Five simple steps to reaching an investment goal

Investing towards a goal over time and then successfully attaining that goal can be a very rewarding experience, but it can be challenging as well due to the temptations, competing priorities and other life complications that will inevitably arise along the way. Yet you don’t have to be a sophisticated or seasoned investor to get it right. When you decide to embark on your investing journey, you can use these five simple steps to significantly boost your chances of success.

Step one – Identify a goal

Successful investing starts with creating goals, then unpacking the parameters required for reaching them. As with most things in life, if you don’t know what you want, you’re unlikely to get very far. A specific goal gives you something tangible to envisage and strive towards. A good starting point is to write down your goal, or even better, keep an image of it where you can see it often to inspire and spur you on. By making it more tangible, you’re more likely to stay the course.

When you have more than one goal it’s best to prioritise these according to our financial circumstances. For the purpose of this article, we’ve selected the goal of investing towards a deposit on a home.

Step two – Determine what your goal costs

The next step is to figure out how much your goal costs today. If you have your heart set on living in a particular suburb and want three bedrooms and a double garage, you can easily find out the average cost of a home that meets these requirements by searching online. If the type of house you have your eye on sells for an average of R1 million and you need a 10% deposit, then your investment goal is R100,000.

Step three – Set a time horizon

You’ve set a goal of R100,000. Now you need to ask yourself by when you would realistically like to achieve the goal. Perhaps you’re newly married, and you’d like to own a home in five years’ time.

Step four – Get real

The next step is to figure out what real return you can expect from your investments; real return being the return over and above inflation. Typically, it’s between 3% and 6%, but can be higher or lower depending on the unit trusts you choose to invest in. A typical balanced fund is widely accepted to be suitable for a five-year investment horizon, including equities to increase the growth potential as well as some bond and cash holdings to deliver diversification benefits and protect against large drawdowns. For example, the M&G Balanced Fund (A class) has returned 9.3% p.a. over the past 10 years, comfortably beating inflation of 5.1% p.a.

Step five - Work it out

As nobody can predict the future, investment professionals work with assumptions.

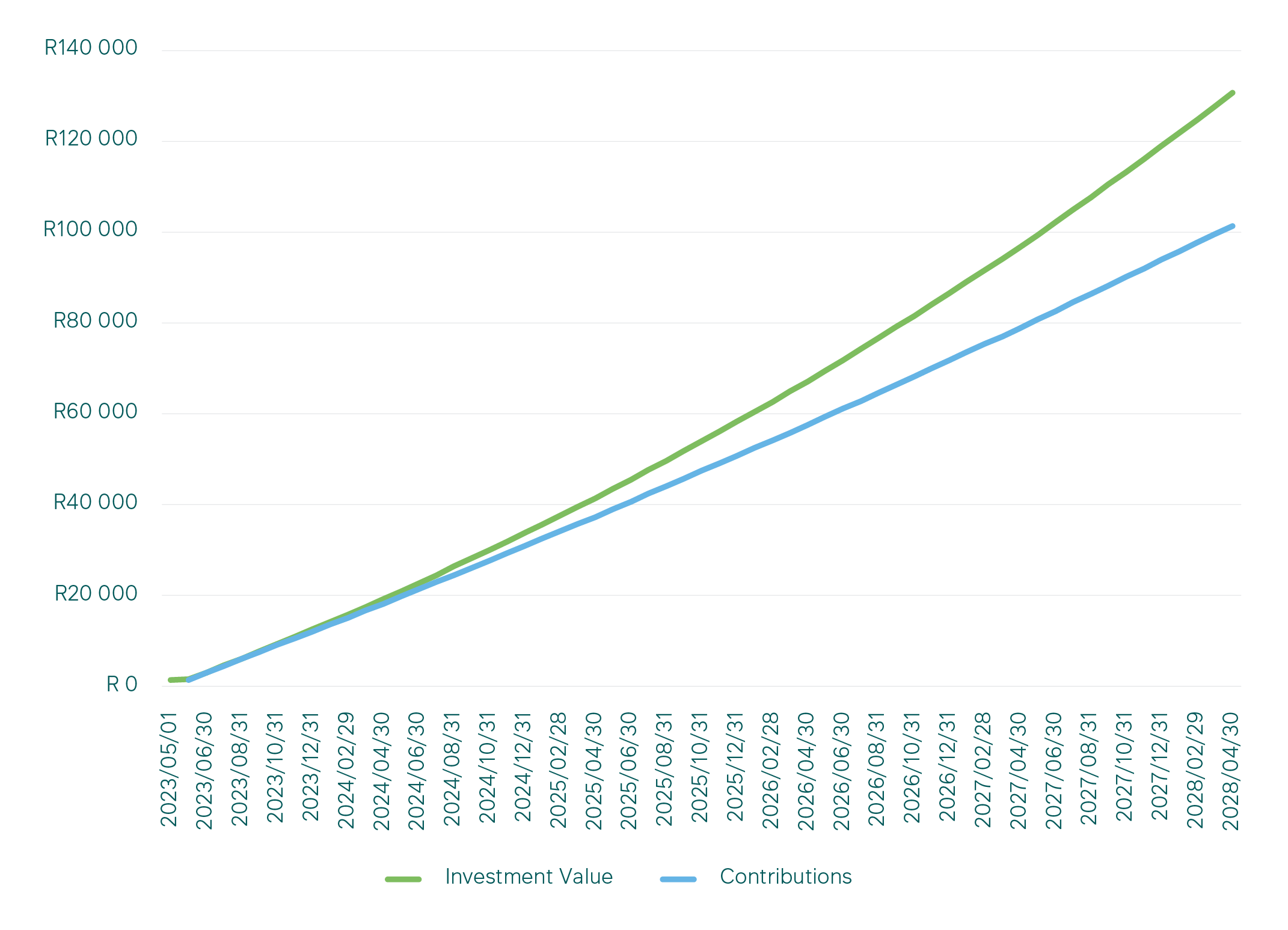

If you assume inflation of 5.5% p.a. going forward (above the midpoint of the SA Reserve Bank’s inflation target range of 3%-6%), then a R100,000 home deposit in today’s money equates to a R130,696 deposit in five years’ time, given that inflation erodes the purchasing power of a rand over time. In order to accumulate R130,696 by the end of your investment horizon, you’ll need to invest R1,515 per month for the first year (increasing the contribution amount by 5.5% annually), assuming your investment delivers a 5% real return (10.5% nominal return) per annum.

The green line in the graph above provides a visual representation of your investment journey, were you to invest R1,515 per month) at a 5% p.a. real return to reach R130,696. The blue line shows the straight sum of the monthly contributions over time, excluding growth, which amounts to R101,434.

Remember that these figures are based on assumptions, and in reality, returns aren’t delivered steadily in a straight line, no matter how consistent you are in investing. There’s no guarantee that your journey will play out as displayed. We recommend that you get help from a qualified independent financial adviser.

So when saving towards a medium-term goal such a deposit for a home, a well-diversified multi-asset solution, such as the M&G Balanced Fund, helps to deliver inflation-beating returns by protecting the downside while offering the potential of higher capital growth – all key elements to successfully turning your investment goals into reality.

For more information on investing with M&G Investments, please feel free to contact our Client Services Team on 0860 105 775 or email us at info@mandg.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter