No label

South Africa’s leading retailers have invested heavily in private label food brands. Here we unpack how those products have evolved – and gained consumer traction – over time.

In today’s competitive landscape, South Africa’s food retailing giants like Pick ’n Pay, Spar and Shoprite have followed their peers in other countries by investing considerable time and money into developing their own food brands. This is in an attempt to meet the evolving needs of price-conscious consumers, differentiate themselves from their competitors, grow customer loyalty and improve profitability. The increasing prevalence of these private label products is proof that South Africans have learned to trust these products, which have become brands in their own right.

From commodity to consumer-centric private label products

Private label products are exclusively manufactured by foreign or local third-party manufacturers according to the retailers’ specification under the retailers’ branding. Examples include Pick ’n Pay’s dealer-owned brand and No Name private label brand, Spar’s private label brand and Shoprite’s Ritebrand.

Private label product offerings initially catered to low-end consumers and started out as cheap, inferior-quality and no-frills packaged versions of popularly consumed products. These products tended to have a long shelf-life, were easily distributable and commoditised in nature. Examples include canned fruit and vegetables, canned meat, cooking oil, long-life milk, rice, pasta, maize and sugar.

Subsequent improvement in content variety, quality and packaging facilitated the premiumisation of private label products. The retailers decided to tier their own-brand products according to different levels of quality (Value, Standard or Premium), allowing consumers to choose what they want at a price they prefer. The Value offering is typically priced 15% to 20% cheaper than the branded alternative. The introduction of fresh, healthier, convenient, exclusive and unique dietary foods resonated well with middle- to upper-end consumers (for example, convenient ready-to-eat meals and organic and gluten-free products). Further differentiation through linking up with social causes and sourcing raw materials sustainably and responsibly resonated well with the socially conscious younger generation.

Reinventing private label strategies

Private label (and branded) product reach improved gradually over time as retailers expanded their store footprints across South Africa. The private label agenda gained even more impetus once foreign nationals started occupying leadership positions in the food retailer sector. They brought with them a wealth of knowledge of the private label experience gained in their home country, including the UK and Australia. Comprehensive store-, region- and customer-specific private label strategies were fleshed out. Buying teams were complemented with product development and brand managers. Store appearance, product displays and cataloguing were improved upon.

Increased investment in product innovation and consumer research and marketing, together with frequent and close collaboration with private label suppliers, were key ingredients for the successful rollout of retailers’ private label product ranges. The increased allocation of eye-level shelf space to private label products, and/or the complete replacement of weaker second- and third-tier national brands with private label alternatives demonstrates that retailers now view their own private label products as equivalent substitutes for many of the country’s established brands.

Mixed buy-in from suppliers

Smaller emerging suppliers were generally keen to jump on the private label bandwagon. However, dominant, established branded food producers have been less enthusiastic, choosing to manufacture private label offerings in limited quantities and for selective products for specific retailers. Insufficient manufacturing capacity, unwillingness to invest in additional capacity, and the fear of loss of brand volumes if consumers permanently switch from their own heritage brands into cheaper private label alternatives are all cited as reasons for the poor buy-in from dominant food producers. Furthermore, the availability of cheaper private label alternatives of similar perceived quality undermines branded food producers’ ability to raise selling prices, especially during times when input costs rise. Promotions to entice consumers to trial their new private label products (and/or to remain competitive) have at times forced branded food producers to lower their brand price premium.

Food producer giants like Pioneer Foods and Tiger Brands have turned their noses up at private label products, as private label-fuelled price wars tend to devalue national brands, training consumers to wait for promotional deals and shift customer focus to price alone, and away from product attributes. They have therefore stepped-up their counter strategies in an attempt to stem the tide of private label substitution creep.

The battle of the brands heats up

In an attempt to beat the food retailers at their own game, branded food producers have similarly upped their advertising and marketing spending to remind consumers of why their iconic brands are important, in an attempt to justify their brand price premium. Without diluting the core brand promise of a memorable experience, brand positioning has been reinforced through greater innovation in pack-size, nutritional content and packaging. More frequent promotional deals have also reluctantly been adopted.

Branded food producers’ arsenals have always included multi-tiered products. For example, Tiger brands complements its premium Koo jam range with its cheaper fighter brand Hugos, while Pioneer Foods’ premium Spekko rice brand is complemented with its Select rice brand. Additionally, they continue to try to improve their distribution to under-penetrated rural and informal areas of the South African economy by bypassing formal retailers and selling directly to spaza shops and wholesalers.

Private label popularity is growing

Despite the growth in the private label business, consumers still buy both branded and private label products at a mix of price points in different product categories. Consumers cherry-pick stores for specific products with attributes deemed important by the consumer at that particular point in time. Among other things, budgetary constraints, value and quality perception, culture, taste, familiarity and dietary preferences play a role in a consumer’s decision to migrate in and out of brands. Globally, trends indicate that private label popularity generally improves during tough economic times and slightly declines or remains flat during good times.

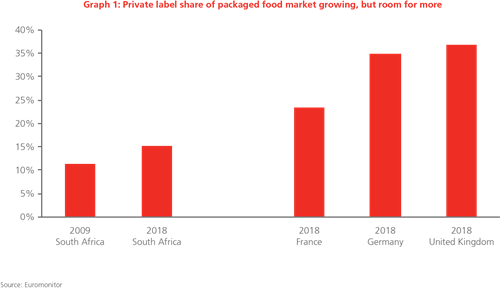

Notably, over the past decade total sales growth in the South African packaged food industry was approximately 9.5% per year, based on data from Euromonitor. Within this, private label sales growth outpaced that of national brands (at approximately 13.5% versus 8.5% per year, respectively), resulting in private label market share increasing from 11.4% in 2009 to 15.1% in 2018.

Despite this growth, however, the graph shows that South Africa still substantially lags its European counterparts, indicating that there is still a lot of room for growth in market share. Woolworths has been the most successful in implementing and growing its private label product range over the years. The Woolworths brand is synonymous with quality, and its continued innovation keeps customers coming back to their stores.

Consumers will decide

As private label products have gained market share at the expense of national brands, bargaining power has shifted to retailers as they depend less on dominant suppliers. The ultimate winners are South African consumers, who get to enjoy a wider variety of innovative products at different price points. Retailers have modernised and fast-tracked their private label product offerings in an attempt to attract and retain customers, and ultimately gain a greater share of the consumer wallet. Branded food producers have had to step up their game in terms of innovation and pricing in order to counter the tide of market share loss to private label alternatives.

Fierce competition between the established national iconic brands and their private label alternatives is expected to continue as pricing, merchandising and promotional strategies evolve over time. Consumers will ultimately decide which brands will stand the test of time as they continue to vote with their wallets.

For more information, speak to your financial adviser or call our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter