SA Banks: Good bets despite rising interest rates

Key take-aways

- During the Coronavirus crisis, SA banks made extensive provisions for non-performing loans, and emerged with healthier-than-expected balance sheets for several reasons.

- SA bank earnings are set to benefit from a gradual rise in interest rates with judicious management of their lending practices, and should not need to raise further provisions.

- M&G Investments believes SA banks should deliver above-market growth and returns based on their current valuations, including a scenario where inflation is higher than expected.

This article was first published in the Quarter 1 2022 edition of Consider this. Click here to download the complete edition.

In South Africa and around the world, central banks are hiking their base interest rates and cutting back their asset purchases as inflation rises and economic growth solidifies in the wake of the (current) retreat of the Coronavirus. Investors are keeping a close eye on the pace and extent of the forecast monetary tightening, concerned that central bank policymakers may err on the side of tightening too much and cutting off growth. With the war in Ukraine and sanctions against Russia pushing energy and food prices higher and threatening to send them skyrocketing even further, central banks’ task of balancing future growth and inflation has been made even more difficult. Lifting interest rates too high, too soon, would impact negatively on corporate earnings and stock valuations across all sectors and types of companies.

Broadly, in a rising interest rate cycle corporate borrowing costs become more expensive, while consumer spending slows. This combination of higher costs and lower sales results in reduced revenue, so companies become less profitable. From a valuations perspective, investors value a company by using a discount rate to calculate the present value of its future cash flow, also referred to as the Discounted Cash Flow method. When applying this valuation methodology, increases to the interest rate result in a higher discount rate, which reduces the present value of companies’ future earnings, and consequently, the price that investors are willing to pay for that stock.

However, there are exceptions to this broad view: banks are one type of company that can benefit from a rising interest rate cycle, as long as that cycle’s duration and extent remain moderate.

This is because they earn a portion of their total income as an endowment – the pot of capital they have set aside earns interest, so their income rises as interest rates increase. As long as consumers can still repay their loans, and banks’ non-performing loans (NPLs) don’t deteriorate too far, this scenario can be earnings-accretive. If, however, the rate hiking cycle is aggressive, with increases coming too fast and/or too steep for more consumers to be able to afford their debt repayments, banks’ impairment costs will rise and earnings will suffer.

Outlook for the cycle

For now, the local market and the South African Reserve Bank are forecasting a moderate hiking cycle in terms of its timing and value. The Forward Rate (FRAs) market is pricing in 11 rate hikes totalling 275 bps over the next 24 months. Local inflation has remained more subdued than its global counterparts due largely to the low growth environment, and inflation expectations remain below the 6% upper limit of the SARB’s 3-6% target range. Globally, meanwhile, although concerns are growing over inflationary pressures from the much higher prices of oil and gas as a result of the Russian invasion of Ukraine, interest rate markets have recently been pricing in more moderate rate hikes from the US Federal Reserve, as investors weigh the balance the Fed must strike between supporting growth and reining in inflation.

Past versus present

Historically, in South Africa we’ve seen that rate hiking cycles of over 150 basis points or so, spread over a short six-month period, have triggered an increase in NPLs such that banks have had to raise their provisioning levels in excess of what they would earn from the endowment benefit. This is more aggressive than the current projected cycle. Also, these days the National Credit Act has made banks much more judicious in their lending practices, so that it is now difficult to compare the current environment with the past. Growth in bank financing across credit cards, vehicle finance, home loans and personal loans has remained in the mid-single- digits, compared to around 20% before the introduction of the Act. It has been even more subdued during the Coronavirus crisis, even lower than inflation. As a precaution, during the worst of the crisis banks took very large impairments, allowing them to set aside high levels of provisions and did not pay out dividends.

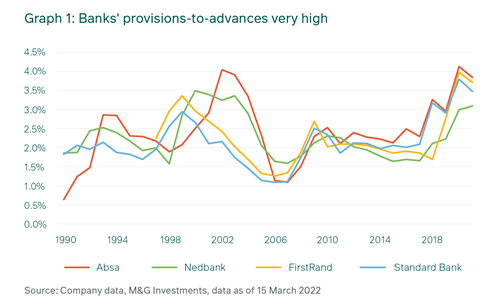

Thanks partly to their more conservative lending practices, banks’ performances proved to be better than expected, as although NPLs did rise notably, they were amply provisioned and maintained healthy balance sheets. Current provisioning levels are substantially higher than what they were during the Global Financial Crisis – in fact, banks have overprovisioned. Graph 1 illustrates how banks’ provisions versus their advances are at very high levels compared to their history.

Overprovisioning and healthy margins

As such, the market is anticipating that some of these provisions will be written back, improving earnings and capital levels further. Another portion could be retained in case of much worse-than- expected NPLs going forward if, for example, interest rates hikes were to be more aggressive than currently expected. In the unlikely event that NPLs are much worse than anticipated, in theory the banks already have the provisioning in place to cover a substantial amount of uncertainty.

It is important to note that bank margins were shielded in part from the full impact of the exceptionally low interest rates. Although they did pass on a portion of the SARB’s interest rate cuts to consumers, banks retained a buffer, which also protected their earnings. Now, as interest rates rise, that buffer will narrow, but banks will be repricing their own lending rates higher as well. The banks have focused on repricing assets and have successfully locked in more attractive margins over the period. We expect bank margins to continue to expand from these levels.

The consumer: Not such a wildcard

Meanwhile, although South African consumers have been hit extremely hard by the Coronavirus crisis, the worst appears to be behind us. Those with jobs have been able to save more due to the low interest rates and lockdown conditions, and are able to afford bigger deposits for their new loans, lowering the risk to banks.

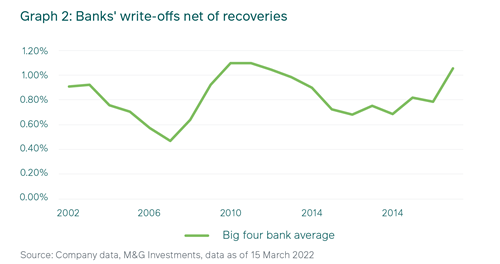

Another favourable factor is that South Africans are used to funding themselves with debt. History has shown that they have a high propensity to repay their loans, so even if they experience difficulties, it is usually a matter of an extended repayment term, rather than a full loss for the lender. Graph 2 shows that the banks’ write-offs net of recoveries (as a percentage of opening gross advances) are currently lower than they were in the years following the Global Financial Crisis, and stable over an extended period at around 83bps. This means that on average, only 0.83% of gross loans written by banks are not recovered compared to the approximately 3.5% they hold in provisions.

A beneficial investment

In short, the above factors make us believe that it is unlikely that banks will need to raise their provisions further during the current rate hiking cycle, thereby avoiding any balance sheet impairments. They should be among the few sectors to benefit from rising interest rates, carefully compensating for rising risks of non-repayment with higher interest rates for customers. Further into the cycle we do think higher rates are likely to dampen some lending activity at the margin, but not to a meaningful degree.

In our view, the South African banking sector is one of the best places to be invested going forward when you consider the direction of interest rates. More importantly, however, bank stock valuations remain extremely attractive compared to their history and relative to many other sectors, and have excellent potential to re-rate further once the true extent of their write-backs of provisions is known. Absa, Investec and Standard Bank are among the top equity holdings in our flagship unit trusts like the M&G Balanced, Inflation Plus and Equity Funds, and we believe this positioning will help add above-market returns to our client portfolios over the medium term.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter