PGMs shine in lacklustre SA equity market

This article was first published in the Quarter 4 2020 edition of Consider this. Click here to download the complete edition.

Key take-aways

- Although the price of platinum has been declining or largely flat, the US$ prices of palladium and rhodium have been rising strongly in the past two years. Demand has been growing in line with the impending imposition of higher global vehicle emission standards, with supply unable to keep up.

- The weakening rand versus the US$ has added to the rand-based revenues of South Africa’s PGM miners. Also, within the PGM sector, company restructuring and cost-cutting have helped expand margins and profits such that they are now at very high levels on an historic basis. Consequently, PGM miners’ share prices have eclipsed the FTSE/JSE ALSI in the past two years.

- The risks of falling PGM prices, company margins and revenues going forward are relatively elevated. Combined with the prospect of rand appreciation, this makes us cautious about prospective earnings for PGM mining companies. However, this is balanced by a fundamental demand underpin, making us neutral on the sector in our best-view portfolios.

Platinum Group Metals or “PGM” stocks have been among the few standout performers in the local equity market in the last two years, delivering returns that have easily eclipsed those in most other sectors. Here we examine the factors behind this outperformance and the complexities in the PGM market, as well as Prudential’s investment views on the South African PGM miners. We also go “back to basics” for those who want to know more about the sector, which plays such an important role in the South African economy.

PGMs not just about platinum

Although platinum, and more recently palladium and rhodium, generally dominate commentary on the sector, PGMs is in fact a group of six silvery white metals that are chemically, physically and anatomically similar: platinum, palladium, rhodium, ruthenium, osmium and iridium. They have chemical and physical properties that make them good raw materials and catalysts within manufacturing processes. For example, platinum, palladium and rhodium have excellent catalytic uses, as they are resistant to oxidation and hightemperature corrosion, and are the three PGM metals most in use around the world. Some 67% of these “3E” (E for Element) PGMs, as they are called, is used for auto-catalysts in the exhaust system of automobiles, 12% for jewelry and 20% for other industrial uses. Consequently, apart from their supply, global auto sales and changing auto emissions standards are the key drivers of the PGM basket price, and this price is dominated by the 3E PGMs. It is no coincidence that the world’s top auto producers - the US, Western Europe and China - are also the largest consumers of PGMs.

The six metals occur together in nature alongside nickel and copper in reeftype ore bodies in only few places in the world: the Bushveld Igneous Complex in South Africa, the Great Dyke in Zimbabwe, Northern America and Russia. The type of PGM reef determines the percentage of the six metals that are present within the ore body, the most predominant being platinum, palladium and rhodium.

South Africa is among the world’s largest producers of PGMs, mining 72% of the global primary supply of platinum, 35% of palladium and 80% of rhodium. The Bushveld complex, discovered in 1924, contains three types of ore bodies: Merensky, which comprises on average 63% platinum, 28% palladium and 5% rhodium ; UG2 (57% platinum, 31% palladium and 11% rhodium on average); and Platreef (44% platinum, 47% palladium and 3% rhodium on average).

The ore bodies found in Russia and Northern America are more palladium rich, with the latter usually comprising 78% palladium and 22% platinum. In Russia, meanwhile, the bulk of the PGM supply comes from Norilsk Nickel’s operations, where palladium is a by-product of its nickel mining and is 32% of production.

What is an auto-catalyst?

An auto-catalyst is a solution of chemicals and a combination of the 3E PGM metals within a cylinder made from ceramic or metal, which forms part of the catalytic system of an internal combustion engine. It converts the pollutants released from the combustion of fuel (such as carbon monoxide and nitrogen oxide) into harmless gas. This is particularly important in the concerted global effort to address climate change, as the 3E metals are an essential element to ensure vehicles meet rising emission standards. “Loadings” refer to the amount of 3E metal that is found in an auto-catalyst, where there can be between 3-7 grams per auto-catalyst. The proportion of 3E metals required is dependent on the engine type: in gasoline/petrol engines auto-catalysts are made of a majority of palladium, while diesel engine auto-catalysts are platinum-dominant. “Thrifting”, meanwhile, is a process that reduces the loadings in an auto-catalyst, while still maintaining efficiency: the autocatalyst is able to maintain its required technical capabilities.

What’s been happening in the PGM market?

The PGM sector on the JSE (the FTSE/ JSE Platinum Index) comprises Anglo American Platinum, Impala Platinum, Sibanye Stillwater, Northam Platinum and Royal Bafokeng Platinum. Consolidation in 2019 saw Sibanye Stillwater acquire Lonmin, making it the one of the largest PGM producers and South Africa’s largest private sector employer.

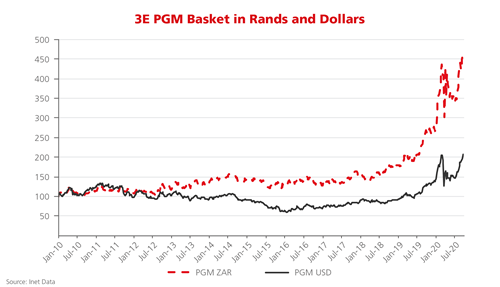

Graph 1 depicts the price history of the PGM basket of metals from just after the Global Financial Crisis in 2009 to August 2020, where we can see that the price in both US dollars and rands rose steadily from the unsustainably low levels it reached at the time and was well supported until 2013. The increase was driven by strong growth in the global car fleet, which offset increases in thrifting from car manufacturers over the period.

While this boosted the revenues of PGM miners, the gains in their profit margins were eroded by rapidly rising mining inflation due to above-CPI wage increases for mine workers.

Then from 2013, we can see that despite the dollar basket price declining, the weakening rand helped the overall rand PGM basket price remain relatively stable. However, mining inflation continued to accelerate on the back of ongoing above-inflation wage increases in the sector and decreasing productivity rates across the South African mines, specifically the deeplevel conventional mines, where costs continued to escalate. This put overall pressure on the profitability of the miners. In response, the companies attempted to address their higher cost bases through restructuring. For example, Anglo American Platinum was one of the first to start reducing costs: as early as 2013 they began restructuring their Rustenburg assets, which they subsequently sold to Sibanye Stillwater. This early intervention benefitted them relative to the other producers. Meanwhile, Impala Platinum, which was especially impacted by low productivity rates, started a process to restructure their high-cost Impala Lease operations during 2018, but the delay proved to be costly for the company.

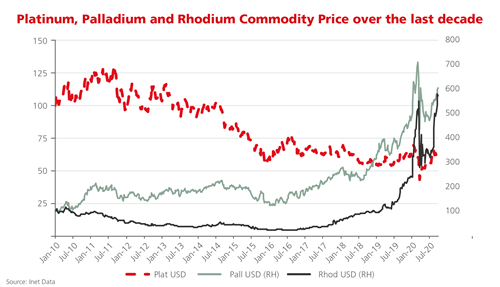

Another negative impact on the industry stemmed from the well-publicised “Diesel-Gate” scandal at Volkswagen in 2015, where investigations found that VW had installed software in its diesel car engines that enabled it to cheat on emission standards. This led to the German automaker facing numerous regulatory investigations and lawsuits - it is estimated that the scandal has cost the company some US$35 billion in fines and settlements as at 2020. Subsequently, with diesel cars falling out of favour it was found that this acted as a drag on platinum demand from European car manufacturers, in turn weighing on the platinum price. These conditions have persisted, with the US dollar platinum price continuing to move largely sideways in recent years, as shown in Graph 2.

Conversely, the prices of palladium and rhodium started to rise from 2018, supporting the overall PGM basket price. This trend has also continued until the present, apart from the brief but sharp fall during the height of the market panic caused by the Coronavirus pandemic. The rising demand has occurred in anticipation of the implementation of more stringent emission regulations -- mainly from China and Europe -- as the more stringent standards require loadings to increase within auto-catalysts. With supply unable to keep up with demand, both the palladium and rhodium markets experienced deficits in 2018 and 2019, driving their prices significantly higher. In turn, this has helped improve the profitability and cash flow generation of the South African miners.

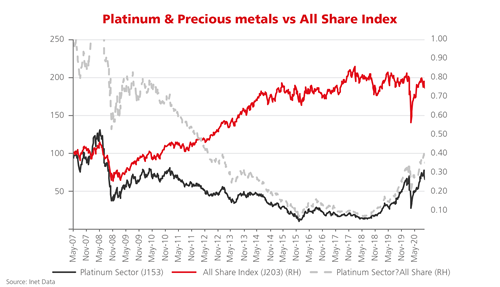

Platinum sector far outperforms FTSE/JSE ALSI

The JSE’s platinum sector has eclipsed the performance of the FTSE/JSE All Share Index (ALSI) for the last two years, returning 383% compared to the ALSI’s 1.2% between August 2018 and August 2020, as shown in Graph 3. The grey line depicts the difference between the two indices, shown by its upward and steepening movement over the period. It even recovered more quickly from the March market crash than the local equity market as a whole. Apart from the surge in the palladium and rhodium prices in US dollars, another key driver of the superior returns has been the weakening rand. Because local miners’ costs are incurred in rands but they earn their revenues in US dollars, they have experienced higher profits simply due to the currency differential. They have been able to use these higher profits and cash generation to de-lever their balance sheets. Company profit margins also had some support from having undertaken cost-reduction exercises and restructuring in previous years, but the key driver was the higher commodity prices. The improved margins and profitability have in turn been reflected in stronger balance sheets and therefore higher share prices.

Impact of the pandemic shutdown and looking forward

The arrival of the Coronavirus pandemic in 2020 and the accompanying economic shutdowns globally have had a fundamental impact on both the demand and supply of PGMs. On the demand side, from March global car sales fell materially, and the expectation is that these sales will only return to their 2019 levels in 2023. According to IHS Auto Data, global light-duty vehicles sales totalled approximately 86 million vehicles in 2019 and are expected to fall to 70 million vehicles in 2020, an 18.6% drop.

On the supply side, during March 2020 the South African government put into place a lockdown that placed the mines on care and maintenance, reducing the expected global supply of PGM for the year.

Despite the disruptions caused by the pandemic, the PGM basket has maintained a strong price following the initial pressure in March, supported by the palladium and rhodium prices and the weak rand. The impact of these supply and demand disruptions could cause the palladium and rhodium markets to be in deficit during 2020. The short- to medium-term outlook for the markets is dependent on the recovery of the South African supply back to 100% capacity, improving global car sales over the next few years, and increased loadings in auto-catalysts due to tighter emission standards.

Platinum, meanwhile, could benefit from substitution, as work is being done to substitute platinum into auto catalysts from palladium. The overall view is that palladium will still experience a deficit market, but the surplus market in platinum is likely to ease somewhat. Both should be supportive of PGM prices going forward.

Over the longer term, the move to electrification (Battery Electric Vehicles or “BEVs”) may cause a structural demand shift as this will decrease the demand for 3E PGMs. We can see this in the capital allocation decisions currently being made by the large miners, in that they are hesitant to take on longer-term capital investment at this point. Examples include Impala Platinum’s investment into Waterberg and Anglo American Platinum for Mogalakwena’s expansion. If BEVs take longer than expected and miners do not invest in new supply, this may extend the PGM bull market for longer.

While pressure from climate change and the repercussions of the pandemic could accelerate the move to electrification, there are also green shoots for the industry. Hybrid vehicle models require 3E metals within their engines, and due to the increasing concern around climate change more focus is being placed on the hydrogen economy. Over the long term, the hydrogen economy will be positive for the PGM industry, enabling the use of hydrogen as a low-carbon fuel source, but this will take time. For now the research and development spending of auto manufacturers is skewed towards BEVs.

The factors underpinning the PGM sector currently are that there is still positive earnings momentum, and near-term company valuations are not overly stretched at prevailing prices. The miners are well positioned, with high margins, good free cash flow and strong balance sheets - this should underpin good cash returns to shareholders in the prevailing price environment. Meanwhile, the risks to the sector are that company margins are elevated and there is limited cost support, as the current PGM basket is trading significantly above the miners’ unit production costs. Given the current uncertainty around the demand for 3E PGMs, if this comes under pressure due to – for example, worse-than expected repercussions on global auto sales from the pandemic and earlier adoption of BEV’s – the current PGM basket price will fall. Another risk is that of rising inflationary pressure, based on miners’ historic performance and management guidance from the current results season.

Prudential’s PGM positioning

Across our general equity funds we have exposure to various PGM miners, and are currently maintaining a roughly neutral position in the sector. While we maintain that there is a fundamental underpin in the PGM basket price from increased loadings, current 3E basket prices are elevated and we are concerned that they will come under pressure.

Within our PGM exposure, we have an overweight holding in Impala Platinum. We prefer it to other platinum miners due to its relative valuation. The share has been among the strongest contributors to performance in the Prudential Balanced and Inflation Plus Funds in recent periods.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter