Table Talk: Investing as a Retiree

Pieter Hugo, Managing Director of Prudential Unit Trusts, shares some insights on everyday investing issues.

Q: I’m a retiree and depend on my monthly income from my investments to get by. I thought my portfolio was well-diversified across lots of different assets, but in the last couple of years the growth hasn’t even kept up with inflation. Should I move out of my multi-asset fund and into something more conservative like cash to make sure my capital will last?

A: Although it’s understandable that you may be concerned about the performance of your multi-asset funds after three years of low equity returns, now is definitely not the time to lose faith in these funds. The appropriate time for switching - if there ever was one - has passed, and retirees are in danger of eroding the longer-term value of their retirement capital should they switch now.

There has been a trend towards switching into cash evident over the past year in the wake of the higher returns (of around 7.0% p.a.) offered by bank deposits and money market funds compared to riskier equity holdings. Poor equity performance has dragged down the returns of well-diversified multi-asset funds in which many retirees are invested: the average ASISA low-equity multi-asset fund delivered only 6.3% p.a. over the three years to 31 July 2017, and the average ASISA high-equity multi-asset fund (the typical “balanced” fund) returned only 5.5% p.a. over the same period, according to Morningstar. Compare these returns with those of the past 15 years, where high-equity fund returns averaged 12.5% p.a., and low-equity funds averaged 10.0% p.a. The longer-term performances are in line with the funds’ generally accepted return targets of inflation + 4% for the less aggressive low-equity category, and inflation + 6% for the more aggressive high-equity category, with long-term inflation at approximately 6%.

Given their recent underperformance, retirees dependent on income from multi-asset funds may think that they will benefit by moving to cash now. However, they would be getting their timing wrong by being too late. Current valuations show that prospective returns from multi-asset funds are higher than those from cash assets. So by moving to cash now, retirees will be exposed to falling cash returns in future (the SARB has already started cutting short-term interest rates), and will miss out on any improvement in returns from multi-asset funds.

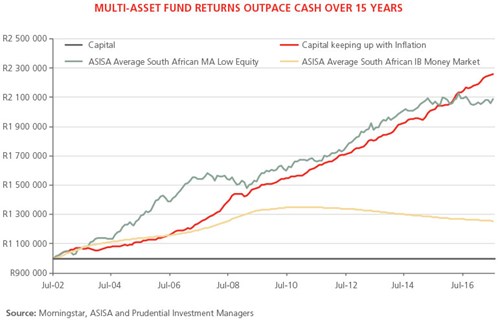

The accompanying graph shows how a R1.0 million retirement investment has performed over the past 15 years (July 2002-July 2017), starting with a 5% annual drawdown and escalating the drawdown by inflation, when invested in different funds. The initial capital investment is represented by the fixed black line. In order to have maintained its real value over time, it would have needed to grow at a rate equal to inflation, to R2.26 million (as shown by the red line).

Would a money market investment have given the retiree an adequate return over the 15 years? Clearly not: the yellow line in the graph depicts how the R1.0 million would have performed invested in the average South African money market fund (the ASISA IB Money Market category) while drawing the income over the period. Due to its low return, the capital would have grown to only R1.25 million. Although it would have successfully given the retiree their income (totalling R1.1 million), the real value of the retiree’s capital would have been significantly eroded (shown by the gap between the red and gold lines).

By contrast, an investment in the average low-equity multi-asset fund is shown by the green line. Although the fund return varies over time, it manages to outperform or remain in line with the inflation requirement (red line) for much of the period. Its more recent underperformance is partly compensated by the earlier excess performance. The retiree ends up with R2.09 million, while also having drawn down R1.1 million in income payments over the 15 years.

From this evidence, it is clear that multi-asset funds have been delivering the returns they are expected to over longer periods, and investors, especially retirees, need to think twice before moving away from them. Anyone switching to cash now is likely getting the timing wrong – they will receive lower returns over the longer term (as the graph demonstrates), or if they plan to switch back to multi-asset funds later, they will also likely mistime their move.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter