TABLE TALK: Investors may be disappointed by their offshore returns since moving offshore last year

This article was first published in the Quarter 3 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Data subsequent to the March 2020 Coronavirus market crisis shows that South African investors have been adding to or moving high volumes of their assets offshore in a quest for safety and/or higher returns.

- To date this has proved to be a costly decision, due to a combination of rand appreciation and strong SA equity and bond returns over the period.

- Investors ignored the prevailing relative asset valuations and bought offshore assets when the rand was weak, and offshore assets were also relatively more expensively valued than SA assets. However, Prudential bought local assets and sold offshore assets at the time and our portfolio returns have benefited subsequently.

QUESTION:

In May last year, after the Coronavirus market crash, I moved about 20% of my portfolio offshore because I thought it was safer and would give me better returns. But so far I’ve been disappointed by the performance – it seems like even though offshore equity markets have been strong and reaching record highs, I’m not seeing the same results in my own rand portfolio. Can you help explain this?

ANSWER:

You’re not alone in this experience. After the Coronavirus market crash we’ve seen a lot of money in the unit trust industry moving out of South African assets – via both new investments and switches. In fact, an astounding R41.4 billion moved into the ASISA Global funds category for the year to end March 2021 (the latest available data), which is more than the entire previous five years’ total of R40.8 billion (March 2015 to March 2020). Note that this is only the sum that went into locally-domiciled global funds – even more would have been sent directly offshore into myriad foreign-domiciled investments.

The severity of the JSE’s drop and the rand’s depreciation in last year’s crisis caused many to react emotionally and opt for perceived safer havens overseas. Yet was this really a well-considered move to safety? Now that more than a full year has passed, we can see that the answer is definitely “no”. To date this has, yet again, proved to be a sub-optimal investment decision based on historical returns rather than the valuations on offer from the assets. Investors may have obtained some extra diversification, but it has certainly come at a significant cost.

Why is this? First of all, we think you need to make investment decisions based on the current valuations on offer, rather than on the most recent historic returns of those same assets. Investors like yourself were selling rands at low prices and buying foreign currency at highs, not usually a profitable strategy. Over the 12 months to 31 May 2021, the rand has rebounded strongly from its historic lows, appreciating substantially against all three major global currencies, especially the US dollar, which has weakened for its own fundamental reasons: the rand was up some 22% against the greenback, more than 10% against the pound sterling and nearly 15% versus the euro. This would have necessarily undermined any gains in offshore portfolio assets.

Given the rand’s extreme undervaluation a year ago (versus its own history), astute investment managers would have anticipated the improved odds of some rand appreciation going forward – albeit not the timing or extent – and seen this as an excellent opportunity to buy more rands and sell offshore assets, which is exactly what we did. There was far more upside than downside risk for the local currency.

Then, apart from the rand, South African equities and bonds have recorded strong gains along with the rest of the world since the crash. The MSCI All Country World Index has returned nearly 42% in US$ terms in the past 12 months, representing an impressive “V-shaped” recovery in global equity markets. Yet in rand terms investors received only a 10.2% return from the same Index due to rand appreciation. Investing in the local FTSE/JSE All Share Index in rands over the same period would have yielded a total 38% return in rand terms. Meanwhile, the Bloomberg Barclays Global Bond Index produced around 4% in US$ terms, but lost nearly 19% in rands. By comparison, a South African bond investment (in the All Bond Index) delivered 11% for the 12 months.

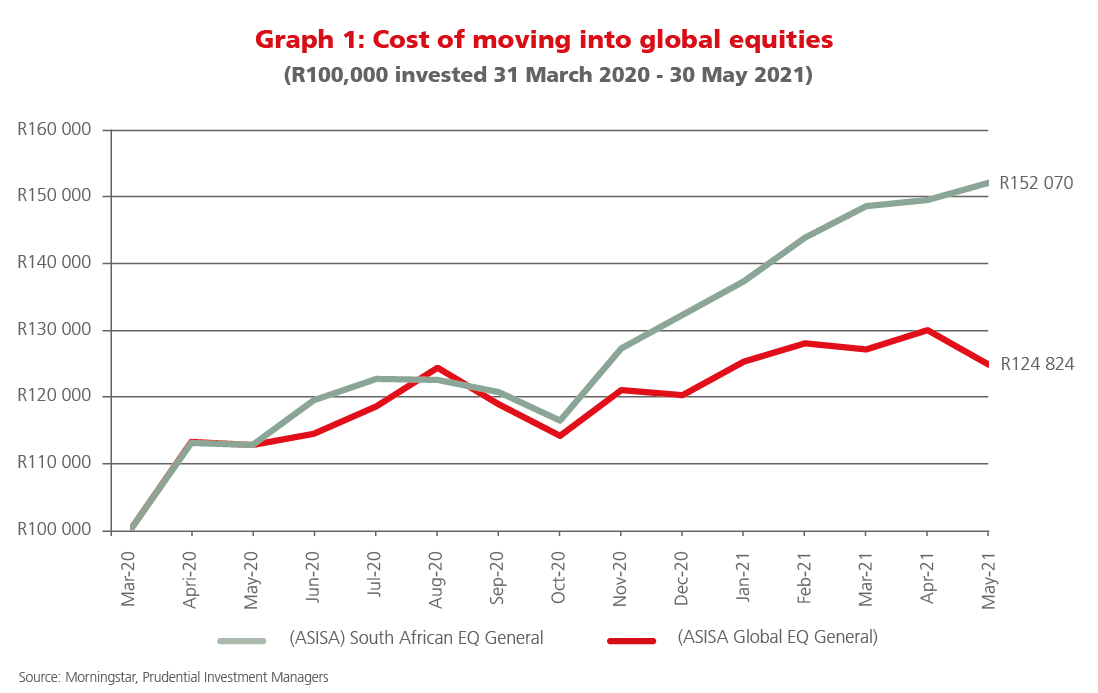

Graph 1 illustrates the cost of not sticking with a longer-term investment plan, by selling a rand investment in SA equities around the height of the Coronavirus crisis at 31 March 2020, and then buying a rand-denominated global equity investment. The red line shows the result if you had sold R100,000 on 31 March 2020 and switched it into global equities, while the grey line depicts the impact of sticking with local equities: the result is the difference between R124,824 and R152,070 – R27,228 or 18% less due to moving to offshore investments during the past 14 months.

Instead of selling South African assets at lows during the crisis it would have been much more lucrative for you to have instead sold developed market equities, which were valued more expensively, and used the proceeds to add SA equity and SA bond exposure when others were selling. These local assets had higher prospective returns, and this is what some active managers like Prudential did. Yet we know that when markets are crashing, it is very difficult for individual investors to go against their natural instinct to avoid losses and instead take the perceived risk of doing nothing, or even better, buying the very instruments that have plummeted in value.

Although this is obviously a fairly short-term example, the point here is that investors can act very emotionally with their investments, especially during times of financial stress. What you should rather do is base your investment decisions on the current asset valuations on offer. This way you would have subsequently reaped the rewards of their relatively stronger returns and added significant market returns (beta) and alpha to your portfolio.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter