Opportunities to invest in SA listed property

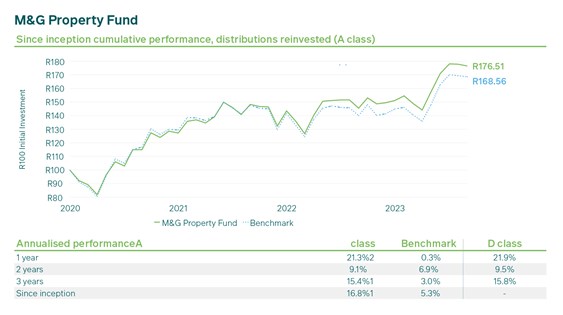

The final quarter of 2023 witnessed a significant boost in the property index, driven by cheap valuations and the anticipation of interest rate declines that propelled property stocks to rally, both globally and locally. This strength continued into the first months of 2024, albeit at a moderated pace as rate cut expectations have been pushed back. To put this into context, the All Property Index (a proxy for property’s performance as an asset class) was the second-best performing asset class for both one- and three-year periods (to 29 February 2024), following closely behind global equity. And this trend could be maintained should the headwinds the sector is experiencing ease further. The M&G Property Fund is poised to capitalise on the opportunities within the South African listed property market. Launched in July 2020, the fund is focused on active management aiming to seek alpha through strategic stock-picking coupled with a commitment to maximise total returns while managing risks effectively.

The M&G Property team employs a consistent, proven investment philosophy and process in managing the fund that is mirrored in the group’s equity investment process. By adopting a valuation-based approach, focusing on the long term, and maintaining a prudent investment strategy, the fund aims to deliver sustainable growth and value to investors.

The investment philosophy is underpinned by a rigorous process that involves deep company research, fundamental analysis, diversification and risk awareness during portfolio construction, and a keen eye for quality companies trading at attractive valuations. This has allowed the M&G Property Fund to deliver award-winning performance, having won the 2023 Raging Bull Award for three-year straight performance in its ASISA category.

We are high conviction managers that take large overweight positions in a concentrated portfolio of stocks that we believe are high quality and will deliver sustained outperformance and value to our clients (compared to tracker funds, closet tracker funds or the index) over the long term. This targeted strategy allows the fund to capitalise on market opportunities, avoid value traps and invest in quality companies trading at discounted prices.

With the prospect of interest rate cuts on the horizon and less loadshedding expected in South Africa, we anticipate that previous headwinds will turn into tailwinds, and that listed property sector stands to surprise on the upside over the medium term. We’ve positioned the portfolio to benefit from these dynamics, while not compromising on our quality criteria – picking stocks with high free cash flow generation and strong balance sheets.

Positioned to capture improving fundamentals

Based on recent company reporting, South African property fundamentals are stable, with vacancy levels steadily declining across all sectors. However, sectoral rental growth has diverged. Office rents remain under pressure due to an oversupply of space. Retail rent affordability ratios are at decade lows, and we’ve seen reported rental reversions turn positive. This positive momentum is somewhat countered by a constrained SA consumer and distress in one South Africa’s largest retail anchor tenants, Pick ‘n Pay. Industrial property has delivered the strongest growth, benefitting from favourable supply-demand dynamics and the pass-through of rising construction costs.

In our view, prevailing headwinds such as rapidly rising property costs and higher interest rates are reflected in company earnings expectations that show limited short- to medium-term growth. Therefore, our preferred South African stocks are high-yielding mid-caps where prospective returns exceed that of the SA government bond yield.

We also find certain SA-listed property companies with offshore exposure attractive. Offshore property fundamentals vary by region and sector. Here we favour stocks with strong balance sheets and enduring growth prospects. Our preferred sectors include retail property in Central and Eastern Europe and Spain where the robust performance is underpinned by resilient consumer spending. Other favoured high-growth stocks include Sirius Real Estate and Stor-age, which have flexible leasing business models supported by sophisticated operating platforms capable of dynamically capitalising on customer demand trends.

The success of the M&G Property Fund underscores the effectiveness of its investment approach and the value it brings to investors. For those looking to explore listed property exposure and benefit from the prospective resurgence of the property asset class, the fund presents a compelling opportunity for portfolio diversification and long-term growth.

To learn more about accessing the M&G Property Fund and incorporating listed property investments into your portfolio, visit www.mandg.co.za and discover the potential for growth in the listed property market.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter