How doing nothing can add value to your investment

Whether you’re new to investing or a seasoned veteran, going through periods of sharp underperformance can play havoc with your emotions. It’s often the case that during times like these investors feel the need to act, whether selling out of the market or adding to their portfolios. The decision to simply do nothing and to remain invested is very often overlooked, but is often the correct course to choose.

While this may sound counterintuitive, especially when market values are declining sharply, staying the course can often add significant value to your portfolio, as long as you’re patient.

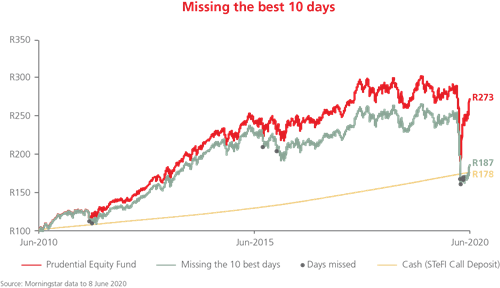

The below graph shows how selling out of a R100 investment in the Prudential Equity Fund during periods of negative volatility would have resulted in you missing out on the 10 best days of fund performance (depicted by the grey dots) over the past 10 years: you would have missed out on 46% of your total returns (the difference between R273 and R187). Interestingly, six of the best days occurred during the Covid-19 sell-off, at a time when many investors were looking to exit the market.

The graph highlights two very important points: 1) periods of negative performance and the highest risk are often rapidly followed by periods of strong fund returns; and 2) selling when markets are down means that you run the risk of missing out on these returns.

What the graph also shows is how a R100 investment in cash would have performed over the past 10 years. While it may seem appealing in hindsight, given the relatively small difference in values at the end of the term, it’s worth highlighting two factors that investors considering cash should take into account: 1) cash investors would have lost out on stronger gains from equity performance over the past 10 years; and 2) our analysis shows prospective returns from cash are significantly lower compared to equities. Following the SARB’s 250 basis points interest rate cuts over the past three months, cash investments are likely to produce below-inflation returns (that is, negative real returns), while we expect equities to deliver double-digit real returns. In fact, our equity market has already started showing some signs of a recovery.

That’s not to say that cash doesn’t have a place in an investment portfolio. It’s a useful asset class for investors looking for liquidity and a short-term parking space for their money (typically 12 months or less). But as a long-term investment, holding cash becomes incredibly risky from an opportunity cost perspective, as the prospective returns for other asset classes are significantly higher over the long term. And for those nervous about going through periods of high volatility, it’s important to remember that the probability of recovery from a market downturn is significantly increased by the length of time that you remain invested in the market.

To sum up, being patient when markets are volatile can add significantly value to your investments and therefore shouldn’t be overlooked as a course of action. While cash may seem tempting, it’s an asset class that is valued to deliver returns below inflation over the long term, and is therefore not an optimal solution for long-term investors.

To find out more about investing, call our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter