A slow burn for SA’s new rapid payments system?

This article was first published in the Quarter 4 2022 edition of Consider this. Click here to download the complete edition.

Key Take-Aways:

- Investors might assume that the impending introduction of a cheap and easy new cashless payments system will be negative for our large commercial banks, since clients will switch away from their more expensive, higher-margin products.

- We believe the actual impact will be more nuanced. If the system is priced correctly, lower-income consumers will be most likely to adopt it, while middle- and higher-income clients may use it but still retain their credit and debit cards thanks largely to loyalty programmes.

- If many participants in SA’s large informal economy use the system, more of their financial activity will be brought into the formal economy. Some will eventually trade up to higher-margin banking products, benefiting banks all around.

Consumers and business owners may be starting to get excited about the introduction of a Rapid Payments Programme (RPP) in South Africa, which is expected in the first quarter of 2023 under the guidance and regulation of the South African Reserve Bank (SARB). The new digital system, developed collaboratively between the larger local banks, will offer a cashless, simple, near-frictionless and cheaper way to conduct real-time transactions for anyone with just a cell phone number or even an email address.

Just think: no more waiting in long queues to deposit or withdraw cash, and no more piles of cash at day-end. No more days-long delays for much-needed payments to clear. No need to scramble for coins or small bills to tip the car guard or petrol attendant; instead, pay immediately by transferring digital rands from your phone to theirs. Merchants are also set to benefit from lower transaction costs, and e-commerce sales will become less expensive and complicated without the complex fraud verification charges of credit cards. These are just some of the more obvious benefits of the RPP.

While South Africa was historically a trend-setter in developing one of the first real-time interbank payment systems back in 2006, it has been focused more on the high-value and low-volume transactions. Despite offering payments within a mere 60 seconds, it is expensive to use and hence its adoption has been very low. It also focuses on bank-to-bank payments, something the RPP seeks to address over time.

How will it work?

The system has been tailored for smaller value and higher volume payments, based on advanced technology used in a simple architecture to keep costs as low as possible. To make a payment using the RPP, the user will send a message to a recipient’s email address, mobile phone number or bank account with the payment amount. Upon receipt, that amount will immediately reflect in the recipient’s account, to be used later for their own digital payments. It can also be converted into cash again if needed, by transferring it into a bank account and withdrawing the funds via an ATM.

What is different about the RPP is the fact that the payer will bear the cost of the transaction, which is expected to be as low as 0.10%-0.30% of the total payment value – substantially cheaper than cash withdrawal charges. Although it will not be completely free as in some other countries like India, it will certainly be cheaper than the 1.5%-2.0% charged by credit cards like Visa and Mastercard, or the even more expensive fees charged by the likes of an American Express or Diners Club. However, these credit card charges are generally borne by the merchants who accept these methods of payment. Banking clients are actively incentivised via loyalty programmes like FNB e-bucks, Absa Rewards and Standard Bank UCount to make use of their credit cards as the preferred method of payment.

In addition to accepting normal payments, RPP will also allow for send-to-receive payments. These are instances where in the shops, the buyer will give the vendor their cell phone number, and the vendor then sends a payment request to them for the buyer’s approval.

From the vendor’s perspective, vendors are incentivised to join the new system because it is so much cheaper than them having to pay the fees charged by banks to process credit or debit card transactions (discussed above).

One largely unknown factor at this stage is the security risks to these transactions and to individuals’ accounts on their cell phones or emails. There is certainly some capacity for fraud – it is possible for hackers to gain access to someone’s phone or email account with potential uncertain consequences at this point. One potential mitigant that the SARB could introduce to address this risk would be to limit payment values, at least to start with, to reduce incentives for fraudsters. We understand the initial transactions will be capped at R3,000.

Boon or bust for banks?

Who wouldn’t been keen about the advent of the new system? At first glance, SA banks and their investors, given that the banks earn high fees and margins from the country’s existing payments set-up, and the RPP is a lower-margin service. Additionally, it uses open architecture that will ultimately allow non-banks access to the payment infrastructure, creating even more competition. It is easy for analysts to assume that the lower cost of the cashless option will encourage droves of bank clients to switch immediately to the new system and give up their existing higher-margin bank products.

However, in our view, this would be an incorrect assumption: based on evidence from several other countries, there are strong incentives for the existing structures to remain in place. In the first instance, the existing bank reward structures typically ensure that transactions like credit card payments not only remain relevant but grow. In the second instance, the low value/high volume nature of the RPP system has been very effective in capturing a large part of the existing cash-based activities. This increases the overall pool of electronic money in the system and more importantly the velocity of the transactions. Key to this is the pricing of the service. The cheaper the service, the better its take-up.

If we look at the examples of India and Brazil, their rapid payments systems have proved to be huge successes. They kept infrastructure costs low and were able to price their services at appropriately low entry points to make them accessible to the lower end of the pyramid. The simpler infrastructure has also allowed the systems to expand more easily, being taken up not only by individuals, but also by shops, medium-sized businesses, informal traders, and many other participants in the informal economy.

Meanwhile, in places like Europe rapid payments have not been as successful. The primary consideration there has been the pricing of their systems, which proved to be inappropriate to incentivise a true transition away from the cash economy.

What about South Africa?

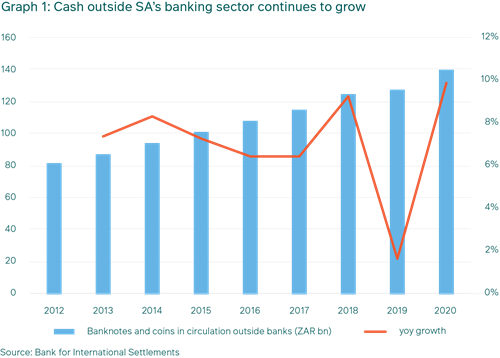

In South Africa, estimates show that just over half of all point-of-sale purchases are still made using cash, while in the informal economy nearly 90% of transactions are cash-based. It is clear from these numbers that the existing payment methods have proved too expensive, too difficult, or do not offer enough value for the average South African. Equally, banks have been less focused on offering affordable services to the lower-income segment of the market, or small businesses, due to the high costs of providing these services, although the traction gained by the likes of a Capitec in capturing this market segment has been a notable exception in recent years. But even their simpler, lower-cost services have not managed to convert many of those operating in the informal economy. Graph 1 shows how cash levels circulating outside of the banking system just keep rising despite South Africa’s relatively sophisticated financial infrastructure.

In fact, to persuade more people to move away from cash, the RPP needs to be affordable enough to outweigh the benefits of avoiding taxes, simple enough to be almost as convenient as cash, while also overcoming questions around distrust of new technology. The feature of its greater security than holding and transporting actual cash certainly works in its favour. Based on what we know of the service so far, we believe the RPP does have a good chance of eventually attracting many users like the average taxi driver or shop owner.

There is certainly a tremendous opportunity for an affordable digital payments system to gain traction. According to Stats SA, the country has some 1.8 million informal traders, of whom 80% do not use banks at all. And of the 20% who do have a bank account, the majority only use it to process payments. However, most South Africans do use a cell phone. Adoption of the digital option could prove transformative for many users such as small, rural traders, for example: cash flows can be tracked on a near real-time basis, without settlement delays, resulting in more efficient timing for stock orders and management and, consequently, more rapid growth for these businesses. This so-called “lazy money” will become more productive. And let’s not forget the broader economic benefit for the South African economy of having cash transactions become trackable by the tax authorities. Even if many users remain below the VAT threshold of R1.0 million turnover, income tax collection becomes possible, and the transaction records can prove to be an invaluable source of information on which to base government policies.

Gradual adoption won’t materially impact SA banks

However, in our view the adoption of RPP will take time, and it is not likely ever to fully replace cash as a transaction medium. We also don’t believe it represents a material risk to banks’ profitability. This is because the RPP is designed largely for the lower-income segment of the market, where the big commercial banks have few higher-margin clients to lose. Also, banks are likely to be able to retain their middle- to higher-income debit and credit card clients who appreciate the benefits of loyalty programmes and not having to carry cash. While these clients may opt to use the RPP occasionally for smaller payments in circumstances where credit cards aren’t possible, they are likely to keep their cards for their convenience and their ability to protect against any fraud. Electronic fund transfers (EFTs) will also remain a competitor for the RPP.

Lastly, another important point possibly overlooked by analysts at first glance is the positive knock-on effect of gradually bringing so many informal market participants into the formal economy over time. First, there is the expected boost to growth from improved efficiency and productivity, and lower security risks as mentioned above. Second, experience in other countries has shown that as people become comfortable with using technology to transfer funds instead of having cash in hand, they also become more open to adopting more sophisticated banking products. This can help banks gain more trust and acceptance among lower-income South Africans and small businesses, and in turn broaden their client base as they sell up their value-added product chain with higher-margin products. Expanding the formal economy can only be positive for our banks over time.

In conclusion, we are looking forward to seeing how the market greets the new system in 2023. Its introduction first by three of the bigger banks, as the most advanced in finalising their architecture, will give them first-mover advantage to some extent. Our M&G house view portfolios remain overweight the banking sector thanks to their attractive valuations and the benefits of higher interest rates (the endowment effect), as well as banks’ high levels of provisioning (continuing from the pandemic period) that are now being used to offset pockets of rising bad debts. As noted above, we see the RPP as introducing some positive opportunities for the sector as well, given the current extent of the cash economy.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter