Exxaro: What is coal worth now in a de-carbonising future?

This article was first published in the Quarter 3 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Exxaro’s growth strategy is to move away from coal production to become a cleaner alternative energy supplier.

- As long as it remains a key player in South Africa’s energy supply chain, it is obliged to continue coal production to support the country’s living conditions during the economy’s transition away from coal dependency.

- In Exxaro’s current valuation, investors are getting its coal and energy assets for free, making it an attractive investment.

- There should ideally be a balance between investing in falling coal vs rising renewables so that energy is never too expensive.

As the pace and importance of de-carbonisation accelerates around the world and reaches ever-further into the daily lives of people and business operations, coal has become a more complex investment choice, and renewable energy sources important investments of the future. But what about now - the transition period between the two? Energy supplies need to be readily accessible and relatively cheap in order to avoid significant disruptions in living conditions, especially in countries like South Africa that are heavily dependent on coal as an energy source. There should ideally be an ever-evolving balance between the phasing out of coal and the growth of renewables.

Investors have a role to play in ensuring that this transition unfolds as smoothly as possible. In a free market, capital would generally go to those companies offering the biggest returns, which in the past has not included renewable energy producers due to their high cost of production. But as the need for their cleaner energy has become increasingly important, they have received government subsidies and improved their technology such that they have evolved into legitimately rewarding investment alternatives. Coal companies, meanwhile, have become much less attractive from an Environmental, Social and Governance (ESG) perspective.

In Exxaro, the listed coal producer, we can see a microcosm of this transition away from coal playing out, and investors may be wondering whether it could still be worthwhile to invest in the group. Here we offer an overview of the company and its latest plans for growth, while also assessing its investment prospects going forward.

About Exxaro

Exxaro is predominately a coal company with most of its sales going to Eskom, as well as a growing export business. The group also has an equity stake in the unlisted Sishen Iron Ore company (SIOC), and owns Cennergi, a renewable energy business, and smaller non-core assets.

Over the last few years, Exxaro has been simplifying its portfolio and strategy. Earlier this year it completed the sale of its holding in Tronox (a Minerals Sands business), and it is currently in the process of disposing of other non-core coal assets including the Leeuwpan mine and Exxaro Central Coal (ECC) Complex of mines in Mpumalanga, as well as its equity stake in the Black Mountain zinc mining business. It has also implemented an “early value” strategy, in which it extracts value from its operations earlier by growing the share of its export business (where profit margins are higher) and by reducing “stranded” assets (those that have devalued prematurely or unexpectedly) through its sale of non-core assets.

Some terminology:

Iron ore has differing physical forms: fines, lump and pellets.

Lower-grade sources of iron ore generally require beneficiation, using techniques like crushing, milling, gravity or heavy media separation, screening, and silica froth flotation to improve the concentration of the ore and remove impurities. The results, high-quality fine ore powders, are known as fines.

Fines require sintering, which is a thermal process where iron fines are agglomerated to get the product suitable for blast furnaces. The lump and pellet forms are of higher-quality iron content and do not need to go through this process; they therefore attract a premium price above fines.

Sishen Iron Ore (SIOC)

As a South African iron ore business, SIOC is differentiated from other iron ore companies due to its higher-quality product. It delivers a higher iron-content “lump” versus its peers (who predominately produce iron fine), and a higher grade versus the 62% Iron Content benchmark. Consequently, it receives a premium for its ore relative to other miners. In addition, most of the iron ore SIOC produces is exported, and about 50% of these export sales go to China. These factors give the company a level of defensiveness for investors in the sector.

As environmental restrictions tighten, our view is that SIOC will benefit given that it produces higher iron-content and lump products that do not require sintering. The risk to SIOC is that it has a relatively low life-of-mine, and therefore over the next decade the company will need to consider life-extension work; however, there are options for it to pursue both within and outside its portfolio.

We are also cognisant of the fact that iron ore prices are elevated at the current levels relative to long-term expectations, which is mainly being driven by supply side disruption from Brazilian production and strong Chinese demand. Over the short-to-medium term we do expect there to be supply normalisation, which will place downward pressure on prices.

Like its peers, the current elevated iron ore prices globally are allowing SIOC to generate high cash flows which - beyond covering its capital spending - will be supportive of paying a strong dividend for its 2021 reporting period, and for as long as iron ore prices remain high. Exxaro’s current policy is to provide 100% flow-through of SIOC’s dividends directly to its shareholders. Because Kumba’s share price is not discounting the elevated spot price of iron ore, and we use it as a proxy to value SIOC, we would note that SIOC shares would also not be discounting it. And we are receiving the SIOC dividend cheaper via Exxaro than if we were to receive it from Kumba directly.

Exxaro’s coal business: Looking offshore for growth

Exxaro’s coal business trades on a very low valuation multiple due to the numerous headwinds facing coal from an environmental aspect. As mentioned, the majority of its coal sales go to Eskom, although the company does have a growing export business.

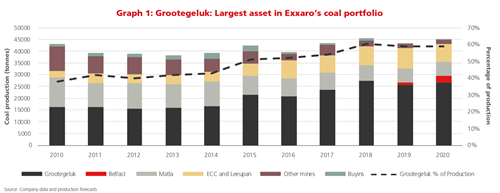

One of the key risks that faces its South African coal business is its dependence on Eskom as a customer. On this front it has few outlets for growth due to existing competition and the continued opening of the local market to new energy suppliers, largely in the form of renewables. A mitigating factor to this risk is the high standards of its Grootegeluk mine, a world-class operation based in the Waterberg that produces more than 50% of Exxaro’s coal (this includes assets the company is selling).

Grootegeluk supplies 20% of Eskom’s required coal and it provides coal to the export market. Grootegeluk coal is used by Matimba and Medupi power plants, with the latter being one of Eskom’s newer power plants, thereby making it an integral part of the SA energy complex. Medupi has a life expectation beyond 2040.

Part of Exxaro’s current growth strategy is to mitigate its dependence on Eskom by diversifying its customers. The focus of this plan is to improve the quantity and quality of its export coal product. This will increase the realised prices it receives, in turn widening its profit margin.

However, one of the challenges to the company’s export sales is the issue of domestic transport, which relates to the problems being experienced by Transnet. Since the Covid-19 pandemic we have seen a decrease in locomotive train capacity and a rise in cable theft and vandalism on the rail lines. There is a possibility that locomotive capacity can improve over the shorter term, but the bigger risk is the increased theft and vandalism, which may require public-private solutions that are complex and will likely take time to resolve.

A de-carbonised future

Another obvious challenge for Exxaro’s future growth is the global coal market, which is facing increased pressure from an environmental aspect as the world moves toward de-carbonisation. But while many developed nations are moving fairly quickly to curb their demand for coal, there is still good demand from Asian and other emerging markets that are more focused on economic growth at a cheaper cost. For South African coal producers like Exxaro, China and smaller Asian markets are natural export markets where demand is likely to remain firm for years to come. That is, until alternative energy technology becomes cheap enough.

Exxaro is very aware of the global energy transition now underway, as well as its own need to embrace and participate in a low-carbon world. It is doing so via its “Just Transition” strategy, which involves increasing its diversification into renewable energy sources by building onto their existing energy operations,and exploiting opportunities for potential growth into battery minerals. These minerals will be vital for the global energy transition journey.

Exxaro’s renewable energy business, Cennergi, comprises two wind farms in South Africa. Signalling its commitment to the business, in 2020 the group bought out its JV partner, Tata Power. Going forward Exxaro plans to use this renewables expertise by focusing on working with mining companies to transition to a greater use of alternative energy sources, as Exxaro has experience managing large capital-intensive projects.

As Exxaro undertakes its Just Transition strategy, one of the risks lies around capital allocation. Management will need to decide how much to invest in expanding its (arguably relatively new) non-coal operations, which will take time to generate cash. Nevertheless, the company has made a clear commitment to no longer spend its capital on expanding its coal assets, and limiting this to “stay-in-business” capex to maintain life of mine. Their dividend policy is equally clear: after paying dividends, the remaining cash flows will go towards growing their renewables business.

An investor ESG perspective

We cannot get away from the fact that Exxaro is a coal business, but at Prudential we have certainly considered the implications of investing in this company from an ESG perspective. Sustainability has been a key element of our investment process for over 20 years. Going forward, Exxaro will no longer be investing in coal growth projects, while at the same time they are currently divesting from coal assets that are no longer core to their operations. The product they supply to Eskom is critical for South Africa’s energy needs (at least for the foreseeable future), and its export products to Asian markets are destined for locations where coal remains a key part of the energy mix. Finally, the growth strategy for Exxaro is firmly focused on renewables. The management team is very aware of the path toward de-carbonisation and the disastrous impact of climate change, and they are actively working to implement their strategy despite the risks and constraints they face.

Getting Exxaro’s coal and energy assets for free

We are holding overweight positions in Exxaro in our two main equity unit trusts, the Prudential Equity and Dividend Maximiser Funds.

Since the beginning of 2021 to 30 June, its share price has outperformed the equity market, helped by the rising iron ore price over the period, making it a top-10 contributor to the relative outperformance of both of these funds versus their benchmark (the average of the ASISA general equity category). Over the past 12 months to 30 June it has also performed strongly and added relative value to these unit trusts’ returns.

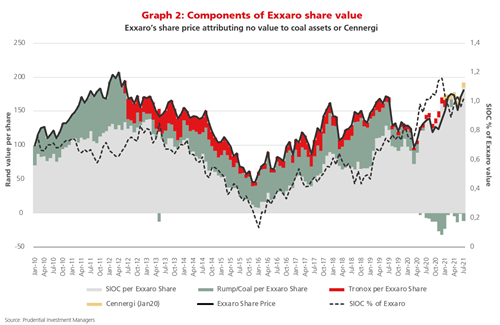

As Graph 2 highlights, most of Exxaro’s value is now derived from its 20.6% stake in SIOC, with Kumba Iron Ore owning the other 76%. Using Kumba’s share price as a proxy for SIOC, we can see that Exxaro’s assets other than SIOC (i.e. rump assets) are not being valued in Exxaro’s share price at all. Essentially, investors are getting the company’s still-valuable coal business and Cennergi for free. (Note, Cennergi is only separately valued after it became 100% owned.)

If we focus solely on the Grootegeluk mine, which is a large and long-life orebody, we feel that the market is undervaluing that asset. The mine’s supply contract with Medupi power station, which has a long operational life beyond 2040, is another positive element in the investment case.

At the same time, the value of its Renewables business (Cennergi) should emerge over time as the ring-fenced project debt is paid off.

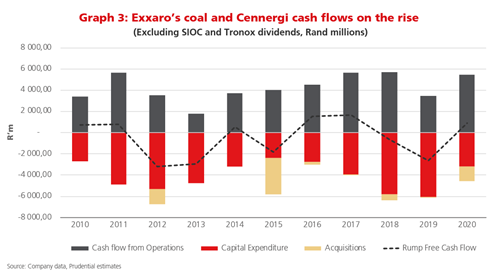

The other positive for investors is the group’s attractive dividend yield. As mentioned above, Exxaro will pass through the full dividend from SIOC, and that is attractive at current commodity prices. In addition, over the last few years the coal business has been investing into its assets and the capital spending programme is winding down. Therefore in 2019 we have seen the cash flows reaching an inflection point (as shown in Graph 3), and we expect the business’ coal assets will soon start contributing positively to group cash flows (as shown by the dashed line in Graph 3). This will provide an underpin to dividend payments going forward.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter