Tax-Free Investments: How are investors benefiting?

Introduced in March 2015, tax-free investments have now been available to investors for nearly three years, including five tax-free unit trusts offered by Prudential. While this remains a relatively short history in terms of investment horizon, we are now able to see more clearly how investors are benefiting from the tax savings they offer.

Among Prudential's tax-free unit trusts, the most popular investment fund choices have been the Prudential Enhanced SA Property Tracker Fund and the Prudential Balanced Fund. One of the reasons the Property Fund is so popular is its potential for relatively higher tax savings while also boosting potential long-term portfolio returns. Yet no matter which tax-free investment vehicle you choose, it's important to remember to make sure it fits within a holistic long-term financial plan. Focus on how to maximise your long-term after-tax return – not on simply what gives you the biggest short-term tax saving.

It is difficult to determine which types of tax-free investments would offer an individual the most benefit. The actual tax savings compared to normal (non-tax-free) unit trusts is dependent on a combination of factors, the primary two being: 1) your marginal income tax rate; and 2) the type and quantum of income and capital gains earned in your selected unit trust. Obviously, the higher your marginal income tax rate, the more you will save in these vehicles. At the same time, fund returns are taxed according to their source of income.

Taking a hypothetical example to illustrate possible fund returns and tax savings over time, let’s see how much tax savings would accumulate to an investor in the 45% income tax bracket if they had been able to invest tax-free over the past 15 years and selected the Prudential Enhanced SA Property Tracker Fund tax-free unit trust. They are able to invest the full annual allowance of R33,000 every year for 15 years, which means that they would have contributed a total of R495,000 over the period. This is very near the current maximum R500,000 lifetime limit. I have used the highest possible tax bracket and allowable contribution expressly to try to provide an indication of what could be the upper limit of the tax saving for individuals.

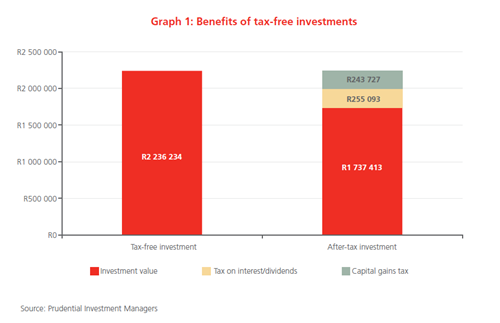

Graph 1 shows that the R495,000 investment in the tax-free fund would have grown to a total of R2.23 million by the end of 2017. By comparison, the same investment in the non-tax-free version of the Prudential Enhanced SA Property Tracker Fund (the identical fund but not the tax-free investment vehicle), and at the same fees, would have grown to R1.98 million, with R255,000 paid in taxes on interest and dividends (and with no annual exemptions applied). Then, if the investor decides to sell all or part of the non-tax-free investment, they will have to pay CGT of around R244,000 on these gains, reducing the investment value to R1.74 million and thus making the tax-free unit trust even more attractive.

The investor would therefore have notched up an extra R500,000 at the end of the 15-year investment horizon solely as a result of the tax-free benefits of this vehicle. This is a substantial bonus for anyone to add to their retirement income.

A similar example for an investor in the tax-free Prudential Balanced Fund in the 28% marginal income tax bracket would have resulted in an additional R270,000 investment value at the end of 15 years.

It is particularly beneficial to hold listed property companies in the form of REITs inside a tax-free investment because there is effectively no corporate or individual tax on the investment returns. While it may seem like holding cash inside a tax-free investment is also very attractive, because it does offer relatively high short-term tax savings, it may in fact be the least appropriate asset class to choose for your tax-free investment over the long term. The primary concern of investing in cash (and other short-term assets) is that it earns after-inflation annual returns of 1%-2% over the long term. This is substantially less than the 6%-8% annual real return provided by growth assets like equities and listed property. The returns on these longer-term investments, re-invested and compounded over many years, will likely be much more powerful than cash.

To invest in one of our top performing tax-free funds, apply online now or speak to your Financial Adviser.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter