TABLE TALK: Why financial advisers are worth it

This article was first published in the Quarter 4 2022 edition of Consider this. Click here to download the complete edition.

Key Take-Aways:

- More global research these days substantiates the value-added to investors by financial advisers, which has been quantified.

- Their value-add comprises better savings discipline, tax efficiency and asset allocation and, most importantly, behavioural coaching to avoid costly mistakes.

- The current volatile market conditions, where SA investors are likely to be reluctant to invest in higher-risk assets, are ideal for advisers to add value. SA equities and bonds represent good value for long-term investors, and advisers can help clients both overcome their reluctance to buy them and stay the course over time.

Question

I’ve seen that you often advocate for investors to use qualified financial advisers, rather than going it alone in their investment journeys. But do they add value beyond the fees they charge? Is their advice really worth it?

Answer

The value of advice is quite difficult to quantify, as it covers a very wide range of aspects. However, these days there is a substantial body of global research that demonstrates measurable, quantitative value for financial advice. There is considerable evidence that this added value for investors derives from various aspects, including improved savings discipline, tax-efficient structuring, better asset allocation decisions and behavioural coaching to avoid costly mistakes. In addition, the better results from advised investing contribute to greater peace of mind for those clients, more success in meeting financial goals, and better preparation for retirement and emergencies, all non-quantifiable benefits that are, in fact, invaluable.

Evidence of value added

Most recently, the November 2022 Whitepaper “Financial Advice in Canada” highlighted several different studies(1) that affirmed the value of financial advice. Perhaps the most well-known of these is the Russell Investments’ “Value of an Advisor” study, conducted annually in the US for several years now. In its 2022 report, Russell found that the approximate value of a financial adviser to their client was 4.91% – in other words, they added a net 4.91% to a client’s total return for the year. They broke this total value into four components:

- 2.37% from behavioural coaching – preventing clients from moving to low-risk assets or selling out of their portfolios during market downturns, and therefore locking in losses;

- 1.22% from tax-efficient investing and planning;

- 1.21% from informed asset allocation choices and family wealth planning (involving insurance, accounting, trusts, etc); and

- 0.11% from active portfolio rebalancing.

Other interesting US research found that those investors with financial advisers prior to the 2008 Global Financial Crisis (GFC) on average lost significantly less money (6.25% less) and experienced less wealth volatility than unadvised investors, after accounting for the level of risk taken, partly because they were less likely to make costly mistakes like selling equities in a downturn (Grable & Chatterjee, 2014).

In Canada, the “2022 Mutual Fund and ETF Investor Study” released jointly by the IFIC and Pollara in October 2022, found that 80% of unit trust investors and 73% of Exchange Traded Fund (ETF) investors stated that they believed they received a better return on their investments due to the advice they received from their adviser, with 74% and 64%, respectively, saying they had better saving and investing habits due to them.

Another study, the “Value of Advice Report” by Canada’s CIRANO Institute in 2018, found that after 15 years of investing, advised investors had accumulated 2.3 times more assets compared to their unadvised counterparts. And even after only four to six years of investing with an adviser, clients had built up 1.58 times more assets. The factors identified as contributing to this better outcome were higher savings rates, a higher allocation to non-cash investments (i.e., high allocation to risk assets in order to match longer term liabilities), and better disciplined behaviour through market downturns.

No time like the present for an adviser

It makes sense that in South Africa financial advisers can add at least as much value as in these developed country studies – and since our financial markets experience even more volatility due to their higher levels of risk, financial advice could conceivably be even more valuable. The current investing conditions are ideal for demonstrating this value, both in terms of actual investment returns and less quantifiable types of support. This is because periods like this – with most asset valuations cheap after having sold off through much of 2022, and market conditions highly uncertain and volatile – have been found to be when financial advisers can add the most potential value to client outcomes.

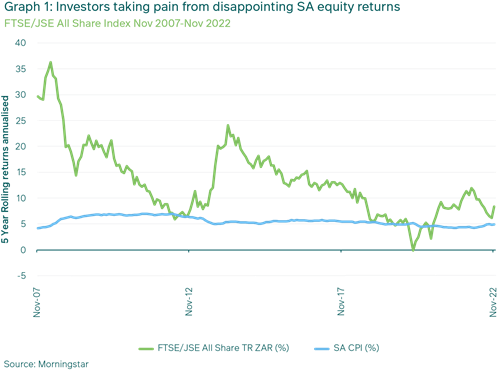

South African investors are understandably nervous and worried about the gloomy economic conditions both locally and globally: slow growth (and a possible global recession in 2023) paired with high inflation and interest rates are top-of-mind. Exacerbating matters is that 2022’s poor performance follows several years of pain from disappointing market returns already (especially longer-term domestic market returns), as Graph 1 shows, making investor sentiment even worse. No one wants to see their investment values continuing such low growth or even falling further. This type of fearful mindset makes it easier to succumb to common human behaviours like short-term thinking, acting out of emotion, selling assets when markets are down, and being too conservative in investment choices. This is where behavioural counselling by a financial adviser can help you avoid costly mistakes like these, and to stay invested during the perpetual ups and downs of financial markets over time.

Biting the bullet to buy risk assets

Investors are probably wondering how best to position their portfolios going into 2023. An adviser can help you answer this question by guiding you in your asset allocation and choice of unit trust funds most appropriate for your personal financial goals and investment timeframe. As the surveys highlighted, in many instances they have add value by helping their clients avoid overly conservative portfolio positioning, instead allocating less to cash and more to assets that can outperform inflation like bonds and equities than unadvised investors would in the same circumstances. This allowed them to better capture the higher prospective returns from these riskier assets.

In our view, for longer-term investors, based on the SA equity and bond valuations at the time of writing, it is worthwhile adding local equities and SA government bonds to your portfolio due to their attractive valuations compared to history and relative to many other assets. Our client portfolios reflect our preference for these higher-risk assets compared to most other asset classes – we think their prospective returns are worth the risk involved in holding them. And if you do hold riskier assets, then a financial adviser can help you stay the course and enjoy their full benefit over time.

Taking advantage of cheap valuations

As valuation-based investors, we are less concerned about the current bearish macro factors – although we do pay attention to them – and more focused on investment valuations, where we have good reason to be cautiously optimistic about investor prospects going forward. In our view, SA equities and bonds are offering attractive (well above-average) prospective returns for the risk involved in holding them going forward. We would therefore suggest it would be a mistake for longer-term investors to avoid SA equities and bonds in the present conditions, despite the negative news that dominates.

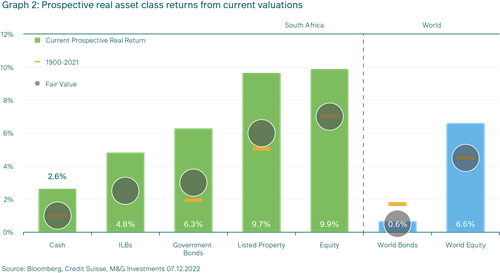

Graph 2 illustrates our high-level estimates of the prospective real returns from different asset classes based on their current valuations. As a brief overview, you can see that South African equity has the highest real return potential at 9.9% p.a. over the medium to long term, compared to its historic average (fair value) of 7% p.a. SA listed property is also very attractive, but we are more cautious on these assets as our in-depth analysis suggests they come with higher risks to prospective earnings than other equity sectors.

Additionally, South African government bonds stand out for their high prospective real return of 6.3% p.a., more than double their historic average of 3.0%. In our view, investors get handsomely rewarded for their associated risks. This is why, going into 2023, we prefer both South African equities and bonds over other local asset classes.

To benefit requires courage and patience

For investors to be successful in taking advantage of these excellent valuations, however, there are some personal qualities they require – the courage to buy assets like equities that have underperformed and disappointed in the recent (or even not so recent) past, and the patience to wait out market downturns and hold these investments until their prospective returns are delivered. No one knows the future trajectory or timing of financial markets, and history shows that it can take years for these “riskier” investments to pay off. But in the end they have done so, as Graph 2 confirms.

This is where the importance of having a financial adviser comes to the fore. There are few people who can stand to suffer financial losses, without being tempted to run for safety. Most need a partner throughout their investment journey who can offer their expertise in deciding how to invest through time, while also helping curtail the often-self-destructive human instincts that emerge along the way. We are all human and prone to the same behavioural mistakes. That is exactly where having a “sounding board” or “financial coach” can help you most.

In conclusion, if you don’t already have a financial adviser who has proved their worth, make sure you find one. Do your homework on the adviser, just as you would for any other professional service provider (lawyers, accountants, builders, etc.) to make sure they’re properly qualified and experienced. Then, even though you never know what’s to come in the investment universe, you’ll have greatly enhanced your chances of reaping the rewards of investing.

Appendix:

1. https://www.ific.ca/wp-content/themes/ific-new/util/downloads_new.php?id=27821&lang=en_CA;

2. https://russellinvestments.com/Publications/US/Document/Value_of_an_Advisor_Study.pdf

3. https://cirano.qc.ca/files/publications/2020RP-04.pdf

4. https://www.pollara.com/wp-content/uploads/2022/10/IFIC_2022_MF_ETF_Investor_Study.pdf

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter