The SA motor industry: Blowing a gasket in 2020

This article was first published in the Quarter 2 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- South Africa’s motor vehicle industry had already been shrinking ahead of the onset of the Coronavirus, and the economic lockdowns it prompted in 2020 had a devastating impact on motor vehicle sales, rentals and manufacturing, causing even more severe downsizing.

- The four main listed motor vehicle companies were hard-hit in terms of profits, job losses, salary cuts, fleet and dealership downsizing and more, and their share prices fell significantly during the worst of the crisis.

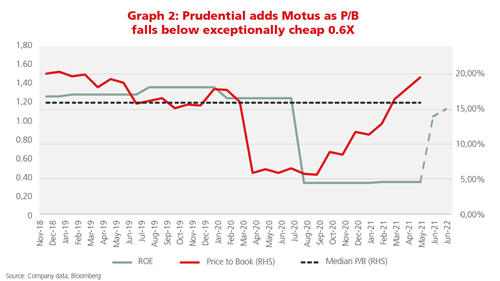

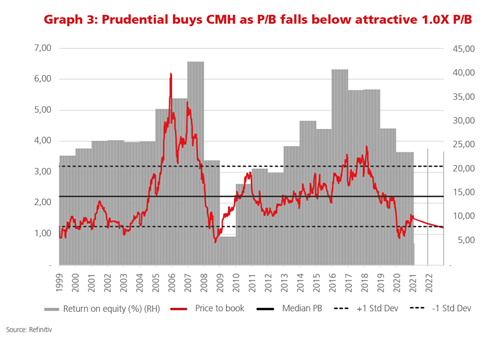

- Prudential added to its position in Motus, and bought shares in CMH, when the companies’ price-to-book valuations were extremely attractive, due to their improved profitability following cost-cutting, much stronger cash generation and prudent cash management. The share prices have subsequently rebounded, adding vaue to client portfolios.

The advent of the Coronavirus pandemic in South Africa was the equivalent of a blown gasket for the local motor vehicle industry, rendering it incapable of powering ahead without some serious repairs in an already-weakened environment. The economic lockdowns of 2020 caused motor vehicle sales to grind to a halt for a time, prompting further downsizing across the major companies, and it was only these “repairs”, plus a better-than-expected performance from the pre-owned vehicle business segment in the last two quarters of the year, that supported industry results. Although both new and used car sales were lower for the year, the cost-cutting and resulting improved profitability left the companies better equipped to accelerate out of the crisis, albeit still having to navigate tough conditions.

An important, but shrinking, sector

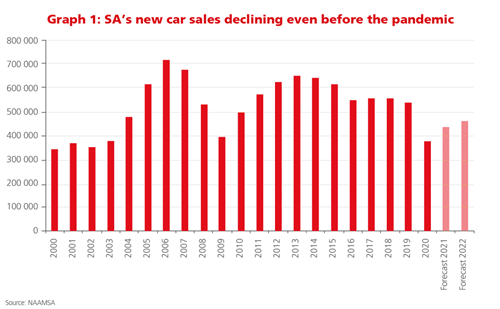

The local automotive industry, comprising vehicle manufacturing, exports and retail sales, contributes some 6.4% to South Africa’s GDP, while accounting for a total of around 457,000 jobs across manufacturing, assembly, retail sales and other associated roles, thanks to the strong multiplier effect created by the sector. It is the country’s largest manufacturing industry. However, these numbers have been shrinking in recent years, as Graph 1 highlights, due to the slowdown in the economy and associated pressure on consumer spending: new vehicle sales amounted to only 536,000 in 2019, a 25% decline from their peak of nearly 714,000 in 2006. Consequently, even before the pandemic, the sector had been downsizing in the form of closing loss-making dealerships; moving away from dealership brand exclusivity to the consolidation of several brands under one dealership; reducing real estate space and staff complements; and cutting rental fleet sizes to help companies remain profitable in a shrinking market.

Not only have consumers been cutting back their new car purchases in absolute terms, but they have also been trading down from premium, more expensive brands like Mercedes and BMW to the more affordable brands like Toyota, VW, Hyundai, Renault, Nissan, Mazda, Kia, as well as relative newcomers Suzuki and Haval. Affordable brands have gained good traction in the local market, having managed to improve their quality significantly over the years, taking market share and heightening competition even further.

Coronavirus takes new sales levels back 20 years, devastates rentals

Into this depressed environment came the Coronavirus, with its accompanying market lockdown, in March 2020. Vehicle sales and manufacturing were completely shut down from 27 March to 13 May, when most of the damage was done, with April sales registering an incredible 98% drop from 2019 levels and May down some 68% after the reopening. And sales have only recovered partially since then: every subsequent month’s volumes have been below their 2019 equivalent. For 2020 as a whole, local new vehicle sales totalled only 380,000, 29% lower than 2019 and at a level last seen some 20 years ago, as illustrated in Graph 1. Buyers have not been sufficiently tempted despite 50-year low interest rates. Vehicle exports from South Africa also fell by nearly 30% for the year as a result of a plunge in offshore demand, hitting jobs and industry revenues alike.

Exacerbating the conditions has been the virtual standstill in business travel and international tourism for most of 2020, which has had a devastating impact on the car rental businesses of the country’s four major listed vehicle retailers: Motus, Bidvest, Barloworld and Combined Motor Holdings (CMH). Approximately 13% of new cars sold in the country are sold on to the rental businesses every year. Leasing operations including those of Europcar and Tempest (both owned by Motus), Bidvest Car Rental (Bidvest), Avis (Barloworld) and First Car Rental (CMH) were dealt a severe blow, and rental demand remains subdued to the present day.

Used vehicle market thrives

One of the only lights in the industry in the last year has come from the pre-owned vehicle market, where demand has risen in recent years due to the trend of consumers moving away from buying new cars. This was only accelerated by the pandemic. When sales restrictions eased in the latter months of 2020, used cars saw strong purchases due to pent-up consumer demand, as well as new demand from consumers preferring to switch away from unsafe public transport, a trend that was mirrored in many other countries. Also in favour of the used car market was the rand’s sharp depreciation, which made new cars more expensive, as well as the decrease in supply from the new vehicle market due to the disruptions in manufacturing. All these factors helped create a floor under pre-owned market prices.

At the same time, the surge in demand for used cars also supported the rental market to some extent. This is because when the rental companies are regularly “de-fleeting”, or reducing their inventory of used rental cars at the end of the tourist season, they sell into the used car market. Last year, many in the industry were concerned that dumping new supply after the severe lockdown conditions where dealerships were not allowed to operate (just after peak tourist season when the most de-fleeting occurs – April to June) would overwhelm demand and cause the used car market to collapse. However, this didn’t happen. Instead, the rental companies sold their stocks slowly into the market and were also met with resilient demand in the third and fourth quarters of the year. Surprisingly, groups like We Buy Cars reported their best August sales ever, and Barloworld’s used car division similarly experienced an excellent August and September. This strong demand contributed to maintaining a price floor under the pre-owned market.

The automotive retailers managed to improve their profit margins after having taken tough downsizing measures. Because they had larger-than-usual de-fleeting that was necessitated by lower rental activity levels, they had more cash on hand, using it in turn to pay down their debt more quickly and improving their balance sheets. Plus, having aggressively cut the size of their rental fleets there was less depreciation to write off, lower overhead costs due to fewer branches and staff (Motus had retrenched 45% of its rental staff, for example) and, also key, improving the utilisation rates from very low levels for their (fewer) existing vehicles. Financing costs for the industry also fell due to the SARB’s aggregate 300bps (3%) interest rate cuts during the year, lower debt levels and having fewer vehicles to finance. For example, given that Motus has debt of R7.6 billion on average, the 300bp reduction in the interest rate saves them around R200 million per year in interest costs, which is highly earnings-accretive.

Not firing on all cylinders

Despite these positive developments, none of this rationalisation has proved successful in returning the vehicle rental businesses to profitability. The general consensus is that it takes a 65%-70% utilisation rate for a company to be profitable, and Motus most recently reported a utilisation rate of 59%. The latest financial results across the motor industry confirm that even though companies are getting closer to profitability in their shrunken formats, much higher total demand is needed for the rental segment to be profitable. This requires the return of international tourism and resumption of business travel, and without these key factors, the rental market is incapable of firing on all cylinders.

If we look at the impact the pandemic has had on the individual listed companies in the sector, we see that all four companies’ share prices de-rated considerably in the first few months of the lockdown, with the 68% drop by Motus the largest, and the 29% decline by Barloworld the smallest. Both CMH and Super Group lost around 50% of their value. Subsequently all have experienced a gradual re-rating, largely due to their higher-than-expected cash generation and improved profitability. All the companies acted prudently, conserving and generating more cash, paying down debts and cutting costs severely.

Geared to meet the post-Coronavirus world

Looking ahead to 2021 and beyond, the National Association of Automobile Manufacturers SA (NAAMSA) expects local new vehicle sales to recover only gradually due to depressed consumer and business sentiment. As Graph 1 shows, it is forecasting a 15% increase in new vehicle sales volumes to around 440,000 for this year, gradually building up to potentially reach 2019’s volumes only from 2023 or so. This is slower than most other countries’ projected recoveries due to the recessionary environment we had already been experiencing. Still, demand is improving, helped by exceptionally low interest rates, subdued core inflation and dealer incentives, among other measures. These factors, combined with good demand in the used vehicle market and the prospect for the local rental market to improve as tourism and business travel gain ground (propelled by spreading vaccinations), gives us reason for optimism that the sector is over the worst. While it will not be a smooth road ahead, at least the companies are now appropriately sized and geared to meet the exigencies of the post-Coronavirus world.

Following we offer snapshots of Motus and CMH, and explain why we are holding these companies’ shares in select client portfolios, including the Prudential Dividend Maximiser Fund.

Motus: Market leader with strong cash flows

Motus is a good example of the experience of the entire sector during the pandemic. It suffered the sector’s largest share price decline, primarily because it has the largest market share (at 20.2% as of June 2020) and is very dependent on the local vehicle market. It unbundled from the Imperial group in November 2018, and is squarely focused on the industry, with a fully integrated business model across imports and distribution, retail, rental, financial services, and aftermarket parts and services. It is focused on entry-level and affordable vehicles rather than the premium segment, and has exclusive sales agreements with Hyundai, Kia, Renault and Mitsubishi, as well as selling popular brands like Toyota and VW.

Prior to the pandemic, Motus was highly cash generative, with a strong free cash flow and balance sheet: it had maintained a net debt/equity ratio (gearing) within its longer-term target range of 50%-75% for several years. During the April-June 2020 period, at the height of the lockdown and end of its financial year, Motus reported a 70% decline in revenue from its rental operations (Tempest and Europcar brands in South Africa), a 40% drop in its retail sales operations and a 50% revenue fall from imports and distribution. Although the company’s vehicle retail and rental business accounted for some 70% of its revenue in the 12 months to June 2020, this segment contributed only 14% of its total profit – the operating margin was only 0.6% for the period. By contrast, its financial services business stood it in good stead, despite its small (3%) contribution to group revenue, thanks to its annuity revenue streams: it comprised nearly 40% of its operating profit with only a 10% decline in revenue. In total, Motus reported a 7.8% decline in total revenue and 41% drop in total profit for its 2020 financial year.

The group also has retail sales and rental businesses in Australia and the UK that provide some diverse income streams. The Australian vehicle market didn’t experience as large a downturn as South Africa, and has recovered much more quickly, and although the UK vehicle market was hit hard by lockdowns, it is also bouncing back more quickly than the local market.

A large part of Motus’ focus during the pandemic was on cutting its costs, starting in an environment where it had already downscaled due to South Africa’s extended economic malaise. Not only did it accelerate its de-fleeting, cutting its rental fleet by 35% or some 7,000 vehicles, but it also closed 19 outlets countrywide and reduced its rental workforce by 45%. Every source of spending was impacted, with both voluntary and compulsory retrenchments, salary cuts for everyone earning over R250,000 annually, salary freezes for FY2021, the postponement of all capital spending and property rental deferrals, among other measures.

Motus also opted to conserve its cash, suspending its dividend payments for both December 2019 and June 2020, but resuming them for December 2020 with a 30% payout level versus its traditional 45%. This was possible due to its strong cash generation during the year, which also allowed it to conduct share buybacks at attractive share prices. The group made it through the worst of the downturn with its existing debt covenants intact, plus some R5.8 billion in unused debt facilities, while its gearing stood at 60% at the end of June 2020, only slightly higher than the 56% a year earlier.

At Prudential we owned shares in Motus before the pandemic, buying when it traded below its longer-term valuation, based on the company’s strong free cash flow and balance sheet, plus its leading market position and large offering of used vehicles and small SUVs. Its retail business is also squarely focused on the growing entry-level and affordable vehicle segments, and the management team has proved its ability to be flexible and scale its operations to match the changing conditions of South Africa’s automotive market. Going forward it has a selective acquisition strategy to further diversify (already with a small presence in Southeast Asia and Southern and Eastern Africa) and implement more operational efficiencies and innovations.

We bought more exposure to Motus in our client portfolios when its P/B was extremely low, after its share price plunged due to the Coronavirus lockdown in March-April 2020, at one point down some 68% to a low of around R23.80. Since then, its price/book value ratio (P/B) has re-rated, rising to 1.3X and closer to its historical P/B of 1.5X. The return on equity (ROE) is also expected to improve to pre-crisis levels. Its share price managed to nearly double by the end of 2020, and as of the end of March 2021 had gained some 287% from its April lows, trading at R89.40 compared to its pre-Coronavirus price of R73.00. This is an excellent example of how Prudential’s clients have benefited as a result of our active, valuation-based investment process.

CMH: Offering excellent value during the crisis

By Kaitlin Byrne, Portfolio Manager

The conditions faced by CMH, and the actions it took to navigate the crisis, were very similar to those of Motus, with its primary focus equally being on retail and rental vehicle operations in South Africa (accounting for over 80% of its profits). For its latest interim results to 31 August 2020, the group reported a 38% fall in revenue, while operating profits were down 76%, and its operating profit margin was squeezed further from the 3.5% it recorded in 2019. This resulted in a loss for the six months of R14.3 million compared to a R90.5 million profit a year earlier.

CMH also underwent extreme cost cutting and down-sizing as it reported total staff numbers were cut by 24% over the six months and it instituted a salary sacrifice programme. It was also able to negotiate concessions from its landlords like rental holidays and payment deferrals, while merging franchises to reduce its rental costs. Thanks to de-fleeting, its finance costs were lower and cash resources rose 13% for the period, and the group was able to declare a dividend for the six months to August 2020 (based on its earnings for the year to end Feb 2020), after skipping its annual dividend payout for the 12 months to end February 2020 to conserve its cash resources.

Being the smallest company in the motor vehicles sector, CMH has low structural costs relative to its competitors and also primarily offers affordable brands like Haval and Suzuki, catering to the more buoyant end of the local market. Because of its ability to bring in the right brands at the right prices, It has been increasing its market share in recent years, but with a market capitalisation of only around R2.0 billion it is still relatively small compared to Motus’s market cap of R17.9 billion.

From its Coronavirus low of around R9.00 in May 2020, the CMH share price reached R15.00 by the end of the year and had nearly doubled to R18.00 by the end of March 2021. Still, this was just off the R18.40 level at which it was trading prior to the advent of the pandemic, so the share has not performed as well as Motus during the recovery. CMH should return to a position where it can earn a 24% return on equity – even with lower rental sales and car sales – as a result of its substantial reduction in costs and interest rate savings.

Consequently, when the company traded at a P/B of 1.0X in March 2020, far below its longer-term fair value of closer to 2.5X P/B, it presented us with a unique opportunity to buy CMH shares. At the same time, it was trading at a very high long-term dividend yield of 18%. Since we believed the cash-generating ability of the business had not deteriorated permanently and we regarded it as an excellent dividend generator, we decided to add it to the Prudential Dividend Maximiser Fund. Subsequently, the CMH share has recovered, adding good value to our clients’ returns, but it is still very cheap at a P/B of 1.6X and a long-term dividend yield of 10%.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter