TABLE TALK: A unique set of investor opportunities in multi-asset funds

This article was first published in the Quarter 1 2021 edition of Consider this. Click here to download the complete edition.

Key take-aways

-

While multi-asset low-equity unit trusts like the Prudential Inflation Plus Fund have underperformed in the last three to five years, most have rebounded since the lows of late March 2020.

-

Although there has been a wide divergence in returns within the category, the Inflation Plus Fund has returned over 30% during the period, and we are excited by the Fund’s prospective returns of 6-9% p.a. above inflation over the next five years.

-

This high prospective return range relative to its history (its objective is 4% above inflation) is due to the very attractive prevailing asset valuations across a range of asset classes the fund is holding, which increase the chances for it to outperform as well as giving it enhanced downside protection.

-

Based on this, investors should consider remaining in the Inflation Plus Fund in order to catch up on the underperformance of previous years.

QUESTION:

I have invested some of my retirement money in a multi-asset low-equity fund, but it has been underperforming its benchmark for over three years. I see returns have started to pick up now - should I sell my holdings and move somewhere else?

ANSWER:

Over the past five years, investors have certainly been disappointed with the low returns delivered by funds in the ASISA Multi-Asset Low-Equity category of unit trusts, which have underperformed their historic averages as well as lower-risk fixed income and cash investments. However, over the relatively short period since the worst of the Coronavirus-related market crash in late-March 2020, South African asset prices have recovered significantly across a range of asset classes, with fund performance reflecting this. In the Low-Equity category, the average fund has returned a very respectable 21.3% from its lows, but there has been a wide divergence of returns between the funds, with the lowest delivering only 1.8% and the highest producing 36.3%. Consequently, the investor experience has likely varied from extreme disappointment to relative satisfaction.

Prudential’s Inflation Plus Fund has been one of the very top-performing unit trusts in the category with a 33.1% return over this period, repeating its historic tendency to outperform in periods when higher-risk assets perform better than lower-risk assets. We know there is still much ground to be recovered by investors, but we are excited by the fund’s return potential over the next five years. Investors should be as well. This is thanks to a unique set of opportunities that presented itself in 2020 in the wake of the Coronavirus crisis. While we certainly owned a lot of assets – both equities and bonds – that fell sharply, we were able to sell some that didn’t fall as much, rotating into others that presented much better upside potential. This has left the Inflation Plus Fund with excellent prospective returns and downside protection, thanks to both the very low valuations (some at generational lows) at which we have been able to buy selected assets, and the fact that such a large and diverse proportion of assets have such high prospective returns compared to their history. Both of these factors increase the probability of fund outperformance into the future under various scenarios. The downside protection is enhanced even more by the fund’s carefully considered diversification and Prudential’s risk-conscious portfolio construction process.

We prefer SA bonds, SA equities and SA ILBs

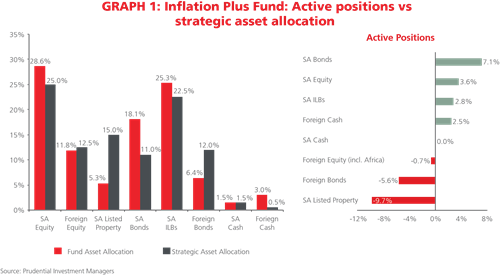

Looking at the fund’s positioning as of the end of 2020, as shown in Graph 1, it holds large active overweights to SA bonds and SA equities, and a moderate overweight to SA inflation-linked bonds (ILBs). According to Prudential’s valuation analysis, although all these assets have become less cheap in recent months, they are still valued at levels well below their historic fair value. For SA bonds, the prospective five-year real returns are the highest they have been since 2004, with the 20-year government bond indicating a real return of 7.6% p.a. and the 10-year bond 5.9% p.a. as of the end of 2020.

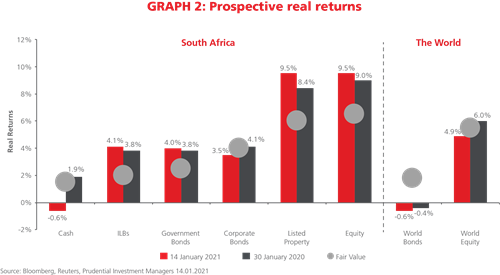

ILBs are also an attractive holding in the portfolio for their excellent diversification and inflation protection qualities. Investors worried about a potential government default would do well to hold these as protection against such a scenario, rather than opting for cash. Our analysis shows ILBs should deliver a real return of around 4.1% p.a. as an asset class compared to their historic average of 2.0% p.a. real. Prudential’s valuations for prospective real returns for each asset class are shown in Graph 2.

As for SA equities, their valuations at the end of 2020 pointed to a real return of 9.5% p.a. for the asset class over the next five years, versus their historic fair value of 6.5% p.a.. While SA listed property is at first glance trading even more cheaply at a prospective real return of 9.5% p.a. compared to its historic fair value of 6.0%. p.a., we are concerned about the high earnings uncertainty in the sector combined with relatively high levels of debt and weak growth prospects. We therefore have a significant underweight to listed property in the Inflation Plus Fund. There is a higher degree of safety in other equity sectors with equally high return potential, such that we prefer taking overweight positions in sectors such as banks (Standard Bank and Absa are among the fund’s top overweights). The fund has its other significant overweight holdings in large, diversified global companies like British American Tobacco and Anglo American, and in well-valued groups like Multichoice, all with good potential to outperform the market.

Underweight global bonds

Examining offshore positioning, Inflation Plus has a large underweight to global government bonds due to the negative yields prevailing broadly across developed markets. Although historically global bonds have offered an average real return of around 1.8% p.a., currently as an asset class they are set to deliver -0.6% p.a. as Graph 2 highlights. The fund also has a small underweight holding in global equities, since global markets are collectively slightly expensive due to the predominance of the expensive US market. As an asset class our valuations show the five-year prospective real return from global equities at 4.9% p.a., when historically their fair value has been 5.5%. On top of this, the rand remains undervalued against the major global currencies, so that any appreciation from current levels could contribute to losses in rand terms going forward.

Prospective real fund returns of over 6.0% p.a.

Looking at the fund’s overall asset holdings and their current valuations, the Inflation Plus Fund is set to deliver a real return of over 6.0% p.a. over the next five years. This assumes that nothing else changes and asset prices and market ratings stay the same going forward. However, should asset prices rise to reach their long-term “equilibrium” or fair value levels, the fund has a prospective real return of 9.0% p.a. It is positioned to outperform its history under a wide number of conditions, including: if the status-quo continues; if SA equities re-rate; if the SA yield curve flattens from its current steep shape; or if the listed property market rallies. It is likely to underperform, however, if the SA yield curve steepens further; if there is a repeat of the listed property crash we experienced in 2020; or if South African and global equity markets de-rate going forward.

As the first two scenarios are highly unlikely, we have a higher degree of confidence in the upside for future fund returns than the downside. With South Africa’s short-dated interest rates at such low levels already and longer-dated bond yields high compared to their history, further significant yield curve steepening is not likely. And based on the exceptionally low valuations for listed property currently, we wouldn’t expect these assets to de-rate by the same extent in 2021.

A return of 6.0% above inflation is one that has typically been delivered by high-risk, equity-only funds in the South African investment industry. So a similar level, or the potential for a 9.0% return, from a lower-risk, well-diversified fund compliant with retirement regulations like the Inflation Plus Fund presents a rare opportunity for investors.

Going forward, investors now have the chance to “catch up” on the inflation-beating returns the ASISA Multi-Asset Low Equity category funds have struggled to produce over the past five years or so. These higher returns are unlikely to come from cash as they did during this period: interest rates are so low that, on our valuation basis, prospective real returns from cash investments are negative over the next five years. So now is not the time to hide in low-risk investments, but instead to hold a portfolio of carefully diversified assets that will provide the potential for excellent, inflation-beating returns with only moderate risk.

For more information or to invest with Prudential, please contact our Client Services Team on 0860 105 775 or email us at query@prudential.co.za.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter