Two keys to accumulating wealth: Understanding the odds and exploiting them

This article was first published in the Quarter 2 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- In an uncertain world, you can improve your investment outcomes by knowing when the odds are favourable and being able to take action. This involves buying when valuations are cheap on an historic basis: at this point, the odds of future outperformance are higher.

- This also involves being able to overcome the fear of uncertainty that prevails when valuations are cheap: they are usually at their cheapest during the biggest crises. This is when fear is at its highest but yet it is usually the best time to buy.

- Diversifying a portfolio to include several investment ideas and different stocks that can perform well under different future scenarios is important in limiting the downside when the future is uncertain. This lowers portfolio risk and keeps you from relying on one forecast outcome.

Although none of us can know the future, and investing in the stock market may seem like a huge gamble, in fact there are ways to reduce uncertainty and improve the odds that your portfolio will produce superior returns. Here we discuss Prudential’s approach and explain how understanding the investment odds, and being capable of exploiting them, are two keys to successfully accumulating wealth over the long term.

Understanding the odds = understanding valuations

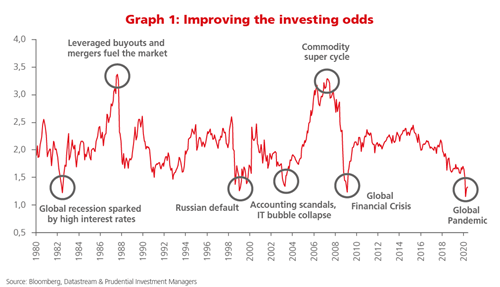

One of the most important factors in constructing our client portfolios is ensuring that we buy assets at cheap valuations compared to their history. This helps reduce future uncertainties and puts the odds of outperformance in our favour. How does this work? Graph 1 shows the history of the JSE’s price-to-book value (P/B) since 1980, and indicates investors’ odds of getting a good future return. It highlights that when the South African market trades:

- At a low P/B of around 1.0X, it is very cheap and investors should expect outsized future returns (since the subsequent historic performance usually improves);

- At an average 2.0X P/B, the market looks to be fair value and investors should expect a fair future return (since the subsequent historic performance is around average); and

- At a high 3.0X P/B, the market looks very expensive, so investors should expect a lower return going forward (since the subsequent historic performance usually deteriorates).

So without knowing the future, we can tilt the odds of outsized returns in our favour by buying shares at cheaper valuations. It is also clear from the graph that fantastic buying opportunities are very rare, as the South African market has only traded close to a 1.0X P/B valuation five times in the last 40 years.

That’s why, when the JSE’s P/B fell to almost 1.0X during the height of the Coronavirus market crisis in March-April 2020, Prudential seized the opportunity to buy high-quality companies at excellent valuations. We recognize that the most important thing to focus on during crises is the odds that the market is offering you. It is very often the case in crises that you as the buyer are being offered fantastic odds to accept the future risks, as looming and dire as they may be or seem to be. These points in the market are nearly always the best times to buy.

Overcoming fear of uncertainty and loss

Yet for most investors, including us, it is exceptionally uncomfortable to buy assets during a crisis, when conditions appear to be at their worst. Many would rather sell to relieve themselves of the intense discomfort they feel from owning assets which are continually falling in price. This is because the human instinct to avoid losses is stronger than that of making potential gains, especially in an environment of such perceived high risk. Many investors therefore don’t take the opportunity to buy at these points – it is exceedingly difficult to go against their emotions. Because there is so much bad news around, the future feels even more uncertain and negative.

In the peak of the Coronavirus crisis we heard many reasons from investors as to why it was not a good time to buy. These included:

- Wanting to “wait and see” how circumstances developed;

- Waiting for certain identifiable catalysts to materialise indicating improving conditions; and

- Thinking they could temporarily switch into safe-haven assets and successfully buy back their riskier assets when the outlook improved.

The problem with this reasoning, however, is that by the time the horizon looks less cloudy or the catalysts arrive, everyone else has also seen things improving. Time and again history has shown that large rebounds usually happen suddenly and very quickly, and it is then too late to get back in the market to capitalise on the lowest prices – investors miss out on the exceptional returns available. And perplexingly, in hindsight it is often very difficult to identify a clear catalyst triggering the move higher; it is simply a sudden change in collective market sentiment.

So when these rare opportunities do come around, investors need to be prepared, and understand that making the decision to buy up assets will feel very uncomfortable since there will be many things to worry about. There is likely to be more downside to the market ahead and high volatility to weather. But understanding the odds and being prepared to take advantage of rare crises – as well as the smaller market mis-pricings that occur more frequently – are critical in accumulating wealth over the long term.

There is an important caveat to this approach, however, which is not to take risk simply for the sake of it… you want to ensure that the odds are stacked in your favour. Careful analysis of the factors driving the asset price, our own judgement of the asset’s fair value and what other assets we are holding are important considerations in ensuring that a share is not only absolutely undervalued, but also relatively undervalued.

Prudential’s track record for delivering strong outperformance over time is built on our understanding and implementation of these factors.

Including diverse ideas to embrace diverse scenarios

Besides using a valuation-based approach when constructing portfolios to deal with uncertainty, Prudential also always considers how a portfolio would perform under the broadest possible range of scenarios, taking account of different potential outcomes.

We try to include many different investment ideas with a variety of stocks to add diversification benefits as well. In this way, the downside is mitigated and upside potential is enhanced, even when something very unexpected happens. We are very cognisant that we, like other investors, do not know what the future holds. We often hear highly regarded economists confidently talking about how interest or exchange rates will go up or down, or how the economy is headed horribly down or fantastically up… only for them to be proven totally wrong. We think it is very dangerous to construct portfolios based on a particular view of the future. What happens if you are wrong? When we construct portfolios, we try to include as many different ideas as possible, all which have good odds. Not all of these ideas will work out, but on balance we hope that we have stacked the odds in the favour of our clients, no matter what future scenarios play out.

Of course the most dangerous risks are usually the ones no one has even thought about, such as last year’s pandemic. Ahead of the market crash we were holding quite a few companies which had strong balance sheets and diversified income sources. This strength has enabled these companies to take advantage of the difficult and volatile environment. Some companies are taking away market share from their weaker competitors who are in distress; some companies have aggressively cut costs; and others have taken advantage of their very low share prices to buy back their shares at exceptionally cheap levels. These actions taken during the pandemic have no doubt improved the future prospects for these companies.

Very good opportunities still available

The local market has recovered from the March 2020 lows, but we still think that it currently offers exceptionally good opportunities and the potential to outperform due to the extent of the valuation disparities in the local market.

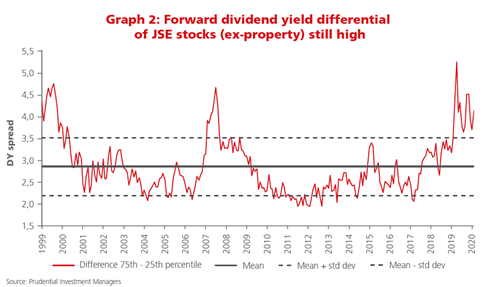

Graph 2 shows the valuation disparity between the dividend yield of the 25th percentile stock (near the top-ranking shares) and the 75th percentile stock on the JSE (near the bottom-ranking shares). When there is a very large gap it means there are many opportunities in the middle to make good returns from stock-picking. And we are now at levels that we last saw during the 2008 Global Financial Crisis and the early 2000s during the IT bubble.

Consequently, currently there are a lot of opportunities for investors to construct a well-considered portfolio that includes many opportunities that could pay off in future years. This is about taking on the right kinds of risks and taking on risk because the odds are in your favour.

Today, we sit in a very uncomfortable and uncertain position. We are still going through a global pandemic, and in South Africa particularly we have other issues like rising unemployment, debt/GDP levels that keep increasing to fairly alarming levels, and state-owned enterprises that are struggling. So in the South African equity market there is a lot to be very uncertain about. During these times of high uncertainty, often the most certain thing is how good the odds on offer really are. Being able to understand this and take advantage of these odds are two keys to successfully building wealth over time.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter