development focus than its peers, with a significant UK pipeline. The exposure to land and developments amounts to 20% of its assets, with capital commitments equating to 9% of assets. A further negative is that its portfolio size, though having grown quickly, is still below average, which results in less diversification. Diversification has been further reduced by a recent substantial deal with Shoprite, in which it acquired a 50% interest in three of the retailer’s large Distribution Centres. This has now led to tenant concentration for the Equites portfolio, with Shoprite being 11% of its tenant base.

Our consideration of the financial risks associated with the company found that Equites was strongly positioned. Unlike other property issuers we analyse, Equites had been able to deliver strong like-for-like (or “stable portfolio”) net property income growth of 7.5% in South Africa during the Covid-19 pandemic. A large contributor to this strong result was that Equites had granted minimal Covid-associated relief payments to tenants.

Other strengths identified from the financial analysis included a low loan-to-value ratio (gearing) compared to its peers, a long debt maturity profile, a high level of unencumbered assets, and a low level of secured debt.

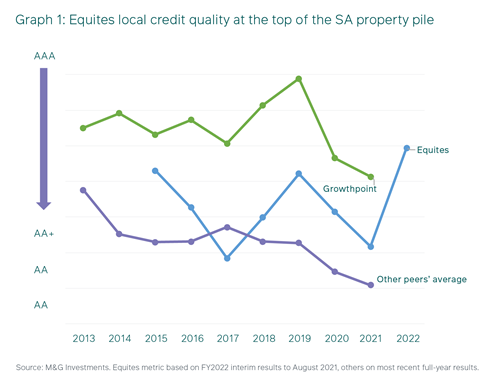

Wherever possible, we try to consider issuers relative to their peers. In the property sector there are a number of issuers, and this comparison is very informative. Based on this peer analysis, which takes account of the metrics referred to above and several others, we considered Equites and Growthpoint to be at the top of the peer group in terms of credit quality, both at a South African local scale rating of AAA, as shown in Graph 1. The other property sector issuers were clustered two to three local rating notches lower, at around AA to AA-.

Environmental, social and governance factors

As with all our potential credit investments, we also consider how environmental, social and governance (ESG) issues manifest themselves and may introduce additional risks to our client portfolios. From an environmental perspective, Equites management demonstrated a keen focus on property operating efficiency, particularly in implementing solar electricity and water-efficiency projects in their properties. They have also made significant progress in obtaining an increasing number of “Green” building certifications across the portfolio.

As for the social aspects, we acknowledged that this was not a major risk for the company, as Equites’ clients are typically corporates rather than consumers. Equites is committed to numerous CSI projects, which also mitigate social risk.

Finally, on governance factors we considered the Board composition and the make-up of skills and experience across the members, noting the position of Leon Campher as Chairman. Leon is well known in the investment industry given his role as CEO of ASISA and past position as CEO of Coronation. Additionally, our past engagements with him as shareholders have been constructive.

Leveraging off equity analysis

For issuers listed on the JSE like Equites, we always seek to take advantage of the in-depth analysis provided by our equity team colleagues. In this case, the equity team had a generally positive view on Equites, viewing debt exposure as being low risk. The equity team’s overweight position in the company at the time gave us further comfort in our decision to take on the credit risk, while also being mindful in gauging the extent to which the equity team’s positioning was based on the company’s valuation, versus their view on its fundamentals.

Checking the Ts and Cs

Reviewing the bond documentation (or terms and conditions) is an important step in our analysis process. We do not outsource this – rather it is performed by the relevant credit analyst. From our review of the Equites documentation we noted the inclusion of both a 50% Loan-to-Value covenant and a 2.0x Interest Cover Ratio financial covenant. These covenants, though not unusual, are not always included in property company listed bonds, and provide some protection against the company materially increasing its financial leverage. On a technical point, we noted that the pricing supplements needed to be checked to make sure that these financial covenant clauses were marked as “applicable”, otherwise they would not apply to these particular bonds being offered.

Another positive came from the inclusion of two “put event” clauses, which are not commonplace. These gave investors protection against both:

- A delisting of Equites’ listed bonds or ordinary shares; and

- A disposal of the greater part of Equites’ undertaking/assets.

Credit Committee go-ahead

On the strength of the credit analysis as described above, the M&G Investments Credit Committee approved a credit limit for Equites. Given our positive view of the credit, we decided to bid relatively aggressively for the issue.

Equites’ debt proved to be very sought-after by investors, given its relatively high credit quality and the subdued numbers of corporate bond issues to go to market since the Covid-19 crisis. This made the auction very successful for Equites, with the three-year bond pricing at Jibar + 1.45%, which was below the guidance. The auction attracted bids from 16 different parties with total bids exceeding the amount on offer by 3.5x – a strong show of support from the market. We were successful in acquiring around half of the volume we bid for – a good outcome considering the strong demand for the issue and the aggressive bidding.

We believe the Equites three-year debt was a sound addition to our M&G High Interest Fund holdings, delivering clients an attractive yield for the risk involved. It has also helped further diversify the fund’s income sources in an environment where the domestic credit market has seen limited new issuers coming to market. Our clients should know that we take advantage of these opportunities to add value to our client portfolios whenever possible, although we will also not overpay or take unnecessary risks should we judge a security to be too expensive or a credit of insufficient quality. It all hinges on our consistent application of our detailed credit analysis process.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter