M&G Enhanced Income Fund: Limiting the downside for outperformance

Flexible income funds like M&G’s Enhanced Income Fund have become a very attractive category for investors looking for lower-risk solutions that also offer the potential for capital growth. This is particularly true in the current elevated interest rate environment, where these funds can deliver higher returns than usual.

Within the ASISA Multi-Asset Income category, M&G Investments could be considered conservative managers as, compared to many other investment managers, we only buy JSE-listed bonds and not unlisted or unrated issues. Our preference is for government, big bank and highly rated corporate bond exposure within our credit limits. Position sizing is of paramount importance as the local corporate bond market is relatively illiquid compared to the government bond market. We also avoid holding structured products such as Credit Linked Notes (CLN’s) due to their opaque nature. Some of these structures can obfuscate the credit risk involved, and we will not chase higher yield at the expense of poor credit quality. Also, we do not approve of the cost-plus accrual methodology most use to price these instruments, thereby avoiding mark-to-market pricing and creating an illusion of low volatility. As a consequence, this can periodically lower our fund’s yield relative to others. However, we prefer to be very transparent in the valuation of the fund and use JSE-published market values for listed assets where we deem these to be fair, and mark-to-market our unlisted money market instruments as well.

Outperforming its dual return and protection objectives

The M&G Enhanced Income Fund celebrates its 15th anniversary on 1 July this year, and over this period we are happy to report that it has outperformed both its benchmark (the STeFI Composite Index) and its ASISA category average, as shown in Graph 1. The fund’s dual objectives are to “maximise total returns in excess of the benchmark over a rolling 36-month period, while seeking to protect capital and reduce volatility through active asset management”. In plain English, that means that our experienced team of portfolio managers, Roshen Harry and I, look to deliver the highest possible return to our investors in absolute terms over a three-year horizon, while being mindful that we have a further mandate to preserve capital by limiting drawdowns. More specifically, beyond these formal objectives we actively manage the risk the fund assumes in order both to deliver a return of at least 2% above the STeFI Composite Index before fees, and to avoid any capital loss over any rolling 12-month period. To date we have consistently met this latter target, with the fund’s lowest annual return being 1.8% after fees in April 2020.

As with all of our funds, the M&G Investments philosophy of being valuation-based, long-term and prudent is enshrined in the M&G Enhanced Income Fund. Our investment process allows us the flexibility to construct the portfolio in favour of the most attractive mix of assets from within the traditional fixed income universe of money market, floating rate notes (FRN’s), nominal bonds, inflation-linked bonds (ILB’s) and foreign bonds. Furthermore, we can allocate tactically outside of these assets via Interest Rate Swaps (IRS), bond options, listed property, currency and equities. An advantage of being part of an established global asset manager is that we have access to the depth and coverage of the M&G Public Fixed Income Team in accessing foreign bond investments.

Longer-term management lessons

Of course, no fund with 15 years of history can have perfect performance given the ups and downs of financial markets, not to mention the major disruptions caused by the 2013 “Taper Tantrum”, December 2015’s “Nenegate” drama and the Covid-19 crash. Given the importance of avoiding meaningful drawdowns for investors in this lower-risk fund category, over time we realised that employing a long-term Strategic Asset Allocation (SAA) model in managing the fund was not ideal in that its relative strictness resulted in excess volatility. As such, we refined the process by introducing more flexibility into the asset allocation process, managing it more tactically and adjusting position sizes more frequently. We have come to appreciate that being cyclically aware allows us to improve the odds in our favour to deliver favourable client outcomes. This worked well in the Covid-19 crash, mitigating the fund’s drawdowns relative to past experience, and it has subsequently resulted in less volatility.

Weathering more recent storms

The most recent incident that caused a meaningful sell-off in local fixed income assets was the “Lady R” affair in May 2023. M&G Enhanced Income Fund did experience a drawdown, but this was relatively well contained because in prior months we had been actively reducing the fund’s risk, giving it limited exposure to interest rate risk ahead of the sell-off. And as the geo-political tensions eased in June, both the currency and local bonds recovered, with the fund performing strongly. The incident afforded us the opportunity to increase our interest-rate exposure at very attractive levels at a time when we had capacity to increase risk. Apart from reinforcing that our more flexible approach has been correct, the incident also highlights that outperformance can be obtained both from being underweight risk during bear markets and overweight risk during bull markets. Limiting losses during drawdowns helps to both smooth out an investor’s journey and reach the return destination faster.

Enhanced performance, but longer-term is key

It is clear that our refinements have borne fruit for investors. For the three-year period to the end of January 2024 the M&G Enhanced Income Fund returned 7.8% p.a. net of fees, ahead of both the category average (7.3% p.a.) and the benchmark (5.8% p.a.).

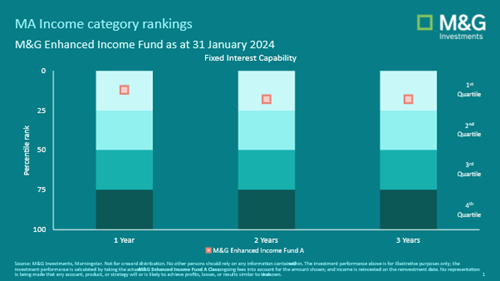

Graph 2: Refinements have borne fruit with top-quartile rankings

Graph 2 illustrates how the fund has achieved a top-quartile Morningstar ranking in its category over the one-, two- and three-year periods to 31 January 2024, ranking 14 out of 115 peer funds over one year, 20 out of 109 over two years and 19 out of 105 funds over three years. While this shorter-term performance is most welcome, we understand that longer-term consistency of returns is key for our investors.

In managing the M&G Enhanced Income Fund we are drawdown-focussed, cyclically aware and tactically alert. We can exploit the entire spectrum of fixed-income instruments, as well as the best opportunities in listed property, equity and global assets. While we can’t expect it to be all smooth sailing, we are confident that we have the right people, philosophy and processes in place such that the fund continues to fully deliver on investor expectations.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter