Multi-asset funds remain a popular choice with investors

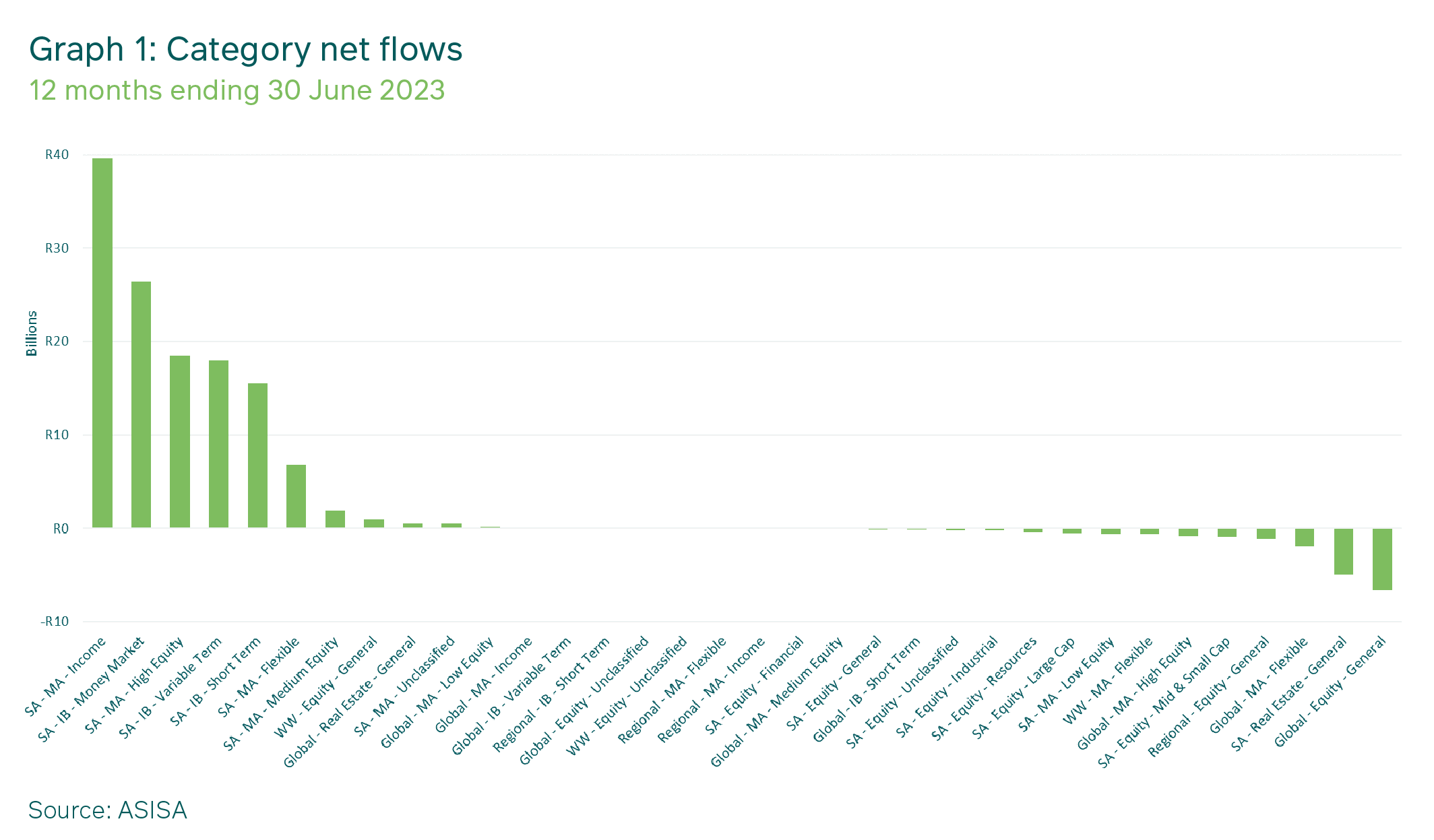

When investing, there are different categories of funds to choose from, depending on your investment needs and goals. Historically, multi-asset funds have been a popular choice. Recent statistics show that 50% of all assets invested in the SA unit trust industry are in multi-asset portfolios, with these funds having gained further popularity over the past year, particularly in the multi-asset income portfolios with nearly R40 billion in flows (12 months to end 30 June 2023). Against the backdrop of the current economic conditions, we unpack what could be driving this trend.

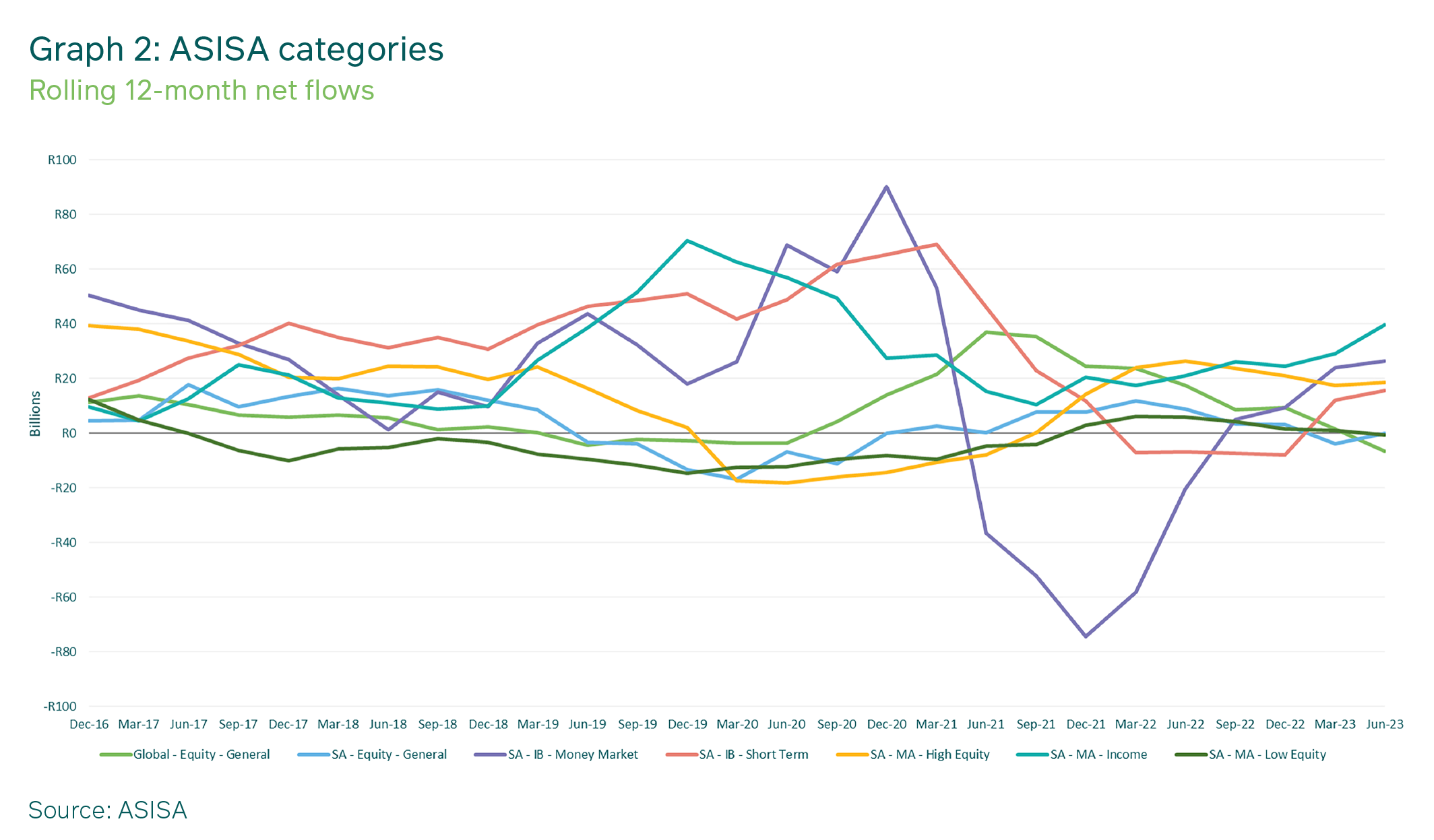

Since 2016, higher equity market volatility and weak equity returns had increased the attractiveness of less-risky interest-bearing funds, and since November 2021 these funds had the added appeal of rising interest rates – up a cumulative 4.5% in the ensuing period. These have lifted the returns from cash-type instruments and lower-risk unit trusts relative to their higher-risk counterparts.

However, now that local interest rates are widely perceived to be near their peak, and the outlook for global growth has improved, investors have seen the increasing appeal of growth assets like equities, as well as the benefits of diversification across many asset classes and geographies offered by multi-asset funds. SA equities and bonds have been offering excellent value from an historic perspective, while offshore assets increase diversification and potential returns, helping to offset SA-specific risks. The most popular multi-asset funds, according to ASISA, have been SA Multi-Asset Income portfolios, which recorded net inflows of R39.6 billion in the 12 months to the end of June 2023, and SA Multi-Asset High Equity portfolios, with R18.5 billion.

At M&G, we have seen higher client demand for diversified solutions including equities and offshore assets. Investors are realising that their cash-type holdings have a short lifespan, and this short-term nature represents a risk for them - namely that they will eventually have to replace them with lower-returning investments unless they move up the risk spectrum. Multi-Asset Income Funds represent that next step, with many able to hold equities and listed property and even investing offshore, like the M&G Enhanced Income Fund.

We also hold the view that SA Multi-Asset High- and Low-Equity portfolios like the M&G Balanced and Inflation Plus Funds are positioned to perform well in a falling interest rate environment. Typically, equities and listed property tend to perform better in a lower interest rate environment as borrowing becomes less expensive for companies, expansion cheaper and revenue growth stronger as consumers have more disposable income. Additionally, this implies that inflation is also falling (or at least well within the central bank’s target range), which is positive for bond markets and equities alike. Interest-bearing funds, with their higher allocation to cash-type instruments, are not likely to do as well.

Just as importantly, the SA equity and bond markets are currently priced very cheaply, making the chances of them producing better-than-average returns over time more likely. Local assets have been weighed down by uncertainty around growth, our political affiliations with Russia, and upcoming elections, among other factors. But in our view, the market is pricing in outcomes that are too pessimistic, and those investors who buy now and are patient should be rewarded with outperformance from both equities and bonds over the next three to five years. The M&G Balanced and Inflation Plus Funds are positioned to take advantage of this, while also including well-valued offshore assets like US Treasuries, emerging market bonds, and European, Chinese and Japanese equities. Based on our long experience, such carefully diversified portfolios should give investors an excellent chance to earn above-market returns over time.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter