A way forward for structural reform

Article Summary

Examining low growth in South Africa: What’s gone wrong and how to fix it.

South Africa is a fundamentally low-growth economy. According to the World Bank’s recent diagnostic assessment of the country*, factors that have contributed to South Africa’s low growth potential include our history of exclusion from world markets due to apartheid, coupled with protectionist policies and subsidies aimed at creating and growing local industry. These have all led to a deeply uncompetitive economy, across many sectors. It is difficult for new companies – both local and foreign – to enter local markets, while high costs hamper our exports.

In order to get ourselves out of this low-growth trap, we need to address the deep, structural constraints that will lift output in sectors such as mining, agriculture, manufacturing and services (to name a few) and improve the ability of those sectors to generate jobs.

The primary reasons we need sustained, high economic growth are evident: to create jobs and reduce inequality. It is only through this that we will create a stable society. Therefore, South Africa desperately needs structural reform.

ABOUT STRUCTURAL REFORM

What is structural reform? Structural reform involves a country implementing policies that can improve both the human and institutional capabilities of that country, in order to generate higher and sustainable growth rates. History has shown that structural reforms can take a long time to bear fruit and manifest in higher growth and more jobs. In the short term, they can be politically unpopular and often cause painful effects such as rising unemployment, inflation, slow growth or even recession.

It can therefore be exceedingly difficult, both economically and politically, to convince stakeholders to endure some temporary pain for longer-term gain. This is despite ample evidence of the huge gains countries can potentially reap if reform is implemented successfully.

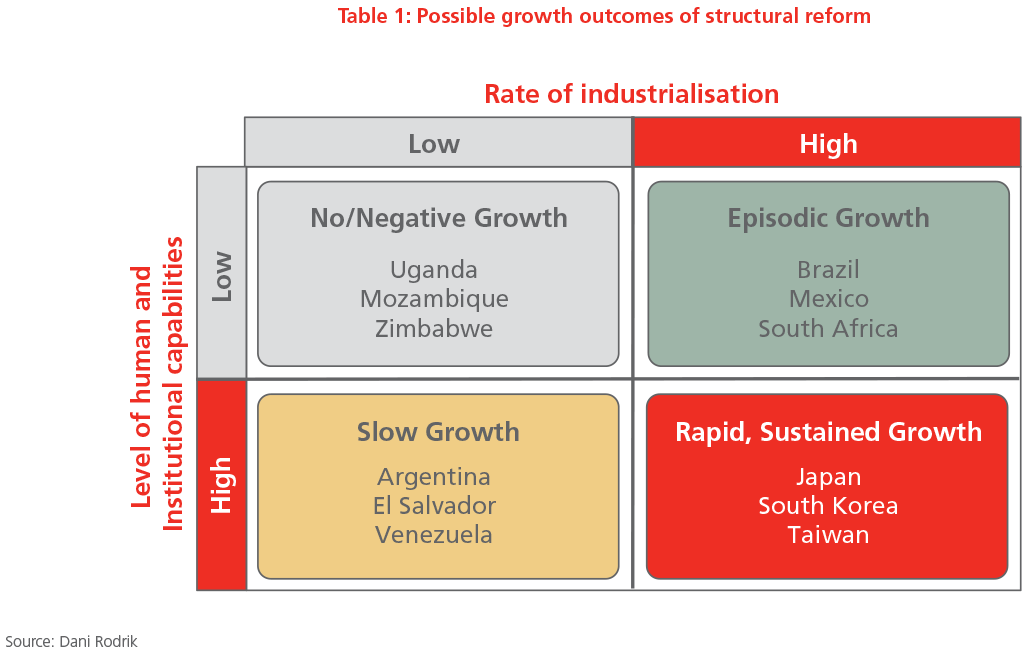

At the same time, the growth outcomes of economic reform can be uncertain, with different countries experiencing a wide spectrum of results. Examples in recent history have shown that the growth rate ultimately achieved can depend on key factors such as a country’s rate of industrialisation and their levels of human and institutional capabilities when the reform is undertaken. Table 1 illustrates how these two factors combine to help predict the potential degree of success of policy interventions in various countries over time.

- Slow industrialisation and low capabilities can lead to no/negative growth, where policy interventions do not raise the pace of industrialisation, nor do they raise the human and institutional capabilities of an economy. Cases here include Uganda, Mozambique and Zimbabwe.

- Countries with high industrialisation but low capabilities typically exhibit boom/bust or episodic growth patterns. In this case one-dimensional reforms increase industrialisation, but the government does not invest in human and institutional capabilities. This initially produces very high growth, as the economy reaps industrialisation benefits, but this growth is not sustained due to the lack of human and institutional capacity to build on the momentum. Brazil, Mexico and South Africa all fall into this category.

- Countries with low industrialisation but high capabilities tend to show slow growth patterns. While a country may have built quality institutions and human capital, it has industrialised little. Consequently the economy cannot produce goods and services at a sufficient pace. We see this typically in countries like Argentina, El Salvador and Venezuela.

- Finally, economies that have built high-quality institutions and human capital, and have industrialised sufficiently have been able to attain high and sustained growth. Success stories here include Japan, South Korea and Taiwan.

The conclusion is that only countries that steadily increase their fundamental human and institutional capabilities, while simultaneously industrialising, become prosperous.

HOW DO WE JUDGE THE SUCCESS OF ECONOMIC REFORM?

Taking the past as a guide, governments can judge the success of their reform efforts as they are being implemented. Their tools include measures of GDP growth, GDP per person (a measure of the average person’s wealth), unemployment, the diversity of production (including exports), and even the level of crime.

Industrialisation and manufacturing exports have been shown to be the most reliable levers for growth, with manufacturing acting as an escalator through an expanding network of suppliers and new job creation. Studies have also found a strong positive relationship between a country’s GDP per person and the diversification of its manufacturing/export capability. The more diversified the economy, the higher the average GDP per person is likely to have. As such, structural reform also entails diversifying the goods and services the economy produces, so that it is more resilient and less prone to boom-and-bust cycles. Finally, it has also been shown that state intervention need not stop growth, if it is backed by research and implemented carefully and expertly.

Past examples of countries that have achieved notable success in implementing structural reforms include Brazil, Malaysia, Peru, Tanzania and Turkey. In most cases the reform programmes have taken place over three decades or longer, but in terms of their acceleration in average real GDP growth per person, it is clear that once reforms start working their way through the economy, the higher growth rate helps improve people’s well-being significantly.

Among these examples, Tanzania showed the lowest improvement, doubling from a 3% average growth rate pre-reform to 6% post-reform, while Peru demonstrated the most improvement, moving from -19% pre-reform to 17% afterwards, an exceptional 36 percentage point increase.

PERU: A NOTABLE SUCCESS

Graph 1 details Peru’s successful reform example. The red line shows Peru’s journey from a lower middle-income country (with real GDP per person of US$3,000) in 1989 to an upper-middle income country at US$6,000. Its major catalyst for GDP growth came in 1993 through a package of reforms that encompassed fiscal reform, industry regulations, business regulations, banking sector reform and more, quickly followed by labour reform in the late 1990s. Although this did spark political turmoil, these far-reaching changes were implemented soundly, and it didn’t take long for productivity and GDP to grow sustainably for many years, even weathering the Global Financial Crisis with relatively little pain.

ZIMBABWE: A RETURN TO ROBUST GROWTH?

Of course, reform isn’t a panacea for economic success, and can go very wrong. Zimbabwe’s land reforms at the end of the 20th century are an example of structural reform policies implemented poorly, resulting in disastrous economic consequences. Real GDP per person actually shrank just under 1.5% per year on average between 2000 and 2017 – meaning the Zimbabwean economy has shrunk by 25% in under 20 years.

It is still very unclear what growth rates Zimbabwe will be able to achieve under its new leadership, but current GDP forecasts for 2018 are around 4.5%. In perspective, this acceleration would also raise South Africa’s trade-weighted growth rate by more than the new fiscal stimulus in the United States, at least in direct terms.

Taking a longer-term perspective, had Zimbabwe simply matched the per capita growth rate of its neighbours over the past two decades (2.9% annually), its GDP per person would now be more than double the current levels. This implies that Zimbabwe’s “politically-adjusted” potential growth rate could be very high.

WHAT ABOUT SOUTH AFRICA?

To return to South Africa, as the World Bank has diagnosed, our country needs to accelerate its economic growth through structural reforms in order to reduce inequality, lift incomes, create jobs and start addressing some of its social problems such as crime.

The country’s real GDP per person has hardly risen since 2008, the time of the Global Financial Crisis – as shown in Graph 2. South Africa has moved from US$5,800 in 1968, when it was the richest country compared to its peer group, to only US$7,500 in 2016. Other middle-income countries, like Brazil, Mexico and Malaysia have managed to grow much faster, outpacing high growth in their own populations.

Although South Africa’s contact crime rate has fallen sustainably from its peak in 2002 as economic growth accelerated through 2008, it has remained stubbornly high as growth has stagnated. Even more importantly, economic growth has not been high enough to prevent unemployment levels from rising steadily, now standing at well over 6 million people.

These conditions make the time ripe for deliberate, meaningful reforms. I believe we can be cautiously optimistic with regard to such reform efforts. Since the election of Cyril Ramaphosa as President in January this year, his government has been engaged in structural reforms, some of which have already resulted in some success. These include:

Energy stabilisation: Additional Medupi and IPP power supplies now online. Base load reserve margins have been rebuilt.

Labour stability: Promotion of a stable labour relations environment in the interest of reducing strike outages. Secret ballots introduced at unions; minimum wage introduced.

Regulatory burden: Reducing time spent on compliance and paperwork, streamlining contract enforcement.

Immigration reform: Relaxation of certain visa regulations with a negative influence on tourism and business travellers.

Renewable energy: Finalisation of latest round of independent power purchase agreements.

Governance: Appointment of independent and qualified heads to the boards of state-owned enterprises (SOEs).

Cabinet reshuffle: Removal of underperforming ministers, and strong appointments to the Ministry of Finance and Public Enterprises.

Other reform considerations for the government include: 1) partially privatising some SOE assets; 2) narrowing the focus of their reform efforts to ensure full support for the most appropriate and achievable reforms; and 3) prioritising the resolution of the Mining Charter impasse to provide certainty, while agreeing on a timeline for implementation.

However, we still need even more far-reaching reforms that will attract investment, build infrastructure, provide high-quality education and skills to grow our human and institutional capabilities and lift potential growth. Only with these types of deep transformative policies will South Africa be able to reduce unemployment and create wealth for ordinary South Africans.

Based on the successes of the past, South Africa has demonstrated its capacity to achieve this.

* AN INCOMPLETE TRANSITION: OVERCOMING THE LEGACY OF EXCLUSION IN SOUTH AFRICA”, THE WORLD BANK GROUP, SOUTH AFRICA SYSTEMATIC COUNTRY DIAGNOSTIC, 2018

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter