Introducing Prudential Global Funds

I’m excited to be able to announce that our new range of global funds, Prudential Global Funds ICAV (Irish Collective Asset Management Vehicle) is now open for investing in South Africa. The Prudential Global Fund range has been launched with the aim of bringing our clients an improved investment management proposition, in partnership with M&G Investments, our London-based parent company within the global Prudential plc group. M&G is one of the UK’s largest and longest-established investment houses.

South African investors will now be able to access a range of four US dollar-denominated global funds, specifically designed for South African investors, managed by an experienced team of portfolio managers at M&G Investments with a strong long-term global track record. The team is managed by Chief Investment Officer Graham Mason, Prudential South Africa’s founder and chairman, while one of the lead portfolio managers is Marc Beckenstrater, formerly the Chief Investment Officer at Prudential South Africa. Marc previously managed the offshore investment portfolios of our South African funds until his relocation to London in March 2017, and has effectively assumed the offshore aspect of his previous role in London, although within a much larger global team.

An attractive offshore solution

Some of the main considerations we had in choosing Ireland as the domicile for the Prudential Global Funds were ensuring the absolute safety of our clients’ money, benefitting from the best service providers in the world, and operating in a market protected by a highly respected regulator. Other significant factors included its use of English (to ensure client-friendly documentation) and its globally recognised European fund standards that provide a robust framework for risk management, risk diversification, regulation of service providers and the safekeeping of assets.

Equally important was the aspect of competitive costs: Leveraging off of M&G Investments’ large scale and long-standing relationships, as well as Prudential’s global brand, we have been able to negotiate attractive fees with service providers to ensure a lower impact on the final costs for our clients. This will be reflected in the funds’ competitive total expense ratios (TERs).

The funds have been designed specifically for South African investors and their unique investment circumstances and needs. This means we have included the important elements of: 1) exposure to a broad range of global assets; 2) active asset allocation; 3) competitive pricing; and 4) cost-efficient implementation.

Besides these factors, the fund range also offers other advantages: a consistent and proven global investment process; the backing of a large and experienced investment team; ease of access for clients and efficient investment and portfolio administration. The end result is an attractive investment solution after fees for our clients.

Investors will have exposure to the Prudential group’s best investment views as implemented in the four funds, across a wide range of geographies, industries and companies. Plus, to show how much confidence we have in their performance, we are using them as global building blocks for many of the South African funds that we manage ourselves. Our client portfolios that have global exposure within their mandates, including our unit trusts such as the Prudential Inflation Plus Fund and Prudential Balanced Fund, will invest directly in the Prudential Global Funds.

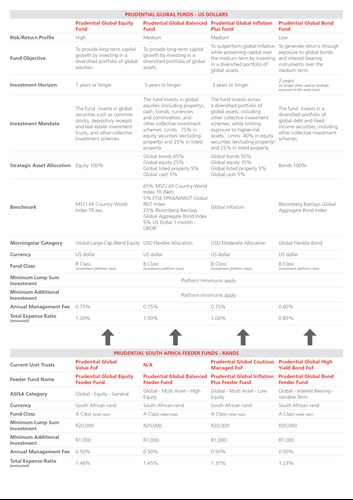

The four US-dollar denominated (and Irish domiciled) funds are the Prudential Global Equity Fund, the Prudential Global Balanced Fund, the Prudential Global Inflation Plus Fund and the Prudential Global Bond Fund. The accompanying table highlights their main features, providing a convenient snapshot of the simple but comprehensive offering. For more in-depth information on the funds and how to invest, visit the Prudential South Africa website (www.prudential.co.za).

Prudential’s same successful investment process

Just as at Prudential South Africa, valuations and fundamentals are at the core of the M&G investment approach, ensuring they buy securities and asset classes at a good (cheap) price relative to their history. They don’t try to forecast the macroeconomic future, but instead capture opportunities through a prudent, disciplined and repeatable framework. The active management approach, like ours, exploits both shorter- and longer-term opportunities, identifying when assets are mispriced to add value to client portfolios. This approach has been tested over many years across a range of market conditions, resulting in strong client returns.

Accessing the Funds

South African retail investors have the option of buying the Prudential Global Funds from all of the leading offshore investment platforms available in South Africa. Since these platforms may change over time, we suggest you first check the Prudential website or contact us to find out which of the funds are available on which platform. When you buy them in US dollars, this means your offshore investment is “fully externalised”, so you will need SARB approval for investment amounts over R1 million per year, and you will receive dollars when you sell your investment.

Investing via our rand-denominated global funds

Those who want exposure to the Prudential Global Funds but prefer to invest in rands can now do so via Prudential’s existing global unit trusts, which are rand-denominated and available directly from Prudential South Africa. You will not require SARB approval to invest, and you will receive rands when you decide to sell your investment.

All three of our global unit trusts already invest directly into the Prudential Global Funds, giving rand investors the same underlying global exposure. In the coming months we will be converting these unit trusts to “feeder funds” – each one will invest uniquely in their corresponding Prudential Global Fund (as shown in the table).

Whichever fund you may choose, it’s important to remember that global exposure is a vital part of any portfolio – adding much-needed diversification and acting as a longer-term hedge against South African-specific risks, like a depreciating rand. Offshore investments can give South Africans attractive holdings in fast-growing countries, industries and sectors under-represented in our stock market, while also acting as a cushion against emerging market volatility. Of course every investor has their own unique investment needs when it comes to building their offshore portfolio, so be sure to speak to a financial adviser to determine how much exposure would be most appropriate for you.

If you need more information about our offshore offering, please feel free to contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter