M&G Investments’ Global fund wins Raging Bull

We are pleased to announce that the M&G Global Inflation Plus Feeder Fund has won a Raging Bull Certificate as the “Best (SA-domiciled) global multi-asset low equity fund” for its risk-adjusted performance over five years to 31 December 2021. This is the second time that the fund has received this accolade, having previously won in 2019.

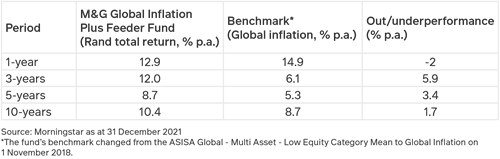

The fund has a long history of outperforming its benchmark, as shown in the performance table below.

We believe that the award is testimony to the substantial experience and skills of the large investment team at M&G Investments, as well as the benefits of having a fund range designed specifically for South African investors.

About our global funds

Our range of global funds is suitable for investors wanting exposure to attractive global assets not available in South Africa, or to diversify their portfolios with a view to reducing the risk inherent in an emerging market like South Africa. It caters for a variety of different risk appetites, from a lower-risk global bond fund to a wide-ranging global equity fund, property fund and two diversified multi-asset funds.

Accessing the funds in US dollars or rands

South African investors have the option of investing in the M&G Investments Global Funds in US dollars via leading offshore investment platforms, including Investec Global Select, Stanlib (INN8), Momentum Wealth International, Sanlam Glacier International, Old Mutual International and Allan Gray.

Those who prefer to invest in rands (and not use their foreign currency allowance) are able to do so through our four rand-denominated feeder funds. Each feeder fund invests uniquely in their corresponding M&G Global Fund and so provides investors with the identical underlying global exposure. Investors can invest directly online in any of the rand-denominated funds via the M&G Investments website, via discretionary unit trusts or via the M&G Tax-Free Investments product.

Raging Bull eligibility and methodology

To qualify for a Raging Bull Award or certificate, or for the PlexCrown ratings, a fund must be open to retail investors; and in the case of an award made on the basis of risk-adjusted returns, be in a major asset allocation sub-category, or in one of the other larger sub-categories. Sub-categories that have at least five actively managed funds with histories of five years or more are included in the awards.

Funds in the multi-asset sub-categories (excluding multi-asset income) are ranked over five- and three-year periods according to the Sharpe Ratio, Alpha, Sortino Ratio and Omega. The funds’ percentile rankings per measure over three and five years are time-weighted by applying weights of 40% and 60% respectively. The fund with the highest weighted percentile ranking is therefore the winner in its sub-category.

Share

Did you enjoy this article?

South Africa

South Africa Namibia

Namibia

Get the Newsletter

Get the Newsletter