Investment Focus: M&G Global Equity Fund: An excellent building block

M&G Global Equity Fund: An excellent building block

Although concerns around an economic downturn and/or persistently high inflation could put global equities under pressure in 2024, global equity can act as a strong diversifier for our local market-specific risk and an important building block in a portfolio. We believe that being selective will be key during the year, especially by focusing on companies that are able to benefit from longer-term structural growth drivers, rather than those with more cyclical exposure. There is evidence of a return to greater value dispersion across stocks globally, even within the same sectors, providing support to an active investment approach for the new year.

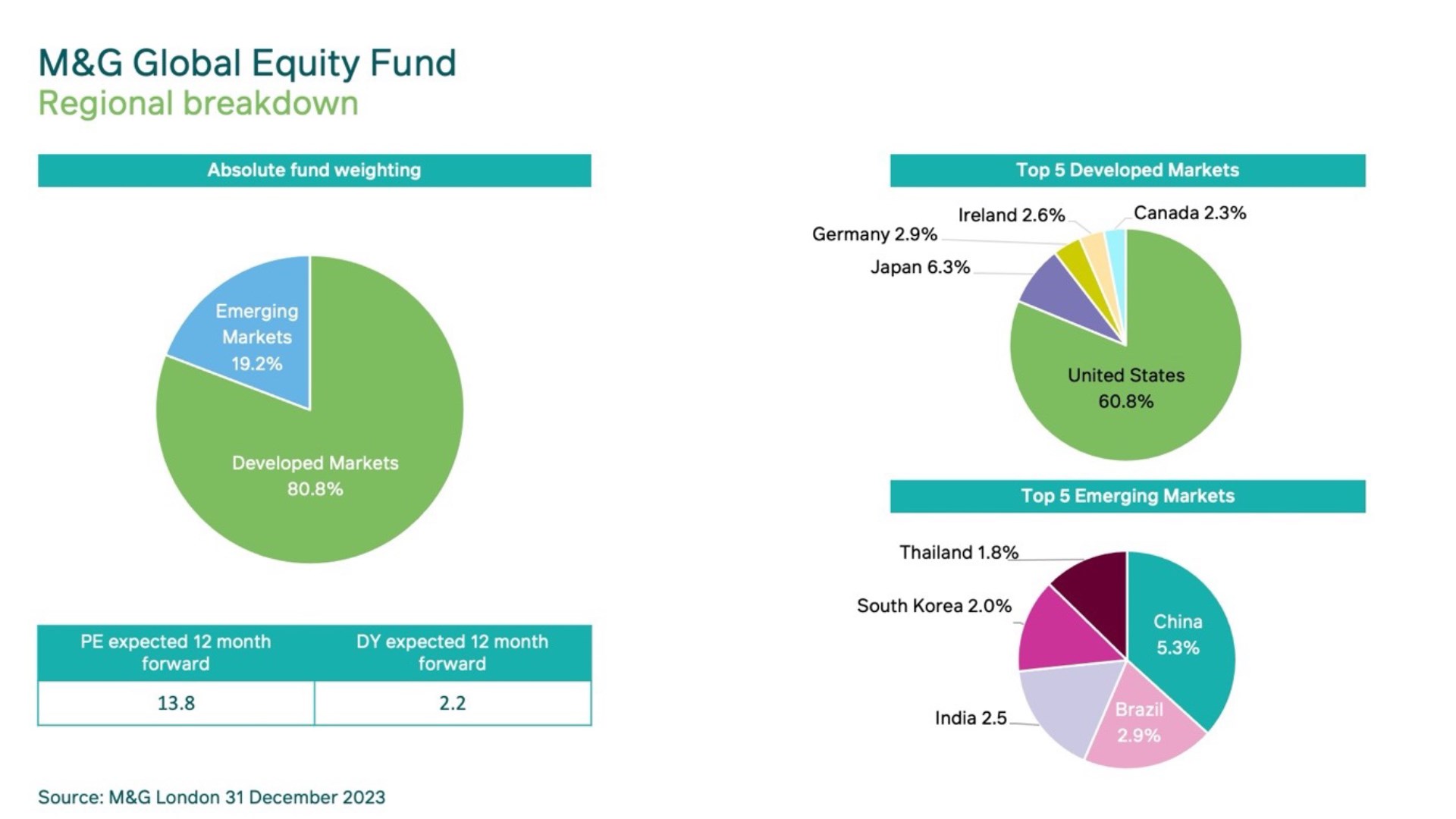

The M&G Global Equity Fund (in US dollars) and M&G Global Equity Feeder Fund (in rand) provide tremendous diversification and growth potential across different regions and sectors, capitalising on the vast power of artificial intelligence to find the best opportunities among the thousands of stocks in the investment universe, along with important input from M&G Investments’ experienced team of portfolio managers. In January the Feeder Fund delivered a respectable 2.3% monthly return, in line with its benchmark (the MSCI ACWI), contrasting with negative returns from local equities.

More important than this very short-term performance, the fund’s approach has helped our clients successfully navigate the tremendous volatility of the past few years: the M&G Global Equity Feeder Fund (in rands) notched up an annual return of 22.7% in 2023 (in line with its benchmark), 13.2% p.a. over three years and 16.8% p.a. over five years (both to 31 January 2024). And it’s notable that these returns were delivered in a period of extraordinary challenges and volatility in both up and down markets. This has tested and proved the robustness and repeatability of the AI model and the overall investment process in navigating the complexities of global equity markets.

The fund’s AI machine-learning model uses a comprehensive proprietary database containing about 10 billion data points and 25-30 years’ worth of historical data, which analyses the prospects of about 10,000 companies on every listed stock exchange in the world on a daily basis. For every stock that triggers a ‘buy’ recommendation in the AI, we leverage the deep technical expertise and fundamental capabilities of over 400 investment professionals globally, before making the decision to trade. Human overrides provide a filter to the buy list in applying expertise and deeper understanding that an AI may overlook. In fact, human oversight remains a key component throughout the process, from building the database and modelling the data all the way down to stock selection.

Given the M&G Global Equity Fund’s unique AI model and outstanding global reach, South African investors have access to an excellent building block for their portfolios offering diversification and growth potential outside of South Africa.

Those investors who have not utilised their full offshore allowance can consider investing in the rand-denominated M&G Global Equity Feeder Fund directly with M&G Investments, while the M&G Global Equity Fund is available in US dollars from several LISP platforms.

*All fund returns A class, net of fees. Source: Morningstar

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter